‘Sputtering’ China weighs down miners

The financials and energy sectors have dragged the ASX to a winning day as Chinese woes weigh heavy on Australian miners.

The financials and energy sectors have dragged the ASX to a winning day as Chinese woes weigh heavy on Australian miners.

Star Entertainment group, which operates casinos in Sydney, Brisbane and the Gold Coast, has been pulled from trading on the ASX after a dire week.

Bank and energy gains offset declines by iron ore and gold miners. REA falls on news it is considering a bid for Rightmove. The Star suspended from trading.

Years after the case was first launched, former mining baron Nathan Tinkler has broken his silence with an exclusive interview in The Australian. READ THE LATEST IN THE COURT CASE.

The Australian sharemarket is likely to start the week in the red as weaker commodity prices weigh on the mining and energy sectors.

The Aussie share market finished the week, and the reporting month of August, in the green as it marked the third straight week of gains.

ANZ CEO Shayne Elliott tells parliament a ban on staff drinking alcohol during work hours is ‘entirely reasonable’, after its conduct scandal. Star halts as NSW casino regulator looks at licence. Ramsay and Harvey Norman fall.

The Australian share market fell again on Thursday, after a poor start thanks to Wall St, as several big name companies report results.

WATCH LIVE: Westpac CEO Peter King speaking during parliamentary Q&A. CBA boss vows to continue lending to gas projects. Ellison’s fortunes hit in MinRes dive. Qantas, South32 flag buybacks as profits fall. Cettire down on profit slump.

The Australian Stock Exchange ended Wednesday flat after some of the country’s biggest companies reported some less than stellar results.

The poker machine maker will launch several new games in the coming months as it look for new ways to increase revenue amid strong competition in Australia and struggles in Argentina.

RBA hike not ruled out as inflation remains sticky at 3.5 per cent. Controlling shareholder Rio to back ERA’s $880m discounted raise. Special dividend boosts Woolworths. Tabcorp’s worse than expected loss, CEO-elect Gill McLachlan’s ‘reality’ check weighs.

The Australian share market finished down on Tuesday, following sagging results from jeweller Lovisa and sluggish performance from Zip and Johns Lyng.

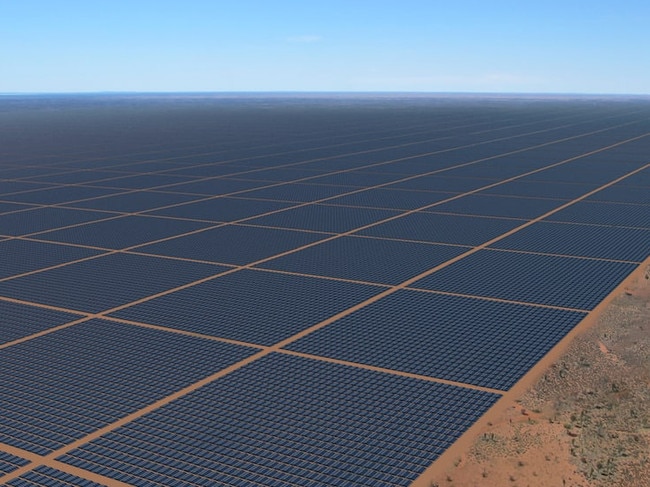

The investment fund backing the $30bn Sun Cable project has warned the ASX is stacked with small mining explorers who risk locking up critical mineral because of a lack of funding.

BHP cuts dividend after profit fall. Coles earnings beat estimates. Woodside to walk ‘growth funding tightrope’. Guzman Y Gomez gains after profit beat. Johns Lyng dives on revenue miss. Lovisa trading update disappoints. CBA chief economist steps down.

A difficult macroeconomic backdrop for listed corporates highlights why portfolio exposures are heavily tilted towards the quality end of the ASX 200.

Ciarán Carruthers to leave Crown. Downgrades loom for Bendigo Bank, NIB. Perpetual’s impairment weighs. Kogan soars. Aussie Broadband jumps on first dividend. Kelsian tanks on capex guidance. Aviation reforms to improve competition.

The average chief executive pay at some of Australia’s biggest companies has surged by an eye-watering amount as dozens rake in bumper bonuses | FULL LIST

Companies, CEOs and their lieutenants who shirk answering tough questions should leave the ASX.

Sleep disorders are a share market winner but pizza and plumbing are under pressure in new stock recommendations.

Original URL: https://www.theaustralian.com.au/topics/asx/page/19