Trading DayTrading DayRio buys lithium player for $US6.7bn. Commodity price falls, China disappointment weigh on Aussie producers. NZ’s central bank cuts rate by 50 basis points, as expected. Shares in Cettire, Zip jump.

Trading DayTrading DayIron ore, copper futures, AUD down after China’s underwhelming economic update. RBA’s ‘step down’ in hawkishness evident in September minutes, but deputy governor Andrew Hauser says inflation job’s not done yet.

DATAROOMDataRoomIGO could be the frontrunner for Rio Tinto’s Winu Project, although BHP spin-off South32 is also said to be interested.

MiningBusinessBHP has offered new jobs to about 800 workers affected by the shutdown of its nickel operations but hundreds have chosen redundancy amid a major commodity downturn.

Brad Thompson

INDUSTRIAL RELATIONSNationThe mining giant is seeking to invoke an exemption for service contractors under Labor’s legislation.

DATAROOMDataRoomRio Tinto may join BHP in a big acquisition and some believe that a major deal in the lithium space may now not be too far away.

CommoditiesMining & EnergyThe push to re-industrialise Western economies and the transition to net zero will provide strong tailwinds for the mining sector for decades to come, both Rio Tinto and BHP believe.

Trading DayTrading DaySigma rockets on ACCC compromise to get $8.8bn merger with Chemist Warehouse across the line. Treasury Wine caves in to proxy demand on CEO bonus. Warmest August since 1910 sees retail sales lift 0.7 per cent.

Trading DayTrading DayBHP and Rio lead iron ore gains as billionaire-run Fortescue and MinRes also lift. Richard White’s WiseTech up after founder’s $46m selldown. Star hit with downgrades. Key Pacific Smiles shareholders reject Genesis bid. AUD above US69c.

MiningMining & EnergyThe mining giant’s balance sheet is in fantastic shape and its growth options are much better positioned than they were just a few years ago, CEO Mike Henry says.

ResourcesBusinessCoal giant BHP Mitsubishi Alliance (BMA) has warned Australia risks returning to an era of lockouts and strikes under Labor’s controversial industrial relations reforms.

Business Breaking NewsInvestors are now putting pressure on Rightmove’s London board to take a seat at the negotiating table for the $11bn offer.

GovernanceMining & EnergyActivist funds have backed down on their push for a vote on better climate disclosures at the BHP annual meeting, after the company’s own report satisfied their demands.

BHP boss Mike Henry has publicly moved on from Anglo American but the London-listed former target remains even more vulnerable.

EditorialFar more than the profitability of mining and energy companies is at stake from bad policies that adversely affect their operations and the viability of investments in new projects.

Editorial

EXCLUSIVEMining & EnergyEnvironmental lawfare, unproductive workplace policies and red tape are threatening resources projects, employers warn, as unions demand yearly $10,000 retention bonuses for BHP’s Pilbara workforce.

exclusivePoliticsMining giant BHP has defended its role in the Australian economy, claiming the amount of tax it paid last financial year was equal to half the entire annual funding of the public hospital system.

INVESTINGWealthShare portfolios shouldn’t simply focus on big banks and resources giants. Our experts examine some smaller stocks.

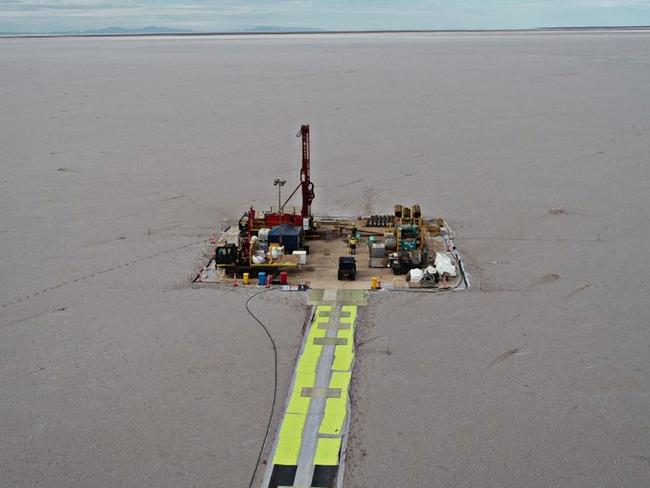

exclusivePoliticsAustralia’s second potential Olympic Dam-sized mine is under threat from a fresh Indigenous heritage claim under federal law seeking to override all state approvals.

LettersIt’s no surprise that the government has delivered a broadside to BHP. Scratch the skin of Labor and there will emerge an “anti-big business” sentiment, aligned with that of associated unions.

Bush SummitPoliticsGina Rinehart has warned that the Albanese government’s industrial relations and environment policies risk alienating Australia’s two largest producers, Rio Tinto and BHP, and could drive the mining giants offshore.

Bush SummitMining & EnergyMinerals Council of Australia boss Tania Constable said an IR ruling threatened to set a precedent which could be applied across the Pilbara’s powerhouse iron ore operations.

Bush SummitNationMining magnate Gina Rinehart says more federal red tape will scare off the nation’s biggest companies, calls for the ‘elimination’ of taxes.

MiningPoliticsResources Minister Madeleine King has gone to war with BHP in an extraordinary spray, attacking the mining giant for always ‘railing against’ Labor policies and refusing to work productively with unions.

Terry McCrannBHP and its multi-billion profits are still all based on China. Today it’s iron ore tomorrow it will be copper.

TerryMcCrann

newsNewsWireThe Australian share market finished down on Tuesday, following sagging results from jeweller Lovisa and sluggish performance from Zip and Johns Lyng.

What do you get when you mix new IR laws, unions muscling their way into the mines and anti-mining sentiment from Tanya Plibersek? Nothing good.

The bets on copper and potash show BHP is undergoing another of its landmark reinventions. Will it be enough?

MiningMining & EnergyBHP has announced a copper ore resource of more than one billion tonnes at Oak Dam in outback SA, and wants to more than double output in the state over the next 10 years.

UPDATEDBreaking NewsBHP has beaten estimates despite a rocky year for the mining giant, posting another eye-watering profit.

Joseph Olbrycht-Palmer