Bitcoin drops off cliff as stock markets plunge

Bitcoin has fallen off a cliff and wiped off all its previous gains as the rest of the market also suffers.

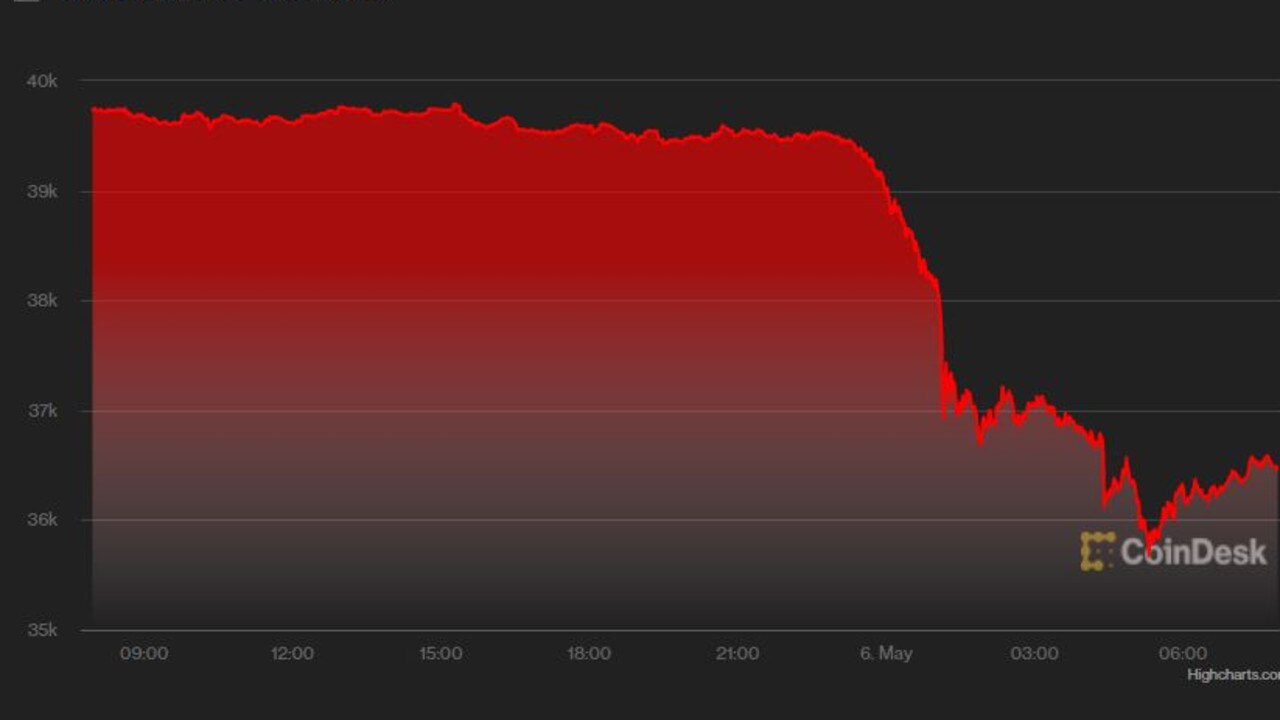

Bitcoin has plunged to its lowest point since Russia invaded Ukraine in a horror few hours for the blockchain.

A whopping US$100 million (A$140m) was wiped off the combined cryptocurrency market cap in the space of a single hour.

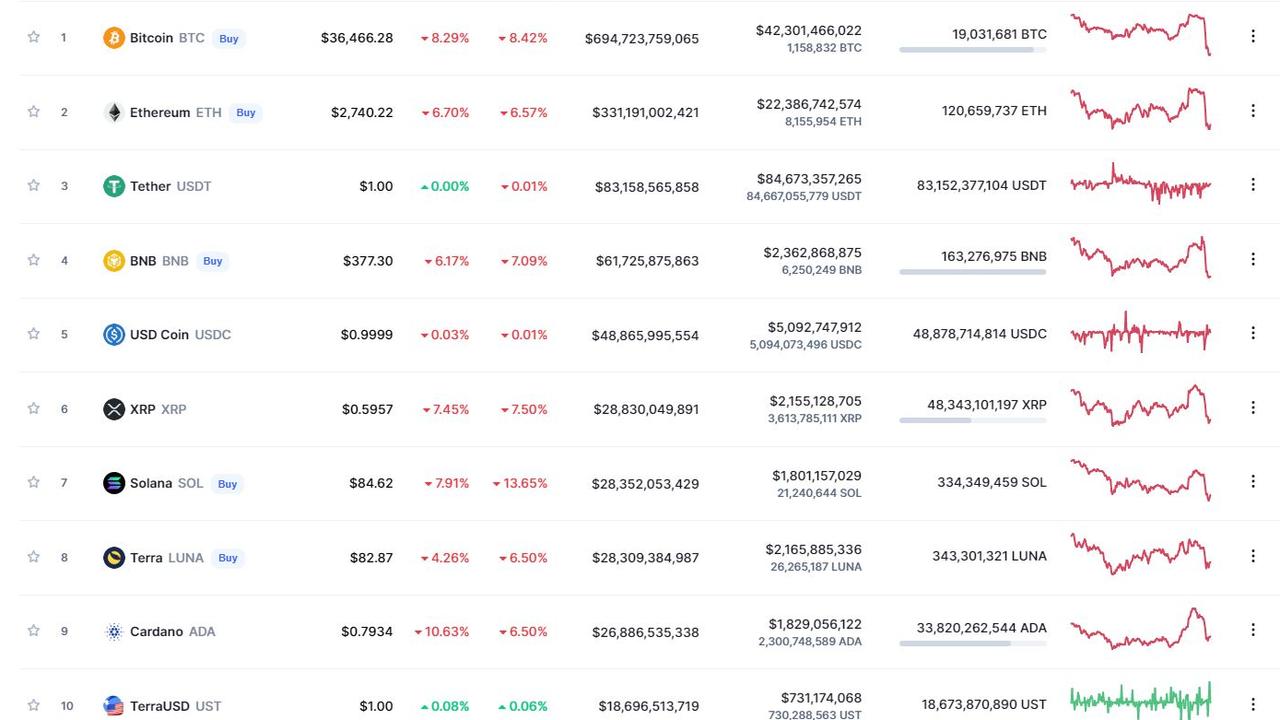

Bitcoin suffered the most; at time of writing, BTC had plummeted by 8.4 per cent, with a 24-hour low of $35,642, its worst price in 2.5 months.

On Thursday Australian time, bitcoin seemingly rallied and rose by five per cent but those gains have since been obliterated.

All the cryptocurrencies ranked among the top 10 (except for stablecoins) were trading in the red, with ethereum down by 6.7 per cent and binance down by 6.2 per cent. Solana and cardano were down by even more, at 8 and 10.7 per cent respectively.

Although the sudden price drop could be cause for alarm, the rest of the stock market is also in dire straits.

Markets plunged after the US Federal Reserve announced it was bringing up the cash rate by 0.5 per cent on Wednesday local time.

The central bank’s chair Jerome Powell assured Americans that he had ruled out a 75-basis-point rate hike, which had been widely anticipated for June.

“A 75-basis-point increase is not something the committee is actively considering,” Powell said.

As a result, gold and bitcoin initially surged in value.

But within 24 hours, opinion changed with commentators believing a 0.75 per cent rise is still likely and the market soon went into a panic.

The Dow dropped 3.4 per cent, the S&P 500 went down by 4 per cent and the Nasdaq had declined by 5.2 per cent at time of writing.

Tony Sycamore, market analyst for City Index, said bitcoin’s price rises and falls was very closely aligned with the traditional stock market.

“The correlation between bitcoin and the Nasdaq is as high as its ever been, which was reflected in their performances for April – the Nasdaq fell over 13 per cent and bitcoin fell 17 per cent,” he said in a note.

“What that means is where the US stock market is going, bitcoin will follow.”

In this case, with markets tumbling dramatically, so did bitcoin.

All bullish sentiment towards bitcoin has for now been put on hold.

Sam Kopelman, the UK manager for bitcoin and crypto exchange Luno, thinks it’s likely that BTC will continue to fall in value.

“Bitcoin’s struggle is by no means in isolation – the S&P 500 [has fallen] to a new record low for the year,” he said in emailed note.

He also warned bitcoin could “slip back into the previously found $36,000-$37,000 support range.”