Outgoing senator’s new job revealed

A long-serving outgoing Coalition senator’s new role once he steps out of parliament has been revealed.

A long-serving outgoing Coalition senator’s new role once he steps out of parliament has been revealed.

The big four bank has pushed out its timeline for interest rate relief by three months, after the RBA said inflation was still too high.

The big four bank is the latest institution to push out its timeline for a Reserve Bank interest rate cut, as customers start spending their stage 3 tax cuts.

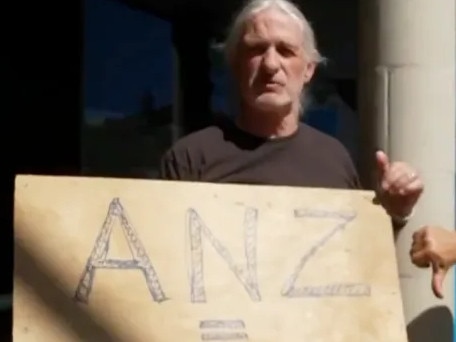

Interim nod for the aviation partners to operate 28 weekly return flights between Doha and Aus cities. Meta warns on incoming social media ban. Cbus chair Wayne Swan says no ‘reserve’ being built for fine payments. ANZ forecasts May rate cut.

ANZ knew of corporate regulator ASIC’s interest in a bungled $14bn bond placement nine months before it informed its shareholders.

A Sydney start-up that can write wills in 15 minutes for a fraction of the cost of the going market rate has picked up $17m to grow its business.

A former ANZ trader is claiming the bank could have ‘vindicated’ him after incorrectly claiming he was involved in market manipulation.

The bank will hire a new head of regulatory relations as it battles allegations of market manipulation.

The lender is pitching its new ANZ Plus platform as cheaper, faster and more compliant with regulation, as it prepares to transition customers to the new system.

ANZ bank has invested $2.5bn into its new online-only products and CEO Shayne Elliott says his team of software engineers has used AI to write code for apps and other programs.

Labor is on the cusp of closing a major deal with ANZ to ensure the bank does not follow some of its rivals and withdraw services from the Pacific, creating a potential opportunity for China.

Overall, Fonterra has flagged $4bn of assets for divestment globally, about half of which are in its ANZ unit.

The financial regulator has signalled its interest in the growing sector, pinning private credit and private markets as a priority for this year.

The lending major also revealed it sacked 88 staff last year for breaching the bank’s code of conduct.

There’s a full slate of career-defining issues coming directly at the ANZ boss. For a CEO heading into his ninth year, it should be much smoother.

The scandal-hit banking giant says the Australian economy is still strong, with high jobs growth and a low number of bad loans.

Super fund HESTA demands early exit for MinRes CEO Chris Ellison as partner Albemarle ramps up pressure. Scandal-hit ANZ’s cash profit drops. Cuscal kicks off $336.8m IPO roadshow. Block down on revenue miss.

Documents show ANZ chief executive Shayne Elliott spent more than 13 minutes apologising to the Office of Financial Management for the $14bn bond scandal.

MinRes takeover/break-up not ruled out as billionaire boss Chris Ellison’s exit plan takes shape. AFP enter PwC Australia offices as part of confidential breach probe. Westpac down on dividend miss, high costs.

ANZ’s revamp of its bond market strategy in 2022 sparked a crisis in its trading team, with some stars quitting and others resorting to risky tactics to deliver profits. Now, the corporate watchdog is investigating.

Corporate regulator ASIC says any decision about its investigation into ANZ is still months away, and says it needs more funding to run costly criminal investigations and prosecutions.

The bank’s board has headhunting firm Spencer Stuart leading the search to replace longstanding chief executive Shayne Elliott, as it navigates immense regulatory scrutiny.

ANZ says it hasn’t come across any surprises since acquiring Suncorp’s banking unit for $4.9bn, despite disclosing a $196m charge impacting its second-half earnings result.

A big four bank will reduce interest rates by up to 0.25 per cent, but you’ll need to meet this strict criteria.

The sharemarket was flat on light volumes as investors awaited key inflation data. Mosaic Brands enters receivership with KPMG appointed. ASX Limited hit by first strike against remuneration report.

Customers have slammed a big four bank for its “outrageous disregard” after it closed a local branch, forcing them to drive 1.5 hours to do their banking.

Local shares rally after Friday’s sell-off as US remains resilient. WiseTech dives as Board investigates allegations against CEO Richard White. Retailers down as Nick Scali drops on profit warning. MinRes shares hit as Board backs CEO Chris Ellison amid investigation over alleged tax evasion. Vulcan issues profit warning.

Can ANZ pull off its Asia growth story? The institutional banking unit is giving it a shot and does house a number of big-name customers, including Toyota.

Tightening supplies of raw materials may magnify a rise in prices if China’s stimulus measures manage to lift growth in the world’s No.2 economy and biggest consumer of most commodities.

Oliver Wyman, which reported on CBA’s governance in 2018, will conduct a sweeping review of culture and risk governance in ANZ’s embattled institutional division.

Original URL: https://www.theaustralian.com.au/topics/anz-bank/page/4