Medibank sees healthy bounce in investments

Medibank says its investment portfolio has begun to rebound after the sharemarket rout in March.

Medibank says its investment portfolio has begun to rebound after the sharemarket rout in March shredded 77 per cent off the total income of all Australian private health insurers.

Total investment income dived to $94.7m in the year to March 31, down from $415.9m a year earlier, according to data from the Australian Prudential Regulation Authority released on Tuesday.

Medibank chief executive Craig Drummond said while investment income had begun to rebound in April and May, it had not come close to recovering from the March sharemarket rout, which was the worst crash in more than 30 years.

“Stockmarkets, private equity, infrastructure and property, all of those markets falling in the March quarter, saw investment returns fall sharply whereas in April and the first part of May, we have seen stockmarkets globally recover a bit,” Mr Drummond told The Australian.

“So some of those investments have improved but they certainly haven’t recovered anywhere near the amount that was lost in the March quarter.”

But Mr Drummond said that unlike the superannuation funds, Medibank’s investment portfolio was conservative, with 82 per cent consisting of defensive investments such as cash and single-A rated fixed interest.

“We don’t take a lot of risk, in fact we take very little risk,” he said, adding that “18-19 per cent of our portfolio is in equities, infrastructure and property, which is significantly less than balance portfolios such a superannuation, which would have two-thirds in growth assets and one third in defensive”.

Mr Drummond said health insurers also had not received a reported financial windfall or engaged in profiteering from the government’s ban on emergency surgery that began in late March and lasted until May 10.

“The vast majority of our customers throughout this COVID period were still experiencing the usual treatment around pregnancy, cancers, appendectomies, kidney dialysis, cardiac, mental health — all of those usual services continued,” he said. “It was the elective surgical component and the non-urgent surgical component that was not covered.

“We saw in April a reduction in hospital claims but it wasn’t as big as you may have expected and we are seeing that beginning to recover.

“Essentially, we had five to six weeks of hospital deferral. That was the vast majority of claims and those procedures will occur over the course of the next six months.”

As social distancing restrictions were eased across different jurisdictions, Mr Drummond said ancillary or extras claims were beginning to recover as people visited dentists, optometrists and allied health professionals such as physiotherapists and podiatrists.

“On a daily basis we monitor extras utilisation and also private hospital eligibility checks and we had a couple of days last week where eligibility checks were back at pre-COVID levels,” he said.

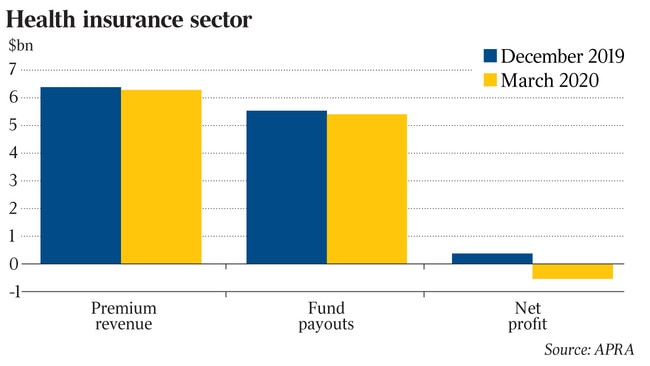

Overall, health funds paid $21.75bn in benefits in the year to March 31, an increase of 3.7 per cent, according to APRA.

Protheses claims continued to outweigh the general market, with medical device benefits rising 5.8 per cent and prostheses utilisation increasing 7.5 per cent. This compares with hospitals claims firming 0.5 per cent.

Private Healthcare Australia chief executive Rachel David said the health funds, doctors and hospitals were working to clear the backlog of non-essential procedures, which she said had blown out waiting times in the public sector.

“Members with private health insurance will have access to timely care in the private system. This compares to the public system where wait times are expected to exceed 1.5 years for common elective procedures,” Dr David said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout