Anthony Albanese to break stage three tax cut promise

Anthony Albanese will breach his election pledge by proposing an overhaul of tax cuts, including retaining the 37pc tax bracket for those earning more than $135,000.

Anthony Albanese will breach his election commitment and risk igniting a damaging political campaign against the government by proposing a major overhaul of the contentious stage three tax cuts, including retaining the 37 per cent tax bracket for workers earning more than $135,000.

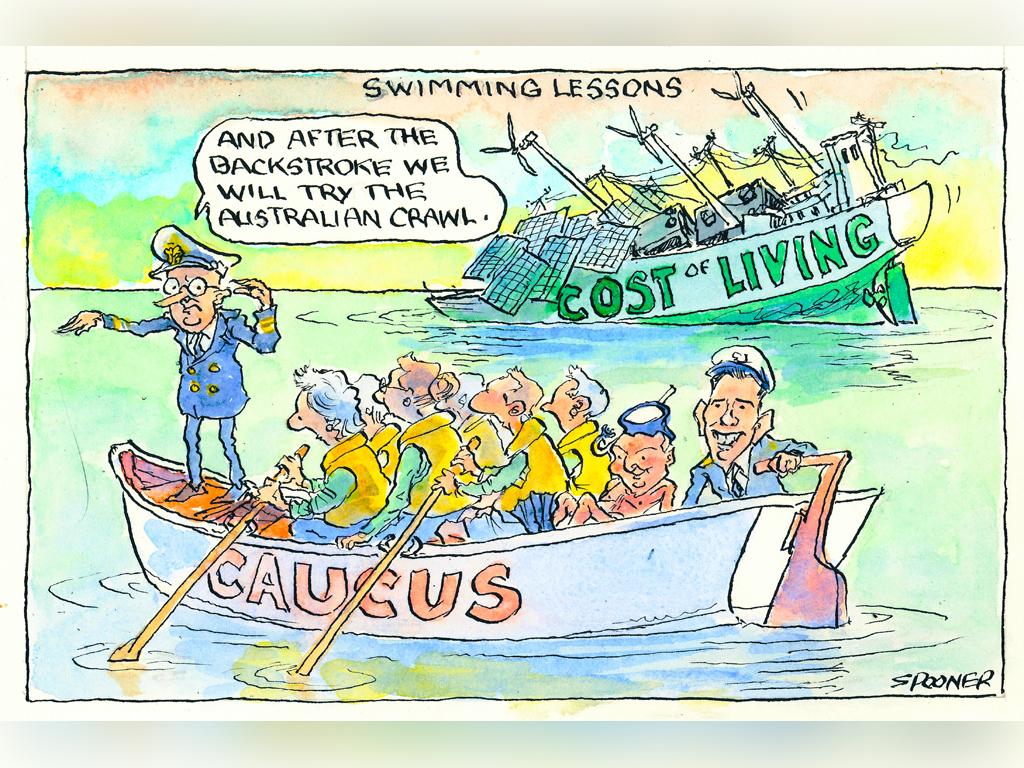

The Prime Minister will put to a special caucus meeting on Wednesday his intention to abandon flattening the tax rate, which, under stage three, would have imposed a 30 per cent tax rate from July 1 on the earnings of all Australians on incomes between $45,000 and $200,000.

The proposed rewriting of stage three would also involve the government reducing the planned 45 per cent income tax rate threshold from $200,000 to $190,000, with the shake-up aimed at delivering greater support to lower-income earners while paring back relief for wealthier Australians.

While the quantum of the tax cuts would remain the same, more tax relief is expected to be provided to workers earning less than $135,000.

Workers earning up to $150,000 could be overall better off under the changes as they will benefit from the lower tax rates for every dollar they earn to $135,000. But it would leave those on incomes above $150,000 relatively worse off.

Under the original stage three package, the 37 per cent tax bracket would be removed, the 32.5 per cent marginal tax rate would be reduced to 30 per cent and the threshold for the 45 per cent tax rate would be increased from $180,000 to $200,000.

Senior cabinet ministers contacted by The Australian on Tuesday night did not deny the suite of changes, but business warned that any tweaks to the stage three tax cuts would “undeniably dent the government’s credibility”.

The top employer groups – representing businesses that support millions of Australian workers – cautioned the Prime Minister that overhauling the tax cuts could jeopardise the “soft landing” for the economy following the post-pandemic surge in inflation.

Mr Albanese is expected to announce the tax changes and other “substantial” cost-of-living relief measures in his Thursday speech at the National Press Club, following the special caucus meeting on Wednesday afternoon. Labor sources conceded to The Australian that reducing tax relief for high-income earners put them at risk of a “broken promise” campaign.

Mr Albanese provided an assurance on Tuesday morning, declaring “everyone will be getting a tax cut” and clarifying the government was “looking at how we can help low- and middle-income earners”.

“Middle Australia particularly is doing it really tough. People have a mortgage, so we’re looking at ways in which we can provide assistance to them. We did that last year with a range of measures,” he told KIIS 106.5.

“People are benefiting from cheaper medicines, childcare, the energy price relief plan. But we’re looking at other ways as well.”

Former treasurer Peter Costello said the government should “stay the course” on the planned stage three tax cuts, arguing they were “part of a package, and stages one and two have already been delivered”.

“If you take away the final part now, you’ll unbalance the whole package,” Mr Costello said on Tuesday. “These stage three tax cuts don’t return anything like the bracket creep that’s occurred over the last 15 years so wage and salary earners are still significantly behind.”

A joint statement issued on Tuesday afternoon by the Business Council of Australia, the Australian Industry Group, the Australian Chamber of Commerce and Industry and the Minerals Council of Australia called on the government to deliver the tax cuts in full from July 1.

The organisations warned that “tinkering at the edges would mean a promise has been broken”, and said Australia had an “unhealthy reliance on taxing incomes.

“Delivering these tax cuts in full would help demonstrate that governments can make and keep promises,” the employer groups said.

“To not do so would undeniably dent the government’s credibility and damage the prospect of the fundamental phased revamp of taxation arrangements that the IMF has recently reminded us is so important for our future.”

The statement was signed by Ai Group chief executive Innes Willox, ACCI chief executive Andrew McKellar, BCA chief executive Bran Black and MCA chief executive Tania Constable.

The push from business came as ACTU secretary Sally McManus called on the government to dump the entire tax cut package.

The union leader told The Australian: “The government should ditch the stage three tax cuts. We need more help for people who are really feeling cost-of-living pressures and these tax cuts primarily help those who need it the least.”

The changes to stage three would require new legislation to be passed through the Senate.

However, the Coalition will oppose them, with opposition Treasury spokesman Angus Taylor saying “moving away from any aspect of the stage three tax cuts would be the mother of all broken promises”.

The Greens have also called for the stage three cuts to be scrapped in their entirety, warning they will “turbocharge inequality and inflation”.

An estimated 1.2 million Australians with an annual taxable income of more than $180,000 in 2024-25 would, on average, pay an extra $2640 to the Australian Taxation Office if the Albanese government chose to break its election promise and not raise the top threshold to $200,000 from mid-2024.

According to the Parliamentary Budget Office’s SMART online tool, the number of Australians paying more tax as a result of not adjusting the upper threshold would also grow to more than 2.7 million by 2033-34 as rising incomes push more workers into the nation’s top income tax bracket. The share of taxpayers in the top tax bracket, if unchanged, is also estimated to double over the next decade, from 8 per cent in 2024-25 to 16 per cent in 2033-34.

In their joint statement, the nation’s leading employer groups warned that Australia’s tax base was eroding and the nation had an “unhealthy reliance on taxing incomes as well as a raft of inefficient taxes, especially at the state and territory level”. “Fixing this mess requires not only political will and co-operation from across the federation, it will require public confidence that a program of reforms will be delivered as promised,” they said. “The micro-economic arguments in favour of staying the course with the stage three tax cuts are compelling.”

The employer groups said the tax cuts would be “positive for economic incentives and real living standards” at a time when Australia was dogged by “low productivity growth”.

They argued that, under the stage three shake-up, most middle-income earners would pay no more than 30 cents in personal income tax for an extra dollar earned which was a plus for workforce participation, work incentives and business investment.

“A further boost will come from the sharp reduction in the difference between personal income tax rates and the rate of income tax paid by companies,” the joint statement said.

“This is particularly important for small and family-owned businesses where effort will be redirected towards business (and employment) expansion rather than on navigating between different rates of tax applying to income flowing from different forms of business organisation.

“The macroeconomic question is centred around the impact these tax cuts will have on the sought-after ‘soft landing’ from the post-Covid surge in inflation. Not proceeding with the stage three tax cuts would significantly add to the risk of an excessive slowing.”

Additional Reporting: Rosie Lewis, Jess Malcolm

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout