University sector key to economy

It is in the nation’s interests to continue to welcome international students.

It is in the nation’s interests to continue to welcome international students.

Listed software business Dubber is still chasing tens of millions of dollars which were diverted away from a company account.

Outgoing NAB chief Ross McEwan, who will now join BHP’s board the day after he exits the bank, has cautioned Australia’s economic bounce-back won’t come easily.

ASX 200 sets all-time high at close. Life360 soars 38 per cent on earnings beat. ASIC wants crime-linked Prospero wound up. China manufacturing activity better than expected but still weak.

An Australian man has captured the moment a scammer lost his cool while trying to access the man’s bank details.

An Australian man has captured the moment a scammer lost his cool while trying to access the man’s bank details.

Fans have reported forking out hundreds to nab last minute flights to Sydney and others have been forced to board a Qantas Airbus after dangerous weather cancelled flights.

Fans have reported forking out hundreds to nab last minute flights to Sydney and others have been forced to board a Qantas Airbus after dangerous weather cancelled flights.

Departing NAB boss Ross McEwan says rules brought in to police the banking sector have put access to finance out of reach of many.

A rise in provisions to cover loan losses, as mortgage arrears ticked up, have clipped National Australia Bank’s first quarter cash profits which fell 17 per cent to $1.8bn.

Rio Tinto annual net profit falls to $US10.1bn; underlying result beats estimates. CSR trading halt amid takeover talk. Woolworths’ Brad Banducci apologised to Rod Sims. Corporate Travel dives. WiseTech soars.

The landmark decision grants ANZ the green light to acquire Suncorp’s regional banking arm for $4.9bn and has the potential to reshape the banking sector landscape.

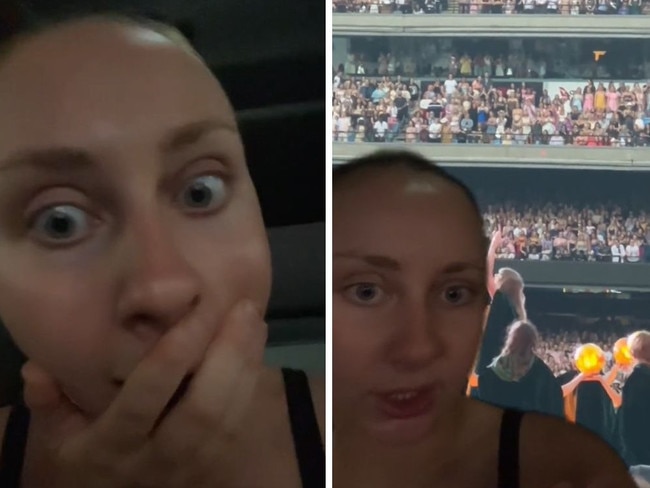

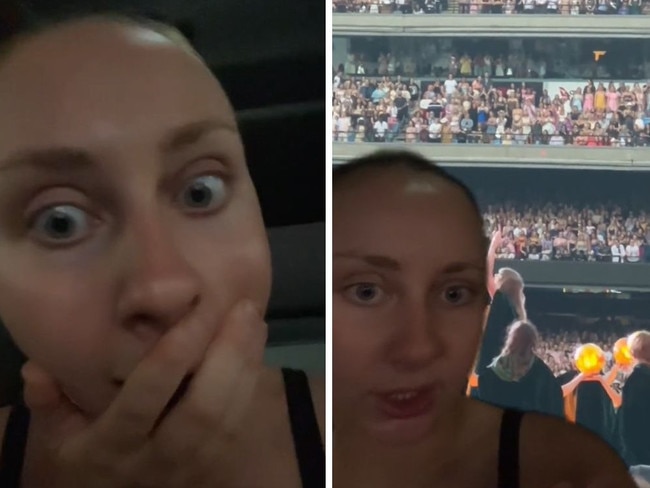

An Adelaide woman said she was able to get “within the first 10 rows” at Taylor Swift’s sold out show and implored other Swifties to do the same.

An Adelaide woman said she was able to get “within the first 10 rows” at Taylor Swift’s sold out show and implored other Swifties to do the same.

The banking boss plans to join the board of UK laser defence and weapons play Qinetiq. He should finish up his current job first.

A major employer has doubled its number of workers coming into its CBD office headquarters by making one considerable change.

National Australia Bank’s new CEO Andrew Irvine has outlined plans to grow its retail banking and business deposit operations, as well as grab new customers in healthcare.

The departure of the straight-talking New Zealand-born Ross McEwan marks the end of an era for an old school banker in a time of digital-first finance.

Can NAB keep its momentum coming out of the royal commission following the exit of hardened bank boss Ross McEwan?

Gains in utilities and materials saw the Australian sharemarket climb on Wednesday as companies announced some big news.

The Taylor Swift phenomenon is about to hit Australia and police are warning Swifties to “please keep your side of the street clean”.

The Taylor Swift phenomenon is about to hit Australia and police are warning Swifties to “please keep your side of the street clean”.

Meet the top local executives tasked with overhauling their multi-billion dollar companies in the age of AI.

The chief executive has announced he will walk away from the top job after four years with the big four bank.

Woodside up after ceasing talks; Santos boss confident about future. CSR drops on UBS downgrade. Woolworths, Coles defend against price gouging claims. Ross McEwan decided in 2023 to leave NAB.

The major bank claims the closures are due to more people choosing to bank online or over the phone.

Using billions of data points, NAB has built what its calls its ‘customer brain’, which aims to solve banking problems before they arise.

Coles and Woolies need to win back trust. But it’s consumers – not governments – that should hold them to account.

ASX rises for third day straight after US records. Prices, costs growth fall sharply: NAB survey. Future Fund cautions market on inflation fight. Another executive leaves Qantas.

People are increasingly concerned about their job security in the year ahead, according to NAB research, particularly younger Australian workers.

Original URL: https://www.theaustralian.com.au/topics/national-australia-bank/page/7