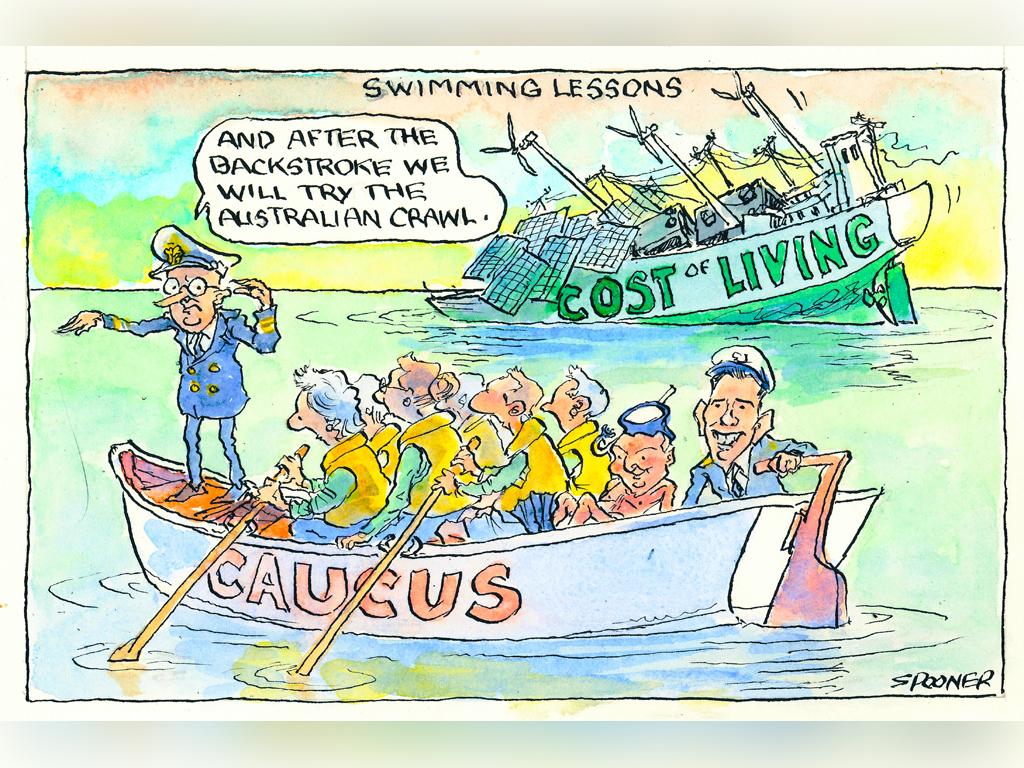

Labor caucus divided over tax cuts ahead of special cost-of-living meeting

The PM faces a divided backbench, with MPs warning any changes will expose Labor to a political campaign similar to the Gillard-era broken pledge on a carbon tax.

Anthony Albanese faces a divided backbench over stage three tax cuts, with his MPs split on whether to modify the package amid concerns it would expose Labor to a damaging political campaign similar to the Gillard government’s broken pledge on a carbon tax.

The future of the stage three tax package was thrown into chaos a day ahead of a snap caucus meeting called to discuss cost-of-living relief, with the government hosing down reports it would keep the top marginal rate at $180,000 while increasing the $18,200 tax free threshold.

Senior government sources rejected suggestions Labor was rewriting the stage three tax cuts, but did not rule out amending the package to limit relief for those at the upper end.

It came as the Prime Minister on Monday flagged that he would target “low and middle income earners who are doing it tough” with new cost-of-living measures expected to be finalised by cabinet on Tuesday. Some Labor MPs told The Australian they were open to amending the tax cuts so the benefits for the highest income earners were less generous, but others said making changes would amount to a broken election promise, with Mr Albanese having recommitted to the tax package at least 36 times in the past two years.

Keeping the top tax threshold at $180,000, instead of lifting it to $200,000, would increase tax revenue by $10bn over the budget’s four-year forward estimates, according to the Parliamentary Budget Office’s SMART online policy tool. If this was accompanied by an increase in the tax-free threshold to $19,400 from next financial year, the shake-up would have a neutral impact on the budget over the forwards and provide $228 in annual tax relief for workers.

Those earning $200,000 would see annual tax bills rise by $3000 when compared to the stage three reforms as currently legislated.

National accounts for the September quarter showed Australians were labouring under the heaviest tax burden in history, which alongside soaring mortgage costs and cost-of-living pressures had crushed consumer spending.

Income tax, net of government benefits, pushed to a record 14.4 per cent as a share of household gross disposable income, from a pre-pandemic level of about 8 per cent, with stage three tax cuts aimed at returning some of the bracket creep back to workers’ pockets. Labor WA senator Louise Pratt indicated initial support for an overhaul of stage three tax cuts that were appropriate for the “economic times”, adding that she was reluctant to pre-empt any decision.

“I think we need to respond to the economic times appropriately,” she told The Australian. “I’m confident the government has always had this in mind, so I’m hoping the government makes the right decision.”

Another Labor MP said they would be shocked if Mr Albanese walked back on his commitment to carry out the tax cuts, comparing it to former Labor prime minister Julia Gillard’s election promise not to pursue a carbon tax.

“It’s like the ‘No carbon tax under the government I lead’ stuff. It’s that part two,” the MP said.

“It might be discussed but I’d be very surprised … I’d be more shocked if that would be revisited.”

Another Labor backbencher urged Mr Albanese not to revisit the policy, given he had committed to it several times since the 2022 election. “Times are different but we have continued to reiterate our stance so many times I don’t know we can go back on our word,” the MP said. “I can see the logic of it … but I am very concerned we would be breaking an election promise.”

Another Labor MP said the government was “damned if we do, damned if we don’t” but signalled support for an overhaul.

“If you’re earning $300,000 a year, you’re probably not desperately needing a tax cut. But if you’re working and earning $45,000 to $50,000, then anything the government can do will be welcome,” the MP said.

“Bread still costs $5 a loaf. Petrol is still $1.77 a litre. It has a bigger impact on people on low incomes than high incomes.”

The debate came as leading economists backed targeted cost-of-living relief measures and the stage three tax cuts to help keep a stuttering economy afloat through 2024 without unduly adding to inflation.

NAB chief economist Alan Oster said he was “more worried about the near-term outlook for the economy”.

“I think the tax cuts will help,” he said. “We have only 0.5 per cent growth in the first half of this year. If you took away a lot of the tax cuts, you would take away from growth, and growth is already pretty poor.

“I think the inflation challenge is … I don’t want to say behind us, but it’s going to be coming down quite a lot from here.”

Treasury in its December budget update projected inflation would slow to 2.75 per cent in 18 months – a forecast that incorporated the impact of the legislated tax changes. Westpac chief economist Luci Ellis said the stage three relief was designed to reverse the effects of bracket creep and it was “very reasonable” for government to consider further measures to ease pressure on struggling households. “As long as they are not handing over a lot of extra income to households, I don’t think the impact on aggregate demand will be material,” Dr Ellis said.

CBA head of Australian economics Gareth Aird said when it came to tax cuts, it was important not to confuse needed reform with immediate economic pressures.

“Tax cuts are proper reform. And we should not be focused on their impact on the short-term business cycle – that’s up to the Reserve Bank to manage.”

Stage three tax cuts – which take effect from July – would create a single flat tax rate of 30 per cent for those earning between $45,000 and $200,000 a year.

Speaking on Sky News, Mr Albanese said the government would take “whatever advice is given to us” after tasking Treasury and Finance to come up with further cost-of-living measures ahead of the May budget.

He said their recommendations would be received ahead of Wednesday’s caucus meeting.

He also defended the government for already delivering $23bn in support through its energy price relief plan, cheaper medicines, cheaper childcare and fee-free TAFE policies.

He said Labor was “making sure customers, when they get to the checkout in the supermarket, can get things at the cheapest possible price. And that’s why we’ve also asked the ACCC for advice about … what further action can be taken.”

Brendan Coates, head of the Grattan Institute’s household finances program, said he supported reducing the size of the stage three tax cuts on the basis that it was “a huge amount of money out the door” at a time of high inflation.

He said the cost of the cuts made it harder to offer cost-of-living relief to poorer households.

Mr Coates said providing an extra 40 per cent in commonwealth rent assistance would cost about $1.2bn a year – about half of the extra revenue raised over the forward estimates by trimming tax relief at the top end.

“That would help about a third of all renters, overwhelmingly those on low incomes, and put as much as $1000 in their pockets. It would also reduce measured inflation over the next financial year by about 0.1 per cent,” he said.

Additional Reporting: Jess Malcolm Rhiannon Down

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout