Crypto crash: Bitcoin, ETH price plummets and bounces in wild day for digital coin markets

The price of bitcoin, ethereum and other cryptocurrencies continues to plummet and it’s likely to get even worse. Here’s why.

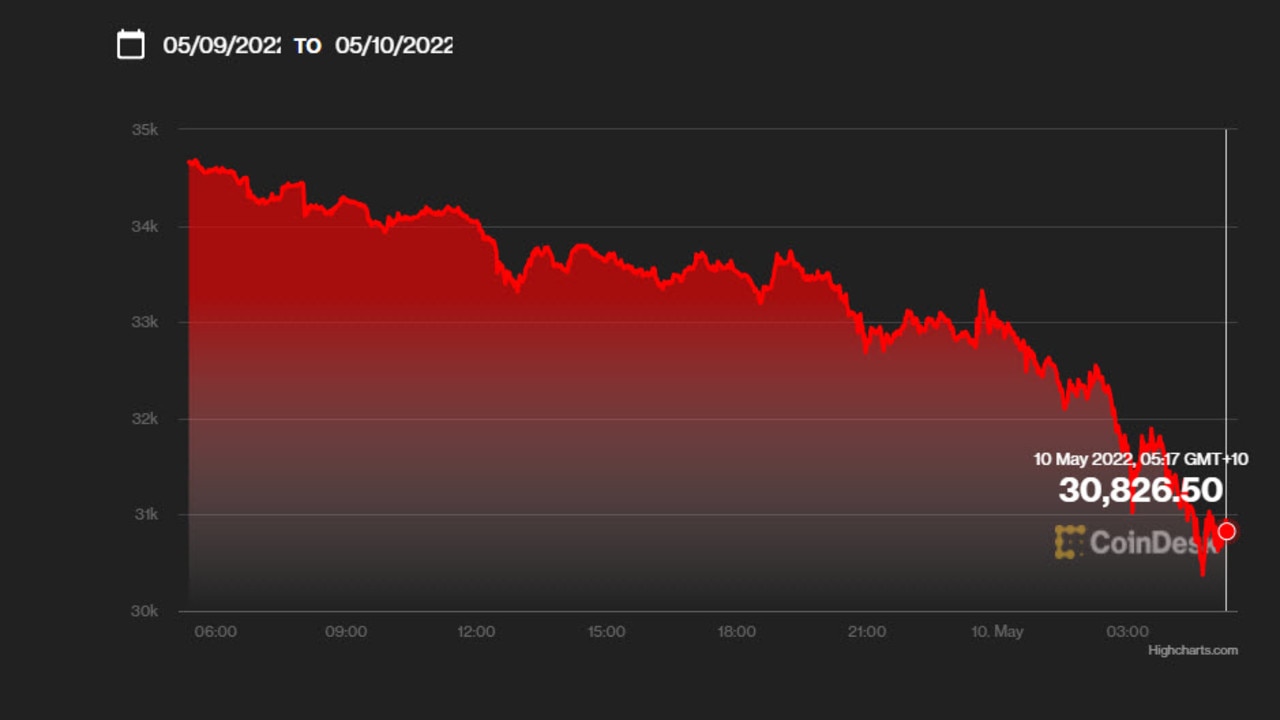

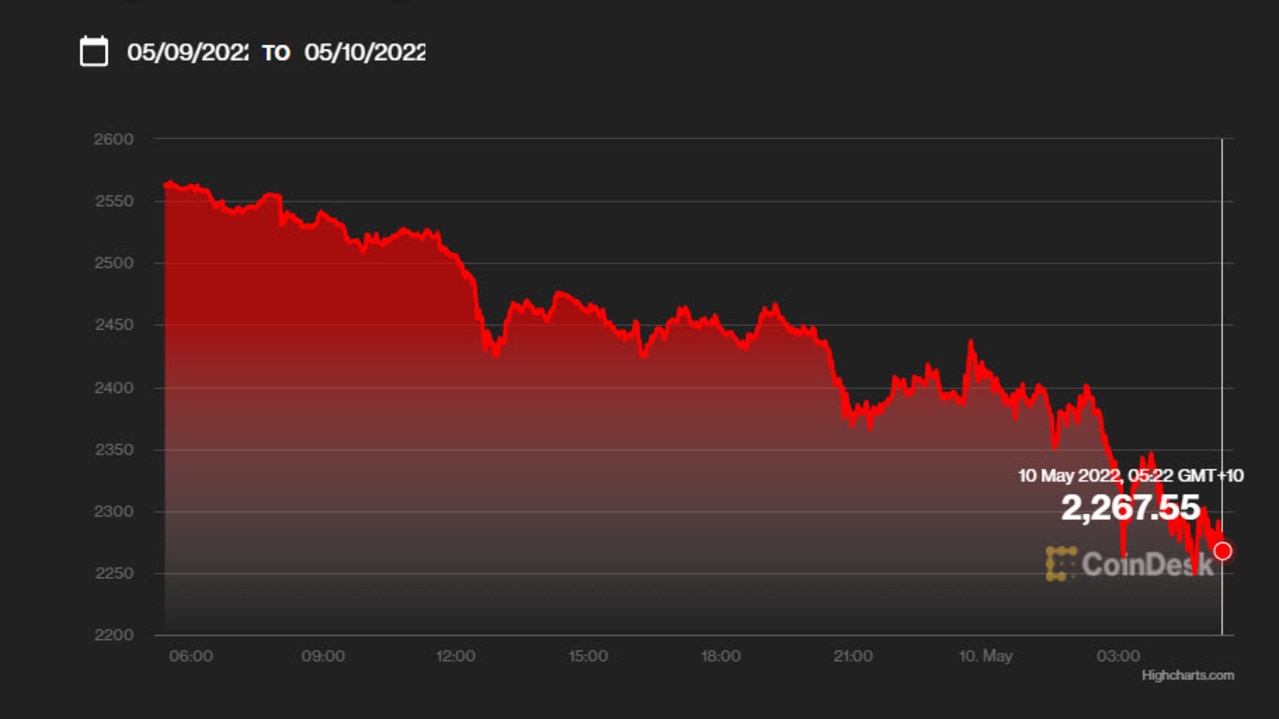

Major cryptocurrencies bitcoin and ethereum have dipped and dived today, crashing more than 12 per cent as another painful month for crypto investors continues.

At 10.10am AEST the price of bitcoin had plummeted to $43,419.84, down $5899.20 over the past 24 hours and miles from the $63,154.29 mark it held on March 29.

It’s down 50 per cent from its all-time high in November 2021 and the lowest the most popular cryptocurrency has been since July last year.

Barely six hours later, bitcoin rose 6.26 per vent to A$45,535.32.

The initial drop was mirrored by most other coins.

Ethereum was trading at $3204.46 at the same time, down $446.73 over the past 24 hours. ETH had been worth $4706.07 as recently as April 3.

But it could get worse for the tentative market.

Analysis firm Glassnode noted in a recent report that the decline “remains modest when compared to the ultimate lows of prior Bitcoin bear markets” in 2015, 2018 and 2020, which capitulated at lows between -77 and -86 per cent off the all-time high.

“As such, further downside remains a risk, and would be within the realm of historical cycle performance,” Glassnode said.

“Bitcoin remains highly correlated to the broader economic conditions, which suggests the road ahead may unfortunately be a rocky one, at least for the time being.”

That’s because world stock markets continue to sink too.

#Bitcoin@Spiking Up âš¡ï¸ pic.twitter.com/DwvAk3KQbs

— Dr. Clemen Chiangâš¡ï¸ (@ClemenChiang) May 10, 2022

China’s zero-Covid policy wreaking havoc

China’s Covid lockdowns have added to stubborn fears over the impact of rising US interest rates and surging inflation to send shares stumbling.

Frankfurt, London and Paris all fell more than two per cent overnight Monday, as did Tokyo. On Wall Street, the Dow was down nearly two per cent in late morning trading, with the tech-heavy Nasdaq continuing a steep decline with a 3.7 per cent drop.

“The bloodletting on stock markets has continued today as we start a new week … with the biggest declines being seen in basic resources after the latest China trade data showed that imports ground to a halt in April,” said market analyst Michael Hewson at CMC Markets UK.

Millions of people in Beijing stayed home on Monday as China’s capital tries to fend off a Covid-19 outbreak with creeping restrictions on movement.

Beijing residents fear they may soon find themselves in the grip of the same draconian measures that have trapped most of Shanghai’s 25 million people at home for weeks.

Lockdowns across dozens of Chinese cities — from the manufacturing hubs of Shenzhen and Shanghai to the breadbasket of Jilin — have wreaked havoc on supply chains over recent months and further stoked global inflationary pressures.

Investors were given more bad news on Monday as China’s April exports slumped to their lowest level in almost two years, due to the nation’s strict zero-Covid policy.

Exports plunged to 3.9 per cent on-year, while imports were stagnant for April. Data also showed the lockdowns have already hit oil demand in China, prompting a five per cent drop in oil prices.

“Oil is off-side too as China confirmed its oil imports in the first four months of the year fell by 4.8 per cent,” said David Madden at Equiti Capital.

US inflation, Russian war also having impact

Stock markets — including the ASX — had dived last week after the US Federal Reserve ramped up interest rates by a half-percentage point and flagged more hikes to tackle decades-high inflation.

“Anxiety is stemming from the Fed’s next moves, with uncertainty creeping in about the scale and speed of interest rate hikes,” said Hargreaves Lansdown analyst Sophie Lund-Yates.

Analysts at Charles Schwab brokerage said that “elevated inflation pressures continue to cloud conviction, with the Fed and other central banks beginning to tighten monetary policy.

Global markets have also taken a beating this year from Russia’s invasion of Ukraine.

“Meanwhile, inflation concerns continue to be exacerbated by the war in Ukraine and ongoing supply chain challenges,” they added.

President Vladimir Putin on Monday defended Russia’s offensive in Ukraine and blamed Kyiv and the West, as he looked to use grand Victory Day celebrations to mobilise patriotic support for the campaign.

However, investors were relieved that Putin made no major announcements, despite reports he could use the anniversary to announce an escalation of the conflict or a general mobilisation.

“Putin has not declared a war on Ukraine to enable full mobilisation which is obviously a relief,” noted Markets.com analyst Neil Wilson.

— with AFP