Big new change in Aussie housing market

Looking to buy your first home? The latest auction results could signal an important change in Australia’s ‘unstoppable’ housing market.

Looking to buy your first home? The latest auction results could signal an important change in Australia’s ‘unstoppable’ housing market.

Aussie homeowners have been smashed with interest rate pain for years now and a leading economist warns the stress isn’t going to end anytime soon.

Nearly 1000 Aussies in one state are racking up yearly bills of $10,000 or more, with dozens hitting above $30,000, through one common act.

Economic activity jumped last month, but Australia’s biggest bank warns the frothy spending could be temporary.

It’s a seriously sneaky tactic used by countless companies around the world – and it’s partly to blame for our skyrocketing cost of living.

A former federal treasurer and current Labor Party national president has come out swinging against the Reserve Bank, saying the RBA is ‘punching itself in the face’.

A multi-millionaire and Shark Tank investor has blasted “idiot” workers for “pissing away” their money on a daily cup of coffee.

There are small signs rents are coming down, but vacancy rates are still razor thin and there could not be any more “rental pain” in 12 NSW suburbs.

The RBA boss has acknowledged the harsh realities of high interest rates on Aussie households, however she said it was required to quell inflation.

The cost of managing your money, getting a loan, and insuring your possessions has gone up way more than the actual inflation rate in the past year.

Australian families are increasingly eating like “uni students” with “struggle meals” of instant noodles as cost-of-living pressures grow.

It’s an everyday item most of us used to chuck in our trolleys without thinking – but new data proves those days are long gone.

An Australian lawyer and former refugee has challenged the ‘anti-woke’ arguments which are ‘destructive’ for society.

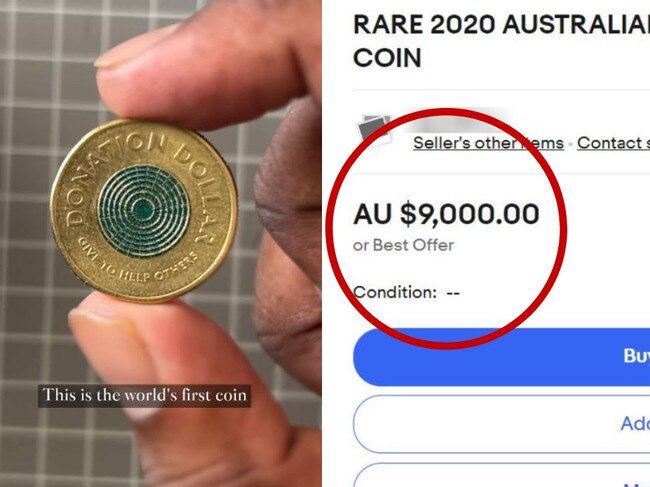

A $1 coin is selling for up to $9,000 online but an expert has issued a worrying warning.

Aussies will be hit by a major price increase from today – and according to Caleb Bond, the reason behind it is “all smoke and mirrors”.

About 5.1 million Australians receiving the pension and income support will see a boost of up to $42.40 in their fortnightly payments in mere weeks.

Shareholders in Coles and Woolworths are licking their lips, but the public is still stretching every dollar further at the checkout.

Two out of the four chief executives of Australia’s major banks have tipped an early-2025 cash rate cut.

Houses in one major city have been left unfinished as a builder that was serving a suspension is put into liquidation.

Seemingly innocent posts are seeing scammers net tens of thousands of dollars from everyday Aussies, and anyone could fall for it.

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

There are certain types of home renovations should be avoided at all costs if you hope to sell your home at a later date.

An Aussie woman has issued a warning after a scammer stole her life savings through what appears to be no fault of her own.

Plenty of Australians still regularly use cash, but it keeps getting harder for those like this man who was amazed to be charged for paying his Telstra bill.

Woolworths Group has announced a dire $108m net profit, a 93 per cent drop on last year.

A council worker has been praised for sending a brutal letter rubbishing a “sovereign” citizen’s nonsensical attempt to escape paying rates.

A savvy young Aussie couple fell victim to cyber criminals targeting one of the country’s most lucrative markets, and it’s a growing issue.

Petrol prices across multiple cities have reached 13-month lows, with some cities reporting peak drops of more than 40 cents.

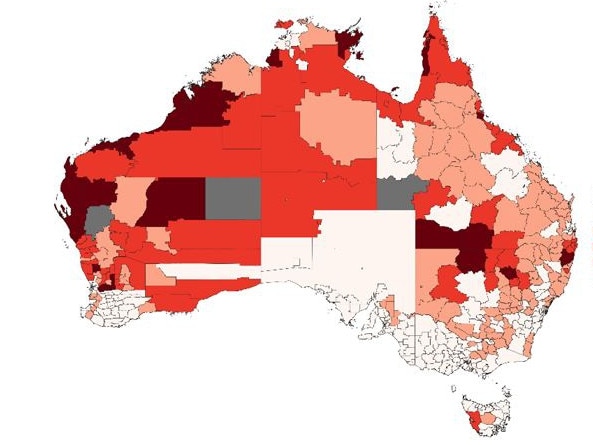

The number of Aussie households struggling to pay for home insurance has jumped by more than 30 per cent as premiums spike due to the risk of natural disasters.

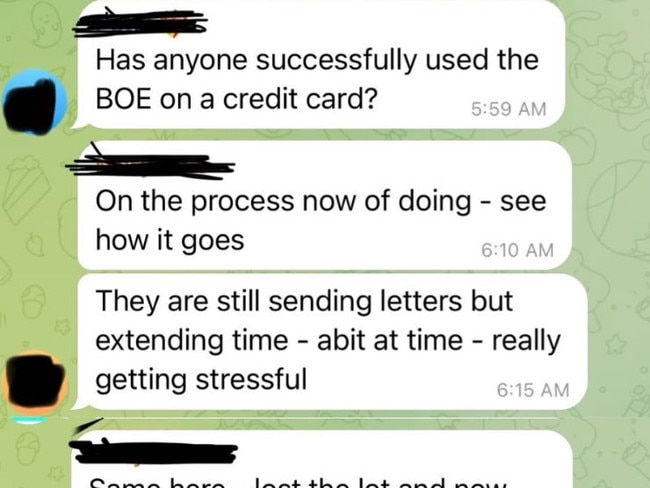

As the big four Australian banks continue making billion-dollar profits, more and more families are falling behind on their house payments.

Making $100,000 a year used to be a kind of salary holy grail for a lot of Aussies, but the country’s cost-of-living crisis has changed that completely.

Another of the major Aussie banks has cut mortgage rates, helping people scraping together repayments or a house deposit.

The Australian economy is growing at its slowest rate since a sharp recession in the early 1990s and it’s particularly bad news for white-collar workers.

Past lotto winners have revealed what they spent their cash on and offered advice to future winners ahead of this week’s monster $100m Powerball jackpot.

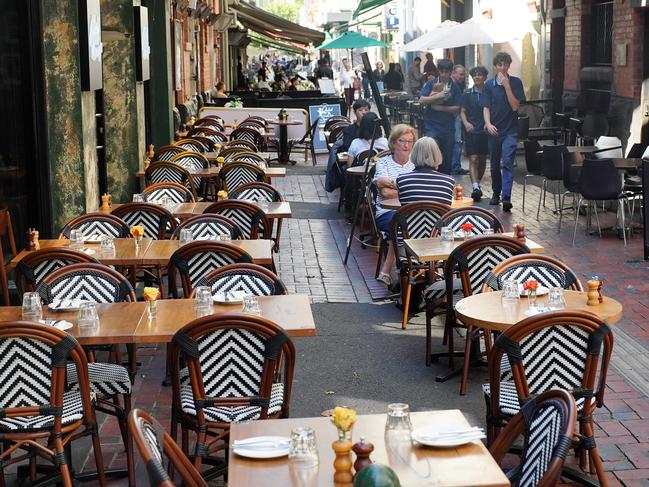

With the rising cost of living stretching budgets further than ever, cost-conscious Aussies are cutting back. It’s left one key industry in a battle to survive.

A new report has made surprising findings about the use of cash and the number of businesses accepting cash in Australia.

A hidden issue is playing out across Australia which will have long term consequences for the country.

Independent Senator Jacqui Lambie has hit out at the government as cost-of-living pressures soar, claiming Aussies can’t purchase essentials for under $10.

Senior government minister Bill Shorten has sparked a fiery debate with the opposition after he claimed the Liberal Party wants to put Australia in a recession.

A property guru has been roasted online for complaining that a painter “immediately” wanted payment after finishing a job.

A housing boom slated to deliver more than a million new homes promises to help fix Australia’s housing crisis, but it also risks a dangerous “race to the bottom”.

Australians have reacted with fury to Cadbury’s shock decision to double the price of two beloved chocolates.

Prime Minister Anthony Albanese has faced backlash following a cost of living ‘joke’, with some calling for his media team to be sacked.

Not all Australians are feeling the same pressure from the rising cost of living, the RBA says, with one major state doing it tougher than others.

Mortgage holders have been given a reprieve after the Reserve Bank kept interest rates on hold at 4.35 per cent, but should not expect a cut anytime soon.

One of Australia’s banking giants has shut down a home loan lender, ending a 33-year-run for the troubled business.

A young couple that “can’t afford” to live in anything but a tiny house have revealed why they are dreading 2025.

A major supermarket has dropped the prices of thousands of essential items as customers struggle with the cost-of-living crisis.

In another blow for struggling Aussies, the cost of a pint, carton or spirit is rising from Monday, as alcohol tax hikes kick in.

A major change across public transport networks in one state could save locals thousands as a new trial is just a day away from beginning.

Wide-reaching research has found the seemingly essential things Aussies are going without in the cost of living crisis.

A young Aussie has opened up about her HECS debt “nightmare”, revealing she feels “misled” and claims she can no longer get ahead.

Fancy some BBQ in Seoul or a ski trip in New Zealand? Qantas has just launched a massive sale to help you get there for less than $1000.

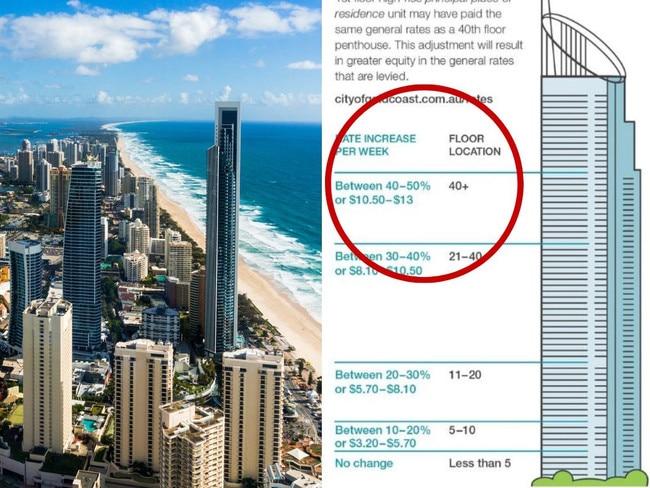

Some high-rise apartments are having their rates calculated in a new way – with massive hikes of up to 50 per cent.

More pain could be on the way for mortgage holders and the Albanese government, with an all-important data release tipped to show ‘persistent inflation’ in the economy.

Australians’ changing driving habits have revealed the shocking reality behind the nation’s cost of living crisis.

An angry Ben Fordham has slammed Anthony Albanese and Chris Bowen over rising power bills – warning Aussies it is “going to get worse”.

An Aussie couple have issued a warning after a horror experience with scammers made them lose their life savings.

A young couple have revealed the reality of trying to get ahead in 2024 and the brutal salary reality in Australia that has become normal.

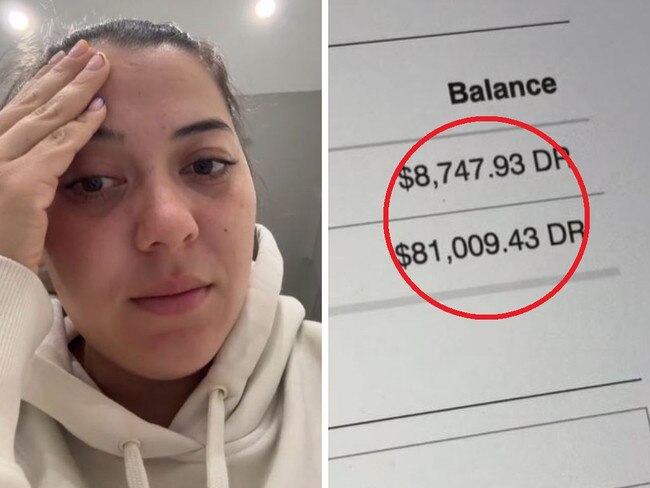

A young Aussie has shared the debt she worries she’ll never be able to pay off – exposing a larger trend sweeping Australia right now.

Australians are being forced to rein in their spending to cope with the cost-of-living crisis, with a third giving up one thing that’s having a huge impact.

One of Australia’s biggest banks has just delivered a big gift to Aussies desperate to lock down a home of their own.

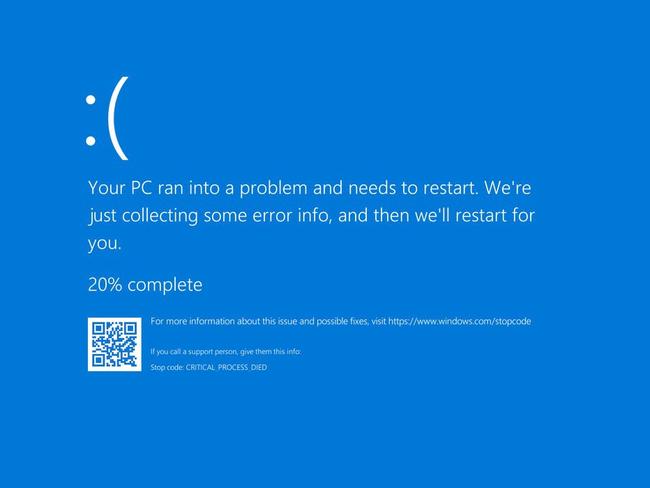

The global IT outage that disrupted workplaces around the world last week cost businesses an eye-watering amount of money.

Millions of workers could go without their wages in the wake of the global IT outage, amid reports multiple payment and payroll systems across Australia were crippled.

New forecast shows the average Aussie will be $21,000 richer in retirement after change in payments from this month onwards. Here’s why.

One of Australia’s largest banks has crunched the numbers to show Aussies are pulling back on streamers and ‘micro treats’ to maintain spending on the two key things that are most important to them.

Taxpayers who mix business and leisure are being warned to avoid these mistakes as the ATO hones in on one type of expense this tax season.

Australians are being nabbed up to an extra $30 when booking tickets online and consumer experts are calling for a review into service fees.

Saving hacks may have become the norm, but one Gen Zer’s “ick” has revealed the budget trend no one really likes.

Young Aussie reveals the grim reality of living on JobSeeker after she made the “decision” to quit her job.

The cost-of-living crisis is forcing Aussies to rein in their spending, but a worrying number say they haven’t been able to due to rising costs.

A young doctor has revealed the conversation she had with one of Australia’s biggest banks that left her so shocked she decided she had to leave.

A young Aussie has revealed how she got into so much debt and the moment she realised her financial situation was “dire”.

The move to ban cash at the popular site has been labelled as “utterly mad” and has had devastating consequences.

A major supermarket boss says the price of eggs will “definitely” increase and the distortion could last for up to three months.

Foreign students wanting to study in Australia have been hit with a hefty application fee as “rorts and exploitation” plague the system.

Australians are increasingly making a desperate move to try to lower the cost of their mortgage, as it’s revealed how much extra the average owner is paying.

With the federal election under a year away it’s a fiercely debated topics – which of the two major parties have households fared better under?

Treasurer Jim Chalmers outlines the changes coming into effect today that will help “every Australian up and down the income scale”.

Reed, 24, was chasing his dream but was forced to give it up as expenses rage out of control in Australia.

Original URL: https://www.news.com.au/finance/money/costs/page/13