Pilot’s $140,000 HECS debt shows why Australians are so fed up

A fed-up Aussie has made a grim admission, claiming young people are being unfairly “punished” for trying to better themselves.

An Australian pilot has lashed out at the country’s HECS system, calling it a “form of punishment” for young people looking to gain a higher education.

Many young Aussies have been left furious this week after 2.9 million people were hit with a brutal increase to their student debts after they were indexed on Saturday.

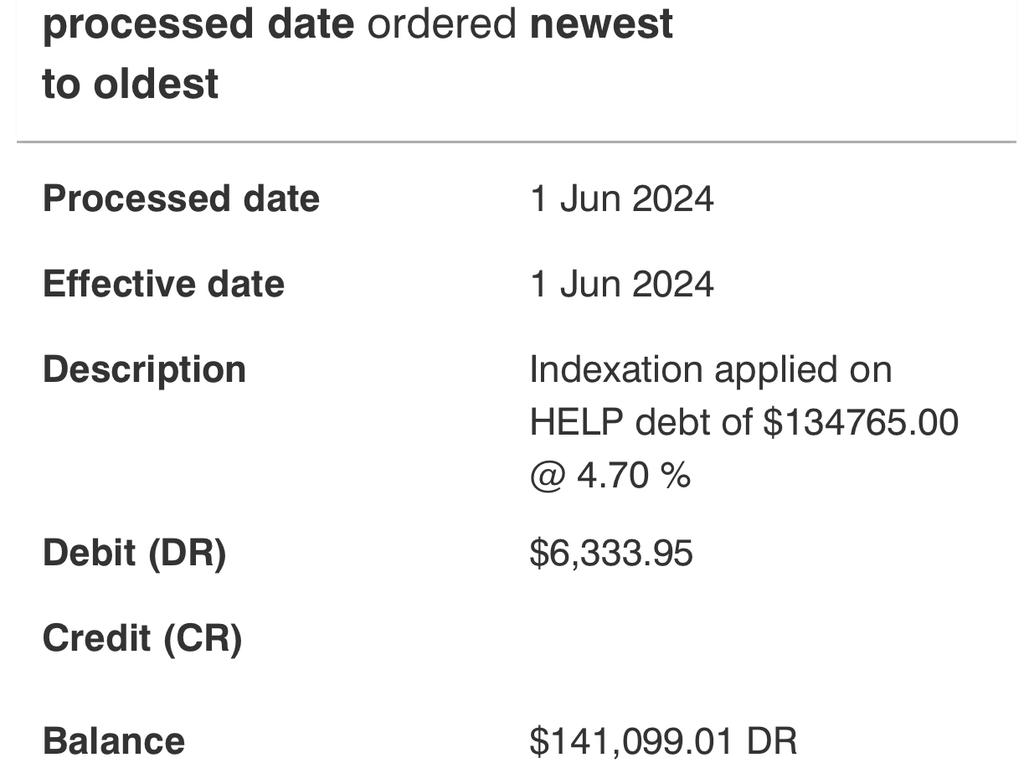

While HECS-HELP debt does not accrue interest, it is indexed for inflation every year on June 1, with those impacted seeing their debts rise by a significant 4.7 per cent last week.

It comes after debts rose by a whopping 7.1 per cent last year – the biggest jump seen in 30 years.

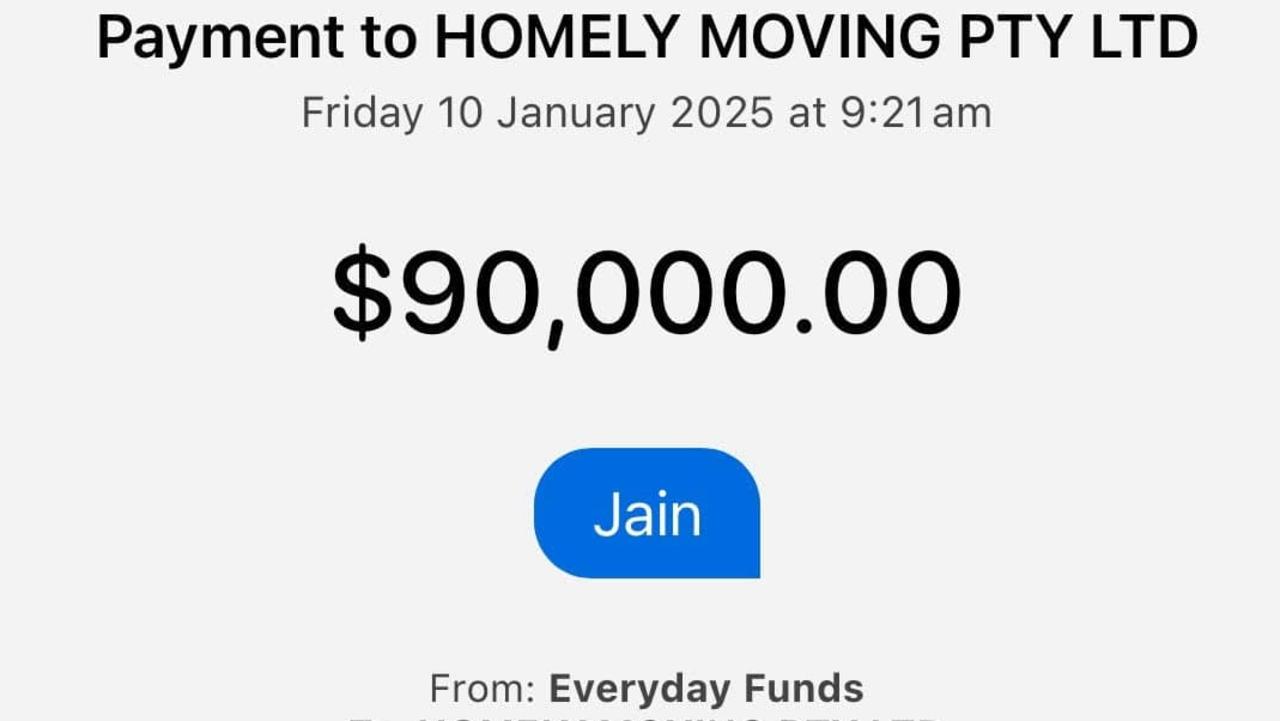

Mark* is one of the millions of people who have been impacted by the unrelenting indexation, with the 29-year-old seeing his debt rise by a massive $6333.95 over the weekend.

The young pilot is now looking down the barrel of a $141,0999.01 HECS debt and, with a salary of $52,000 a year, he fears he will never be able to pay it off.

In 2018, the NSW local completed a Diploma of Aviation, which cost $97,000. In 2022, he completed an Advanced Diploma of Aviation through TAFE NSW.

Speaking to news.com.au, he revealed that “due to the low income” of some pilot jobs, he had only been able to start paying off his debt in the past 18 months.

According to the Holmes Institute, pilots who complete their academic training often work as instructors while finishing their flight hours. The average pay for these positions in Australia is around $59,600 a year.

According to SEEK, the average annual salary for full-time pilot positions in Australia range from $100,000 to $120,000 a year.

HECS repayments are not taken out of a person’s income until they hit the compulsory repayment threshold, which is $51,550 for the 2023-2024 income year.

“Unfortunately for most students seeking a higher education, getting a government loan is the only means of affording the study,” Mark said.

“The student loan system hardly helps Australian students anymore.”

The graduate claims the HECS system has now become a “form of punishment” for those striving to achieve a higher education.

He said indexation is not reasonable and “deters and demotivates people from wanting to study and improve themselves through education”.

The federal government recently announced a plan to wipe $3 billion in student debt for just under three million Aussies.

The proposed change, included in the May budget, will see the lower of either the Consumer Price Index (CPI) or the Wage Price Index applied to the indexation process. Currently, indexation is done in line with CPI.

Legislation still has to pass in order for the change to be applied – which won’t happen until later this year – but, once it does, it will be backdated to June 1, 2023 and the revised indexation rates will automatically be added by the Australian Taxation Office to people’s loans.

This means, last year’s 7.1 per cent indexation will be reduced to 3.2 per cent and this year’s will be reduced to 4 per cent, instead of 4.7 per cent.

However, many people have been left unimpressed by the changes, claiming it does nothing to solve one of the major issues of indexation.

While payments towards your HECS debt are taken out of your pay in real time, that money is not coming off your debt at the same rate.

Instead, the Australian Taxation Office holds these funds as a credit until you file your tax return on or after July 1.

But, because indexation occurs before this on June 1, your past contributions are actually applying to the higher indexed rate, despite coming out of your pay much earlier.

This means potentially thousands of dollars in repayments Aussies are making each year essentially have less of an impact in bringing down their HECS debt because of the odd timing of indexation.

HECS debt can also impact young Aussies who are looking to buy their first home.

Mark claimed his significant debt has made it “near impossible” for him to break into the housing market.

“My HECS debt is significantly reducing my borrowing power from the banks. There is no relief anywhere, no way to get ahead and no incentive from the Australian Government to pursue a vocational education,” he said.

“My student loan is a healthy house deposit and with the indexation adding thousands of dollars a year, paying it off completely will never be a reality.”

Since Saturday, Aussies have taken to social media to express their outrage at seeing their debts rise once again.

One X user, who goes by @amaegazooma, shared a screenshot of her debt, revealing it had risen by $5928 and was now sitting at $132,071.

Another user, @laterkatersays, revealed that in the past eight years she has paid $31,480.89 towards her HECS debt.

“In that time, the total balance has reduced by only $19,624.39. And all the Boomers who got their education for free wonder why we can’t afford house deposits,” she wrote.

Another uni graduate revealed his debt had risen by $1400, writing: “Why are we punishing people for getting an education again?”

More Coverage

One social media user claimed at least $14,000 of their more than $70,000 HECS debt was a result of indexation.

“If I earn $100,000 every year (big if!), and do not engage in any further studies … assuming indexation of 3 per cent, I will finish paying off my HECS in 2040, at the age of 50,” they said.

*Name has been changed for privacy reasons