‘No crimes’ by board or executives, AMP claims as it hits back at Hayne commission

AMP has raised doubts over evidence presented to the Hayne royal commission suggesting potential criminal breaches.

AMP has raised doubts over evidence presented to the Hayne royal commission suggesting potential criminal breaches over the “fee for no service” scandal, after a week that laid waste to its reputation and paved the way for a management and board overhaul.

In its first formal response to explosive claims at the royal commission, AMP yesterday said “there is no evidence” its board and executives acted inappropriately and further distanced them from the actions of sacked general counsel Brian Salter.

But it admitted to wrongly charging 16,000 clients for services it did not provide as well as misleading the Australian Securities & Investments Commission about its efforts to clean up the practice.

In a statement, AMP said while it took responsibility for past failings in relation to fee-for-no-service and had taken steps to ensure that these failings did not recur, it “does not accept all of counsel assisting’s open findings”.

“AMP strenuously denies the allegation by counsel assisting that it is open to find that AMP has committed a criminal offence in providing the Clayton Utz report to ASIC,” AMP said.

It noted the issues raised in the fee-for-no-service case study presented to the royal commission concerned matters that were almost entirely the subject of an ongoing ASIC investigation.

Still, late on Friday the Hayne royal commission released a cache of documents outling the close interaction between AMP’s previous chairman Catherine Brenner and former AMP chief general counsel Brian Salter with Clayton Utz in the preperation of the report.

The documents also show Ms Brenner requested Claton Utz to prepare an “external and independent” investigation into AMP’s fee for no service issues. It was alledged in the Hayne royal commission that Clayton Utz gave AMP 25 drafts of the report in doing so removing references to former AMP chief executive Craig Meller so that it would not “attract unnecessary attention to him by ASIC” ...

In one email chain sent by Ms Brenner to Mr Salter released on Friday, the former AMP chairman asks “has CU [Clayton Utz] now included in their report that we will give to ASIC their findings on Craig [Meller]?”.

AMP said it had repaid 15,712 customers a total of $4.7 million in relation to the fee-for-no-service issue. In most cases fee charges were the result of administrative error, AMP said, while a minority were cases where the charging of fees was authorised. It had reported them in detail to ASIC in October 2017 and then to the royal commission in March.

Last month counsel assisting Rowena Orr QC told the royal commission that it should be open to finding that in four of the 20 times AMP misled ASIC over a fee-for-no-service scandal it breached four sections of the Corporations Act that carry criminal penalties.

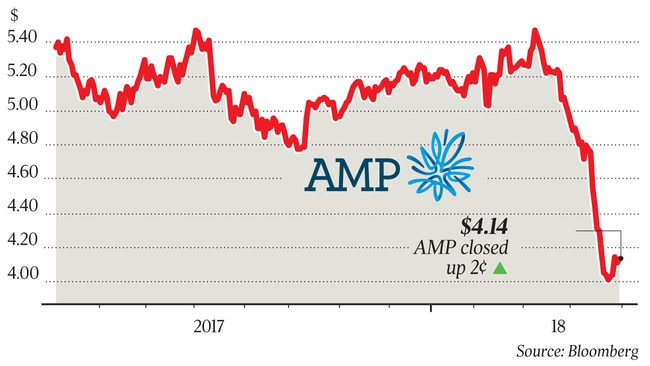

The allegations led to last weekend’s resignation of Catherine Brenner as chairwoman and the sacking of Mr Salter, who was only told half an hour before the news was to be released to the sharemarket. Chief executive Craig Meller’s retirement at the end of the year was brought forward to last month.

“AMP accepts that any misrepresentation, even if inadvertent, to ASIC is unacceptable and must be corrected as soon as it becomes apparent,” the company said in a statement accompanying its submission.

But it said the more than 20 separate misrepresentations referred to in the royal commission had been overstated when there were only seven in 12 communications to the regulator.

In a cache of documents released to the royal commission yesterday, AMP claimed the extent of the interaction between it and Clayton Utz in preparation of the legal firm’s report had been “overstated”.

“In AMP’s submission to the royal commission we assert that: there is no evidence to suggest that the board, including the former chairman and former CEO, acted inappropriately in relation to the preparation of the report,” AMP said.

“The board were not aware of the nature and extent of the interaction during the preparation of the report; there is also no evidence that Clayton Utz made any changes to the report that they did not agree with or that they do not stand behind the report; and the extent of interaction between AMP and Clayton Utz has been overstated.

“Irrespective of the criticism surrounding the production of the report, it was an important and powerful catalyst for the actions AMP has taken and is taking to address the challenges in the advice business.”

In documents AMP sought further to distance the company, board and senior management from the actions of Mr Salter, who denies any wrongdoing.

AMP said Mr Salter held detailed and lengthy discussions with Clayton Utz over the final draft of the report but AMP directors and its head of advice Anthony Regan were kept in the dark.

Last month the royal commission heard that Clayton Utz made 25 changes to its report at the request of AMP after exchanging 700 emails. It is alleged Clayton Utz and Mr Salter produced the report for the AMP board’s internal purposes, not to answer concerns raised by ASIC over corporate governance. The report identified incidents of misleading conduct going back to 2015.

But in defending its actions AMP did not provide any cover for Mr Salter.

Clayton Utz was under instruction to deal directly with Ms Brenner if there were concerns about group leaders, including Mr Salter.

“Mr Mavrakis (of Clayton Utz) attended the board meeting on 16 October, 2017. He did not raise any concerns with the board about the accuracy of the report or the manner in which it had been prepared. The board had no reason to suspect that the report may not have been prepared in accordance with their instructions.”

AMP said there was no evidence that Mr Salter made any changes to the report with which Clayton Utz did not agree, nor was there any evidence that Clayton Utz believed its independence, in the sense required by the retainer, was affected by any interactions with Mr Salter.

A spokesman for Mr Salter said he would not be commenting on the AMP submission.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout