Albanese must honour tax promise or risk confidence

Meanwhile, the way in which the cost-of-living crisis is now being handled has unleashed a bevy of ideas rooted in the politics of envy that can only do lasting damage. The wish list from Labor’s socialist left is to scrap negative gearing and capital gains tax concessions for investment properties and to wind back incentives for high-income earners to take out private health insurance. Experience has demonstrated the folly of all three suggestions. Others want the federal government to scrap payroll tax, a state tax that should have been abolished when the GST was introduced. Above all, Mr Albanese must be careful he does not repeat mistakes of the past.

The stage three tax cuts can be defended on political, equity and financial grounds. They are the third instalment of reforms designed to align the rates of corporate and personal taxation. Since they were announced, bracket creep has eaten further into the money that wage earners take home. Debate must be rooted in the understanding that this is taxpayer money being taken by government. It is not government money that is being given to high-wage earners as a gesture of largesse. As Anthony Keane wrote on Monday, high-wage earners are paying a disproportionate share of income tax. Someone earning $50,000 will pay about $6600 in tax next financial year, while a person earning $200,000 will pay around $51,600 – enough to fund two full age pensions, or 2.5 people on JobSeeker. The higher earner also pays four times as much Medicare levy.

The bottom line is government must look beyond income tax. It must also admit some things are beyond its control. There is a danger for government in accepting responsibility for everyday concerns such as grocery bills, power costs, housing and petrol prices. A suite of oversight measures is now in place for grocery stores that is reminiscent of the Whitlam government’s failed Prices Justification Act of 1973. Mr Albanese said on Monday: “We want to make sure whether it be the ACCC, Dr Craig Emerson’s review, the Senate inquiry that’s taking place, that we want that downward pressure on prices that people pay at the checkout because that’s what makes an enormous difference to the family budget.”

Gough Whitlam’s bureaucratic regime was introduced to ensure that no company should charge an “unjustified” price for its goods and services. The scheme was scrapped by the Fraser government because it was ineffective, costly and bad for industry efficiency and investment. Rather than walk back, Mr Albanese must build on the Hawke-Keating reforms that followed and were designed to grow the economy and build community wealth. This involves delivering tax cuts, being prepared to act to solve potentially costly industrial disputes on the waterfront, encouraging workplace productivity, and finding equitable ways to raise government revenue that do not discourage effort. Calling a talkfest to ventilate extreme positions that favour the marginalised and not the mainstream is a recipe to worsen the predicament the Albanese government is trying to escape.

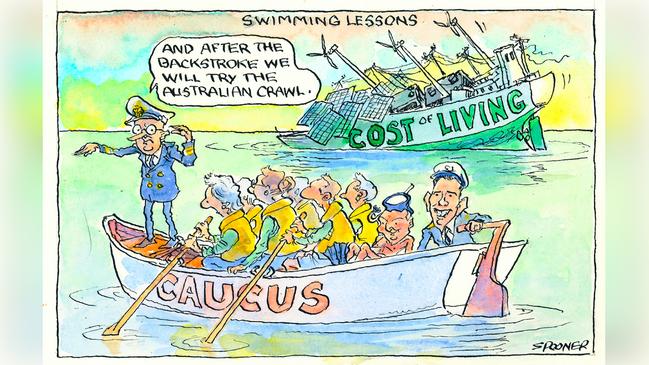

Anthony Albanese has complicated his political challenge by raising expectations the government can do more than is possible to ease immediate cost-of-living pressures without long-term cost. By seeking options and recalling caucus early to Canberra, the Prime Minister has put himself under unnecessary pressure. Sending a message that changes to the stage three tax cuts could be back on the table is wrongheaded and loaded with risk. The federal government has spent the first half of its first term adamant that it will not break the election promise to deliver the stage three tax cuts in full. To do so now would send a signal to voters that politicians cannot be trusted.