Sinister reason man lost $90k house deposit

A Melbourne man thought he had overcome his biggest hurdle in buying his first home. But what happened next has left him traumatised and lost.

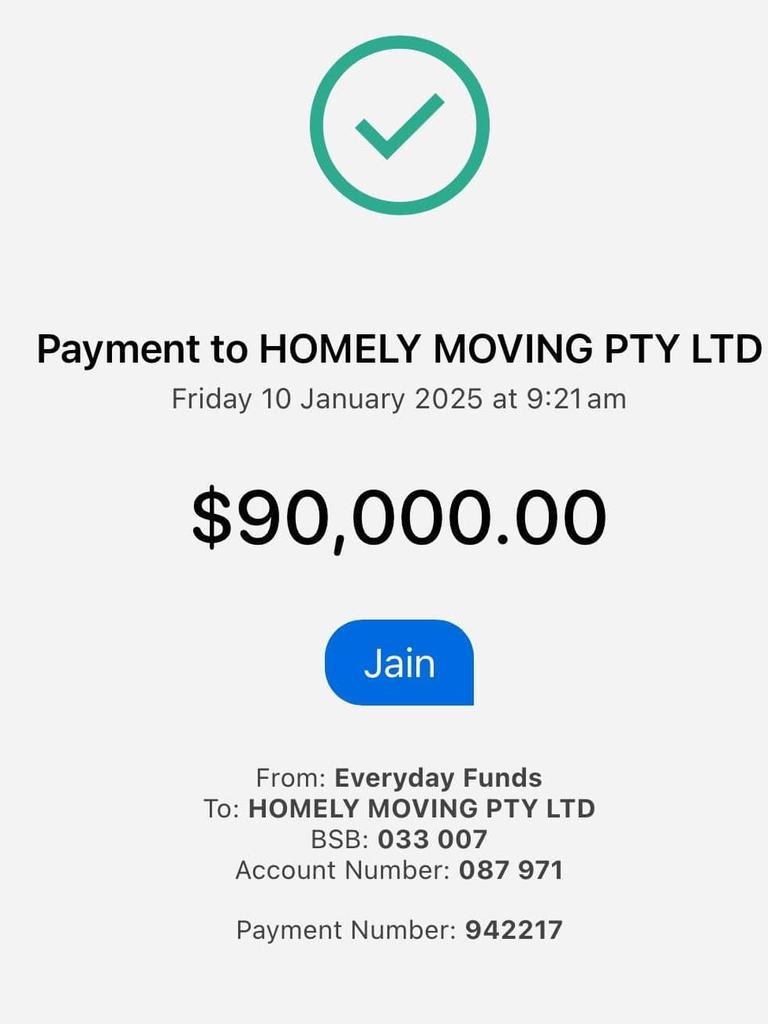

A Melbourne man who was purchasing his first home lost his $90,000 house deposit to a chilling scam – leaving him sick when his conveyancer chased the missing money on the day he was set to buy the house.

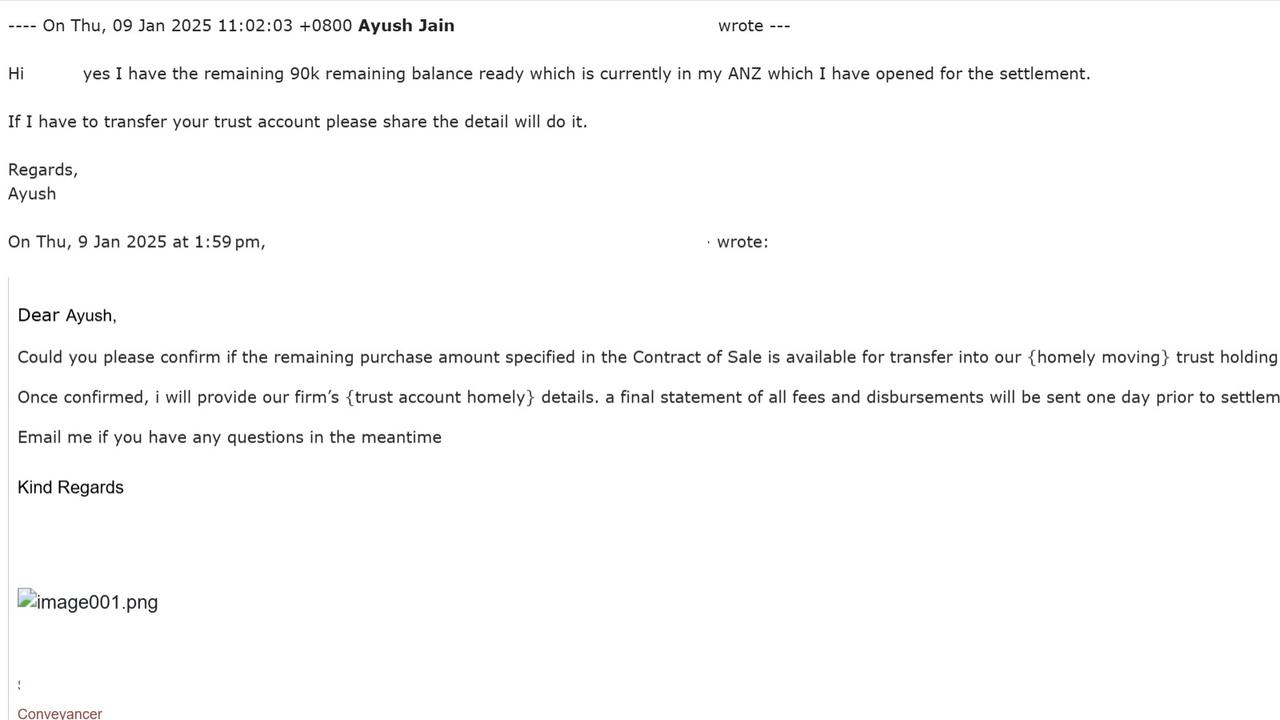

Ayush Jain believes his conveyancer’s system was compromised, and the scammer intercepted emails, changing the bank account details to the fraudulent account – where he promptly deposited his life savings intended to purchase the house.

The IT worker said no red flags were raised as the email did not appear any different from others he had received, plus the conveyancer had come recommended from a friend who had also deposited funds into the trust account.

“This isn’t the first time a scam like this has happened in Australia … Yet it seems the banks aren’t doing enough to prevent these types of scams,” Mr Jaim said.

“For the banks, this may just be another case, but for everyday people like me, it’s everything.”

Mr Jain is lending his support to news.com.au campaign People Before Profit, which is calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world leading legislation making compensation mandatory for scam victims within five business days except in cases of gross negligence.

IT’STIME BANKS PUT PEOPLE BEFORE PROFITS. SIGN THE PETITION HERE.

Mr Jain said he transferred the $90,000 from his ANZ account to a Westpac account.

He reported the scam to ANZ on January 15 this year – six days after the transfer – and has been desperately waiting for any information.

“Days have passed with no updates, and with each passing day, my hope of retrieving the funds diminishes.,” he said.

“It’s frustrating to question why these major banks are taking so long to respond and how scammers are able to open accounts in their systems without being detected.”

The 35-year-old said he had been told by ANZ that they are still waiting to hear back from Westpac about whether his life savings could be retrieved.

The dad-of-one said he had been left with significant anxiety, high blood pressure, regret, and financial instability.

“Getting a first home is a very big thing and we are so traumatised,” he said.

In a devastating blow, he has been informed ANZ has closed my complaint with only $1135 recovered out of the $90,000.

Mr Jain is lucky to still have purchased the dream home but it has left him in serious debt.

“Personally it has affected us a lot, and at that time there was such pressure if we didn’t settle the property I would lose $50,000,” he said.

“So I have good friends who helped me in borrowing the money and settled the property so as not to lose another $50,000 … Every morning I wake up and I’m just doing a call to the bank to get any update and wondering what I can do.”

He said the stress was “eating me from the inside” and left him feeling helpless.

Mr Jain believes scams are a “big issue” in Australia and is frustrated by the inability to get information from a bank that receives scammed funds.

“I can’t contact Westpac, although I tried going into the branch and every time they said you have to come through ANZ, and they will let us know,” he said.

“How are there not much laws preventing the money being scammed? It’s very rare they are able to retrieve the money as there has been so many days.”

Mr Jain said he had also reported his scam ordeal to the police and Scamwatch.

He said if the money isn’t recovered he doesn’t know how the family will “survive”, particularly as his wife is currently on parental leave and they are living on a single income.

An ANZ spokesperson said the bank always attempt to recover funds customers have lost to scams or fraud.

“The ability to recover funds depends on a number of factors including how quickly it is reported to us, whether they are transferred to another financial institution, and the speed in which funds are then on-transferred by scammers. In many instances, cyber criminals on-transfer funds within minutes, or use them to purchase cryptocurrency,” they said.

“We’re seeing scammers use increasingly sophisticated and targeted methods to exploit Australian consumers who are trying to pay legitimate businesses for goods or services.”

Customers are encouraged to check new or updated account details with the legitimate company on a phone number they have independently sourced, before sending funds, the ANZ spokesperson added.

“If intending to pay a large amount, send a small amount first then check the legitimate company or individual received it before sending a larger amount,” they noted.

A Westpac spokesperson said they could not comment on specific cases.

“When we are informed of scam activity by another bank, we take immediate action, including by blocking accounts where necessary. We do everything we can to recover funds, but this is not always possible,” they said.

“Whether criminals have fraudulently accessed an account or tricked an unsuspecting customer into getting involved, we are focused on identifying, investigating and shutting down illegitimate accounts to prevent further harm.”

When it comes to detecting mule accounts, we’re tackling this in a number of ways including through biometrics and ID verification when people open a new account to make sure they are who they claim, the Westpac spokesperson added.

“We also co-operate with other banks directly as well as through the Australian Financial Crimes Exchange and we continue to work with authorities,” they added.

sarah.sharples@news.com.au