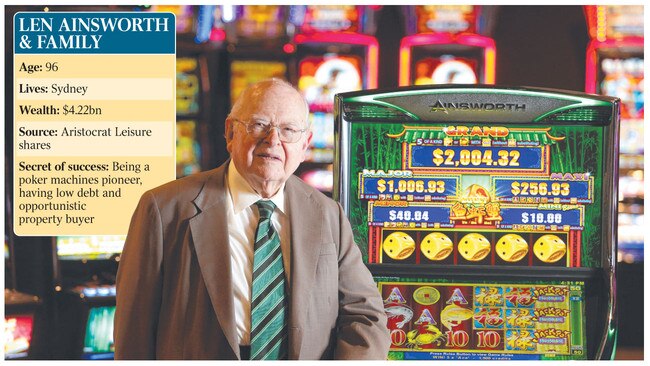

Poker machine king Len Ainsworth eyes storage boom

Having a factory roof blown off, a cancer scare, high interest rates, credit crunches, recessions: Len Ainsworth has seen it all.

Having a factory roof blown off by a gelignite bomb, a cancer scare, high interest rates, credit crunches, recessions and other downturns: Len Ainsworth has seen it all during seven decades in business.

He made his fortune as a poker machine manufacturing pioneer and more recently diversified by putting some of his wealth into property.

The country’s oldest billionaire at 96, Ainsworth tells The Australian he is still taking a keen interest in business despite the COVID-19 shutdown. “I’m still breathing. Life is full of beauty,” he says.

Ainsworth says simple business fundamentals like not going into the coronavirus downturn with too much debt gives him the ability to strike deals for assets that could be acquired at discounted prices.

“I always do pretty well in downturns. It could be the case that some opportunities present themselves during all this.”

In Ainsworth’s case that means looking for opportunities in property.

His private Associated World Investments has property holdings, both residential and commercial, in Sydney and rural areas of NSW such as Bowral and the Southern Highlands.

“I make money from renting apartments to people and I also have commercial properties. As long as they can still pay their rent then you should be OK, and there could be opportunities come up when the owners have to sell because they’ve got themselves into problems with taking on too much debt.”

Ainsworth says he has taken a particular interest in acquiring property to convert to storage facilities, including one on Parramatta Road in Sydney’s Lidcombe that property records indicate he paid $19.5m for in August 2018.

“I’m quite interested in storage and in fact there’s a bit of a pattern to it. You’ll have a family in which the children will grow up and then they will find they’ve got all this stuff, and of course they can’t bear to part with it so they put it in storage.

“It can be the same when people move into an apartment too. They need somewhere to put everything. So storage has been something good to be in. And you might find more people have to move house too.”

Most of the Ainsworth family’s wealth, estimated at $4.22bn on this year’s edition of The List — Australia’s Richest 250, is derived from his and his family’s shares in poker machines maker Aristocrat Leisure.

It is now more than 25 years since Ainsworth has had a management role at Aristocrat, though the company’s dividends have long supplied a regular and large income.

Ainsworth, however, backs Aristocrat’s announcement last month that it will suspend its dividend for its latest financial results, which are set to be announced this week.

“It is a sensible attitude given what is happening at the moment,” Ainsworth says, while noting the shutdown of licensed clubs in Australia and big gambling centres such as Las Vegas overseas.

Ainsworth founded Aristocrat in 1953 after transforming his father’s dental supplies business, during what were the intensely competitive early days of Sydney’s licensed club industry.

At one stage, the roof of Ainsworth’s factory was blown up by a rival with a gelignite bomb but the business would thrive as poker machines became legal in Australia and Ainsworth travelled to the US and elsewhere to study industry trends.

But Ainsworth stepped down from Aristocrat in 1994 after what later turned out to be a false cancer diagnosis.

By then, he had passed many of his Aristocrat shares to family members and they have been maintained even as Ainsworth later started rival Ainsworth Game Technology. He sold his AGT shares in 2018, receiving a cheque for about $473m in the process.

He still has property and philanthropic and investment interests via his private Associated World Investments.

Ainsworth says he donates to causes such as medical and health research. He has signed Warren Buffett’s Living Pledge to give away much of his fortune.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout