ASX adds 1pc on mining surge as gold, iron ore outperform

The broader market is still far from its record high, but rising commodity prices sent Fortescue, Evolution and Saracen to new highs.

- Miners surge to all-time highs

- Rainfall doubles profit for Elders

- BGH lobs discounted bid for Village Roadshow

- Brookfield drops out of Virgin race

That’s all from the Trading Day blog for Monday, May 18. The ASX hit five-day highs early but finished up 1pc as miners rallied on rising commodity prices.

Markets were further helped by optimistic comments from US Fed chair Jerome Powell that the US economy would recover steadily in the second half, so long as there was no second wave.

In local news, the bidding race for Virgin narrowed while private equity player BGH lobbed a discounted takeover bid for Village Roadshow.

John Durie 8.45pm: Playing risky game for Virgin

Virgin administrator Vaughan Strawbridge, of Deloitte, is playing a knife-edge game of keeping a lot of people in the room until the real action starts on June 12, when the final two bidders are selected.

Virgin is drowning in $6.8bn debt and locked into a series of expensive contracts for everything from six A330 wide-body aircraft to caterer Gate Gourmet and 9000 staff.

The potential bidders are not allowed to speak to the asset owners until after June 12, so time is limited and Virgin’s working capital resources are also constrained.

The global airline industry on some estimates undertook 4.6 billion flights last year and 47 million in April, which means on that trend will fly just 564 million flights this year.

Obviously, some markets are being opened up, but you get the picture - the airline industry is on its knees and its cyclical blue sky is limited until the international market is reopened.

Brookfield pulled out of the process after it was not selected in the first round, but its 75 per cent owned Oaktree Capital is teamed up with US airline investor Indigo Partners. Oaktree, like separate bidder Cyrus Capital, specialises in distressed debt.

Cyrus Capital, the New York-based hedge fund, was established by Stephen Freidheim in 1999 and was one of the original backers to Virgin America when Sir Richard Branson established the airline in 2007.

They sold to Air Alaska seven years later and have been looking to repeat the turn elsewhere.

Bain is the fourth contender and a serious player, with KordaMentha in the background.

When the parties are narrowed to two they will be free to negotiate deals with some of the lease holders to knock out bad contracts, before a final deal.

If you were Boeing or Gate Gourmet - dealing with A or B, knowing only one would win the prize - you would not be about to hand over the crown jewels.

But that’s tomorrow’s issue and in short this battle has a long way to run.

David Rogers 8.30pm: We’re not out of ammo: Powell

Jerome Powell’s 60 Minutes interview was mostly viewed as positive for risk assets.

The Federal Reserve chairman — while suitably cautious — motivated investors to keep moving back into equities, thereby reducing the “negative wealth” effect of the recent bear market.

“Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year,” Mr Powell said, adding that “in the long run, and even in the medium run, you would not want to bet against the American economy.”

Jacquelin Magnay 8.10pm: Huawei grows ‘thicker skin’

Huawei chairman Guo Ping said his company had developed “a thicker skin’’ and was confident of overcoming new US measures to block growth, while calling new US actions “arbitrary and pernicious’’.

Speaking at the company’s annual global analyst conference in Shenzhen, Mr Guo said: “The US has taken technological leadership as foundation for their supremacy. Any other countries or companies with more advanced technologies may put the US superiority at risk.’’

He cited how Huawei had helped control the coronavirus epidemic in China, helping consumers, particularly those locked down in Wuhan for 80 days, to have free videos and access for home work and home schooling and highlighting differences in Chinese and European provisions.

Mr Guo said: “On the second day after the UK locked down, their network went down too, and the European Union required Netflix to downgrade video from high definition to standard. China could cope with it, but other places had to reduce quality of their services.’’

The Chinese company said the past year since the US put Huawei on an entity list had been difficult, but Mr Guo said “we have spent the past year patching up holes and toughened our skin’’.

On Friday, the US Commerce Department introduced a new hurdle for Huawei, requiring licences to sell semiconductors made abroad with US technology.

In a statement, Huawei said the US actions undermine the entire industry worldwide.

“To attack a leading company from another country, the US government has intentionally turned its back on the interests of Huawei’s customers and consumers. This goes against the US government’s claim that it is motivated by network security,’’ the statement said.

Mr Guo said as a result of the US actions, investment in the company’s research and development had increased 30 per cent and noted for each of the past seven years, Huawei had returned 27 per cent annual compound growth.

7.50pm: Optimism oil prices will rebound

The most wagered-upon oil prices these days are for crude bobbing at sea on big tankers - or even still in the ground.

In futures markets for both overseas-benchmark Brent and West Texas Intermediate, the main US price, barrels for December delivery have the highest open interest, or total number of options and outstanding contracts.

It is unusual for betting to center on barrels scheduled for delivery so far into the future. The most open interest almost always relates to oil for delivery the next month, or sometimes the month after that.

The situation reflects traders’ aversion toward near-term contracts as long as the coronavirus pandemic is pummeling fuel demand. Front-month West Texas Intermediate futures last month crashed below $US0 as buyers already swamped with oil fled the market. The popularity of the December contracts also indicates optimism that prices will rebound later this year as shelter-in-place orders are eased.

In data going back to 2006, there hasn’t been another instance in which a West Texas Intermediate contract seven months out had the greatest number of bets related to it, according to Dow Jones Market Data. On only one other occasion - exactly four years ago - has the greatest open interest been in the sixth Brent contract out, which in that market is December’s.

West Texas Intermediate for June delivery ended Friday at $US29.43 a barrel, while contracts for barrels in December were $US32.01. A barrel of Brent for December ended Friday at $US35.11, 8pc higher than July’s closing price of $US32.50.

The differences were much larger last month, when fuel consumption nosedived and unprocessed crude and unsold petroleum products overwhelmed storage facilities and refineries. Prices for on-the-spot deliveries of oil plunged and so did those for prompt futures contracts.

As near-term crude prices collapsed, the massive exchange-traded United States Oil Fund spread out its exposure deeper into the calendar. Since its launch in 2006, the fund had held all of its assets in one of the two front months of West Texas Intermediate futures. By Friday, the $US4.1bn fund, which is popular with day traders and hedge funds alike, held $US1.02bn of December futures. Its next-largest exposure was to August futures, to the tune of $US623m.

Energy traders have done particularly well this year betting on near-term oil prices to fall while wagering on rising prices later in the year. So-called carry trades involving West Texas Intermediate this year have earned better than 80pc on annualised basis, according to Bank of America Securities analysts.

In a note to clients, they said carry trades have historically performed well even after supply gluts peak and suggested such trades as a hedge against a second viral outbreak The opportunity to profit by holding oil back from the market until prices rise - or at least not losing money selling crude for less than it cost to extract - stoked a run on oil-storage capacity as well as oceangoing tankers.

“Our storage is worth its weight in gold,” said Jim Teague, chief executive of Enterprise Product Partners, which owns pipelines, storage facilities and export terminals. “Our people have found places to store crude oil that two months ago we didn’t even know existed.” Hess Corp said that rather than shut in its North Dakota wells, it is storing crude at sea.

Hess chartered three very large crude carriers, or VLCCs, and will fill one of the 2-million-barrel tankers during each of May, June and July with plans to sell the cargoes in Asia late this year.

The tankers’ cost, which has shot up during the pandemic, is more than covered by the higher prices that Hess was able to lock in hedging in the futures market and by moving the oil from the domestic market and into the higher-priced Brent market.

“You’re actually getting a value uptick because of moving it out of the United States, where oil is locked up, into a market that will take it,” CEO John Hess told investors recently.

Dow Jones Newswires

Rachel Baxendale 7.35pm: Geelong Cats cotton on to retail

Nine weeks ago, Geelong father of two Ben Waller was preparing for round seven of women’s footy as operations and recruitment manager for the Geelong Cats AFLW and VFLW teams.

Today the 39-year-old is working the 4pm to midnight shift as one of 300 new workers at clothing company Cotton On’s giant distribution centre at Avalon airport, having temporarily been stood down from his old job with the Cats as a result of the coronavirus pandemic.

Amid grim news on Thursday that 594,000 Australians lost their jobs in April, the Cotton On story provides a positive example of how our changed circumstances have given some businesses the ability to create jobs, as more people shop online.

Mr Waller said that like so many other Australians who either lost their jobs or saw them go into hibernation, he was uncertain about his future.

“At that stage, we didn’t really know how long (the pandemic) was going to go on for, and it became more and more important to seek other employment,” he said. “Offers went out from Cotton On about three weeks ago, and since then we’ve had a crew from the Cats who have jumped on board which has been excellent. I’ve got young children and it’s just so good to have more purpose in my day and to be able to connect with colleagues and meet new people.”

John Stensholt 7.04pm: Poker machine king eyes boom

Having a factory roof blown off by a gelignite bomb, a cancer scare, high interest rates, credit crunches, recessions and other downturns: Len Ainsworth has seen it all during seven decades in business.

He made his fortune as a poker machine manufacturing pioneer and more recently diversified by putting some of his wealth into property.

The country’s oldest billionaire at 96, Ainsworth tells The Australian he is still taking a keen interest in business despite the COVID-19 shutdown. “I’m still breathing. Life is full of beauty,” he says.

Ainsworth says simple business fundamentals like not going into the coronavirus downturn with too much debt gives him the ability to strike deals for assets that could be acquired at discounted prices.

“I always do pretty well in downturns. It could be the case that some opportunities present themselves during all this.”

In Ainsworth’s case that means looking for opportunities in property.

James Kirby 6.45pm: Delays to financial advice changes

A new standards regime for the financial advice sector that was expected to kick off by the end of the year has been pushed out as parliament and key stakeholders in the industry try to reframe advice in the context of the coronavirus crisis.

The so-called FASEA regime, which has been planned as the template for the trouble-plagued sector in the wake of the financial services royal commission, hinges on a new qualification system for advisers.

Each one of the nation’s financial advisers was meant to have sat and passed a new exam by the end of this year, but a report from the Adviser Ratings group shows that a mere 7488 have done the exam, with 1080 failing to pass.

That leaves the vast majority of advisers — at least 16,000 — not having attempted the exam at all, with just months to go before the original slated deadline.

As the deadline has approached, an unlikely combination of stakeholders — particularly a coalition of the Association of Financial Advisers and the Finance Sector Union — have sought to press parliament to follow through on an earlier agreement to extend the qualification deadline by a year, which would mean the exam deadline moved to January 2022.

Max Maddison 5.40pm: Nepal casino in administration

ASX-listed Nepalese casino operator Silver Heritage Group has become another scalp of the COVID-19 downturn, as the company collapsed into voluntary administration amid liquidity problems.

In a statement to the ASX, Silver Heritage said attempts to generate liquidity through “possible transactions” fell short. The onset of coronavirus and the temporary closure of its Nepalese facility were blamed for the collapse of a potential funding deal.

The collapse of the Southeast Asian gambling operator comes only months after main lender OCP Asia offered the company a reprieve, providing funds in January to cover short-term funding needs. Silver Heritage said OCP was unwilling to provide further support.

KPMG’s Ryan Eagle and Amanda Coneyworth have been appointed administrators of the company.

In the statement, the board of directors expressed regret that “these events have come to pass”, while acknowledging Silver Heritage’s employees for their “hard work and contribution”.

The company flagged liquidity issues in late February, which among other things, stemmed from the closure of its Vietnamese venture, Phoenix International Club, due to local gambling restrictions.

In a trading update in late March, Silver Heritage said it was still pursuing payment of $US1.47m ($2.3m) from a $US5.25m settlement with the Phoenix Club.

On February 29, Silver Heritage said managing liquidity outside of Nepal was a “key issue”, as the company’s balance sheet pointed to significant outstanding debt with two main lenders: $US13.9m with Nepal Bank, and $US16.4m in OCP Asia bonds.

Having opened South Asia’s first Integrated Resort, Tiger Palace Resort in Nepal, Silver Heritage also manages gaming at the Millionaire’s Club and Casino, in Kathmandu.

The company’s casinos attempted to capture customers from emerging gaming markets, which had shown significant growth due to rising income levels, liberalisation of gaming regulations and rapid growth of outbound Chinese and Indian tourism, before the coronavirus pandemic hit.

5.12pm: Miners surge to record highs

Heavyweight miners outperformed as iron ore prices lifted, led by record trade in Fortescue. The Pilbara-based miner surged to all-time highs of $13.53 and settled to a 5.8 per cent lift to $13.28 at the close.

Elsewhere, BHP put on 4.5 per cent to $33.10 while Rio Tinto added 5.8 per cent to $90.30.

Gold miners cheered a 7-year high in prices – Newcrest lifted by 6.7 per cent to $32.36 as Northern Star jumped 4 per cent to $14.60, Evolution rose by 5.9 per cent to a record of $6.07 and Saracen Minerals soared to record highs of $5.62, up 11.3 per cent.

4.59pm: Virgin downgraded further by Moody’s

Virgin’s credit rating has been downgraded further into junk status by ratings agency Moody’s, citing a missed coupon payment last week.

Moody’s said this afternoon it had downgraded Virgin Australia to Ca from Caa1 after missing a coupon payment last week and after entering voluntary administration.

While the process of the airline’s recapitalisation continues, Moody’s said its credit profile was vulnerable to shifts in market sentiment “in these unprecedented operating conditions”.

“Today’s action reflects the impact on Virgin of the breadth and severity of the shock, and the broad deterioration in credit quality it has triggered,” the agency wrote in a statement.

Moody’s also downgraded Virgin’s senior unsecured and backed senior unsecured ratings to C from Caa2, and its backed senior unsecured MTN program to (P)C from (P)Caa2.

Read more: Virgin bidding pool short-listed to four

Bridget Carter 4.35pm: PEP offered Village Roadshow lifeline

DataRoom | Pacific Equity Partners is understood to have put forward a proposal in the form of a financial lifeline to Village Roadshow ahead of the latest $400m-plus takeover play by rival BGH Capital.

It is understood that PEP, which last year bought the right to secure 19 per cent of the company held by the Kirby family and Graham Burke’s Village Roadshow Corporation, was understood to have offered liquidity in some form in recent weeks.

This was either through equity or debt.

But PEP is thought not to have made a revised takeover proposal following its pre-COVID-19 indicative bid launched in December that valued the theme park and cinema owner at about $761m on an equity value basis and was subject to due diligence.

No doubt, the latest offer by PEP was one that would have enabled the private equity firm to have gained an even stronger hold on the company so it could have made a revised proposal should conditions have improved.

Read more: Village private equity deal keeps it in the family

4.14pm: Commodity rally lifts ASX

A rally in commodities was the driving force for the lift on the local stockmarket on Monday, alongside encouraging comments from US Fed chairman Jerome Powell.

At its best, the benchmark ASX200 was up by 1.5 per cent, but a late pullback sent the ASX to close up 56 points or 1 per cent to 5460.5.

Materials notched gains of 4.1 per cent while financial stocks pulled back by 1.2pc, weighed down by ex-dividend trade in Macquarie.

Cliona O’Dowd 3.39pm: Super funds rebound from March rout

After suffering their worst monthly returns in close to 30 years in March, super funds bounced back in April as sharemarkets around the globe rallied despite the threat of a worldwide recession due to the coronavirus pandemic.

It came as new figures showed super funds paid out $9bn in early release payments in the three weeks to May 10 to members hard hit by the coronavirus crisis.

In welcome news for super savers, research house Chant West said the median growth fund, which typically is 60 to 80 per cent invested in growth assets, rose 3.1 per cent in April.

But the gain wasn’t enough to fully offset the 12 per cent battering funds took in February and March, leaving the return for the 10 months of the financial year to date in the red at minus 3.3 per cent.

Read more: Super funds bounce back in April

Bridget Carter 3.36pm: NRMA drafts Macquarie for railway buy

DataRoom | The National Roads and Motorists Association is understood to have hired Macquarie Capital as part of its talks to buy the tourism business Journey Beyond.

DataRoom can confirm that NRMA and Journey Beyond’s owner, Quadrant Private Equity, had been in negotiations for the member-owned mutual organisation to buy its tourism business.

However, the talks have now come to a halt for the time being because Journey Beyond is not generating any revenue due to the measures introduced to curb the spread of COVID-19.

It is expected that discussions will once again resume when the company recommences trading.

The discussions with NRMA had been ongoing for some time, sources have said, but one of the challenges right now for any suitor is that the business is too difficult to value with no revenue coming through the door.

Journey Beyond owns the luxury passenger train service The Ghan and last year, Jefferies Australia was hired to sell the tourism operator.

Will Glasgow 3.19pm: China minister avoids trade questions

Chinese commerce minister Zhong Shan continues to avoid questions on its trade frictions with Australia while insisting the two countries are communicating.

“We are communicating with each other,” Minister Zhong said when doorstopped leaving a press conference in Beijing on Monday.

At the hour long press conference – for which journalists were required to register three days in advance – Minister Zhong and his counterparts from the Ministry of Commerce refused to take any questions from international media, including those from Australia.

Australian Trade Minister Simon Birmingham is still to talk to Minister Zhong, his Chinese counterpart, to discuss China’s plans to impose an 80 per cent tariff on Australian barley and its decision last week to block much of Australia’s beef imports into the world’s second biggest economy.

Follow the latest at our coronavirus live blog

3.02pm: Fortescue lifts to record

Shares in the Andrew Forrest-backed Fortescue Metals have set a new record high in afternoon trading as bulk miners surge on commodity strength.

The miner hit heights of $13.53 and was last trading up 6 per cent to $13.30.

Iron ore prices were up by 2.8pc in earlier trade.

“Iron ore futures on the Singapore Exchange hit $US90/t for the first time since March, on rising supply-side concerns. COVID-19’s outbreak in Brazil is threatening to disruption iron ore exports even further,” ANZ chief economist David Plank said in a note.

“The virus is taking hold in Para, which produces around 35pc of the country’s iron ore.”

He added that solid economic data out of China was helping further, with steel production up 0.2pc year-on-year to 85.03mt in April.

2.50pm: Dividend cuts holding back ASX: JPM

Australia’s strong performance in dealing with COVID-19 in the past three months hasn’t translated to sharemarket outperformance, in part due to the cut to dividends, according to JP Morgan Australia’s head of research Jason Steed.

After ranking countries according to how much of their economies are back on-line, he found Australia was one of eight countries in the First Movers group but in contrast to this “containment outperformance”, the ASX200 has been a laggard; underperforming the MSCI DM by 670bp over the past three months.

As a result, Australia now trades at a 5 per cent discount to the Developed Markets benchmark on a one-year forward P/E multiple.

“This stands in contrast to our economists’ view that the Australian economy will suffer less as a result of the crisis,” Mr Steed says.

He notes that Australian companies have had a high rate of capital raisings and much deeper dividend cuts than other markets.

“Australian corporates have moved aggressively to shore up balance sheets, with aggregate capital raised of $14.9bn, running at 3.0 times the US and 3.6 times the UK,” he says.

Australian boards have been far more decisive in scaling back dividends – a 27pc fall in 12-month dividend estimates this year has been the deepest scale-back globally.

“In our view, the degree of dividend downgrades is the most pernicious factor afflicting the performance of the ASX 200,” Mr Steed says.

Nick Evans 2.42pm: Atrum Coal surges on regulatory repeal

Shares in Canada-focused metallurgical coal hopeful Atrum Coal have surged on the back of the repeal of a regulatory change in Alberta, where the company’s Elan coking coal project is located.

Shares in Atrum were up 5.5c, or 26 per cent, to 26.5c at 2pm AEST after the company said the provincial government in Alberta had repealed a 1976 coal development policy that could have made it more difficult to win approvals mining at Elan.

The company said the land use designations under the old rules would have forced it to seek special exemptions at ministerial level for an open pit operation at the project. Removing the policy means the company can seek approvals under the same system as competitors such as Gina Rinehart’s nearby Grassy Mountain project – acquired through the $700m takeover of Riversdale Mining last year.

In a client note released on Monday Argonaut Securities analysts said the decision represented a “significant de-risking” of Elan, opening up an easier path to permitting.

“Argonaut believes this change of policy, and the subsequent de-risking to the permitting process, greatly increases the corporate appeal for the Elan Project,” the note said.

“Premium coking coal projects of this scale, located in low-sovereign risk jurisdictions with access to transport infrastructure are extremely rare. We regard the project as a takeover target for a major diversified mining company.”

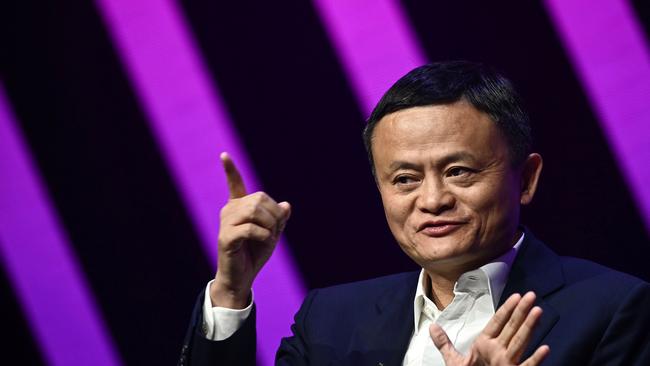

2.28pm: Jack Ma resigns from SoftBank board

Alibaba Group co-founder Jack Ma is stepping down from the board of technology investment company SoftBank Group, the latest confidant of SoftBank Chief Executive Masayoshi Son to depart.

SoftBank said Monday that Mr Ma, who has served on the board for 13 years, would resign June 25, when the company holds its annual shareholder meeting.

Tadashi Yanai, head of Uniqlo operator Fast Retailing, left the SoftBank board at the end of 2019 after 18 years of service, and Nidec chief executive Shigenobu Nagamori left in September 2017.

Mr Ma’s departure marks a turning point in a longstanding relationship with Mr Son. In 2000, Mr Son put $US20 million into Alibaba, a then fledgling internet company, based on what Mr Ma called his “shared vision” with the Japanese tech billionaire. It is now SoftBank’s most valuable holding.

SoftBank, which is set to release results for the year ended March 31 later Monday, has said it lost nearly $US17 billion in its technology-focused Vision Fund for the year. Greater-than-expected losses at office-share firm WeWork pushed SoftBank’s expected net loss for the year to around Yen900 billion ($US8.4 billion).

Dow Jones Newswires

2.13pm: Aussie oil names attractive: Macq

The risk/reward in Australian energy equities looks attractive, as oil prices bottom out, according to Macquarie.

In a note, the broker writes that macro data points will be the key catalyst for the sector, given the unprecedented decline in oil demand sparked by coronavirus shutdowns, but that prices are set for a recover in the second half.

“Most Australian Energy stocks are already trading above spot oil scenarios (in anticipation of the next oil equilibrium market being reached), somewhat consistent with the forward curve being in a reasonably steep contango (but still offering good upside),” Macquarie says.

Oil Search is the best pick in the local sector, with an outperform rating “given it already raised equity and has a strong growth profile in Alaska and PNG that we expect will eventually move forward when the oil market moves back to equilibrium”.

Santos was rated at Outperform too while Woodside was downgraded to Neutral.

2.06pm: Hours worked slowly rising: ABS

The number of Australians with a job has steadily increased over the four weeks to early May, a survey by the Australian Bureau of Statistics has found.

The proportion of people reporting they had a job had increased to 64.2 per cent, up 0.8 percentage points over the month from the lowest point in the first week of April, figures from the Household Impacts of COVID-19 Survey show.

The proportion of people indicating they had worked paid hours also increased by 3.2 percentage points to 59 per cent.

While not significant, the figures may indicate some improvement in labour market conditions, which have suffered from the impact of the COVID-19 related lockdowns.

Data released last week showed Australia’s economy lost a record 594,300 jobs during April following coronavirus-related social distancing measures imposed in late-March, which led to widespread business closures.

AAP

Our latest Household Impacts of COVID-19 Survey results are out now at https://t.co/w1QmHB0G1K pic.twitter.com/pNkRMqR8cS

— Australian Bureau of Statistics (@ABSStats) May 18, 2020

Lilly Vitorovich 1.43pm: 10Daily to close from Friday

Australia’s third-ranked commercial television broadcaster Network Ten is shutting down its news and entertainment website 10 Daily, just days after BuzzFeed announced the closure of its Australian site.

The closure was announced by 10 Daily’s senior reporter Josh Butler on social media platform Twitter on Monday lunchtime, and confirmed by a Ten spokesman.

Ten’s decision to shutter 10 Daily, which was set-up in May 2018, follows changes to the broadcaster’s strategy.

“Network Ten’s digital media strategy is evolving to capitalise on our momentum and match the new global operating model. That means an increased emphasis on streaming services and social media,” he said.

Ten, which is owned by US media giant ViacomCBS, is cutting costs as advertising revenue drops sharply during the coronavirus crisis.

Sad news - @10Daily is being closed from Friday

— Josh Butler ðŸ‰ðŸï¸ (@JoshButler) May 18, 2020

There will be a lot of people left without jobs - news, lifestyle and entertainment journalists; editors; video editors; social staff. They’re all guns

If you need people, please DM me and I can recommend you a few legends to hire

1.02pm: Mining shares push ASX higher

Local shares are trading near their best levels of the day led by a surge in materials stocks.

At 1pm, the benchmark ASX200 is higher by 66 points or 1.22 per cent to 5470.9 – from an earlier five-day high of 5486.3.

Heavyweight miners are doing a lot of the heavy lifting – BHP is up by 4.4pc while Rio adds 5.3pc but those gains are surpassed by gold miners after the commodity rallied to seven-year highs at the weekend.

Newcrest is up by 6.3pc as Evolution puts on 4.5pc and Northern Star gains 3.8pc.

Ex-dividend trade in Macquarie is providing some downdraft as it trades down 2.4pc.

Here’s the biggest movers at 1pm:

Lachlan Moffet Gray 12.56pm: NSW, Transurban discuss toll relief

NSW is in “constant dialogue” with toll road operators about potentially lowering fees to encourage more people to commute by car as the state develops strategies to avoid crowding on public transport.

NSW Transport Minister Andrew Constance said that as well as reducing maximum passenger limits on public transport, expanding bike paths and erecting “pop-up” parking areas, the state is talking to the state’s largest toll operator – Transurban – about doing something about fees.

The operator, which manages the Cross City Tunnel, the M2, the Eastern Distributor and the Lane Cove tunnel recently increased tolls.

“I was irritated when Transurban lifted their tolls in the last quarter, and we are in constant dialogue in relation to this and we are in constant dialogue with them on this,” Mr Constance told 2GB on Monday.

“I think there is a need for everyone to play their part.”

However Mr Constance did not say if the government would take explicit action in this manner, citing the complexity of toll road contracts.

Follow the latest updates at our coronavirus crisis live blog

12.38pm: Shares, dollar get lift from Powell

The Australian dollar and shares are getting a solid lift from optimistic comments from Fed chair Powell in an interview aired earlier today.

AUD/USD rose 0.6pc to an intraday high of 0.6453, while the S&P/ASX 200 rose 1.5pc to a 5-day high of 5486.3 as S&P 500 futures surged 1.1pc. The Australian share index only needs to rise a few more points to break 5489.5 and set a two-week high.

As well as Powell’s prognosis that “the economy will recover”, he also warned “you wouldn’t want to bet against the American economy”.

There was also an implied threat of more stimulus with his comment that: “we’re not out of ammunition by any shot … There’s almost no limit to what we can do with these lending programs.”

The Federal Reserve’s “unlimited” QE has been massively tapered from $US75bn a day of Treasuries alone in mid-April to $6bn in mid-March and while it may have slowed the US share market’s rise, its QE program of more than $10bn a day may be enough to keep shares rising, perhaps at a slower pace.

The Fed’s balance sheet as of last Wednesday was a staggering $US6.93 trillion, which was 67pc bigger than it was when it started ramping up its QE in late February.

Jerome Powell, Chairman of the Federal Reserve, says the trillions of dollars in additional federal debt to support the U.S. economy during coronavirus could be paid down over decades. https://t.co/sYXgPHmdSG pic.twitter.com/0ZIeJhXjDC

— 60 Minutes (@60Minutes) May 17, 2020

Lilly Vitorovich 12.21pm: Ad spend feels sting of cost cutting

Advertising spending dropped about 43 per cent last month from a year earlier, as companies slashed spending during the coronavirus crisis and spending could get worse this month before possibly improving in June, according to UBS.

UBS media analysts Eric Choi, Tom Beadle and Claire Yan say the double-digital fall in agency booking numbers in April is “broadly consistent with recent media owner updates”, citing industry group Standard Media Index.

However, the growth rate could improve once late digital bookings are accounted for.

“We remind SMI correlation with reported revenue growth has been historically imperfect outside of metro TV,” they say.

SMI data suggests weakness across all mediums in April, with the outdoor ad sector hit the hardest, down 63 per cent followed by magazines (-54 per cent), metro and regional radio (-48 and -41 per cent, respectively).

Digital dropped 43 per cent pre-late bookings; newspapers fell 38 per cent, and metro and regional TV fell 29 and 31 per cent, respectively.

UBS says there is the potential for May’s ad market growth rates “to be in line with or modestly worse” than last month’s falls, particularly as April last year was a weak previous corresponding period comparative “impacted by unfavourable Easter and ANZAC day timing”. Ad spending last year in May also benefited from the federal election and political party spend.

Perry Williams 12.09pm: Boral still needs to raise funds

Building products group Boral still needs to conduct an equity raising to ease pressures on its balance sheet and faces potential US writedowns, analysts say.

Boral on Friday issued a new $US200m bond, $365m of new bank loan facilities and extended $US665m of an existing $US750m debt facility.

But the move may not be enough.

“We still think an equity raise will be required,” Morgan Stanley analyst Andrew Scott said. “While covenants are unlikely to compel a raise, we still believe that prudent balance sheet management will see Boral look to bolster the balance sheet with equity at some point in time.”

Investors are wary of US writedowns and the need for a capital raising to “right size” the balance sheet, UBS said, which the next CEO must address. Boral boss Mike Kane is due to depart by the end of August. Its share price gives no value to the US business, UBS added.

“Investors we talk to are concerned that Boral is too complex, spanning too many geographies and businesses units, which is leading to a stretched management team and subsequently poor asset performance.”

Boral’s disparate assets will be challenging to manage during COVID-19 volatility, particularly in North America with a stretched balance sheet hiking risks for equity holders, Ord Minnett said.

“We believe CEO Mike Kane’s successor will take a close look at the carrying value of goodwill in North America,” Ord Minnett said.

Boral last down 1.2 per cent to $2.48.

Read more: Boral dented by virus, homes weakness

12.01pm: Japan falls into first recession since 2015

Japan dived into its first recession since 2015, according to official data Monday, with the world’s third-largest economy shrinking by 0.9 per cent in the first quarter as it wrestles with the fallout from the coronavirus.

The drop in gross domestic product followed a 1.9-per cent decline in the fourth quarter of 2019 as a tax hike and typhoons hit Japan hard – even before the pandemic shut down much of the economy.

A recession is defined as two consecutive quarters of negative GDP growth and some analysts predicted the Japanese economy would suffer worse as the effects of the coronavirus become clear.

“We expect the worst is yet to come, with the state of emergency in Japan and the severity of the pandemic among Western nations continuing to derail the Japanese economy,” said Naoya Oshikubo, senior economist at SuMi TRUST.

Nevertheless, the first-quarter result was slightly better than economists had forecast, with expectations for a 1.1-per cent decline

AFP

11.27am: Elders hits 10-year high

Drought breaking rains have spurred a jump in Elders shares to their best levels in 10 years, as the group reported a near doubling of its profit.

The company reported a 90 per cent surge in net profit to $52m in the six months to March 31, with the company combating bushfires and the coronavirus pandemic.

Good news sent shares in the agribusiness up as much as 7.7pc in morning trade, to hit new 10-year highs of $10.18.

R ead more: Rainfall brightens Elders outlook

11.13am: Village Roadshow jumps on revised bid

Village Roadshow investors have cheered the new takeover bid from BGH, albeit at a significant discount to the previous offers it had on the table earlier this year.

After the first hour of trade, VRL shares are higher by 13.9 per cent to $2.01 – hitting as much as $2.10.

The theme park operator said this morning it had entered into exclusive discussions with BGH for a bid worth $2.40 a share – down from the $4 per share bid it lobbed in January.

But, the offer has a number of conditions – both of which seem to have been dismissed by the market.

Shares are trading in line with the base offer of $2.20 – with the assumption likely that Village Roadshow will not be able to meet conditions that its major Sea World and Movie World parks will be open by the time the scheme is voted on, or that a majority of its cinema venues be open by the same date.

VRL last up 13.3pc to $2.00.

Read more: Village flags takeover deal

David Swan 11.04am: Superloop soars on COVID sales boost

ASX-listed broadband provider Superloop is surging in morning trade as it joined a throng of tech companies to see an upside to the COVID-19 pandemic, with the company reporting strong fibre connectivity and cyber security sales as digital demand continues to climb.

In the first hour of trade, shares in the group soared as much as 22.5pc to $1.15.

Superloop listed in 2015 as a wholesale ‘dark fibre’ provider but has since expanded to providing consumer NBN plans, and the company said in an update on Monday that it demand for its internet services had ramped up significantly in the last month.

It said traffic over its global network soared by 30 per cent in a matter of weeks.

SLC shares last traded up 18pc to $1.15.

Read more: Superloop reports surge in broadband demand

10.47am: US supports ASX to 5-day high

Australia’s S&P/ASX 200 has surged 1.3pc to a 5-day high of 5466.6 – a larger than expected rise after back-to-back gains on Wall Street and a solid rise in US stock index futures this morning.

S&P 500 futures are holding onto most of a 0.9pc rise after some optimism from Fed chair Powell in a 60 Minutes interview.

Resources and tech stocks are leading broadbased gains in most growth sectors, but the Financials sector is lagging as Macquarie trades ex-dividend

BHP is up 3.2pc, Newcrest up 5.5pc and Fortescue is up 3pc, while Macquarie is down 1.6pc.

Aristocrat is up 4.7pc after securing additional debt financing.

ASX200 last up 1.1pc to 5462.2.

10.43am: A word from Virgin’s administrators

Virgin Australia’s administrators say they have short-listed “a small number” of well funded parties “with strong aviation credentials” to progress to the next level of negotiations.

In a statement, lead administrator Vaughan Strawbridge writes:

“We have been very pleased with the progress of the administration and sale process to date, with excellent engagement from highly credentialed parties who have worked tirelessly to be in a position to put forward indicative proposals for the future of Virgin Australia.

“ … We received more interest than anticipated from parties who are eager to be a part of the future of Virgin Australia.

“We understand some parties will be disappointed that they have not been invited to continue their interest and we hope they will respect our decision which is predicated on the business continuing and achieving the best outcome for all people impacted. We thank all those who have been a part of our process to date.”

Read more: Brookfield exits Virgin bidding race

Bridget Carter 10.34am: Cyrus seeks partners for Virgin bid

DataRoom | Global hedge fund Cyrus Capital Management is expected to choose a partner in its pursuit of Virgin Australia as it moves through to the second round of the contest to buy the collapsed airline.

Cyrus has offices in New York and London and is mostly dominant in the North American and European markets.

It joins US-based Indigo Partners and private equity firms Bain Capital and Australian-based BGH Capital in making the shortlist of parties that will now carry out work in the Virgin Australia data room and engage with management before making final offers on June 15.

Voluntary administrator Deloitte was understood to have finalised the shortlist on Monday morning. Out of the contest is Brookfield, which is recently said to have lost its partner Macquarie Group, and Indian-based InterGlobe Aviation, which is a major shareholder of low cost Indian carrier IndiGo.

Market analysts believe it is likely that Cyrus will not bid for Virgin Australia independently and likely need a partner.

Read more: Brookfield exits Virgin bidding race

Jared Lynch 10.26am: Rainfall doubles profit for Elders

Drought-breaking rains across Australia’s east coast have fuelled a near doubling of profit for listed agribusiness Elders as it forecasts a positive winter crop.

The company reported a 90 per cent surge in net profit to $52m in the six months to March 31, with the company combating bushfires and the coronavirus pandemic.

“The first half of FY20 has been tumultuous with devastating bushfires across large parts of Australia, the COVID-19 pandemic and conversely, drought-breaking rains across many parts of Australia,” chief executive Mark Allison said.

“Successive rainfall events across major cropping areas on the east coast have had a positive impact on operational performance within the last period, lifting farmer confidence and driving strong demand for crop inputs.”

Revenue meanwhile rose 26 per cent to $925.2m, with the company attributing the rise to a 50:50 split between acquisitions and organic growth. Elders forecast full year earnings guidance of $96.5m to $112.9m, in-line with consensus, citing a positive winter crop outlook.

“The company has forecast a positive outlook for winter crop on the back of recent rainfalls across the eastern states,” Mr Allison said.

10.22am: BGH lobs takeover bid for Village Roadshow

BGH Capital has lobbed a revised takeover bid for Village Roadshow at a significant discount to its previous offer lobbed in January.

Village Roadshow said this morning that BGH had offered $2.40 a share, a haircut from $4 apiece the private equity group offered in just four months ago, pre-COVID-19.

The revised proposal consists of a base offer of $2.20 a share plus an additional offer price of 12c per share in the event that Movie World and Sea World have reopen to the public three business days prior to the day its shareholders vote on the deal, plus a further 8c a share if the majority of its cinemas and business locations have reopened by the same date.

“After careful consideration of the proposal, VRL has entered into a Transaction Process Deed with BGH under which BGH will be provided with the opportunity to undertake confirmatory due diligence and negotiate transaction documentation over a four week period on an exclusive basis,” the target said in a statement to the market this morning.

In December, the theme park operator was the subject of a $1bn offer from Pacific Equity Partners with shares to be acquired at $3.90 apiece, which was followed by a $4 per share offer from BGH.

Read more: BGH tops PEP for Village Roadshow takeover

10.11am: Gold miners outperform as ASX lifts

Local shares are decisively higher in opening trade, adding 1.1 per cent with gains across all sectors bar banks.

At the open, the benchmark ASX200 is up by 58 points or 1.07 per cent at 5462.6.

Mixed trade in the major banks is the only detractor from otherwise broad market strength, though gold miners are outperforming suggestive defensive trade.

Newcrest is higher by 6pc while Evolution adds 4.5pc, Northern Star jumps by 6pc and Saracen Minerals by 7.9pc.

9.55am: Village Roadshow burning through cash

Theme park operator Village Roadshow says its in advanced discussions with its lenders to increase its debt levels, as ongoing closures of its parks and cinemas hits its balance sheet.

In an update to the market, the owner of the Gold Coast’s Movie World, Sea World and Wet’n’Wild, among other leisure centres, says its burning through between $10m and $15m a month, with operating costs to increase as it prepares for its venues to reopen.

The group’s parks and centres have been closed since March 23 and remain closed until given the green light from the state authorities.

At April 30, Village Roadshow had undrawn debt facilities of $5m, and the company expects a net debt position of approximately $315m by June 30.

“VRL is in advanced discussions with lenders to increase its debt financing facilities …(and) has also progressed discussions with Industry Groups and Government at Federal and State levels to develop financial action plans and support,” the company says.

9.40am: J Powell gives some optimism for shares

US stock index futures appear to be benefiting from a degree of optimism from Fed chair Jerome Powell.

S&P 500 futures are up 0.8pc in early trading after Mr Powell said: “In the long run, and even in the medium run, you would not want to bet against the American economy”.

In a CBS News 60 Minutes interview recorded last Wednesday, Mr Powell also said that: “Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of the year.”

But for the economy to fully recover, Mr Powell said it may depend on the arrival of a vaccine.

“The economy will recover (but) it may take a while (and) it could stretch through the end of next year,” he added.

US futures gains add to positive leads for the Australian sharemarket after a 0.6pc rise in S&P/ASX 200 futures on Friday night.

On the charts, the S&P 500 appears to have found support near 2800, leaving the S&P/ASX 200 supported near 5300.

9.28am: Tyro still feeling the squeeze

Payments provider Tyro says its transaction value for May is down by 22 per cent as many of its merchants experience reduced traffic due to social distancing restrictions.

In the latest of its weekly updates, Tyro reported transaction value for the two weeks to May 15 was down by 22pc to $601m compared with $770m at the same time last year.

Still, that shows some improvement after values in April slumped by 38pc.

Year to date, the company is still tracking better – up 18pc so far to $17.791bn.

Nick Evans 9.22am: Panoramic backer to the rescue

Panoramic Resources’ major shareholder has come to the rescue of the struggling WA nickel miner, putting in place an option to buy the company’s secured debt as its advisers try to get a recapitalisation away.

Zeta Resources, which owns about 35 per cent of Panoramic shares, said on Monday it had put in place a put and call option to buy Panoramic’s $30m of secured debt with Macquarie Bank, in an effort to underpin the company’s ongoing equity raising efforts.

Panoramic is said to be chasing an $80m capital raising, its fourth since the beginning of 2019, and Zeta said the option would only come into play if the equity raising did not succeed. Zeta said it had put a $7m deposit down with Macquarie, to be offset against the exercise price, if it bought the debt.

Panoramic mothballed its Savannah nickel mine in the Kimberley region of WA in mid-April, citing the impact of coronavirus lockdowns, saying it could not continue to operate the mine in the face of movement restrictions in the region.

The company last traded at 12c a share.

Read more: Panoramic forced to mothball Savannah mine

9.16am: Aristocrat prices $US500m loan

Poker machine maker Aristocrat Leisure has priced a $US500m term loan B facility, in a bid to preserve its balance sheet as coronavirus forces the closure of casinos globally.

In a note this morning, Aristocrat said the facility would mature in October 2024, and was expected to settle on May 21.

“We are very pleased with the outcome of this debt raising which was significantly oversubscribed. The TLB market continues to provide Aristocrat with flexibility and competitively priced debt on a covenant light basis and we are grateful for the ongoing support of this important debt market,” chief financial officer Julie Cameron-Doe said.

Once settled, Aristocrat’s total term loan B debt will be $US2.35bn, priced at a weighted average LIBOR +218bps.

Glenda Korporaal 9.02am: Brookfield drops out of Virgin race

Canadian infrastructure investor Brookfield is believed to have pulled out of the bidding war for Virgin Australia.

Brookfield was considered one of the leading contenders to buy Virgin but, as Virgin administrator Vaughan Strawbridge considers some eight indicative bids lodged on Friday with a view to cutting them to a short list of three, reports emerged that Brookfield has pulled out.

It came as Mr Strawbridge, of Deloitte, came under mounting pressure to cut the shortlist of bidders for the collapsed airline to only two as quickly as possible, as some parties that lodged first-round indicative offers on Friday could walk away from the process.

The Australian understands that with the final bids due by June 12, Brookfield had been pushing hard for Deloitte to take only two parties through to the next stage of the process. It is believed some bidders are concerned enough about the issue that it could be a make-or-break condition of their bids.

“There are too many stakeholders who need to be engaged and negotiated with for more than two parties to be short-listed, particularly given the tight time frame,” said a source close to one group.

“Deloitte is not going to let any of the bidders speak to key stakeholders like creditors and employees until the start of June.”

Read more: Call to cull Virgin bidders to two

8.51am: What’s on the broker radar?

- Breville cut to Neutral, price target raised 25pc to $20 – Macquarie

- Charter Hall raised to Buy – UBS

- Charter Hall raised to Buy – CCZ Statton

- GrainCorp cut to Hold – Morningstar

- Lynas rated new Outperform – CLSA

- Woodside cut to Neutral – Macquarie

8.10am: Trade tensions help gold to 7-year high

Gold prices have jumped to levels last seen in 2012, as renewed US-China trade tensions added to concerns about a deep economic slump due to the coronavirus pandemic.

Spot gold rose 0.7 per cent to $US1,741.65 per ounce. During the session it hit its highest since November 2012 at $US1,751.25. Bullion has risen over 2 per cent so far this week.

US gold futures settled 0.9 per cent higher at $US1,756.30.

“While subdued physical demand and central bank buying may have slowed its ascent, there’s very little reason to sell gold in a time of unprecedented public largesse and deteriorating relations between the world’s economic super powers,” said Tai Wong, head of base and precious metals derivatives trading at BMO.

Underpinning the damage inflicted by the outbreak was the latest US retail sales data that showed a second straight month of record declines in April. Adding to the bleak economic scenario was renewed friction between the United States and China over the outbreak, with President Donald Trump suggesting he could even cut ties with Beijing.

Reuters

7.48: Oil prices jump

US crude prices have reached their highest price since March, on strengthening fuel demand as countries around the world eased travel restrictions they had imposed to curb the spread of the coronavirus.

US crude gained 19.7 per cent last week and Brent crude rose 5.2 per cent after a week of bullish news. Both contracts gained for the third consecutive week.

West Texas Intermediate (WTI) oil settled up $US1.87, or 6.8 per cent at $US29.43 a barrel, just off the session peak of $US29.92, its highest since mid- March. WTI soared 9 per cent in the previous session.

Brent crude settled up $US1.37, or 4.4 per cent a barrel at $US32.50. Brent rose nearly 7 per cent on Thursday.

Reuters

7.19am: ‘Delusional’ Shkreli denied release

A judge rejected the request of convicted pharmaceutical executive Martin Shkreli to be let out of prison to research a coronavirus treatment, noting that probation officials viewed that claim as the type of “delusional self-aggrandising behaviour” that led to his conviction.

US District Judge Kiyo Matsumoto said in a nine-page ruling Saturday that the man known as the “Pharma Bro” failed to demonstrate extraordinary and compelling factors that would require his release under home confinement rules designed to move vulnerable inmates out of institutions during the pandemic.

The low-security prison in Allenwood, Pennsylvania, where the 37-year-old Shkreli is locked up has reported no cases of coronavirus among inmates and staff, and there’s no evidence in his medical files to suggest a childhood bout with asthma continues to pose a significant health problem, Matsumoto wrote.

“Disappointed but not unexpected,” Shkreli’s lawyer, Benjamin Brafman, said.

Shkreli is serving a seven-year prison sentence for a 2017 conviction for lying to investors about the performance of two hedge funds he ran, withdrawing more money from those funds than he was entitled to get, and defrauding investors in a drug company, Retrophin, by hiding his ownership of some of its stock. A judge ordered Shkreli to forfeit $US7.3 million.

AP

6.29am: Long recovery ahead: Powell

Federal Reserve Chairman Jerome Powell said the U.S. economy could take more than a year to recover from the coronavirus-induced shock, in an interview broadcast on Sunday.

“It’s going to take a while for us to get back,” Mr. Powell said in a rare television interview on the CBS News “60 Minutes” program. “The economy will recover. It may take a while. It may take a period – it could stretch through the end of next year. We really don’t know.”

Mr. Powell was interviewed Wednesday at the central bank’s Washington headquarters. CBS News released an excerpt of the interview, which is set to air on its regular evening broadcast.

Without a second wave of infections this year, Mr. Powell said was hopeful the economy could “recover steadily through the second half of this year,” adding, “For the economy to fully recover, people will have to be fully confident, and that may have to await the arrival of a vaccine.”

Dow Jones

6.15am: Emirates ‘to cut about 30,000 jobs’

Emirates Group is planning to cut about 30,000 jobs to reduce costs amid the coronavirus outbreak, which will bring down its number of employees by about 30 per cent from more than 105,000 at the end of March, Bloomberg News reports.

The company is also considering speeding up the planned retirement of its A380 fleet, the report added, citing people familiar with the matter.

An Emirates spokeswoman said that no public announcement has been made yet by the company regarding “redundancies at the airline” but that the company is conducting a review of “costs and resourcing against business projections”.

“Any such decision will be communicated in an appropriate fashion. Like any responsible business would do, our executive team has directed all departments to conduct a thorough review of costs and resourcing against business projections,” the spokeswoman said.

It comes after Emirates said it would join fellow Middle Eastern carrier Etihad Airways in resuming services between Australia and Europe via its Dubai hub.

David Rogers 5.50am: ASX tipped to open higher

Australian shares should open higher yet remain subject to developments in regard to the coronavirus pandemic, the economy, central bank policy and geopolitical factors.

S&P/ASX 200 futures rose 32 points or 0.6 per cent, on Friday night, suggesting the benchmark share index will open up at a four-day high around 5437.

The local market index rose an impressive 1.4 per cent to 5404.8 points in regular trading on Friday, almost fully recovering from a 1.7 per cent fall on Thursday after a similar bounce on Wall Street.

The S&P 500 rose 0.4 per cent to 2863 points on Friday despite a bigger-than-expected 16.2 per cent fall in April retail sales versus a 12 per cent fall expected by economists. On the chart, the S&P 500 appeared to find support on dips below 2800 points last week.

Offsetting concern about slumping retail sales was a smaller-than-expected fall in the Empire State Survey of New York manufacturing and a higher-than-expected University of Michigan Consumer Sentiment reading, both for May.

AMP Capital’s head of investment strategy and chief economist, Shane Oliver, said high-frequency data in the US and Australia continued to suggest activity could have hit bottom.

“Our weekly economic activity trackers for the US and Australia based on high frequency data for things like restaurant bookings, confidence, retail foot traffic, box office takings, credit card data, mobility indexes and jobs data are up from their lows in mid-April — albeit only a bit — and more so in Australia,” Dr Oliver said.

“In Australia weekly consumer confidence has risen for six weeks in a row, surveys show a pick-up in consumer spending, and traffic flows have picked up — in fact the traffic last Saturday in Sydney seemed to resemble a normal Saturday, which tells me that there is a bit of pent up demand.”

But broader share volatility will continue as economies gradually reopen following coronavirus-prompted shutdowns, and potentially face second-wave infections. “Part of the reason is the fact that lockdown restrictions are easing and countries are not all going to be successful in terms of the easing of those restrictions,” said CommSec chief economist Craig James. “What we’ll see is investors responding to changes in COVID cases. Those countries being very successful in coming out, their sharemarkets are perhaps going to hold up best.”

Investors await Reserve Bank minutes on Tuesday and remarks later this week by RBA governor Philip Lowe at a FINSIA event on Thursday, as well as testimony on Wednesday by US Federal Reserve chair Jerome Powell to the US Senate banking committee.

The Bureau of Statistics will issue data on the coronavirus pandemic’s impact on the household sector on Monday and preliminary retail sales on Tuesday.

5.30am: Leaders weigh reopening risks

On a weekend when many pandemic-weary people emerged from weeks of lockdown, leaders in the US and Europe weighed the risks and rewards of lifting COVID-19 restrictions knowing that a vaccine could take years to develop.

In separate stark warnings, two major European leaders bluntly told their citizens that the world needs to adapt to living with the coronavirus and cannot wait to be saved by a vaccine.

“We are confronting this risk, and we need to accept it, otherwise we would never be able to relaunch,” Italian Prime Minister Giuseppe Conte said, heeding a push by regional leaders to allow restaurants, bars and beach facilities to open Monday, weeks ahead of an earlier timetable.

In the US, images of crowded bars, beaches and boardwalks suggested some weren’t heeding warnings to safely enjoy reopened spaces while limiting the risks of spreading infection.

A member of President Donald Trump’s cabinet, Health and Human Services Secretary Alex Azar, wouldn’t second-guess state and local officials as they decide whether to let restaurants and other businesses reopen. He said the lockdown measures also carry “serious health consequences,” including the risk of suicide, delayed cardiac procedures and cancer screenings.

The warnings by Italy’s Conte and British Prime Minister Boris Johnson came as governments worldwide and many U.S. states struggled with restarting economies blindsided by the pandemic. With 36 million newly unemployed in the U.S. alone, economic pressures are building even as authorities acknowledge that reopening risks setting off new waves of infections and deaths.

“We are facing a calculated risk, in the awareness … that the epidemiological curve could go back up,” Conte said, adding that Italy could “not afford” to wait until a vaccine was developed.

Health experts say the world could be months, if not years, away from having a vaccine available to everyone despite the scientific gold rush now on to create one.

Britain’s Johnson, who was hospitalised last month with a serious bout of COVID-19, speculated Sunday that a vaccine may not be developed at all, despite the huge global effort to produce one.

“I said we would throw everything we could at finding a vaccine,” Johnson wrote in the Mail on Sunday newspaper. “There remains a very long way to go, and I must be frank that a vaccine might not come to fruition.”

AP

5.25am: China vows to defend Huawei

China warned it would take “necessary measures” to protect Huawei and other firms after the United States announced new restrictions on the tech giant’s purchases of semiconductor technology.

Washington on Friday ramped up sanctions on the company at the centre of US spying allegations, cutting Huawei off from global chipmakers.

“China will take all necessary measures to resolutely protect the legitimate rights and interests of Chinese firms,” the Ministry of Commerce said on Sunday.

“China urges the US to immediately cease its wrong actions,” the ministry added, calling the restrictions a “serious threat to global supply chains.” The threat of retaliation comes a day after Beijing condemned the US move as “unreasonable suppression of Huawei and Chinese enterprises.” The US Commerce Department said Friday its new sanctions would “narrowly and strategically target Huawei’s acquisition of semiconductors that are the direct product of certain US software and technology.” US officials have repeatedly accused the Chinese technology giant of stealing American trade secrets and aiding China’s espionage efforts, ramping up tensions with the rival superpower while both sides were involved in a long-simmering trade war.

As a result, Huawei has increasingly relied on domestically manufactured technology, but the latest rules will also ban foreign firms that use US technology from shipping semiconductors to Huawei without US permission.

The new restrictions will cut off Huawei’s access to one of its major suppliers, the Taiwanese chipmaker TSMC, which also manufactures chips for Apple and other tech firms.

Huawei has not yet responded to requests for comment.

AFP

5.20am: Wall Street recap

Wall Street stocks shrugged off early weakness and finished higher Friday despite another round of dreadful economic data and escalating US-China tensions.

The Dow Jones Industrial Average ended up 0.3 per cent at 23,685.42. The broadbased S&P 500 added 0.4 per cent at 2,863.70, while the tech-rich Nasdaq Composite Index jumped 0.8 per cent to 9,014.56.

Friday marked the second straight turnaround session, suggesting hunger for equities when bargains present themselves.

Stocks were initially pressured following weak retail sales data and US actions against Chinese telecom giant Huawei that escalated Washington’s tensions with Beijing.

But the Federal Reserve’s muscular response to the coronavirus crisis has reassured equity investors, said Gregori Volokhine of Meeschaert Financial Services.

These programs include vehicles to purchase corporate debt, which means “solvent borrowers have a backup and that lifts their shares,” he said.

Friday’s batch of data included a historic drop in US retail sales in April and an unprecedented decline in industrial production.

In one bright spot, the University of Michigan monthly survey showed consumer sentiment improved slightly in May, ticking up to 73.7 per cent from 71.8 per cent in April.

But Oxford Economics warned the bounce was “fragile,” according to a note Friday.

“Whether it can be sustained will depend in part on whether the government enacts further stimulus measures to help households and whether the relaxation of restrictions results in a resurgence in COVID-19 infections,” the note said.

“The majority of consumers continued to rank the pandemic’s threat to public health as their main concern.”

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout