Virgin administrator Vaughan Strawbridge, of Deloitte, is playing a knife-edge game of keeping a lot of people in the room until the real action starts on June 12, when the final two bidders are selected.

Virgin is drowning in $6.8bn debt and locked into a series of expensive contracts for everything from six A330 wide-body aircraft to caterer Gate Gourmet and 9000 staff.

The potential bidders are not allowed to speak to the asset owners until after June 12, so time is limited and Virgin’s working capital resources are also constrained.

The global airline industry on some estimates undertook 4.6 billion flights last year and 47 million in April, which means on that trend will fly just 564 million flights this year.

Obviously, some markets are being opened up, but you get the picture - the airline industry is on its knees and its cyclical blue sky is limited until the international market is reopened.

Brookfield pulled out of the process after it was not selected in the first round, but its 75 per cent owned Oaktree Capital is teamed up with US airline investor Indigo Partners. Oaktree, like separate bidder Cyrus Capital, specialises in distressed debt.

Cyrus Capital, the New York-based hedge fund, was established by Stephen Freidheim in 1999 and was one of the original backers to Virgin America when Sir Richard Branson established the airline in 2007.

They sold to Air Alaska seven years later and have been looking to repeat the turn elsewhere.

Bain is the fourth contender and a serious player, with KordaMentha in the background.

When the parties are narrowed to two they will be free to negotiate deals with some of the lease holders to knock out bad contracts, before a final deal.

If you were Boeing or Gate Gourmet - dealing with A or B, knowing only one would win the prize - you would not be about to hand over the crown jewels.

But that’s tomorrow’s issue and in short this battle has a long way to run.

Cloud lifts off

Melbourne-based Ted Gannon’s Panviva is one of those overnight success stories who has been at it for two decades, but COVID-19 has delivered him the entree to rapidly expand his cloud-based software company.

The selling point is the ability to quickly deliver presentations to call centre staff and others where the new information is needed in quick time.

The Telstra Ventures-backed company has a string of blue-chip clients including Bupa, Medibank, ANZ, Westpac and Dulux, but 60 per cent of its $12m in annual revenues are now derived from the US, with state governments like Texas, Virginia and Indiana signing up to the service.

Cheaper power

Next month the PEMM (Prohibiting Energy Market Manipulation) Act comes into force and, other things being equal, should translate into lower electricity prices for Australian consumers.

In round terms, wholesale costs account for 35 per cent of your electricity bill and transmission around 40 per cent.

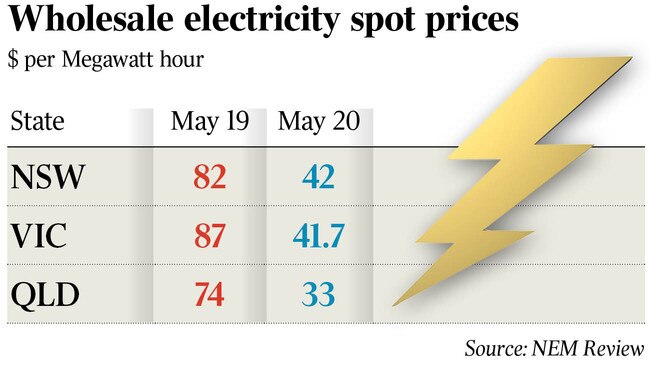

Wholesale electricity prices are around half year-ago levels and the new law says if wholesale rates are down for a sustained period then retailers must reduce retail prices.

The average house uses around six megawatt hours of electricity a year, which is down due to a number of factors including rooftop solar panels, more energy-efficient appliances and better educated consumers.

The spot prices are not necessarily what your retailer will pay because they are spot futures prices compared to long-term contract prices, which while ultimately based on market prices, may take some time to get to that level.

But it’s a guide.

The reason why spot prices are down so much is due to a combination of factors including increased supply of wind and solar power - which including rooftop panels now account for 30 per cent of national power, up 20 per cent on a year ago, with more supply coming.

Gas is now selling at around $3.50 a gigajoule, a bit over one-third of the price of a couple of years back and coal prices are down. Demand is down a touch and a confluence of reasons explain the fall in wholesale prices.

The PEMM legislation was designed to ensure the big retailers, who are in the main also the big suppliers, ensure there is enough liquidity, don’t manipulate prices and where wholesale prices are down for a sustained period deliver those gains to consumers.

The test looms.

Reform pact

Prime Minister Scott Morrison’s speech next week on a new pact between business, unions and governments holds the key to the reform process going forward.

The landmark speech, flagged in The Australian on Monday, mirrors the accord introduced by the late Bob Hawke and Paul Keating after their 1983 election.

The basis of the accord was an agreement between business and the unions centred on controlling inflation and the business community was a belated convert thanks to the support of the late Sir Arvi Parbo and then Business Council chief Geoff Allen.

There was a firm policy substance to the agreement; it wasn’t just a collection of “pascoes”, also known as platitudes and soft options. If the unions and business are to sign on to a reform pact then it has to have a firm heart, like the obvious hope for sustainable employment growth. It remains to be seen whether Morrison can deliver this next week.

Debate on many policy options were rightly criticised by Terry McCrann as being recycled ideas, but the missing element is actually putting the ideas to work.

The virus has created the vehicle by which the policy can be delivered - and the national cabinet comprised of federal and state governments gives the means by which old but good ideas can actually be implemented.

A classic case being telehealth, which was long rejected by Health Department bureaucrats as opening the door to Medicare abuse.

The argument was if the government let doctors bulk bill on phone consultations they would make off like bandits, billing for 500 more patients than they actually spoke to.

The reform got nowhere, but all of a sudden telehealth became necessary because COVID-19 stopped people visiting the doctor and so telehealth became a much lauded reality.

The private health industry jumped in and opened the net for its HICAPS payments system and now telephone and digital communication with health professionals.

Time will tell whether the health bureaucrats were right to be concerned, but then the digital world should have a way of tracking abuse.