Bank grilling turns to small biz

Regional banks will join the big four under the spotlight as the third round of bank inquiry targets small business lending.

Regional banks will join the big four under the spotlight as the third round of bank inquiry targets small business lending.

The investigation into the tech giants’ impact on the media’s ability to fund quality news couldn’t come soon enough.

The emails that caused AMP to unravel, released by the banks inquiry, provide an astonishing glimpse inside the company.

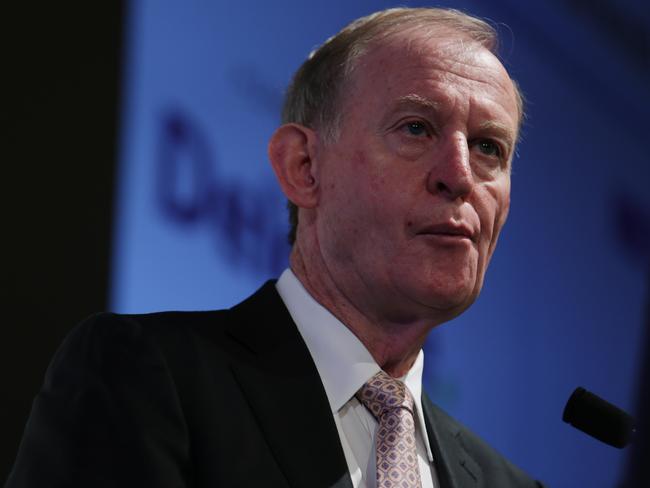

Former Future Fund chairman David Murray agreed to take on the rescue mission at AMP in an effort to restore public faith.

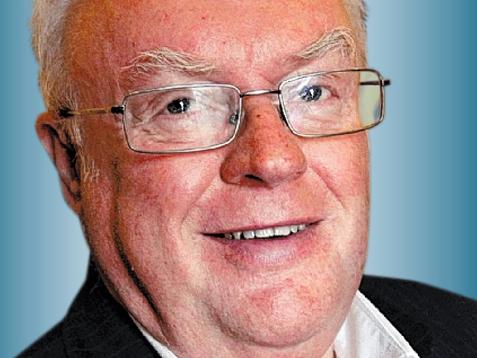

Stability and restoration of trust are the key goals for AMP chief Mike Wilkins now he has David Murray as the change-agent.

Acting chairman Mike Wilkins acknowledges widespread anger, insisting the company is not “hiding from the facts”.

AMP has raised doubts over evidence presented to the Hayne royal commission suggesting potential criminal breaches.

Directors holding more than three board seats across our biggest companies are under pressure to quit amid inquiry fallout.

The company will be hoping David Murray can lead it back from the wilderness, but it will be far from easy.

The public has every right to be suspicious about the motivations of many company directors.

The bank inquiry may have sparked a tactical retreat but the banks won’t be exiting financial advice forever.

David Murray has been appointed incoming AMP chairman and will join the company’s board on or before July 1.

We’re finally waking up to the fact that most people simply didn’t need the services that were being rammed down their throat.

Financial advisers also have a poor record in the US.

The inclusion of female directors does not appear to have improved company ethics.

Customers are being treated as an afterthought when it comes to data privacy.

CBA now admits it should have told customers it had lost historical records for close to 20 million accounts.

The woman who ran the CBA wealth management arm that charged fees to the dead has received a million-dollar windfall.

It’s hard to know what was worse: the woeful advice or the lack of action by watchdogs.

After six years of not making any disclosed political donations AMP gave over $350,000 to the major parties, which started just after Catherine Brenner joined.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/29