Future Fund probed ANZ bond trading scandal

The Future Fund did its own investigations into the ANZ bond trading scandal, contacting market participants to get a sense of how it might have happened.

The Future Fund did its own investigations into the ANZ bond trading scandal, contacting market participants to get a sense of how it might have happened.

A series of cascading executive moves in one day, including a high-profile defection, are reshaping the top of the nation’s banks.

The corporate regulator will seek to wind up a second fund after Melbourne property developer Paul Chiodo was raided by authorities.

The banking major is staring down competition from Westpac and CBA, which are vying for its top spot in business banking, where the profits are richer than home loans.

More advisers are directing client money into managed accounts but some in the industry question the benefits.

The federal government debt agency has met with ANZ bankers as it confronts refinancing a $80bn pile of Covid-19 debt, softening its stance toward the bank which was frozen out of all government bond deals.

Hostplus chief investment officer Sam Sicilia has pushed back against criticism heaped on industry funds over a lack of leadership accountability.

The lure of defensive investments is well timed for the many managers rolling out reams of new income-focused strategies. But some are riskier than others.

Throughout the history of food trade, tariffs have followed. That’s why its worth listening to the cooler heads at the farm gate.

Sharemarket turmoil and a grim outlook for investment returns is prompting many to question what effect all this will have on their superannuation.

Most SMSFs are run by a couple, and when one behaves badly, the consequences can last long after separation or divorce.

The former boss of Barclays had sex with a member of Jeffrey Epstein’s staff in a New York apartment owned by the convicted paedophile’s brother, a court has been told.

Westpac chief executive Anthony Miller says the best answer to Donald Trump’s tariffs is to engage more with the rest of the world, rather than a retaliatory response to the US.

Setting up a super system for the accumulation phase is easy compared with the demands of supporting members in retirement, an industry expert says.

The corporate watchdog has sounded the alarm on payday lenders shifting vulnerable customers up to higher-value loans that provide fewer consumer protections, a day after lashing the super industry.

ASIC chair Joe Longo has launched a major broadside at leaders of the superannuation industry that should send shockwaves across the sector.

ASIC chair Joe Longo has hit out at Australia’s $4.1 trillion superannuation sector for its failure to properly service its millions of members, calling it the ‘poster child’ for bad governance.

ASIC is suing AustralianSuper for taking too long to process 7000 death benefit claims, with one one widow saying she only received her payment after making a formal complaint to the regulator.

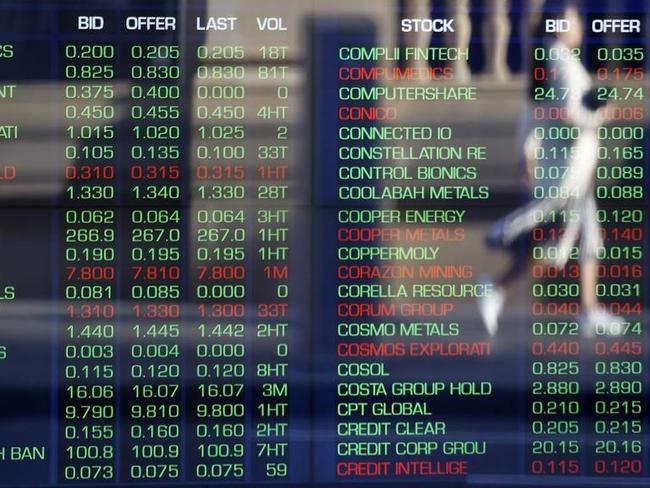

Australian stocks trimmed half of a sharp intraday fall as US futures rebounded after recession fears hit Wall Street. Brookfield begins Healthscope sale process. Brickworks takes a writedown on US operations. Polynovo shares drop after CEO sent packing.

The ACTU has accused the prudential regulator of straying beyond its purpose and seeking to ‘all but run’ industry super funds.

Banking major ANZ invited about 250 high-valued clients to its annual three-day knees up in the Hunter Valley as it tries to halt the decline in deals market share.

Pacific Equity Partners’ Gateway fund has been returning up to 20 per cent to wealthy investors in recent years and soon access is expected to be made available to a broader clientele.

It’s the most uneven match up. Canada is betting it all on a former central banker with almost no political experience to take on Donald Trump’s tariffs.

Salter Bros understood to be leading race for Star’s Sydney hotel, as casino group reviews Bally’s last-minute offer. Stocks lift from six-month lows. Energy sector leads gains. Johns Lyng dives.

Simon Conn is leaving Investors Mutual after 27 years. This is what he thinks about Trump, markets and government spending.

Project Antares was the radical plan CEO Steve McCann had quietly been working on for months. It fell into place just as the casino was about to run out of cash.

The crypto industry is mobilising ahead of the looming election to lobby for political backing, setting up a potential clash with ASIC over plans to regulate the sector.

Through its novel deal with Insignia, US software and admin giant SS&C Technologies has big plans to become a major player in the Australian superannuation market.

Women work 10 times harder to prove themselves in funds management according to serial outperformer Jun Bei Liu.

The big four bank chief economist has analysed and probed every data point over nearly four decades. This is what he has discovered.

Original URL: https://www.theaustralian.com.au/business/financial-services/page/2