ANZ in strife over claims customers dudded interest

ANZ is yet again in hot water with the Australian Securities and Investments Commission which is examining allegations it incorrectly calculated interest on thousands of savings accounts.

ANZ is yet again in hot water with the Australian Securities and Investments Commission which is examining allegations it incorrectly calculated interest on thousands of savings accounts.

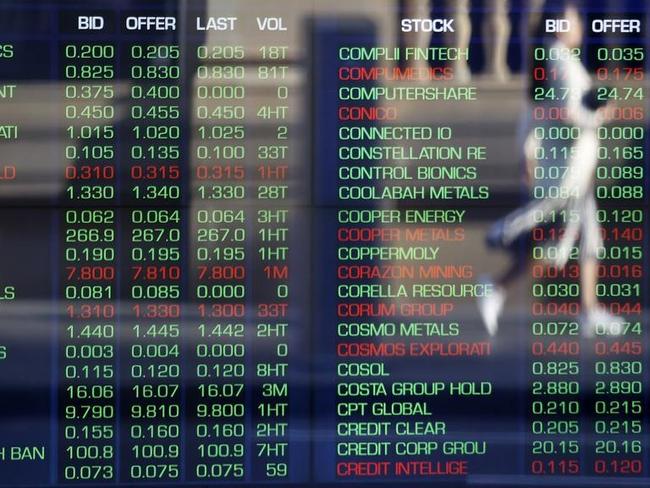

ASX backs away from six-week high on Trump’s tariff threat against Canada, Mexico but still ends strong. Financials lead as Macquarie upgrades ANZ, NAB. Liontown, HUB24 soar on updates. Wesfarmers winds down Catch. Billions coming in insurance sector buybacks: MS.

An ex-ANZ trader has lost a bid to add fresh elements to a lawsuit against his former employer concerning allegations he was involved in market manipulation.

With the Albanese government holding out for interest rate cuts ahead of the impending federal election, ANZ switched its call, tipping a move lower by the Reserve Bank next month.

Another major bank says a February rate cut is on the cards, with ANZ making a big change to its expectation of when Aussie mortgage holders will get a reprieve.

Slow spending lifts chances the RBA will move earlier than expected to deliver interest rate relief.

November retail sales undershoot expectations despite Black Friday boost. Casino group Star’s investors react to latest cash crisis. Rex board aware of ‘bewilderingly bad’ sales: ASIC. Arcadium lifts on US nod to Rio buyout.

ANZ bank’s board is again shying away from full transparency, and providing to shareholders a sanitised summary of an independent report into governance is not good enough.

A major bank has restored services after an outage left customers unable to access their accounts on one of the busiest shopping days of the year.

Qantas, Woolworths and now ANZ have all found out the hard way. On reputation – you go up slowly but come down at high speed.

ANZ CEO Shayne Elliott has withdrawn an attempt to secure a bonus from shareholders in an attempt to avoid a blow-up at the lending major’s AGM.

Protesters have targeted ANZ bosses over the bank’s ties to the world’s largest weapons company and its funding of major polluters.

The ASX 200 suffered its worst day in three months, as investors dumped tech, bank and mining stocks. The Australian dollar also hit a two-year low after big falls on Wall Street following the Federal Reserve’s weak rates outlook.

Former ACCC chair Graeme Samuel says allegations ANZ took fees from accounts of dead customers suggest the bank learnt nothing from the Hayne royal commission’s findings.

The royal commission’s findings should have served as a wakeup call but in reality, at ANZ while the bank’s top brass said all the right things, they didn’t adequately heed the warning.

Financial regulator targets crypto giant over alleged customer fails. Insignia rejects Bain bid. Chalmers’ spending plans to challenge RBA fight. ANZ facing more regulatory scrutiny. Aus economy in ‘reasonable shape’: NAB CEO.

ANZ is again in the corporate regulator’s sights – this time over allegations it incorrectly slugged dead customers’ accounts with fees and failed to fix glaring system deficiencies.

Surprise inclusions in RBA’s new-look monetary policy board; new governance board members named. Data centres-focused DigiCo continues to decline. HSBC sued for alleged scam fails. China slump a blow to Treasurer’s mid-year budget update.

Outgoing banking boss Shayne Elliott says we may have passed the worst but risks remain in the outlook.

APRA in August handed ANZ a to-do list of problems it felt needed addressing and it appears the regulator had grown tired of raising issues with the banking major.

Analysts say the appointment of an outsider to run ANZ doesn’t address existing problems and risks, and it appears investors feel the same way.

When celebrating the bank’s 50th anniversary of operating in Singapore in October, outgoing CEO Shayne Elliott quipped that he was proud to be part of ANZ, ‘warts and all’.

ANZ has shunned two leading internal leadership candidates amid its lingering scandal, with the big four bank appointing outside candidate and Portuguese banker Nuno Matos to the top job.

He’s mad about sports but when it comes to the high-octane world of banking incoming ANZ CEO Nuno Matos is described as a keen adopter of technology and ‘very focused’.

ANZ has a history of its ambitions being bigger than its balance sheet. The arrival of a big name global banker adds to these worries.

One of Australia’s largest companies has found its new chief executive, an international banker of “calibre and extensive experience”.

Ex-HSBC veteran Nuno Matos will be next ANZ CEO. Platinum crashes, Regal down after takeover talks end. CBA, Goodman jump. Star hits record low. Woolworths flags $140m hit from now-ended strikes. Sonic buying German lab group for $699m. GQG rises after canning buyback.

Brands and marketers should strive to create work that drives a ‘return on creativity’, argues Ogilvy ANZ’s chief strategy officer, Fran Clayton.

Senior ANZ traders personally footed the expenses of other staff, allegedly including members of its risk team, for travel and dining, according to new revelations.

US jobs data due. ASX has worst day, lowest close in over a week after record highs. Goodman Group, APA Group sell-downs completed. Iluka’s WA refinery costs weigh as government steps up support. Domino’s downgraded. Aristocrat down as gaming CEO joins rival. WiseTech director pockets nearly $200m via share sale.

Original URL: https://www.theaustralian.com.au/topics/anz-bank/page/3