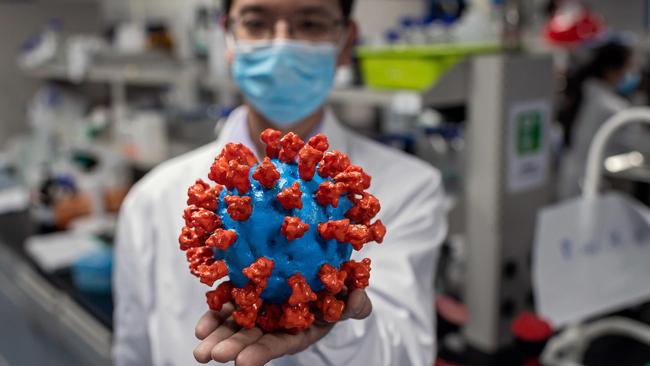

ASX jumps 1.8pc on hope of coronavirus vaccine

Local shares added 1.8pc in their third day of gains despite new tariffs, as oil prices surged.

- Virus trial helps ASX up 1.8pc

- Bulk of job losses behind us: RBC

- Listed barley growers shake off tariffs

- Worst of contraction is over: Macq

That’s all from the Trading Day blog for Tuesday, May 19. The ASX surged to a 10-week high, up 1.8pc for the day, as world markets rally amid optimism about a potential coronavirus vaccine.

Overnight, US biotech Moderna reported initial positive results for its COVID-19 vaccine in human trials. The news sent the Dow up by 3.9 per cent as the S&P 500 jumped 3.2 per cent and the Nasdaq gained 2.4 per cent.

Locally, Tabcorp scrapped its dividend, while Aussie barley farmers grappled with new 80pc tariffs from China and Macquarie wrote the worst of the contraction might have passed.

Nick Evans 8.40pm: Resources upbeat about tariff risks

The resources sector is keeping a close watch on the growing trade stoush between Canberra and Beijing, but senior sources say they do not expect any spillover into Australia’s critical minerals exports.

Despite concerns coal exports could again be targeted with increased scrutiny at Chinese ports, industry sources say there is little sign Beijing is preparing to broaden its attack on Australian exports from barley to mineral commodities.

Last week China’s state-backed coal transportation and distribution association reportedly called on authorities to tighten restrictions on imported metallurgical coal to protect domestic producers, exacerbating concerns Australian exporters could get caught up in the trade tensions after calls from Scott Morrison for an investigation into China’s role in the emergence of the COVID-19 panic sparked criticism from Beijing.

But industry sources say there has been no sign of any threat to key commodities, with no slowdown in the rate of coal exports from Queensland or NSW ports, or of iron ore shipments from the Pilbara.

With China’s leadership seen as likely to announce stimulus measures at the Communist Party’s National People’s Congress on May 22, resources sector sources say they expect any further retaliatory action from China to target consumer goods and agricultural exports — wine or dairy products — rather than take action that could make it more expensive for China’s industrial heartland to contribute to the country’s recovery from the coronavirus.

John Durie 8.17pm: Power to ‘switch on’ energy reform

Neville Power is in the process of helping to advise government on sustainable strategies to boost economic growth post-COVID-19, but has hit an apparent brick wall over energy policy. Many in business — from BHP, Rio Tinto and down, and even Power’s old shop Fortescue — are committed to zero net carbon emissions in 2050 or, to be more precise, “in the second half of the century”.

But in public interviews, including with this column, Power has stepped well clear of the commitment, arguing instead that the growth of renewable energy would bring Australia under its international targets.

True enough, but the argument is over both supply (renewables) and demand, and every state in the country has a stated zero net emissions target for that very reason. It’s as if Power is speaking on behalf of the federal government on the issue.

Leo Shanahan 7.52pm: Watchdog calls out BigTech news claims

Rod Sims has called out Google and Facebook over claims they don’t make any money from news media for what they are: rubbish.

The big techs have done a good job so far of conflating issues of payments for advertising on news story searches and Google News while ignoring the broader issue of the overall benefit they derive from the presence of original journalism on their platforms.

While the ACCC is rightly looking into the opaque digital advertising market in Australia and how it interacts with media and other competitors, perhaps not enough attention is paid to the self-evident value of journalism to tech giants.

On Tuesday, Rod Sims made the point explicitly, highlighting the fact tech giants make money from news’s very existence on their platforms, but also pointed to the difficulties in quantifying costs.

“Clearly the biggest benefit is not the direct benefit, which is the ads shown against news items. That’s the really, really small benefit. The bigger benefit is the indirect value that Google and Facebook gain from having news on their platform,” Mr Sims said on Tuesday.

Jared Lynch 7.23pm: Medibank: ‘Bounce in investments’

Medibank says its investment portfolio has begun to rebound after the sharemarket rout in March shredded 77 per cent off the total income of all Australian private health insurers.

Total investment income dived to $94.7m in the year to March 31, down from $415.9m a year earlier, according to data from the Australian Prudential Regulation Authority released on Tuesday.

Medibank chief executive Craig Drummond said while investment income had begun to rebound in April and May, it had not come close to recovering from the March sharemarket rout, which was the worst crash in more than 30 years.

“Stockmarkets, private equity, infrastructure and property, all of those markets falling in the March quarter, saw investment returns fall sharply whereas in April and the first part of May, we have seen stockmarkets globally recover a bit,” Mr Drummond told The Australian.

“So some of those investments have improved but they certainly haven’t recovered anywhere near the amount that was lost in the March quarter.”

But Mr Drummond said that unlike the superannuation funds, Medibank’s investment portfolio was conservative, with 82 per cent consisting of defensive investments such as cash and single-A rated fixed interest.

David Swan 6.57pm: Media, tech giants split on revenue

Competition tsar Rod Sims has lifted the lid on negotiations that broke down between the tech giants and Australia’s media companies, revealing that a proposed revenue sharing model was a key sticking point that could not be resolved.

Last month, the Morrison government ordered the Australian Competition & Consumer Commission to devise a world-first mandatory code for the tech giants to pay media companies for their content after talks about a voluntary code failed.

Announcing a new options paper on Tuesday, ACCC chair Mr Sims said it became clear early on during the discussions that the goalposts were too far apart for the parties to be able to reach an agreement.

6.34pm: TPG releases merger booklet

Telco TPG has released its 350-page scheme booklet relating to a $16bn merger with Vodafone Australia.

TPG reiterates to shareholders that the value and strategic opportunities offered by the merger reflect a compelling proposition for TPG shareholders.

“The TPG directors unanimously recommend that TPG shareholders vote in favour of the scheme, in the absence of a superior proposal,” the TPG board says.

The TPG board also commissioned an independent expert, Lonergan Edwards, to prepare the Independent Expert’s report in relation to the Scheme.

The Independent Expert has concluded “that the scheme is in the best interests of TPG shareholders, in the absence of a Superior Proposal,” the report says.

The merged TPG Vodafone will have a mobile market share of around 17 per cent and a fixed line broadband market share of around 25 per cent.

Glenda Korporaal 6.08pm: FIRB may shape Virgin result

As the four shortlisted bidders hunker down in virtual discussions with Virgin’s administrators and management this week, the foreign investment review processes are ticking away in the background.

While the administrator, Deloitte’s Vaughan Strawbridge, will want to see a bid which means the smallest haircut for Virgin’s $7bn in creditors, the decisions of the Foreign Investment Review Board, then Treasurer Josh Frydenberg, could be crucial in shaping the winning consortium, bringing in a host of other “national interest” considerations.

Under temporary changes introduced in March, designed to stop foreign bidders snapping up Australian assets at rock bottom prices during the COVID crisis, foreigners need FIRB approval regardless of value or the nature of the investment.

All four bids for Virgin are expected to need FIRB approval.

Lilly Vitorovich 5.25pm: Missing Alan Jones already?

Commercial Radio Australia (CRA) plans to release a special online listening survey late next month to keep advertisers in the loop, but it won't give an early indication of Ben Fordham and Neil Breen's performance on breakfast radio following the departure of Alan Jones.

Amid concerns by media buyers about buying airtime following the industry body's decision last month to suspend the next three official radio surveys during COVID-19, CRA said Tuesday that it has commissioned research provider GfK to undertake the survey via an online e-diary.

The survey will capture data across the five major capital city markets from a sample of 2000 participants from May 17 to June 13. It will provide information on how many people listened to radio and key metrics on time, place of listening and demographics. However, it won’t provide individual station-specific results.

A CRA spokeswoman told The Australian that “clients will get a useful insight into audience trends”, including the capital city performance and aggregated data on day parts, such as breakfast.

“The survey is not intended to replicate the official radio surveys due to the sample size and different methodology involved.”

Richard Ferguson 5.06pm: Trade minister hits back at China Embassy

Trade Minister Simon Birmingham has slammed China’s Embassy in Australia for calling the nation’s success in securing a global investigation “nothing but a joke”, saying Australia will not engage in cheap politicking with the communist nation.

A spokesman for Chinese Ambassador Cheng Jengye said earlier in the day there would be no “independent international review” as Australia wanted because the investigation will be led by the World Health Organization.

Senator Birmingham later said he would not stoop to political attacks over COVID-19, pointing out it has led to the loss of Chinese lives and jobs.

“Australia is not going to engage in cheap politicking over an issue as important as COVID-19,” he told Sky News.

“COVID-19 has claimed the lives of hundreds of thousands of people around the world, including Chinese lives. It’s caused economic devastation with the loss of millions of jobs including Chinese jobs

“And we think these issues ought to be considered seriously. Our engagement through the World Health Assembly has been to seriously engage with other parties around the globe.”

Read more: Trump warns WHO on funds membership

4.59pm: Aussie dollar surges

The Aussie dollar is surging after the close, hitting its best levels since mid March on renewed risk sentiment.

At 5pm, AUDUSD spiked to US65.64c - up 0.6 per cent.

The currency hasn’t traded that strong since around March 10.

It comes as investors cheer positive vaccine trial results and look through to the possible opening up of the economy.

4.11pm: Virus trial helps ASX up 1.8pc

Investors cheered early signs of potential coronavirus vaccine on Tuesday, sending shares to a 10-week high.

A strong Wall Street lead sent the market up as much as 2.7 per cent early with gains across all sectors, but optimism waned by the close, trimming the benchmark ASX200's rise to 99 points or 1.81 per cent at 5559.5.

The lift represents a third day of gains for the market, its first three-day rally in two months.

Meanwhile, the All Ords added 101 points or 1.82 per cent to 5658.8.

David Ross 4.02pm: Hazelwood Power station fined over bushfire

The operator of the now closed Hazelwood Power station and mine in the Latrobe Valley in Victoria’s east has been fined $1.56m by the state’s Supreme Court.

Hazelwood Power Corporation last November was found guilty of 10 charges for the fire in 2014 that tore through the north end of the open-cut mine near Morwell.

The fire blanketed the Latrobe Valley in smoke for 45 days after it was sparked by embers from a nearby bushfire on a day of significant fires across the state.

Justice Andrew Keogh in his sentencing remarks on Tuesday said the operator of the Hazlewood mine had demonstrated a degree of complacency by not preparing adequately for the fire.

“This was not because of any conscious disregard by (Hazelwood), which was clearly attentive to the risk of coal fire at the mine,” he said.

“It was in (the corporation’s) interest to reduce the frequency and size of coal fires, and it had achieved real success in doing so. Hazelwood hadn’t come under attack from a bushfire or burning embers in almost 60 years of operations.”

WorkSafe Victoria CEO Colin Radford said while the Hazelwood corporation did not start the fire it should have prepared better for the risk.

Read more: Hazelwood fined $156m over bushfire

Bridget Carter 3.12pm: Virgin asks for emergency gov’t funds

DataRoom | Virgin Australia is understood to have reached out to the federal government on Monday night for emergency funds to keep the airline in operation until the conclusion of the sales process, say sources.

It comes after administrator Deloitte shortlisted four parties on Monday to take through to the second round of a sales process, where final bids are due around June 12.

The hope is to reach a conclusion for a transaction by the end of next month.

However, some in the market believe that the timetable could be overly ambitious and say that with all the stakeholders that need to be consulted, including unions, governments and other creditors, they believe that a sale of Virgin Australia is unlikely to be concluded any time before at least September.

Virgin Australia collapsed last month owing its creditors $6.8bn and fears are mounting that it is running out of cash.

Some say that should Virgin Australia be unable to pay its bills to stay in the air, liquidation may be the only option.

Read more: BGH, Bain, Indigo and Cyrus form Virgin Australia shortlist

Jared Lynch 3.04pm: Listed barley growers shake off tariffs

Listed agribusinesses GrainCorp and its spin-off United Malt are both trading higher in the afternoon session, even as Aussie barley growers brace for a financial of at least $500m a year from new China tariffs.

Barley growers were expecting a bumper 12 million tonne crop this year following significant rainfall which broke three years of drought.

But now 60 to 70 per cent of that barley is looking for another market, after the People’s Republic of China imposed the high tariffs, which will cruel its trade with Australian barley growers.

Grain Growers chairman Brett Hosking said exporters were facing a challenge to find alternative international markets for the barley originally destined for China.

GrainCorp edged higher after an early slip, last up 0.25pc to $4 while United Malt trades up 0.75pc to $4.05.

Read more: Barley growers scramble to find markets

2.33pm: Bulk of job losses behind us: RBC

The easing of job losses, coupled with a softening of some coronavirus restrictions is encouraging for the economy, according to RBC chief economist Su-Lin Ong.

Following the release of the latest ABS payrolls data, Ms Ong writes that “labour shedding has been front-loaded and the bulk of it is behind us, with far more modest losses near-term”.

“In terms of acutal numbers, the payrolls data suggest just under one million jobs since mid-March.”

She adds that jobs in accommodation and food servies saw some small gains in employment for the two week reporting period and while “they are are from a low base and small”, they are “moving in the right direction”.

“Encouraging early signs in the hardest-hit groups although we caution that the eventual recovery in the labour market will take considerable time, likely years, amid much uncertainty, sub-par growth, and possible permanent changes to industry post COVID-19.”

1.58pm: Adelaide Brighton rebrands as ADBRI

Buiding materials supplier Adelaide Brighton has rebranded as ADBRI as it told shareholders at its AGM today its trading for March and April had been in line with expectations.

Chief Nick Miller told shareholders the start of the year had been slow after rain, bushfire, smoke and heat events, but had stabilised since, even amid the coronavirus downturn.

Mr Miller said defence project work had helped to offset the impact of a subdued residential market in South Australia but its Sunstate joint venture with Boral was experiencing lower cement sales and NSW was subdued.

“It is clear that housing approvals will decline, and as Raymond previously stated, it is difficult to predict with any certainty how protracted this might be,” he said.

“All levels of Australian Government are working with industry to fast-track infrastructure projects to bring necessary stimulus to the economy, and again, it is difficult to forecast exactly when each project will come to market.”

At the meeting, shareholders approved the name change to ADBRI, an “evolution” from its original name to show its national spread.

ABC last traded up 6.3pc to $2.55.

1.46pm: Baby Bunting surging on sales growth

Baby Bunting shares have risen more than 15 per cent after Australia’s largest specialty retailer of baby goods said its sales growth had continued despite the coronavirus lockdowns.

The company said since December 30, total sales growth is 13.2 per cent, comparable store sales growth is 8.1 per cent and online sales are up 66 per cent, compared to the same period a year ago.

“Our sales performance reflects the less discretionary nature of the baby category and we have welcomed many new customers to our brand in these difficult times,” Baby Bunting said.

BBN last up 15.7pc to $3

.09.

AAP

Bridget Carter 1.19pm: Latest high profile banker to call quits

DataRoom | Key players heading for the door at investment banks has been a hot topic of late, and the latest name to surface in the discussion is Aiden Allen.

Mr Allen is currently the head of investment banking at UBS and the talk around the market is that the New Zealand outfit Jarden has been making efforts to recruit the high-profile adviser as part of a major push into the local deal-making scene.

Already, in recent days, Jarden has tapped some of the most successful operatives in the Australian investment banking market.

This includes equities expert Robbie Vanderzeil, who left UBS this year, along with the Goldman Sachs head of equity capital markets for Australia and New Zealand, Sarah Rennie, who worked at UBS before Goldman’s.

Also joining the Sydney base of the group across the Tasman is ex UBS equities syndicator John Spencer and Dane Fitzgibbon, who was co-head of capital markets at UBS between 2004 and 2017.

Read more: Staff departures continue at Goldman Sachs

Lilly Vitorovich 1.08pm: Nine’s NZ business hangs in the balance

The future ownership of Nine Entertainment’s New Zealand media business Stuff hangs in the balance after NZME’s push to buy the business for just $NZ1 (93.6c) failed.

NZME, which owns Auckland masthead the New Zealand Herald and other media assets, disclosed on Tuesday morning that it has been “declined an interim injunction to preserve the exclusive negotiation period previously agreed with Nine”.

Nine, led by chief executive Hugh Marks, on May 11 rejected NZME’s view, declaring that talks were over. On the same day, Stuff CEO Sinead Boucher declared that the negotiations had ended the previous week.

Nine is understood to be in talks with other potential buyers of Stuff after walking away from NZME’s offer, which is substantially lower than the $1bn-plus former Fairfax boss Fred Hilmer paid for the business nearly two decades ago.

As a result of the NZ High Court’s decision, NZME has told the NZ Commerce Commission that it has withdrawn its clearance application.

NZME said it is “disappointed but respects the Court’s decision”.

Read more: NZME fails in push to buy Nine’s Stuff

1.01pm: Shares trim gain to 2pc

Shares have trimmed a gain as much as 2.7pc to 2pc at lunch, as global markets cheer positive steps toward a coronavirus vaccine.

In early trade, shares hit a ten-week high of 5606.8, but were last up by 110 points or 2.02 per cent to 5570.8.

Heavyweight miners are again helping most - BHP is up 5pc as Rio Tinto trades up by 4.4pc while the major banks are all gaining by between 2pc and 3pc.

James Hardie is a standout, up 10.3pc after strong results while gold miners such as Northern Star are pulling back from yesterday’s rally.

Here’s the biggest movers at 1pm:

12.36pm: Worst of contraction is over: Macquarie

The worst of the stockmarket contraction may have passed, according to Macquarie, so long as there is no second wave of infection or shutdowns.

In an equity strategy note, Macquarie notes that if March 23 is taken as the low, then current levels are in the ‘late contraction’ phase of a recession - “that part of the recession where stocks often go up even when unemployment rises above 10pc”.

Comparing the current environment to previous recessions, Macquarie writes that we could wait for a re-test of the lows, but in the 1990-1991 recession that was nearly two years later.

As such, the broker is overweight Resources, especially iron ore majors BHP, Rio Tinto and Fortescue as they generate free cashflow to pay dividends, while gold miners Evolution and Saracen are top picks given money supply expansion.

“We switch to Crown Resorts (from Star Entertainment) given the better balance sheet and Blackstone’s interest. We add a new position in Wesfarmers who could do an accretive acquisition or return capital. We also maintain Aristocrat as the digital business revenues should have benefited from the shutdowns,” Macquarie says.

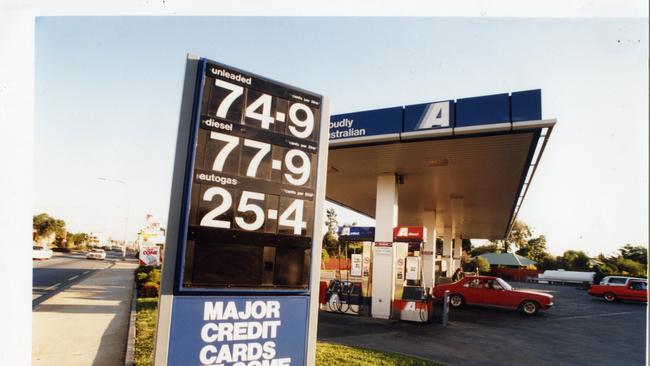

Perry Williams 12.29pm: Ampol makes ASX debut

Caltex has started trading under its new name, Ampol, after shareholders approved the brand switch last week at its annual general meeting.

The new ticker is ALD on the ASX.

The first Ampol sites will appear in Sydney and Melbourne in the second half of 2020 with a national rollout in 2021 and use of the Caltex name officially shelved by the end of 2022.

Caltex was using the brand name under licence from Chevron but the US giant terminated the deal in December after re-entering the Australian fuel retail sector, buying Puma’s 360 petrol stations.

ALD last traded up 2.9pc to $26.05.

Read more: Timing right for Ampol brand switch

Adam Creighton 12.27pm: RBA warns of pain for property developers

Property developers are about to face a world of pain as the economy braced for an economic downturn “unprecedented in the 60-year history of Australia’s quarterly national accounts”, the Reserve Bank Board has heard.

The RBA board, which kept the official cash rate at 0.25 per cent, a record low, at its May meeting, expects a slump in commercial property rents and outright deflation through the economy, according to the many minutes.

“A large amount of new office space was expected to be completed in Sydney and Melbourne in 2020. Members noted that demand was not expected to keep pace with stronger supply in the near term and therefore it was likely that vacancy rates would rise and office rents would fall,” the minutes said.

“At the same time, the supply of rental housing had been boosted as properties that had previously been offered as short-term accommodation were shifted to the long-term rental market,” the added.

The Reserve Bank expects the economy to contract 8 per cent over the year to June, and the jobless rate to remain reach 10 per cent before falling to around 6.5 per cent by mid 2022, according to RBA’s quarterly economic update.

Read more: Economy lurches into unknown territory

12.04pm: Job losses are slowing: ABS

The avalanche of job losses from mid-March is showing signs of slowing with some jobs even coming back to the accommodation and food services industry, according to the ABS.

In its latest release, head of labour statistics Bjorn Jarvis writes that the rate of job losses slowed between mid-April to early May.

“The largest net job losses over the seven weeks of the COVID-19 period, in percentage terms, were in Victoria and New South Wales, where the falls in payroll jobs were around 8.4pc and 7.7pc,” he said.

“Payroll jobs worked by people under 20 continued to show the largest falls (-14.6pc), and were particularly high in some states and territories, such as the Australian Capital Territory (-19.2pc).”

He adds that accomodation and food services industry, one of the hardest hit, had dialled back its rate of job losses - from 33.3pc initially to 27.1pc by the start of May.

11.57am: Monetary policy working: RBA

The Reserve Bank board noted its monetary stimulus is “working broadly as expected” in its latest minutes, adding that the packaged had contributed to the significant improvement in the function of the government bond market.

Minutes of the board’s May meeting show a broad discussion of the international and domestic outlook - including that household consuption was expected to cotnract by 15pc over the first half, while lower incomes, confidence and population would keep demand for new housing low for an extended period.

Members discussed the impact on investment of more peole working from home and a continuing shift of retail activity online.

#RBA May minutes: policy settings "working broadly as expected", 3yr yld at target & market functioning had improved allowing purchases to be tapered but will step up again if needed. pic.twitter.com/qCKCmHmyPP

— James Foster (@JFosterFM) May 19, 2020

Nick Evans 11.32am: Stanmore Coal suitor falls short

Indonesia’s Golden Investments has failed to secure full control over Stanmore Coal at its second attempt, after the company’s second biggest shareholder failed to sell into its $1 a share bid.

Golden, controlled by Indonesian coal major GEAR, was left hanging with 75 per cent of Stanmore shares when the offer closed on Monday night, according to disclosures made to the Australian exchange on Tuesday.

Another 14.4 per cent per cent is held by M Resources, a coal trading company owned and run by Matt Latimore.

Weirdly, M Resources sold down $15m worth of shares on the market on Friday - on the numbers, just enough to tip Golden over the 75 per cent threshold.

But the company did not sell the rest of its shares before the offer closed on Monday night.

SMR last down 5pc to 95c.

Bridget Carter 11.27am: Decmil halted for $40m raise

DataRoom | Decmil has entered a trading halt to embark on a capital raising as it reshuffles management to appoint a new chief executive.

The firm is looking to secure up to $40m through an institutional placement and an accelerated non-renounceable entitlement offer.

Its largest shareholder, Thorney, has indicated it intends to take up its full entitlement in the offer. Among other major shareholders participating is founder Denis Criddle, while board members are also participating.

The company entered a halt this morning, as it also announced the appointment of executive director Dickie Dique as its chief executive to lead its turnaround strategy.

Funds raised will be used to recapitalise the balance sheet and position the company to maximise growth opportunities.

Decmil is understood to have been selling the raise on what it believes to be a robust order book and strong pipeline, with several recent contract wins announced.

Shares have ralled since its relisting on March 30.

Read more: Decmil kicks off capital raising

11.19am: Nasdaq to restrict Chinese IPOs

The US Nasdaq market is reportedly tightening its IPO rules in a bid to restrict Chinese companies from debuting on its exchange, according to Reuters.

In a report citing unnamed sources, Reuters says changes to listing criteria have been driven “largely by concerns about some of the Chinese IPO hopefuls’ lack of accounting transparency and close ties to powerful insiders”.

The move comes as tensions flare between the two countries over China’s handling of the COVID-19 pandemic.

Exclusive by @DEER_ECHO_

— Vincent Lee (@Rover829) May 19, 2020

NEW YORK, May 18 (Reuters) - Nasdaq Inc is set to unveil new restrictions on initial public offerings, a move that will make it more difficult for some Chinese companies to debut on its stock exchange, people familiar with the matter said on Monday.

Robyn Ironside 11.02am: Qantas won’t block out middle seat

Qantas is preparing for a return to more regular domestic flying with a range of new safety initiatives taking effect from June 12, including face masks for passengers and hand sanitising stations at departure gates and lounges.

The wellbeing improvements are designed to give passengers peace of mind when coronavirus restrictions ease, but will not extend to seats being blocked out for “social distancing” on flights.

Qantas medical director Dr Ian Hosegood said that social distancing was simply not practical.

QAN last traded up 6.1pc to $3.59.

Read more: Mask but no gaps on Qantas flights

Cliona O’Dowd 10.49am: OFX slashes dividend amid volatility

Australian currency transfer business OFX has slashed its dividend by close to 30 per cent and says it will not commit to positive operating leverage this year as it steps up its investment in the business amid an uncertain revenue outlook.

The ASX-listed company, formerly known as OzForex, delivered a 19 per cent lift in statutory net profit for the 2020 financial year, to $20.3m, with the result boosted by strong trading activity through the March quarter.

Turnover for the year rose 4.1 per cent to $24.7bn, while fee and trading income jumped 6.6 per cent to $137.2m. Transaction volume was up 6.2 per cent for the year.

“The investment we have made in our infrastructure and systems meant we were well prepared for the extreme market volatility we saw in February and March related to COVID-19, which stimulated strong trading activity across both our consumer and corporate segments,” OFX CEO and managing director Skander Malcolm said.

“This delivered a record fourth quarter with net operating income up 16.3 per cent, contributing to net operating income growth for the year of 5.4 per cent.

Bridget Carter 10.46am: Nickel Mines raising $231m

DataRoom | Nickel Mines is raising $231m through Credit Suisse and Bell Potter Securities.

The proceeds of the offer will be used to fund the $US120m exercise price for the options of a 20 per cent interest in the Ranger Nickel Project and the Hengjaya projects.

It will also fund $US30m of compensation for Shanghai Decent’s estimated share of undistributed retained earnings of the 20 per cent interest in the two projects being acquired by Nickel Mines.

Shares are being sold in an accelerated non-renounceable entitlement offer where shareholders receive one share for every 3.6 that they hold.

The group is selling 462.6 million securities and shares are being sold at 50c each, which is a 9.2 per cent discount to the average weighted trading price of about 55c per security.

10.34am: James Hardie in pole position on results

Optimism from building materials supplier James Hardie has sent its shares to the top of the leaderboard on Tuesday, with gains of 10.8 per cent.

James Hardie said net profit was up 6 per cent to $US241.5m for the 12 months through March and noted that its margins in North America would stay relatively resilient despite COVID-19.

“We enter fiscal year 2021 with significant momentum in both our commercial and Lean initiatives, albeit in a rapidly evolving and highly volatile market and economy,” said chief executive Jack Truong.

JHX shares hit $24.50 and last traded up 10.8pc to $23.74.

Read more: James Hardie annual profit up 6pc

10.27am: Insurance Council taps Hall as new chief

Insurance Council of Australia has tapped former Commonwealth Bank exec Andrew Hall as its new chief and executive director.

In a notice this morning, the Insurance Council said Mr Hall would start in the role in early September after wrapping up a seven year stint with CBA as executive general manager for corporate affairs.

“General insurance plays a vital role in the Australian economy and will be crucial as we recover from the dual hits of the pandemic and bushfire crisis,” Mr Hall said.

“Insurance will also need to continue tackling the challenges of climate change and important regulatory changes, while also transitioning to the new Code of Practice, which must meet and exceed community expectations.”

Outgoing chief Rob Whelan will serve until futher notice.

10.12am: Shares surge on vaccine hopes

Shares are surging higher to follow US strength on hopes of a vaccine.

At the open, the benchmark ASX200 is up by 2.66 per cent or 145 points to 5605.7 - its highest trading levels since March 12.

Energy stocks are outperforming after a jump in oil prices. The sector is up by 5.5pc while financials lift by 2.8pc and discretionary stocks by 3.4pc.

BHP is a standout with a 4.2pc lift while Oil Search lifts by 10.7pc.

AUDUSD is lifting 0.4pc to US65.47c.

9.59am: Cochlear to pay $428m in patent dispute

Cochlear has been denied a rehearing of an appeal of a US patent decision, forcing the hearing implant maker to pay out $US280m ($428m).

The local health heavyweight lost an appeal ruling that it had wilfully infringed the patents of two competitors Alfred E.Mann Foundation for Scientific Research and Advance Bionics in March. Cochlear had petitioned for a rehearing but today told the market its attempt had been unsuccessful.

“The Judgment will become final on 26 May 2020 and remanded to the District Court for payment of approximately $US280m being the Judgment amount and post judgment interest. This payment is expected to be made in the current financial year,” it said in a note today.

The company added that a decision on prejudgement interest and attorney’s fees was still pending in the US District Court - both applications Cochlear opposes.

Read more: Cochlear faces earnings hit after losing appeal

9.53am: ANZ confidence continues to lift

ANZ consumer confidence lifted for its seventh week as easing restrictions stoked hopes of a recovery.

The weekly survey showed confidence was higher by 2.2pc, while survey respondents’ view of current finances was up up by 8.8 but future finances higher by just 0.2 per cent.

“As a result, ‘future financial conditions’ is now only around 5pc below the long run average, though overall sentiment is closer to 20pc below average,” ANZ head of Australian economics David Plank says.

“With more good news about the easing of restrictions likely, it seems reasonable to expect further gains in sentiment. Consistent with this, ANZ-observed card-spending data shows household spending is holding up.”

ANZ-Roy Morgan Aus Consumer Confidence: ‘future financial conditions’ is now only ~5% below the long run average, but overall sentiment is closer to 20% below average. It seems reasonable to expect further gains in sentiment. #ausecon @DavidPlank12 @roymorganonline #ausretail pic.twitter.com/B4Z7nqppN1

— ANZ_Research (@ANZ_Research) May 18, 2020

Lilly Vitorovich 9.34am: ACCC drafting media, tech news code

Australia’s competition watchdog has called for help in drawing up a draft news media and digital platforms bargaining code, which would force technology giants Google and Facebook to pay media companies for the news they carry on their platforms.

Australian Competition & Consumer Commission chairman Rod Sims says they are “keen to tap views on all the issues and ideas involved with this code” following the release of a so-called concepts paper on Tuesday morning.

“Given the tight timeframe we are seeking precise views on the content of the code and this concepts paper will facilitate this,” he said in a statement.

“Our digital platforms inquiry highlighted the acute need to address the imbalance in bargaining position between news media and particular digital platforms, and that is what the code will do.”

The ACCC’s concepts paper sets out a range of issues which it wants feedback and information on, including what should be included in the draft bargaining code and how particular issues should be addressed.

David Swan 9.27am: TechnologyOne lifts subscription revenue

Listed Software-as-a-Service provider TechnologyOne has continued to grow despite the COVID-19 pandemic, with its profit after tax up 6 per cent year-on-year to $19.1m in its half year results.

In its H1 FY20 results released on Tuesday morning show earnings before interest, taxes, depreciation and amortisation (EBITDA) was up 30 per cent to $34.83m, while expenses were up 7 per cent to $112.45m.

Revenue came in at $138.4m for the half, up 7 per cent, while Software-as-a-Service annual recurring revenue was up 33 per cent to $110.2m.

The Brisbane-based company increased its interim dividend to 3.47 cents per share, up 10 per cent on a year earlier.

Executives said COVID-19 is accelerating the move to Software-as-a-Service applications, of which TechnologyOne is one of Australia’s largest providers.

Read more: Are subscription business more resilient in a crisis

Lachlan Moffet Gray 9.04am: Tariffs to pressure GrainCorp, United Malt

China’s imposition of 80 per cent tariffs on Australian barley is set to put the pressure on listed local producers GrainCorp and its spin-off United Malt.

Following a government investigation into Australian grain exports, China found Australian subsidies and dumping had “substantially damaged domestic industry,” the commerce ministry said in a statement.

A 73.6 per cent anti-dumping tariff and 6.9 per cent anti-subsidy tariff on imports of Australian barley will take effect Tuesday, the ministry said.

National Farmers’ Federation chief Tony Mahr has slammed the decision as “particularly devastating” for Australian farmers struggling after years of drought and in the wake of the past bushfire season.

“A significant and devastating hit to the Australian agriculture industry. It was really looking forward to a bumper year,” Mr Mahr told ABC News on Tuesday.

Read more: Farmers’ chief slams China’s devastating hit

8.59am: What’s on the broker radar?

- Dacian Gold raised to Speculative Buy - Canaccord

- Elders cut to Hold, price target raised 44pc to $10.20 - Morgans

- Evolution price target raised 16pc to $5.70 - Citi

- Graincorp price target cut 52pc to $4.50 - UBS

- Newcrest prce target raised 15pc to $35 - Citi

- Northern Star price target raised 10pc to $14.90 - Citi

- Ramsay Health cut to Sell - Morningstar

8.44am: Wagners halted for court decision

Wagners shares have been halted ahead of the open, pending a court decision on its pricing dispute with Boral.

The dispute dates back to March 2019, when Wagners said Boral, its key cement buyer, was trying to force down its contract rpices because it had been offered cheaper prices by a competitor.

Wagners suspended deliveries to Boral, prompting a $10m hit to Wagners earnings, and more than a year later, a decision will be handed down by the Supreme Court of Queensland later today.

Wagners requested the halt so that it had an opportunity to receive and review the decision, expected to be lifted on Thursday or if it releases an announcement sooner.

Read more: Wagners profit dives as Boral dispute drags on

8.30am: Tabcorp scraps final dividend

Tabcorp says it won’t pay a final dividend in full year 2020, as it deals with the impact of the coronavirus pandemic.

The betting giant also said it had agreed with bank lenders to waive leverage and interest-cover covenants for lending facilities worth $2.2 billion.

It was still working with other holders, including those who own US private placement debt, to obtain other covenant changes.

“We welcome the support of our syndicate banks during this challenging period,” said chief executive David Attenborough. “The waivers complement recent actions we have taken to preserve our liquidity and mitigate the financial and earnings impacts of Covid-19.”

The company said it has $820 million of available liquidity as of May 15, up from $749 million as of April 3. Debt of $171.5 million, which Tabcorp says is fully hedged, matures in December, with another $225.8 million maturity in July 2021.

Dow Jones

8.10am: Westpac loses senior executives

Westpac says consumer chief executive David Lindberg and chief information officer Craig Bright are leaving to take up new roles overseas.

An international search has begun for their replacements.

The moves mark the most significant executive shake-up at the bank since Peter King was recently named chief executive.

The exits also come after the bank on Friday admitted it failed to give financial crimes regulator Austrac a report on 19.4m international funds transfer instructions within 10 business days. However the bank will contest some of Austrac’s agency’s key allegations around anti-money laundering breaches.

The exit of Mr Lindberg, a fast rising executive under former chief executive Brian Hatrzer, leaves open the strategy for the bank’s retail businesses including St George Bank, BankSA, Bank of Melbourne and RAMS brands.

Westpac also announced the appointment of Les Vance to a new role as group executive,

financial crime, compliance and conduct.

“Westpac has made significant progress in improving its financial crime capability and I am

confident Les will continue to build on this platform of work,” said Mr Peter King.

7.50am: James Hardie lifts profit 6pc

Building materials supplier James Hardie Industries said its annual profit rose by 6pc and signaled margins in North America would stay relatively resilient in the first quarter of the new fiscal year despite headwinds from the coronavirus crisis.

James Hardie said its net profit totalled $US241.5 million in the 12 months through March, up from $US228.8 million a year earlier. Net sales increased by 4pc to $US2.61 billion.

The company’s adjusted net operating profit, which strips out asbestos liabilities, rose by 17pc to $US352.8 million.

James Hardie has faced thousands of compensation claims in Australia after workers who mined asbestos for decades, before it was phased out in the 1980s, developed deadly asbestos-related lung diseases such as mesothelioma.

“We enter fiscal year 2021 with significant momentum in both our commercial and Lean initiatives, albeit in a rapidly evolving and highly volatile market and economy,” said Chief Executive Jack Truong.

James Hardie confirmed it would not pay a final dividend, and it declined to provide guidance for the 2021 fiscal year due to uncertainty created by the coronavirus pandemic.

Dow Jones Newswires

7.45am: Oil prices surge

Oil prices overnight jumped to their highest values in over two months on positive early results on a potential coronavirus vaccine, optimism about a resumption in economic activity and signs producers were following through on planned output reductions.

Brent futures for July delivery rose $US2.31, or 7.1 per cent, to $US34.81 a barrel, while US West Texas Intermediate (WTI) crude rose $US2.39, or 8.1 per cent, to $US31.82.

That was the highest settles for Brent and WTI since March 11, just a few days after prices started to collapse following the failure of a production cut agreement between the Organisation of the Petroleum Exporting Countries (OPEC) and Russia, a group known as OPEC+.

Reuters

7.10am: ASX set for early boost

Investors can look forward to shares rising early on the Australian market after US markets climbed on hopes of a coronavirus vaccine and economic recovery.

At 7am (AEST) the SPI 200 futures contract was higher by 109 points, 1.99 per cent, to 5,593.0, indicating a solid gain in early trade.

The S&P 500 climbed 3.2 per cent overnight as investors took note of US company Moderna’s encouraging results from early tests of an experimental vaccine for COVID-19.

Investors also took heart from Federal Reserve chairman Jerome Powell’s comments over the weekend. He expressed optimism that the US economy could begin to recover from the pandemic in the second half of the year.

Meanwhile in Australia, the Reserve Bank will publish the minutes of its monetary policy meeting from earlier this month.

Building materials manufacturer James Hardie was expected to release annual results.

The Australian dollar was buying US65.25 cents, up from US64.32 cents at the close of trade on Monday.

AAP

6.10am: US stocks surge on vaccine hopes

US stocks rallied on hopeful developments about a potential coronavirus vaccine, recovering ground following the biggest weekly percentage drop in nearly two months.

Markets have rebounded sharply from their late March lows and have been particularly sensitive to any developments suggesting progress toward a vaccine for the virus.

Investors cheered after drugmaker Moderna said its experimental coronavirus vaccine induced immune responses in some of the healthy volunteers who were vaccinated in a clinical study. The results offer a positive sign about its capabilities to protect people against the new coronavirus.

Still, the results are preliminary. Many vaccines fail to pass muster, even after showing positive signs in early testing.

Moderna shares jumped about 20 per cent, pulling up the broader market.

“The idea that there has been progress in Moderna’s trials but also the more positive news that it looks like coronavirus could be tackled with a vaccine, has helped boost sentiment,” said Edward Park, deputy chief investment officer at Brooks Macdonald.

The Dow Jones Industrial Average jumped 912 points, or 3.9 per cent. The S&P 500 rose 3.2 per cent, erasing last week’s 2.3 per cent loss. The Nasdaq Composite added 2.4 per cent.

The S&P 500’s energy, real estate, industrials, materials and financials sectors all rose at least 4 per cent. The energy group climbed 7.6 per cent, driven by an 8 per cent jump in oil prices.

Exxon Mobil added 6.8 per cent and Chevron rose 5.7 per cent. Both stocks are still down more than 20 per cent for the year.

After closing higher yesterday, Australian stocks are in for another day of gains, with ASX futures up 108 points, or 1.9 per cent, at 6am (AEST).

As economies emerge from monthslong lockdowns, markets will tend to creep higher, said Paul Chew, head of research at Phillip Securities in Singapore. But a stronger rally will likely be on hold until investors believe there is little risk of a big second wave of infections, he said.

“Even with better economic numbers, the market won’t rejoice,” Mr. Chew said, adding economic data are lagging indicators.

Monday’s rally put the S&P 500 back near the top of a trading range that has been rigid over the past month, said Frank Cappelleri, executive director at brokerage Instinet. The top of the range has sparked sell-offs, and the bottom has sparked rallies.

Federal Reserve Chairman Jerome Powell cautioned Sunday that the U.S. economic recovery could take more than a year. The unemployment rate is likely to keep rising through June and then begin to decrease as businesses reopen, and both the Fed and lawmakers may need to do more to bolster the economy, he said in a broadcast interview.

Overseas, the pan-continental Stoxx Europe 600 gauge rose 4.1 per cent. Most major Asian benchmarks ended the day higher. Japan’s Nikkei 225 gained 0.5 per cent, while the Shanghai Composite Index edged 0.2 per cent higher. Australia’s benchmark S&P/ASX 200 traded 1 per cent higher.

Dow Jones Newswires

6.00am: Oil futures climb

Oil futures climbed, with U.S. prices notching their highest settlement in more than two months.

Positive results from an experimental COVID-19 vaccine fed expectations for a rise in energy demand. Expectations for supply declines also continued to contribute to oil’s gains.

June West Texas Intermediate oil rose $US2.39, or 8.1pc, to settle at $US31.82 a barrel on the New York Mercantile Exchange. That was the highest front-month contract finish since March 11, according to Dow Jones Market Data.

Dow Jones

5.55am: Fed prepared to use ‘full range of tools’

The Federal Reserve chairman and the Treasury secretary are set to testify before a congressional panel on Tuesday

Federal Reserve Chairman Jerome Powell said the central bank will use its “full range of tools to support the economy” as a result of the economic shock caused by the coronavirus pandemic in testimony prepared for delivery to a congressional panel on Tuesday.

Mr Powell and Treasury Secretary Steven Mnuchin are set to appear by videoconference before the Senate Banking Committee on Tuesday morning (US time) as part of regular testimony required by the $US2 trillion economic relief package President Trump signed into law in March.

The legislation provided the Treasury with $US500 billion to provide direct aid and to backstop credit markets, including $US454 billion to cover losses in Fed lending programs.

Dow Jones Newswires

5.48am: Facebook chief wants EU to lead

Facebook founder Mark Zuckerberg urged the European Union to take the lead in setting global standards for tech regulation or risk seeing countries follow China as a model.

“I think right now a lot of other countries are looking at China... and saying: ‘Hey, that model looks like maybe it might work. Maybe it gives our government more control?’,” Zuckerberg said, during a video debate with EU commissioner Thierry Breton.

“I just think that that’s really dangerous and I worry about that kind of model spreading to other countries,” Zuckerberg said.

AFP

5.46am: JC Penney to close 240 stores

J.C. Penney will close almost 30pc of its 846 stores as part of a restructuring under bankruptcy protection.

The Plano, Texas, retailer said that it plans to close about 192 stores by February 2021, and then 50 additional stores in the year after that. That would leave the company with just over 600 stores.

Penney filed for bankruptcy reorganisation on Friday, making it the biggest retailer to do since the coronavirus pandemic forced them to shut down all stores.

The pandemic has begun to fell some of the weakest companies as retail sales plunge. J.Crew and Neiman Marcus sought bankruptcy protection days before J.C. Penney. All three were already laden with debt and having trouble connecting with consumers.

AP

5.45am: Uber cuts 3000 more jobs

Uber has cut 3000 jobs from its workforce, its second major wave of lay-offs in two weeks as the coronavirus slashed demand for rides.

The San Francisco company has cut a quarter of its workforce since the year began, eliminating 3700 people from the payroll earlier this month. Uber will be refocusing on its core business, moving people and delivering food and groceries, said CEO Dara Khosrowshahi, in a note to employees. The ride-hailing giant will be closing or consolidating 45 offices globally, and almost all departments will be affected by lay-offs. The company is closing its Incubator and AI Labs and will pursue strategic alternatives for its job recruiting app, Uber Works, Khosrowshahi said.

AFP

5.42am: Air France lifts flights

Air France said it hoped to double the number of cities it serves, including over 40 European destinations, by the end of June as nations begin to lift coronavirus travel restrictions.

“Between now and the end of June and subject to travel restrictions being lifted, Air France plans to gradually resume its flights,” the airline said.

Like other airlines, Air France grounded most of its planes as governments imposed stay-at-home orders and demand for travel evaporated.

Air France said it was currently operating between three and five per cent of its usual schedule and serving 43 destinations for essential passenger traffic as well as cargo.

AFP

5.37am: Stocks surge as nations reopen

Global stock markets rose sharply as governments relaxed coronavirus lockdowns and investors were willing to bet that the world economy has seen the worst of the pandemic’s impact.

A joint French-German plan for a massive EU relaunch program worth a staggering 500 billion euros ($US542 billion), announced just before European markets closed gave them an extra push over the finishing line.

Oil prices surged back above $US30 per barrel and gold rose to levels not seen in more than seven years.

“It has been a very optimistic start to the new week with stocks, crude oil, copper, gold and silver all pushing higher,” said Fawad Razaqzada at ThinkMarkets.

Traders also not only brushed off a warning from the head of the Federal Reserve that a full recovery would likely not come until next year, but took the statement as a sign that more central bank stimulus is coming, further fuelling their appetite for stocks.

“Sentiment has been boosted as many European countries including Spain, Italy and the UK reported the lowest number of COVID-19 related deaths for two months at the weekend and as several countries ease lockdown restrictions,” Razaqzada said.

On Wall Street, the Dow Jones index was more than 800 points higher by the late New York morning, while key eurozone markets were more than five per cent up at the close, with London up over four per cent, Frankfurt 5.7 per cent higher and Paris up 5.2 per cent.

Sentiment was also boosted by US biotech firm Moderna reporting “positive interim” results in the first clinical tests of its vaccine against the new coronavirus performed on a small number of volunteers.

“Risk appetite is running wild after Moderna’s experimental vaccine showed promising early signs to create an immune-system response that might be able to fight off COVID-19,” said Edward Moya at OANDA.

Major markets in Asia had closed higher earlier Monday, but by much lower percentages than subsequently posted by European and US markets.

AFP

5.33am: France, Germany propose relaunch plan

The leaders of Germany and France are jointly proposing a 500 billion-euro ($US543 billion) recovery fund for European economies hit by pandemic.

In a joint statement, German Chancellor Angela Merkel and French President Emmanuel Macron said the proposed fund would see European Union budget expenditure used to help sectors and regions that are particularly affected by the outbreak.

Macron said France and Germany are proposing that the 27 EU countries decide to borrow together on the markets and use the 500 billion euros to bring financing to hardest-hit economic sectors and regions.

“We are proposing to do real transfers (of money) ... that’s a major step,” he said.

Countries benefiting from the financing would not have to repay the sum, said Macron.

“We are convinced that it is not only fair but also necessary to now make available the funds... that we will then gradually repay through several future European budgets,” said Merkel.

The borrowing marks a major shift by Germany, which has until now rebuffed Spain and Italy’s calls for so-called “coronabonds”.

AFP

5.30am: US economy showing ‘encouraging signs’

The US economy is showing “encouraging signs” and there’s no need for another spending package to combat the downturn caused by the coronavirus pandemic, a White House Adviser said.

“If the economy recovers slower than we expect, then it’s possible we’ll have to put some more cash in there and we stand ready to talk about that with Congress, but right now we think you should monitor the data,” economic Adviser Kevin Hassett said on CNBC.

The world’s largest economy is showing “a lot of encouraging signs,” he said, citing data shared by private companies with President Donald Trump’s administration.

Congress has already moved to provide $US2.9 trillion -- or about 14 per cent of US gross domestic product -- in spending to households, businesses and states and local governments facing the virus.

AFP

5.25am: China puts tariffs on Australian barley

China has announced 80.5 per cent tariffs on Australian barley, days after suspending beef imports from the country -- a move that could escalate tensions between the countries.

Following a government investigation into Australian grain exports, China found Australian subsidies and dumping had “substantially damaged domestic industry,” the commerce ministry said in a statement.

A 73.6 per cent anti-dumping tariff and 6.9 per cent anti-subsidy tariff on imports of Australian barley will take effect Tuesday, the ministry said.

Last week, China suspended imports from four major Australian beef suppliers, amid a diplomatic standoff between the two countries over Canberra’s push to probe the origins of the coronavirus.

China’s foreign ministry has denied a link between restrictions on trade with Australia and the inquiry, saying they are “two completely different things.” But Beijing’s ambassador Cheng Jingye said last month that Australia’s push for an independent investigation may provoke a consumer boycott in China.

The Chinese commerce ministry said it had decided to levy the tariffs, which will be valid for five years, after an investigation based on “relevant Chinese laws and World Trade Organisation regulations.”

AFP

5.20am: Indonesia plans tech tax

Indonesia will slap a 10 per cent value-added tax on the digital offerings of foreign companies from July 1, the finance ministry said, a levy that could apply to internet giants such as Spotify and Netflix.

Products and services including video games, music and movie streaming could be subject to the levy, the government said.

“The tax for foreign digital products is a part of the government’s effort to create a level playing field for all businesses,” the tax directorate said in a statement.

The move was also aimed at boosting public revenue to help mitigate the impact of COVID-19 on Southeast Asia’s biggest economy, it added.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout