Chevron to sell 16.6pc stake in $34bn North West Shelf LNG plant in Western Australia

Chevron Australia says the move follows ‘a number of unsolicited approaches from a range of credible buyers’.

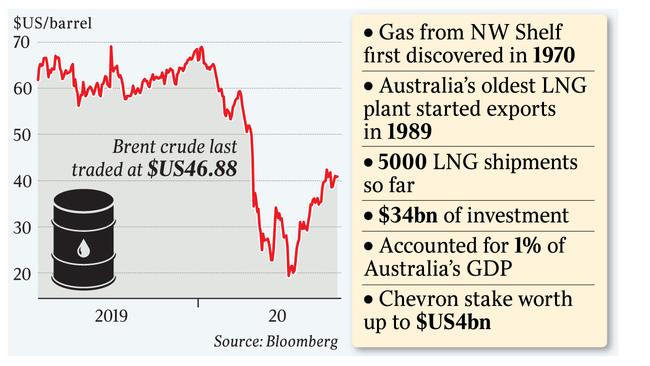

US giant Chevron is selling its 16.6 per cent stake in the $34bn North West Shelf LNG plant in Western Australia following interest from buyers in a potential $US4bn ($5.8bn) deal, marking the largest shake-up in the state’s energy industry for decades and a potential foreign investment test for the Morrison government.

The move followed “a number of unsolicited approaches from a range of credible buyers”, Chevron Australia managing director Al Williams said in an internal note to staff seen by The Australian, and could emerge as the first national security test under tougher foreign takeover laws introduced earlier in June by Treasurer Josh Frydenberg.

The sale could face regulatory hurdles if PetroChina or another Chinese bidder emerges as a contender for the strategic asset, potentially exacerbating fraught relationships between Canberra and Beijing.

Mr Frydenberg and WA Premier Mark McGowan could both have a say in determining the eventual buyer. Recent changes to Australia’s foreign investment regime mean the Treasurer will almost certainly need to approve the sale of Australia’s biggest LNG processing hub, even though Chevron is not an Australian company.

PetroChina, which owns a stake in the Browse gas project, could emerge as a frontrunner with China’s CNOOC also a lead contender, Credit Suisse said. NW Shelf operator Woodside may also be a contender and potentially hold pre-emption rights.

While noting FIRB and West Australian government considerations would “loom large”, a new entrant “with motivation, deal-making nous and no joint venture baggage could be beneficial to the joint venture dynamic in our view,” Credit Suisse analyst Saul Kavonic said.

Such is the importance of the NW Shelf project’s infrastructure — it is the biggest supplier of gas to WA’s domestic market as well as a substantial exporter — any decision to sell could also need clearance from ASIO and other Australian security agencies under Mr Frydenberg’s stricter security test for foreign investment.

The NW Shelf is also covered by a longstanding state agreement with the WA government, which would need to be amended by Mr McGowan if Chevron sells out.

The WA government has far better relationships with Beijing than its federal counterparts, however, and is not seen as a likely barrier to any credible buyer.

A shake-up of Australia's oldest LNG plant, which started exporting gas in 1989, has been on the cards for several years.

The terminal is facing the depletion of its gas reserves in the next few years, forcing the facility to move to a new tolling model where it will process gas from third parties for the first time.

“The NWS project is shifting its focus towards becoming a globally competitive third-party tolling facility and this is the appropriate time for Chevron to consider fair value proposals for our interest from potential buyers,” Mr Williams said.

Chevron also controls the Gorgon and Wheatstone LNG plants in Western Australia, which cost a combined $US88bn to build and accounts for a quarter of the nation’s LNG capacity.

The sprawling NW Shelf complex is Australia’s largest LNG plant, located 1260km north of Perth, and includes five LNG export processing trains and two domestic gas facilities. Woodside runs the facility in a joint venture with BHP, BP, Chevron, Shell and Mitsubishi with Mitsui.

Credit Suisse had previously said Chevron may sell its stake in the LNG plant following its $US50bn takeover of Anadarko Petroleum while others think an infrastructure buyer could also be an option given the reliable tolling fees from the facility.

Chevron said it would work on setting up the tolling model with its partners.

“During the marketing period, Chevron will continue to support the NWS joint venture in the sale and efficient operation of the NWS project and work towards establishing the NWS project as a competitive and profitable tolling facility,” Mr Williams noted.

Woodside Petroleum is the most likely buyer of the stake, consultancy WoodMackenzie said.

“In terms of buyers, there are a few likely suitors, but of the existing participants we see Woodside as the most likely buyer. It is well-positioned financially and has announced it is ready and looking for M&A opportunities in Australia,” WoodMac senior analyst David Low said.

“For the NWS joint venture partners, this means an increasing proportion of tolling revenue will be generated, unless each party can monetise its own gas molecules through the facility,” Mr Low said.

“Chevron unsuccessfully tried to monetise the Clio/Acme asset via the NWS last year, and is unlikely to be able to monetise any of its gas through the facility in the near-term. We see this as part of the reason why its stake in the NWS is up for sale.”

Extracting value

Woodside said it was focused on extracting value from the LNG terminal.

The NW Shelf Project is a significant supplier of gas to the Western Australian and international markets and we look forward to unlocking its future value alongside our joint venture partners,” a Woodside spokeswoman said.

Chevron had historically been seen as a potential hurdle in moving the NW Shelf towards a toll-treating future, given it operates two rival LNG plants in the same region: Gorgon and Wheatstone.

Chevron cutting staff

Chevron, which is cutting up to 15 per cent of its global staff due to an oil downturn, said in early May it would slash as many as 600 staff from its Australian operations.

Its 2021 business plans were also being adjusted to reflect the "cancellation, deferral and slowdown of work and we must do even more to control spend to ensure we are competitive".

Four of the NW Shelf partners — Woodside, Shell, BP and Japan Australia LNG — also hold stakes in the long-delayed Browse project offshore Western Australia with gas from that field in line to be processed through the Karratha gas plant.

Woodside has indicated it will make a final investment decision on Browse by late 2020 but that process was torpedoed due to the oil price crash over the last few months and no new sign-off date has yet been given by chief executive Peter Coleman.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout