‘Ripped off’: Australians rage as millions hit by brutal HECS spike

A brutal change that came into effect on Saturday has impacted millions of Australians, sparking fury at the “unfair” situation many have found themselves in.

Just days ago millions of Australians across the country were hit with a brutal increase to their student debts.

While HECS-HELP debt does not accrue interest, it is indexed for inflation every year on June 1.

This means that the 2.9 million Aussies currently saddled with HECS debt saw their loans increase by a significant 4.7 per cent on Saturday.

Last year, those with student loans saw their debts rise by a whopping 7.1 per cent – the biggest jump seen in 30 years.

Adelaide speech pathologist Laura O’Loughlin, who has experienced years of her debt rising faster than she can pay it down, has been hit particularly hard by the latest indexation.

By the time the 31-year-old completed her studies, her debt was sitting at $107,000, accrued through what she described as “pretty stock standard health degrees”.

She completed a bachelor and honours in science in order to “boost” up her marks so she could get into her desired masters program, which was the Masters of Speech Pathology at Flinders University.

This alone cost $60,000 for a two-year degree, which is a “complete joke”, according to Laura, who branded it one of the most expensive degrees in Australia.

Do you have a HECS debt? Share your thoughts: alexandra.foster@news.com.au

This brought her debt to over $100,000 without taking into account her Student Start-up Loan.

The SSL is a voluntary $1273 loan for eligible students who get Youth Allowance, Austudy or ABSTUDY Living Allowance.

You can get the loan up to two times a year, with the amount borrowed added to your HECS debt.

Indexation caused Laura’s debt to rise so significantly that, despite putting thousands of dollars towards her HECS, by June 1, 2023, the figure had only lowered by $1000. This brought her total to $106,000.

“And that was after working full time for five years on a reasonable wage,” she told news.com.au.

“So we’re basically just the most ripped off generation, in my opinion. There are just so many issues with this system. The fact that I managed to, on a full time wage, only put $1000 on my HECS/student start loan, that’s insane to me.”

This will be the first year she has been able to put a dent in her HECS, after opening her own business and moving into a higher tax bracket.

Due to this, she was able to recently make a large contribution towards paying off her debt, bringing it down to $89,000. However, she still copped a $4000 indexation increase on Saturday.

Laura has been working hard to get herself into a financial position where she could begin to chip away at her debt.

This meant that it wasn’t until she was 30 that she found herself in a position to be able to afford to take a holiday, while also putting extra money towards her student loans.

Aussies erupt over brutal HECS spike

Since Saturday, Aussies have taken to social media to express their outrage at seeing their debts rise once again.

One X user, who goes by @amaegazooma, shared a screenshot of her debt, revealing it had risen by $5928 and was now sitting at $132,071.

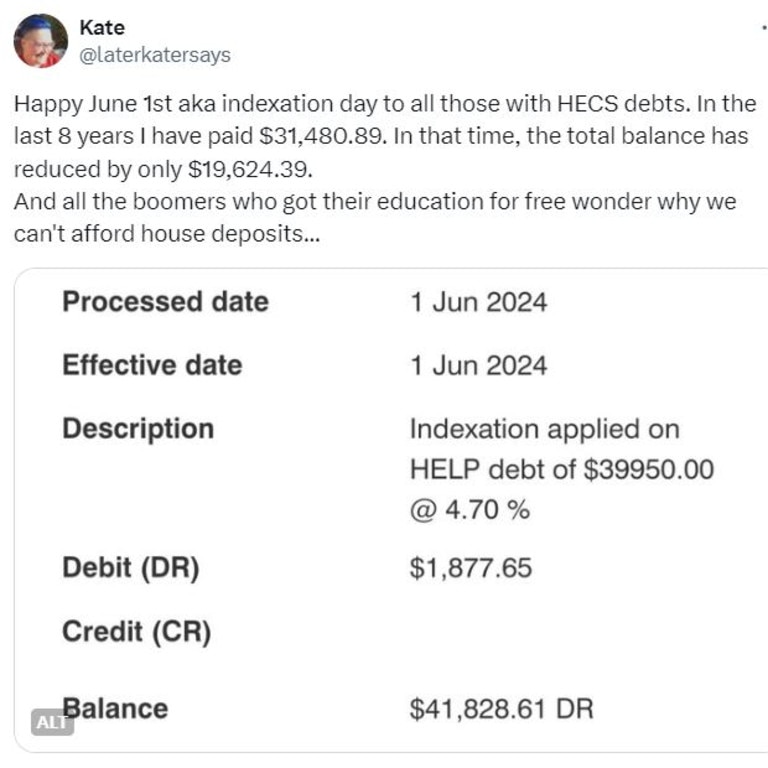

Another user, @laterkatersays, revealed that in the past eight years she has paid $31,480.89 towards her HECS debt.

“In that time, the total balance has reduced by only $19,624.39. And all the Boomers who got their education for free wonder why we can’t afford house deposits,” she wrote.

Another uni graduate Jack Boddeke revealed his debt had risen by $1400, writing: “Why are we punishing people for getting an education again?”

The Federal government recently announced a plan to wipe $3 billion in student debt for just under three million Aussies.

The proposed change, included in the May budget, will see the lower of either the Consumer Price Index (CPI) or the Wage Price Index applied to the indexation process. Currently, indexation is done in line with CPI.

Legislation still has to pass in order for the change to be applied – which won’t happen until later this year – but, once it does, it will be backdated to June 1, 2023 and the revised indexation rates will automatically be added by the Australian Taxation Office to people’s loans.

This means, last year’s 7.1 per cent indexation will be reduced to 3.2 per cent and this year’s will be reduced 4 per cent, instead of 4.7 per cent.

However, many people, including Laura, are unimpressed with this proposal.

She branded the proposed changes “measly”, questioning why Australians are supposed to be “jumping for joy” at a change that won’t provide nearly enough relief for people with large HECS debts.

She said it was “pocket change” when you compare it to the vastness of some people’s loans.

The 31-year-old also believes women are unfairly impacted by HECS indexation, pointing out that women who take time out of the workforce to have children are seeing their debts rise each year without being able to pay them down.

“If I had a child now I would go backwards. I think this is also directly contributing to people’s choices to have or not have children because we’ve got that to worry about on top of everything else and, of course, your HECS affects your borrowing capacity too,” she said.

She believes the increasing HECS burden is also causing another issue to emerge in for those working in the health space.

Laura said, like herself, many people are moving into the private health space in order to increase their incomes so they can start paying down their debt.

“It is directly contributing to the short staffing in the government sector as well because the government is not paying enough to combat the indexation,” she said.

“If I had stayed on my government wage, my debt would still be going up this year.”

Laura added that there was a similar situation developing in the teaching space, with people having to leave the profession due to low wages.

Sydney local, Léa, is another young Aussie who is struggling to pay down their HECS debt.

The 23-year-old graduated with a Bachelor’s of Advanced Science from Macquarie University in 2022, with a HECS debt of $25,474.

As of today, their debt is sitting at $24,031, having gone up by $1078 with the most recent indexation.

“So despite putting $4000 towards it since graduation, it’s only gone down by $1000,” Léa told news.com.au.

While they think the changes proposed by the Albanese government are a “good start”, it is “still not enough”.

“My salary only went up by 3 per cent this year, not 4.7 per cent, so the debt increases aren’t really representative of how much we’re receiving in wage increases,” they said.

A recent Finder survey of 1071 respondents – 271 of whom have student debt – revealed more than 3 in 5 are slightly or extremely concerned about their ability to repay their interest-free loan – up from 54 per cent last year.

The research found 12 per cent don’t think they’ll ever be able to repay their student debt.

That’s more than 354,000 people who have no confidence that they will be able to pay off their student loan.

Outstanding HECS-HELP debt has risen to just over $78.2 billion for the 2022–2023 financial year, up from $74.3 billion in 2021-2022.

More than half of those with student debt owe up to $40,000, 21 per cent owe between $40,000 and $100,000, and just over 1 per cent owe above $100,000.

Richard Whitten, money expert at Finder, told news.com.au that, even with the government changes to indexation, it is still going to “hit many Australians hard”.

“Four per cent this year is still a fairly high indexation rate. If your debt is in the tens of thousands you’re looking at a hefty increase,” he said.

“Student debt is still a less urgent debt compared to credit card debt, personal loan debt or even buy now pay later charges. You always want to focus on those high interest debts first.

“But with the cost of university rising, and future indexations likely to be higher than in the many low inflation years we’ve had before 2022, people with student debt should consider paying some of it off if they can.”