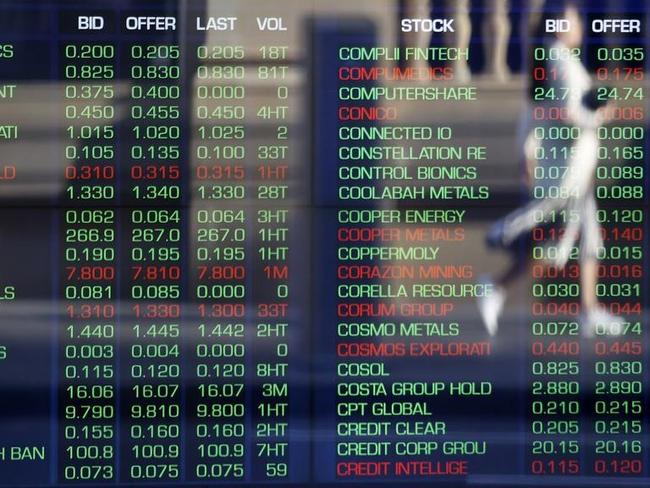

ASX 200 hammered on Trump tariffs

Nearly $50bn was wiped off the Australian sharemarket on Monday as fears of a trade war led by US President Donald Trump tariffs ripped through the local market.

Nearly $50bn was wiped off the Australian sharemarket on Monday as fears of a trade war led by US President Donald Trump tariffs ripped through the local market.

The medical device manufacturer was the first ASX-listed company to warn of a hit to earnings from Donald Trump’s decision to place tariffs on Mexican and Canadian imports.

The corporate regulator is probing whether ASX’s settlements arm broke the law when it was unable to process batch settlements.

Aussie shares retreat heavily along with the Aussie dollar and cryptos as Trump orders tariffs. A$ hits five-year low. Tariffs biggest trade shock since 1930s: RBC. Cettire “assessing” US tariff changes. Anna Bligh to vacate ABA’s top job.

The Australian share market is expected to fall from near-record highs following President Donald Trump’s shock move to immediately forge ahead with tariffs.

Australia’s sharemarket has broken records this week all while its US counterpart takes a deep breath to recover from the shock of China’s AI capability.

Friday’s rally in mining, real estate and technology stocks pushed the ASX 200 to a new record high.

A strong day for Aussie shares as the ASX 200 rises 0.5 per cent to a record high close at 8532.3. Origin cuts APLNG guidance. Citi upgrades BlueScope. Rinehart lifts Lynas stake. Broker upgrade for Zip. Lendlease selling Capella. US probing if DeepSeek used Nvidia chips. Trump advisors hunt for deals as Canada, Mexico tariffs loom.

Incitec Pivot Limited has put its mega Gibson Island property in the Brisbane River, touted as the largest industrial sale of its kind on the eastern seaboard, on the market.

The sharemarket has jumped to a record high of 8515.7 points, amid positive leads from Wall Street after big tech reports and Reserve Bank rate cut hopes. DeepSeek will not derail Microsoft’s $US80bn AI investment this year. Zip and MinRes drop.

The Chemist Warehouse founders were back in suburban Melbourne to vote in its huge merger with ASX-listed Sigma. The celebrations were a typically low-key setting for some of Australia’s richest entrepreneurs.

The Aussie sharemarket soared on Wednesday as markets factor in the likelihood of a rate cut in February.

The founders of the retail juggernaut have got bigger by sticking close to their market. Now Chemist Warehouse faces the ultimate test.

China’s answer to ChatGPT has plenty to say about Australia – labelling its human rights record a ‘mixed picture’ – but draws blanks when asked about the Tiananmen Square massacre, Xi Jinping, or China’s own record on human rights.

Underlying inflation hits lowest number since early 2021. Rate cut expectations brought forward. Aussie shares a sea of green after US rebound. Sigma in trading halt pending shareholder meetings over Chemist Warehouse merger.

A smaller tech sector exposure and a strong performance from consumer discretionary stocks saw Australia finish marginally in the red, despite a sell off on Wall Street.

The ASX-listed former market darling may lose the $99.5m invested in its gigafactory IM3NY.

Don’t mention the Hundred Years’ War: Britain’s Labour government has been attacked by the defence establishment for decision to rename submarine.

Seesaw day on the ASX following heavy falls across US tech stocks. Investors spooked following emergence of low-cost Chinese generative AI model DeepSeek. Goodman, NEXTDC, DigiCo, uranium stocks, Nuix fall hard.

The ASX is poised to open marginally higher when trading resumes on Tuesday, though investors remain wary as they await data expected to shape Australia’s monetary policy.

The weak Australian dollar could deliver sharp misses from retailers and other importers this earnings season, but could underpin a financial windfall for some others.

As Donald Trump inflames the diversity, equity and inclusion debate in the US, super funds here reiterated their support for DEI reporting by ASX-listed companies.

Major retailers were responsible for the Aussie sharemarket closing just shy of a record high – with the dollar also climbing to a new peak.

US shares consistently beat ours for value and under newly installed President Donald Trump there are indications the pattern will accelerate.

Australian shares track US gains. Wesfarmers soars on upgrade. Goodman reverses intraday gain. Monadelphous, Synlait jump on updates but Kogan dives. Trump China comments lift stocks, $A. IGO creeps up despite hammer blow dealt to lithium plant.

The Aussie sharemarket has snapped a three-day winning streak as consumer-facing stocks and an “unloved” mining sector drag the index lower.

ASX is at risk of new enforcement action or further licence conditions over a damaging settlement outage caused by a decade-old systems error.

ASX down after most US stocks fell. Department store chain, Premier shareholders show huge support for merger. Bain boosts Insignia offer to $4.60 per share. Evolution drops on downgrades. Fortescue ships record amount of iron ore.

Australian sharemarket firmed on Wednesday, as Donald Trump helped the strong performance by Australia’s tech sector and uranium shares.

The secret behind the steady exit of local investors from the Australian sharemarket is not so much the attraction of Wall Street, but the poor value offered by the ASX.

Original URL: https://www.theaustralian.com.au/topics/asx/page/8