AGL Energy’s Powering Australian Renewables Fund is believed to be weighing an entry into the contest for John Laing Australia’s $750m renewable energy business that is up for sale.

It is understood that PARF, which also counts the Future Fund as an investor along with the Queensland Investment Corporation, is considering an entry into the race, which has apparently attracted expressions of interest from about 80 parties, although it has not yet offered a firm commitment.

Should it become a contender, PARF will join a long list of other groups competing for the portfolio of solar and wind farms that are up for sale through adviser Macquarie Capital.

PARF, set up by former AGL Energy boss Andy Vesey, has between $2bn and $3bn under management and has an aim to develop and own about 1000 megawatts of large-scale renewable generation projects.

The fund was established in 2016 through a partnership with QIC on behalf of its clients, which includes the Future Fund and those invested in the QIC Global Infrastructure Fund.

Some believe that delays on AGL’s $450m Silverton Wind Farm project in northwest NSW could be a deterrent for PARF to compete, along with issues related to marginal loss factors, which represent the transmission losses within each of the five regions of the National Electricity Market.

Others also question the logic, saying that the fund was full.

PARF has four renewable energy projects in Australia, including solar and wind farms, and should it acquire the John Laing assets it would be the first major acquisition since it was established.

The AGL-backed venture would be competing for the portfolio of eight renewable energy assets along with the Dutch Infrastructure Fund and Palisade Investment Partners, which has teamed up with First State Super for the contest.

That partnership is advised by Royal Bank of Canada and Grant Samuel.

Other groups likely to be in the mix are infrastructure investors such as ICG and AMP Capital.

Macquarie Infrastructure and Real Assets has also been mentioned, along with Canadian funds.

Pacific Hydro’s owner, the State Power Investment Corporation out of China, was looking at the asset, but is understood to have dropped out of the contest.

There is also a pension fund out of Korea thought to be in the mix, as well as APA, Alinta and First Sentier.

First-round bids are due at the end of the month, which will not involve any on-the-ground work.

While the business is attractive, it has had problematic contracts that have needed to be addressed.

Earlier, the price tag was expected to be about $750m.

Groups are eager to acquire wind farms to capitalise on the trend towards renewable energy.

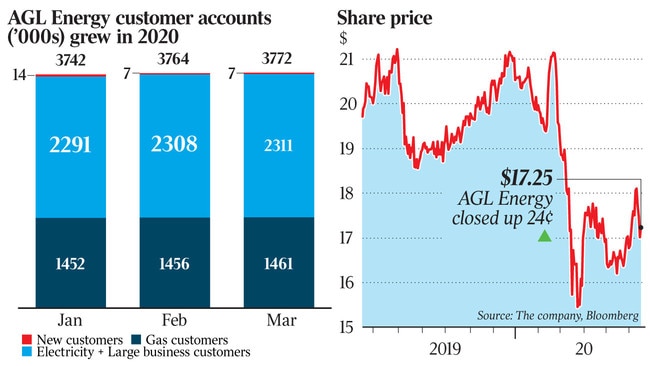

AGL is the largest listed renewable energy investor in Australia.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout