‘Going up’: 35yo’s opens up about $115,000 HECS debt nightmare

A young Aussie has opened up about her HECS debt “nightmare”, revealing she feels “misled” and claims she can no longer get ahead.

The HECS indexation is creating panic among Australians, with one revealing that it has made her “regret” going to university.

When Judy was 18, she made a financial decision that she’s still paying off well into her thirties.

She went to university and used the Higher Education Loan Program, also known as HECS, so she didn’t have to pay her fees upfront.

Judy, 35, completed a Bachelor of Entertainment Management at the Australian Institute of Music and a Bachelor of Arts at the University of New South Wales.

Now, she works in insurance, and her debt is $115,000.

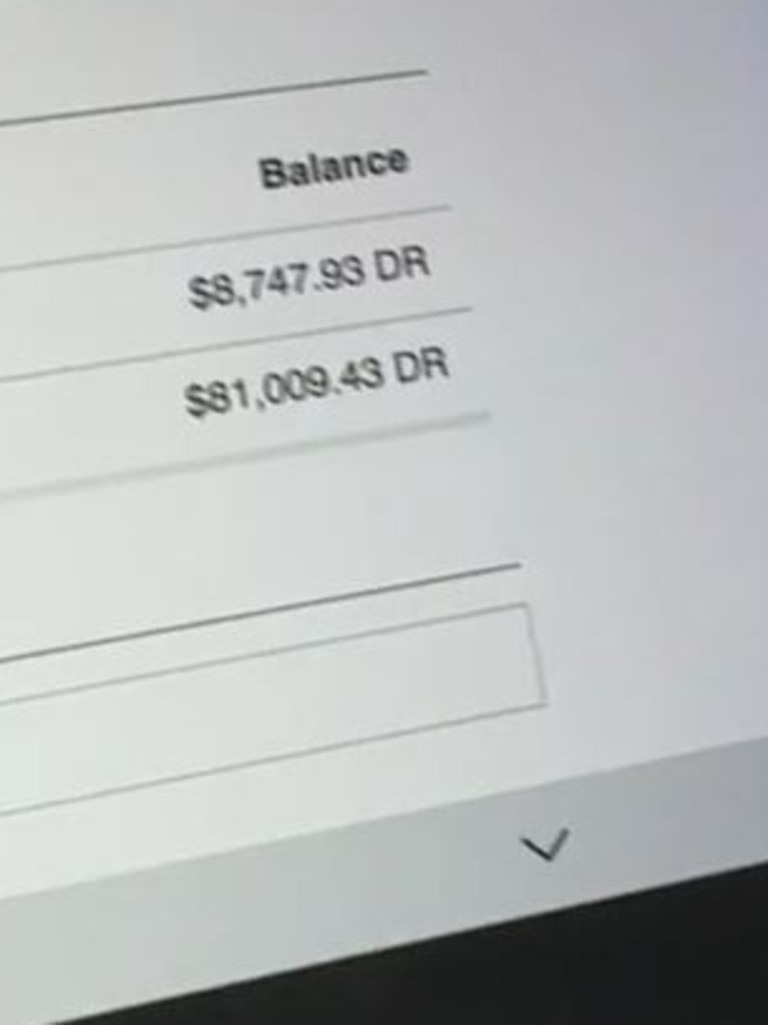

Judy pays roughly $8000 a year on her debt, which isn’t decreasing; instead, thanks to indexation, it is increasing.

In June this year, unpaid HECS-HELP loans jumped 4.7 per cent, annually indexed to the consumer price index (CPI). This follows the 7.1 per cent indexation hike in 2023.

“I can never get ahead due to this debt and have not made a dent in it due to indexation, so instead of paying it down, it’s going up,” she told news.com.au.

According to the comparison website Finder, the average person with HECS owes up to $40,000, 21 per cent owe between $40,000 and $100,000, and just over one per cent owe above $100,000.

For Judy, it isn’t just that she owes six figures, it is the fact that she knows this debt is impacting her future.

“It’s impacted my borrowing power. No matter how high paying my job is, it’s all gone to HECS, and I stress and panic every time indexations hits,” she said.

“I have been paying it off for over 10 years, and instead of it staying at five figures, it has gone into six figures.”

The debt isn’t something that she doesn’t think about. It’s something that, for Judy, haunts her and she’s constantly worried about it.

“I have two young children now, and no matter where I go, this debt will forever follow me,” she said.

Judy’s not alone in her anxiety about her HECS debt.

Alicia, a schoolteacher, recently told news.com.au that she was “stressed” over her $81,000 HECS debt.

When she shared her story online, Aussies flocked to the comment section to share their own debts.

“Mine is well into $100k, and I can’t breathe thinking about it,” one wrote.

“Life is feeling like a scam at this point,” another admitted.

“Mine indexed and got to $95k. I’ve just accepted I’ll be paying off the index for the rest of my life,” someone else shared.

“Mine was $30,000 and now somehow $61,000! I know they went up but come on! I’m pretending it doesn’t exist,” someone else wrote.

Judy has tried to manage the debt, even seeking financial advice, but the response has left her feeling more disappointed than supported.

“They said on the bright side that this debt will die with me and that my children don’t have to take over it. I can’t imagine how many others feel knowing they didn’t have that knowledge before they signed away their life basically and locked themselves into debt when they’re so young,” she said.

Now, Judy feels “misled”, and like she was sold a “dream” that this debt would be something she could pay off because it wouldn’t accrue interest, but to her, indexation feels the exact same as interest.

It is increasing her loan gradually, so she can never get ahead of it. It feels the exact same as having credit card debt that she can’t get on top of.

Now, at 35, she “regrets” even doing her degrees. She said she only went to university because of societal pressure and she didn’t want to be “deemed as a failure.”

“I wasn’t sure what I wanted to do or pursue at 18. Nobody really knows what they want to do, even when they’re older. People change or decide to do a career jump midway through,” she said.

The 35-year-old said if she’d known this debt would follow her around for the rest of her life she’d never have signed up to it.

Judy said that if she’d known the long-term “impacts” of paying off her HECS, she would have tried “to pay it off” while studying.

Of course, this is all in hindsight. The working mum pointed out that she didn’t know about indexation and how much the cost of living would increase.

When she was studying in 2022, the HECS indexation didn’t feel like “much at all”, but now that has changed.

“Now I’m in a field where it doesn’t require a degree, so in the end, it was technically a waste,” she said.