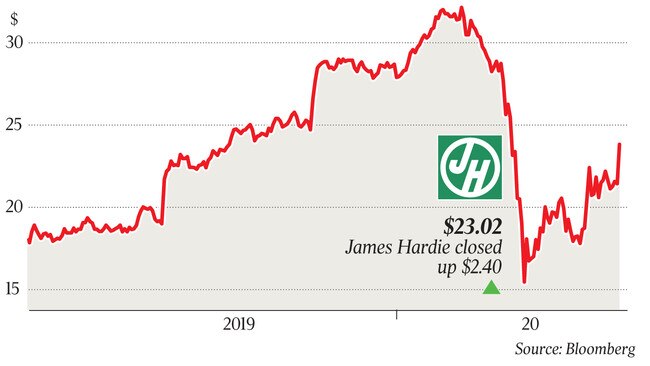

US outlook, increased profit, lift James Hardie shares

Shares in James Hardie surged over 10pc after a bullish assessment of its North American operations, and a lift in profit.

Shares in building products manufacturer James Hardie surged by over 10 per cent after a bullish outlook about its North American operations.

The company did not provide formal guidance due to volatility associated with the coronavirus but its shares hit $23.70 after it reported a strong March quarter.

The company generated a group adjusted net operating profit of $US86.6m for the March quarter and $US352.8m for the full year to end of March, an increase of 17 per cent for both compared to prior periods.

It had group adjusted earnings before interest and tax of $US121m for the quarter and $US486.8m for the full year, an increase of 21 per cent and 20 per cent, respectively, compared to this time last year.

James Hardie chief executive Jack Truong said the company delivered strong fourth quarter results globally, and showed it could execute in both growing and highly volatile markets.

He called out the North America unit, which grew above market while delivering high returns.

Underpinning that region was James Hardie’s 11 per cent volume growth in the exterior business, coupled with sustained volume growth of 5 per cent in the interior business.

The company’s lean manufacturing initiative also improved performance across its North American manufacturing network, helping to deliver 26 per cent adjusted earnings before interest and tax growth at a 25.3 per cent adjusted EBIT margin in the fourth quarter.

In the quarter, James Hardie’s Asia-Pacific segment delivered steady financial returns with revenue up 2 per cent and adjusted EBIT growth of 4 per cent in local currency at a margin of 20.5 per cent.

Europe delivered strong revenue growth of 7 per cent in euros in the quarter, led by fibre cement growth of 50 per cent and fibre gypsum growth of 3 per cent.

“Our performance in March was exceptionally strong, despite the highly volatile market environment in which we operated. We supplied our customers seamlessly around the world, growing revenue by double digits in each region we operate in,” Dr Truong said.

James Hardie improved its liquidity position, increasing from $US464m at the end of 2019 to $US510m at the end of March and $US578m at the end of April, while reducing its leverage.

Dr Truong said the fourth quarter marked the fourth consecutive quarter of strong financial results, which yielded a full year adjusted profit was a lift of 17 per cent on last year.

James Hardie said the full year result was driven by its strong North America performance, delivering seven-plus per cent growth above market and $US29m in cost savings in fiscal year 2020, and the full year earnings margin in North America was 25.9 per cent.

“We enter fiscal year 2021 with significant momentum in both our commercial and lean initiatives, albeit in a rapidly evolving and highly volatile market and economy,” Dr Truong said.

But the company said that given the highly volatile and uncertain circumstances surrounding the COVID-19 pandemic and its effect on demand in the countries in which it operates, it was unable to provide annual guidance.

But it said that for the first quarter of fiscal year 2021, it expects its North America segment adjusted earnings margin to be between 22 per cent and 27 per cent. It will also have more than $US600m in liquidity.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout