ASX retreats as supermarkets wobble

The Australian sharemarket more than surrendered its gains from the previous session as a host of blue-chip firms slipped into the red.

The Australian sharemarket more than surrendered its gains from the previous session as a host of blue-chip firms slipped into the red.

In a major move, a US investment bank has told clients cryptocurrency has taken over real estate as its preferred alternative asset.

The local sharemarket moved higher on Wednesday, even after technology stocks had another shocker.

It’s been a horror few weeks for cryptocurrency – and now the two biggest blockchains are set to shed as much as 70 per cent of their current value.

Tesla has lost half a trillion dollars as its founder Elon Musk has become embroiled in controversy, including a $350,000 sexual harassment pay-off.

Mining and energy companies gained but there were losses for the local banks, health care firms and supermarkets in the first ASX session under an Albanese government.

A man who was barely out of his teens when he invented one of the most popular cryptocurrencies has revealed he’s lost half his fortune.

Billionaire Bill Gates has declared cryptocurrencies have “no valuable output” as analysts predict more “destruction” in the market.

The Australian sharemarket did little to recover after it shed billions of dollars on Thursday morning, with retail stocks in a tailspin.

It’s been a horror week for cryptocurrency investors and the outlook just got more dire.

Atlassian and other technology companies have already endured months of pain on the share market, but experts warn there is more to come.

In classic Elon Musk fashion, the tech billionaire has raised eyebrows after sending a single emoji to the current CEO of Twitter.

One crypto enthusiast has lost a whopping $650,000 while another is seriously in debt after taking out a $430,000 loan to buy the coin.

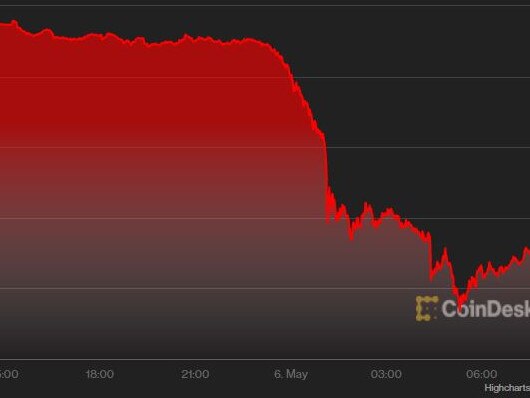

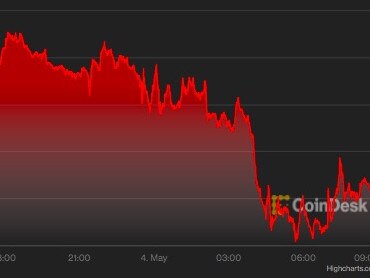

Cryptocurrency is officially in panic mode, after a staggering $200 billion was lost in just 24 hours. But what really caused the crash?

The cryptocurrency market has had billions in value wiped off it after an epic fail and now the accusations are flying that something sinister went down.

Crypto investors panicked on Thursday as the value of cryptocurrencies including bitcoin plunged, with some saying they would lose their homes as a result.

The technology sector was a sea of red after worrying data spooked investors and sent the sharemarket to a five-month low.

A worrying sharemarket sell-off resumed on Thursday in the wake of concerning US data, with one particular tech stock savaged.

The tech juggernaut is no longer the world’s most valuable company, after being toppled by a Saudi Arabian oil giant.

Gains for the major miners helped the Australian sharemarket avoid a fourth straight loss and consolidate its position above the 7000 level.

The ASX tumbled again amid fears Chinese Covid-19 lockdowns and rate hikes will hurt global growth, with mining and energy companies particularly affected.

The price of bitcoin, ethereum and other cryptocurrencies continues to plummet and it’s likely to get even worse. Here’s why.

Australian shares have dropped in early trading, after a shocking day on world stock markets, as fears over China’s Covid lockdowns added to the rout.

The Australian sharemarket slumped again as worries over tightening Chinese Covid restrictions added to an already bleak mood for equities.

The Australian sharemarket had its worst day since Russia invaded Ukraine back in February, capping a miserable week for investors.

The Australian sharemarket suffered a brutal opening blow on Friday with very few companies unscathed in the dramatic plunge.

Bitcoin has fallen off a cliff and wiped off all its previous gains as the rest of the market also suffers.

Everyone was expecting the cryptocurrency to keep plunging but some unexpected news caused it to soar in value instead.

Bitcoin’s price has plummeted in the past 24 hours after one of the richest men in the world called it less than worthless.

Volumes were subdued as ASX investors waited for Wednesday night’s meeting of the US Fed and an expected 50 basis-point rate hike.

Original URL: https://www.news.com.au/finance/markets/world-markets/page/19