‘Pointless’: 28yo reveals HECS debt she can’t pay off

A young Aussie has shared the debt she worries she’ll never be able to pay off – exposing a larger trend sweeping Australia right now.

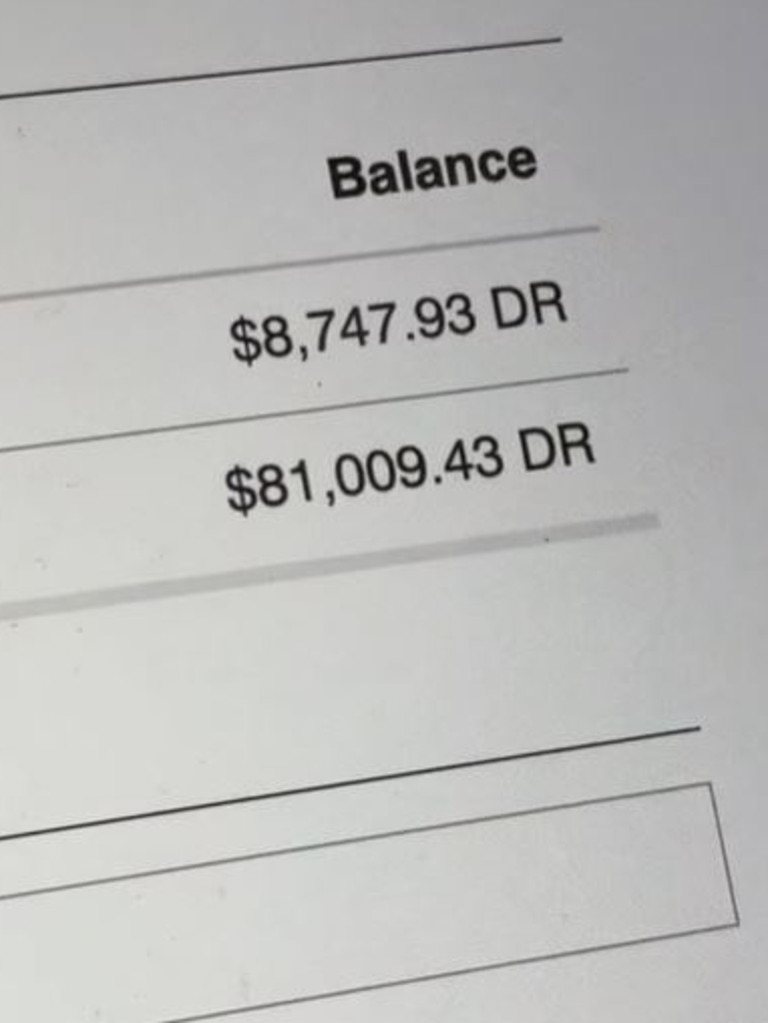

Young Aussies are panicking as their HECS debts continue to rise because of indexation, and Alicia, who owes $81,000, is stressed.

Alicia, 28, worries that she will never repay the student loans she took to get a double degree in Science and a Bachelor of Urban and Environmental Town Planning. Later, she completed her Master’s in Teaching.

The Sydneysider who now works as a high school teacher and content creator said that her degrees cost her $70,000, but because of indexation, even with her paying them back regularly, they have now ballooned to $81,000.

It isn’t an uncommon story. When she shared her debt online plenty of other Aussies share they were in the same costly boat.

“Mine is well into 100K and I can’t breathe thinking about it,” one wrote.

“Life is feeling like a scam at this point,” another admitted.

“Mine indexed and got to 95k. I’ve just accepted I’ll be paying off the index for the rest of my life,” someone else shared.

“Mine was $30,000 and now somehow $61,000! I know they went up but come on! I’m pretending it doesn’t exist,” someone else wrote.

According to the comparison websiteFinder, the average person with HECS owes up to $40,000, 21 per cent owe between $40,000 and $100,000, and just over one per cent owe above $100,000.

More than 63 per cent of people in student debt are slightly or extremely concerned about their ability to repay their interest-free loan – up from 54 per cent last year.

The research also found that 12 per cent don’t think they’ll ever be able to repay their student debt. That’s more than 354,000 people who have no confidence that they will be able to pay off their student loans.

Alicia told news.com.au that she’s glad she went to university to study because she’s so passionate about what she does, but she’s fed up with the system.

“It is frustrating that even on a good salary, my HECS seem to just keep increasing; I was so shocked when I saw that amount doing my tax this year,” she said.

The teacher explained that her frustration stems from the fact that she’d always been told her HECS would be an interest-free loan, even the best kind of debt a person could get into, but now, with indexation, that isn’t the reality.

“I started university when I was 17 years old, I didn’t know all the information then that I do now. I didn’t know what indexation was, and to be honest, I am still a bit confused about how it works,” she said.

“When we started university, we were told, ‘This is the cost of the course or the cost per semester’, and that’s it. None of us knew what indexation is or that it was even a part of our HECS. How it can go from 0.6 per cent to 7.4 per cent.”

Alicia said paying it off feels “pointless” when the total amount increases yearly.

At this point, she doesn’t think she’ll ever be able to pay the debt off, making her worry about her future.

“What happens when I decide to have a family and go on maternity leave, then the repayments stop again and continue to rise? At this rate, with indexation, who knows how much our HECS debts could really be costing us and if we will ever be able to pay it off.”

Carrying $81,000 worth of debt around has begun to give Alicia “anxiety” and she’s concerned it’ll stop her from ever owning a home.

“Having a $90k debt to your name surely can’t be good when you’re looking to buy a home, although at this rate, that is just not something I feel like I will ever be able to do,” she said.

“Even with a good salary and good budgeting. We are in a cost of living crisis where everything is so expensive, $500 a fortnight is taken out of each pay to go towards my HECS.”

The young teacher thinks the system is deeply flawed.

“Young people are pushed to go to university, where they will most likely have to get an HEC’s debt, and no one has explained any of the terms and conditions,” she said.

“No one has taught us about indexation; no one has explained how the repayments work.

“We are told it’s an interest-free loan, which is basically a lie when you factor in indexation.”

For Alicia, the $81,000 debt feels like it is stopping her from achieving other financial goals.

It is a constant source of worry.

“I do think it is a broken system that continues to punish young people, even as we strive to better ourselves. Everything our parents or grandparents had just seems too far out of reach for us. There is no light at the end of the tunnel for us in our 20s and 30s.”

Money expert Richard Whiten stated that due to high inflation last year, student loans experienced higher interest rates than in years prior.

Mr Whitten advised that while it is a “flexible” repayment, it is best to get ahead of the debt even more than the minimum repayments.

“If your budget allows, consider small, extra contributions they can significantly reduce your long-term burden and accelerate repayment,” he said.

“If you have other debts, like a personal loan, a credit card balance or even unpaid buy now pay later charges, you’re likely better off paying those off first. Because the interest or fees will be higher.”