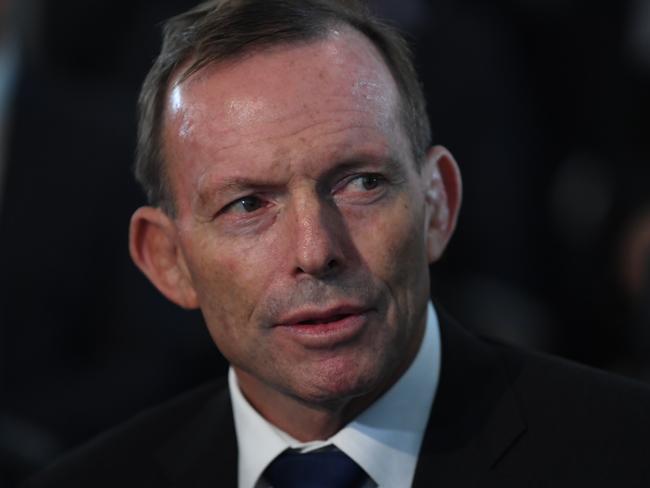

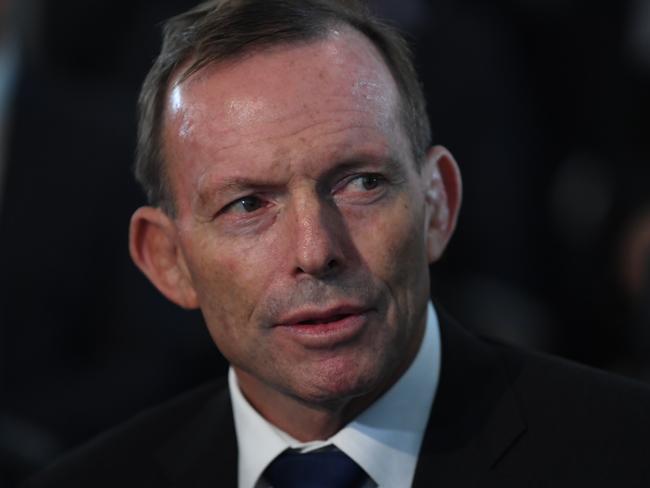

Abbott slams banks’ priorities

If banks had of stuck to the subject of banking instead of making political statements they may not be where they are now.

If banks had of stuck to the subject of banking instead of making political statements they may not be where they are now.

Chris Bowen says Scott Morrison should explain his comments on CBA resignations, describing them as “cynical and dishonest”.

The CBA is expected to cut executive pay again this year and has been slammed for a culture where no one learned from mistakes.

The royal commission is revealing a deep malaise — venality, in fact — in the boards of all the big banks.

Financial advisers and big banks are breaking up even before the royal commission has finished its work.

Chris Bowen says the CBA review is a report on one bank, when we should be receiving final royal commission findings on the whole sector.

Commonwealth Bank will order 500 executives to read a scathing report on the bank’s culture and come up with ways to fix it.

Commonwealth Bank CEO Matt Comyn will forgo a short-term bonus of up to $2.2m this year in the wake of bank scandals.

The politicians who moralise about the banks are no white knights when it comes to doing the right thing. Far from it.

CBA has been forced to top up capital levels by $1bn after a review of culture found big profits “dulled its senses” to risks.

AMP legal counsel Brian Salter has hit back at criticism of his role in the fee-for-no-service scandal.

On average, the more a person pays for experts to manage their superannuation savings the worse the investments perform.

Many of the 14,000 or so financial planners working for arms of the big banks could face prosecution for shoddy advice.

AMP’s handling of the fees-for-no-service scandal has been akin to “putting a Band-Aid on a haemorrhaging wound’’.

It’s now two boards that Catherine Brenner is off, the former AMP chairman standing down from the Art Gallery of NSW.

AMP’s Brian Salter has defended his role in the fees-for-no-service affair and says he learnt of his sacking via the ASX.

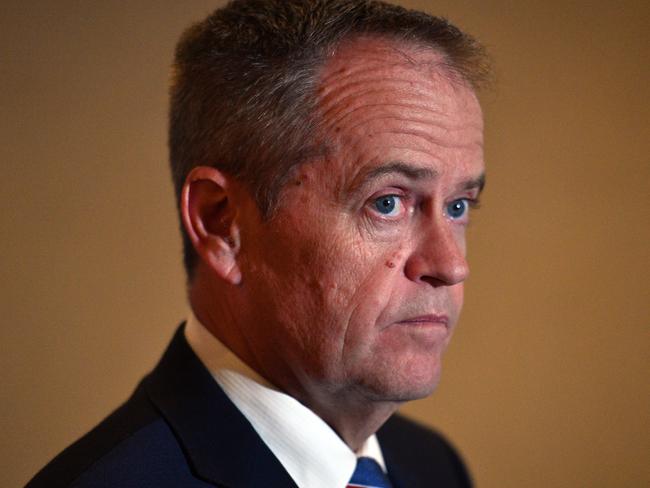

Bill Shorten claims tax cuts for the big banks would be the “biggest reverse political donation in Australian history”.

AMP has today carefully avoided any acceptance of the fact it was caught stealing from customers and lying to the regulator.

Catherine Brenner resigns as chair and AMP company secretary Brian Salter will depart after bank inquiry revelations.

The AMP board held a crisis meeting last night to resolve the future of chairwoman Catherine Brenner.

Original URL: https://www.theaustralian.com.au/topics/bank-inquiry/page/30