’Perfect storm’ hits up to 600 Chevron jobs

The energy giant may cut up to 600 local jobs amid the crunch of low oil prices and a coronavirus-induced downturn.

Two of Australia’s biggest energy operators plan to slash up to 700 jobs as the oil market crash and Covid-19 economic shutdown force the industry into emergency action to cut costs.

Energy giant Chevron has signalled reducing nearly a third or 600 of its 2000 Australian staff, as revealed online by The Australian, due to a ‘perfect storm’ of the pandemic and slump in crude prices.

Alinta Energy, Australia’s fourth largest electricity retailer and owner of Victoria’s Loy Yang B coal plant, also plans to shed up to 50 of its 700 permanent workers due to structural changes in the nation’s power industry.

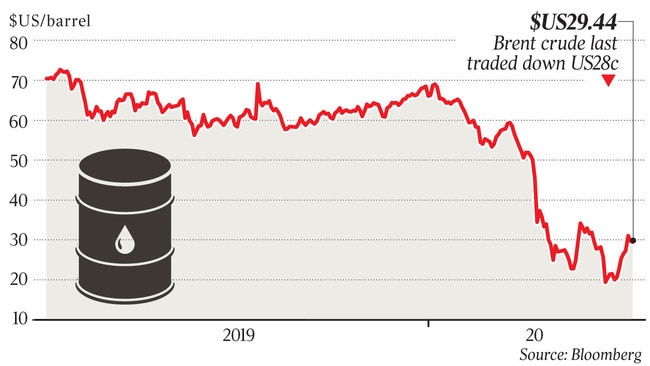

Australian energy companies have already frozen $60bn in spending and reduced over 1000 jobs in response to the biggest oil slump in a generation which has piled pressure on balance sheets that had banked on higher energy prices.

US oil major Chevron - operator of the $US88bn Gorgon and Wheatstone LNG plants in Western Australia - said 20-30 per cent of its 2000-strong workforce could be axed indicating up to 600 people may be affected.

“With crude prices near 20-year lows and global annual energy demand forecasted to drop by 6 per cent, the largest in 70 years, we have a challenging road ahead to preserve cash in the short-term while protecting value for the long-term,” Chevron Australia managing director Al Williams said in an internal memo seen by The Australian.

“As we look ahead to a prolonged period of difficult market conditions, we are reducing activity and spending levels for the remainder of 2020. We must also review our go forward workforce requirements across all departments.”

Alinta, owned by Hong Kong’s Chow Tai Fook, has also initiated job cuts with about 50 staff to depart.

“Having grown rapidly over a number of years, we have taken the opportunity to review and determine the most sustainable operating structure for the future,” an Alinta spokeswoman said. “We were planning to grow the business but for various reasons a number of those growth opportunities and areas are not going ahead. We have seen a number of structural changes in our operating environment materialise quickly and our view is that they will be enduring.”

Chevron said its 2021 business plans were being adjusted to reflect the “cancellation, deferral and slowdown of work and we must do even more to control spend to ensure we are competitive”.

“When the perfect storm of Covid-19 and the oil price collapse hit earlier this year, I spoke about the need to urgently accelerate our efforts. I am proud of the way you have been resilient, working together as one team in response to these unprecedented challenges,” Mr Williams said.

A review will be headed up by Chevron’s production operations manager Rob Dobrik to identify where to make the 20-30 per cent workforce cuts potentially required to meet its business outlook and changes within the company. All changes will be made by the end of September.

‘While many of you have communicated to me that you understand that the market conditions and our revised business outlook could lead to workforce changes, we recognise that this confirmation of workforce reductions may create anxiety,” Mr Williams said. “We are committed to keeping you informed as work progresses and more detail becomes known.”

After Woodside Petroleum cut up to 500 jobs at its Western Australia gas plants, Chevron said it was considering its own reductions as it grapples with the fallout from coronavirus and plunging oil prices.

Alinta said no power station roles at Loy Yang would be affected but noted Covid-19 had been partly to blame for the role reductions.

The pandemic “is not the driver behind these changes, but there are areas of the business like face to face sales and the associated support for these channels that have been immediately impacted,” Alinta said.