Bracket creep to push a further 1.5m into top tax bracket

An extra 1.5m Australians will be pushed into the top tax bracket over the coming decade if Labor chooses to renege on raising the highest threshold as legislated in the stage three tax reforms.

An extra 1.5 million Australians will be pushed into the top tax bracket over the coming decade if Labor chooses to break a promise and renege on raising the highest threshold as legislated in the stage three tax reforms.

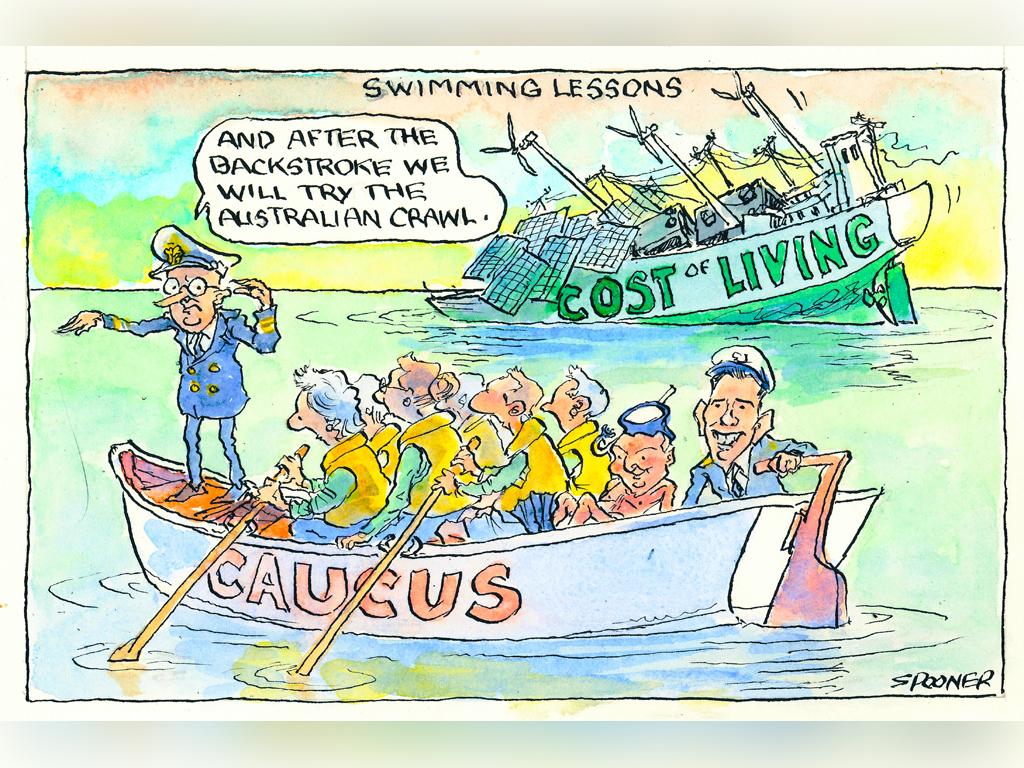

Amid fevered speculation that Anthony Albanese could announce changes to the legislated tax cuts following Wednesday’s special caucus meeting, The Australian’s analysis using the Parliamentary Budget Office’s SMART online tool shows there will be an estimated 1.2 million Australians with an annual taxable income of more than $180,000 in 2024-25, and who will on average pay an extra $2640 to the ATO if the Albanese government chooses to break an election promise and not raise the top threshold to $200,000 from mid this year.

By 2033-34, the analysis shows that the number of Australians paying more tax as a result of not adjusting the upper threshold will grow to more than 2.7 million people as climbing incomes push workers into the top income tax bracket and the population grows.

The share of taxpayers in the top tax bracket, if unchanged, is estimated to double over the next decade, from 8 per cent in 2024-25 to 16 per cent in 2033-34.

With the Albanese government on course to can promised tax relief, Sydneysider Roberto Scotto, 47, said the mooted changes would be a “kick in the guts” as he struggled to buy his family a home amid soaring cost of living.

Mr Scotto works 60 hours each week to run his own media-buying business, paying himself around $180,000. Still, he is unable to break into an overheated property market, with his rent nearly doubling in the past three years.

“Making $180,000 is like earning $60,000 15 years ago. It’s not like we’re buying lunch every day; we’re having breakfast at home to save money. We’re not buying coffee every day. Budgeting is a massive thing,” he said.

The $180,000 threshold has not been changed since 2008, and holding it at that level rather than lifting it to $200,000 would raise $10bn in additional tax revenue over the coming decade.

An increase in the tax-free threshold from $18,200 to $19,400 from next financial year would leave a neutral impact on the budget over the forwards, and provide $228 in annual tax relief for workers. By contrast, Australians earning $200,000 would see their annual tax bills rise by $3000 versus the stage three reforms as legislated.

If the top income tax bracket had been adjusted to account for inflation since June 2008 – as is the case in other leading economies such as the US, Sweden and Canada – then the highest threshold would be $266,000.

As bracket creep and a booming labour market push the income tax burden on households to record levels, Westpac chief economist Luci Ellis urged the government to index the tax thresholds to 2.5 per cent – the mid-point of the Reserve Bank’s inflation target – as a way to limit the political stoushes over ad hoc adjustments to the income brackets.

Such an approach would also blunt the deleterious impact of bracket creep of workers’ living standards, Dr Ellis said.

EY chief economist Cherelle Murphy said it was important to recognise that climbing average income tax rates came at an expense to the economy, as they tended to reduce the appetite for Australians to work.

“If you continue to let inflation eat up people’s wages and result in higher tax bills, it discourages workers to chase higher wages and work harder,” Ms Murphy said.

“On the other hand, of course, at this point in time when we still have inflation, clearly it (the tax cuts) won’t be neutral for spending. So it’s not a black and white argument,” she added.

The IMF in its annual report on Australia said the country was overly reliant on income tax, and that “comprehensive tax reforms remain indispensable to long-term fiscal sustainability and productivity”.

“Average income tax rates are high in Australia, and bracket creep will raise the tax burden shouldered by workers to finance age-related spending,” it said.

The stage three tax cuts are factored into Treasury forecasts, which suggest consumer price pressures will continue to ease despite the stimulatory impact from more than $10bn in tax cuts in 2024-25.

December’s budget update forecast inflation will drop to 2.75 per cent in 18 months’ time, and back into the Reserve Bank’s 2-3 per cent target range.

With the economy slowing to a near stall, analysts and investors expect rate cuts from the middle of this year.

ANZ head of Australian economics Adam Boyton estimated that the legislated changes to create a flat 30c tax rate on income between $45,000 and $200,000 would add around 0.4 percentage points to economic growth next financial year.

That stimulus was the equivalent to two RBA interest rate cuts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout