Jerome Powell’s equities lift: we’re not out of ammo

Jerome Powell’s 60 Minutes interview was mostly viewed as positive for risk assets.

Jerome Powell’s 60 Minutes interview was mostly viewed as positive for risk assets.

The Federal Reserve chairman — while suitably cautious — motivated investors to keep moving back into equities, thereby reducing the “negative wealth” effect of the recent bear market.

“Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year,” Mr Powell said, adding that “in the long run, and even in the medium run, you would not want to bet against the American economy.”

And in reference to the potential for more monetary stimulus, he said: “We’re not out of ammunition by any shot. There’s almost no limit to what we can do with these lending programs.”

Combined with favourable supply factors boosting crude oil and iron ore prices, Mr Powell’s comments sparked strong rise in S&P 500 futures in Asian trading on Monday.

The improved risk appetite helped the dollar rise 0.5 per cent to US64.5c, while the S&P/ASX 200 share index rose 1 per cent to 5460 points even as banks lost ground.

After the local market closed, S&P 500 futures extended their rise from 1 per cent to 1.6 per cent.

That came after the sharemarket proved resilient last week to weak US economic data, worrisome Fed comments, deteriorating US-China relations and uncertainty — after such a strong bounce from the March lows — about whether an economic reopening would spark a second wave of infections.

At the end of last week, US retail sales for May plunged more than expected, the Fed warned that asset prices “remain vulnerable to significant price declines should the pandemic take an unexpected course, the economic fallout prove more adverse, or financial system strains re-emerge”, and the US Commerce Department indicated that it would not allow US chip supplies to Huawei after 90 days.

But still the US sharemarket rose, with the S&P 500 appearing well supported near 2800 points.

Even after the Fed said it would further taper its quantitative easing program this week, the scale and breadth of the central bank intervention and government fiscal stimulus since the coronavirus outbreak may — combined with still-bearish sentiment — be enough to keep shares moving higher.

Certainly, the Fed’s “unlimited” QE has been massively tapered from $US75bn a day of US Treasury bonds alone in mid-March, to a planned $US6bn ($9.3bn) a day planned for this week.

But combined with its plans to buy $US4.5bn of mortgage bonds a day, that’s still $US10.5bn a day.

As well, the Fed kicked off its corporate debt ETF buying program last week.

The Fed’s balance sheet as of last Wednesday was a staggering $US6.93 trillion, which was 67 per cent more than it was when it started ramping up its QE in late February.

Bank of America’s head of APAC & global emerging markets strategy, Ajay Singh Kapur, said “sentiment remains depressed”, which was “bullish for (risk) markets”, and that investors should “stay bullish on massive (central bank) liquidity support”.

BofA’s “global risk-love” index, which looks at 35 global financial markets inputs, remains in “deep panic” (bullish on a contrarian basis), and at the bottom tenth of its history since 1987.

That fits with BofA’s Bull & Bear Indicator, which remained at its “extreme bearish” (also bullish on a contrarian basis) of zero for the eighth straight week.

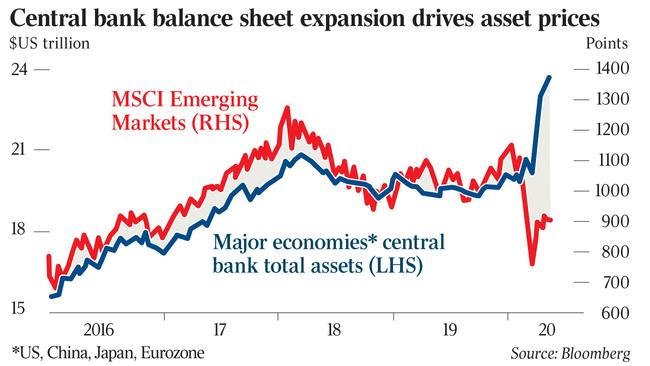

It may be particularly good for emerging markets equities, which are significantly lagging the rapid expansion of central bank balance sheets, more so than developed markets equities.

“With sentiment languishing at washed-out levels, an estimated $US14 trillion policy bazooka this year — more than $US7 trillion of fiscal stimulus and $US7 trillion of central bank balance sheet expansion — should continue to thrust under-owned Asian/EM equities higher as the COVID-19 new cases curves flatten across the world, absent a resurgence of new cases,” Mr Kapur said. “Those waiting for fundamentals to improve may miss out on some of the early gains.”

BofA also notes that policy stimulus is swamping supply in financial markets, with 10 global rate cuts, $US7.9 trillion of QE and $8.7 trillion of fiscal stimulus in 2020, compared to issuance of US investment grade bonds of $967bn, junk bonds of $124bn, and equity of $43bn.

Australia’s strong performance in dealing with COVID-19 in the past three months has not translated to local sharemarket outperformance and there are several reasons for that, according to JPMorgan Australia’s head of research Jason Steed.

After ranking countries according to how much of their economies are back online, he found Australia was one of eight countries in the “first movers COVID group”. But in contrast to this “containment outperformance”, the ASX 200 has been a laggard; underperforming the MSCI developed markets by 670 basis points over the past three months.

As a result, Australia now trades at a 5 per cent discount to the developed markets benchmark on a one-year forward P/E multiple.

“This stands in contrast to our economists’ view that the Australian economy will suffer less as a result of the crisis,” Mr Steed said.

But Australian companies have had a high rate of capital raising and much deeper dividend cuts. “Australian corporates have moved aggressively to shore up balance sheets, with aggregate capital raised of $14.9bn, running at three times the US and 3.6 times the UK,” he said.

Still, while leverage in Australia is moderately higher than developed markets, raisings to date have in many cases been “precautionary or growth-oriented” and did not, in his view, reflect “Australian-specific “corporate fissures”.

In addition to being more proactive in raising capital, Australian boards had been far more decisive in scaling back dividends, and Mr Steed said the degree of dividend downgrades was “the most pernicious factor afflicting the performance of the ASX 200.”

A 27 per cent fall in 12-month dividend estimates this year has been the deepest scale-back globally. Still, much of the dividend reductions have been driven by uncertainty above the pandemic.

Perhaps a successful easing of lockdowns will allow companies more certainty about dividends.