Tipping point behind crypto ‘death spiral’ which saw $200 billion wiped in just one day

Cryptocurrency is officially in panic mode, after a staggering $200 billion was lost in just 24 hours. But what really caused the crash?

Billionaires have lost fortunes, markets are in panic mode and one expert has even gone as far as to declare that “crypto is dead”.

But what has caused all the mayhem in the cryptocurrency world?

In a nutshell, the latest drama was the result of a massive sell-off, as spooked investors raced to offload their assets.

However, the reasons behind that mass sell-off are complex.

Tipping point behind massive crash

Over the past week, the value of bitcoin plummeted by almost 60 per cent from its highest-ever point.

Insiders have put that phenomenon down to concerns that the US Federal Reserve’s attempts to kerb skyrocketing inflation would push the economy into a recession, which suddenly made less secure investments like cryptocurrency a seriously unattractive option.

But this week, a far more specific crisis was unleashed, sending shockwaves through the industry.

Shock collapse

If we know one thing about crypto, it’s that it’s notoriously unstable and subject to both huge explosions in value – and crushing sudden drops.

A solution to that instability was the invention of so-called “stablecoins” – cryptocurrencies that are “pegged” against the US dollar or other traditional assets, which in theory protected them from market bloodbaths.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

For example, many stablecoins are pegged to the US dollar, which means that an investor should be able to sell a token at any point, and get $US1 in return.

That idea of security saw the popularity of stablecoins explode – but in recent days, the bottom fell out of the stablecoin industry.

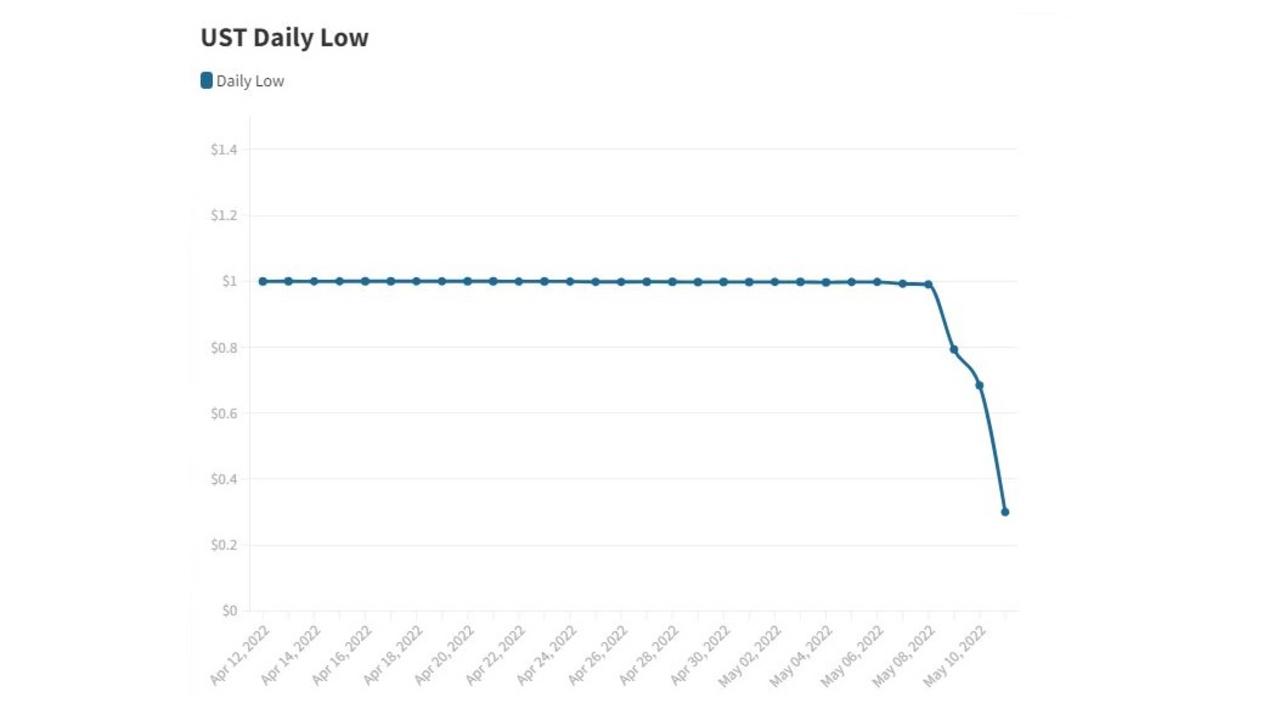

This week, TerraUST, an “algorithmic” stablecoin with its value backed by a sister token known as Luna, broke that crucial peg, which saw its value fall to just 30 cents.

The idea behind that arrangement is that if Terra fell below $1, it could be swapped for Luna, which was supposed to ensure stability – but this week, both crashed simultaneously, with Luna collapsing by a devastating 98 per cent, with some investors losing their life savings.

The same happened to fellow stablecoin Tether, which also broke its peg to the US dollar.

And that turmoil in turn caused the price of other cryptocurrencies to plummet, with bitcoin falling to its lowest level since December 2020, with Ethereum also falling by 16 per cent.

$200b gone in 24 hours

To put the disaster into perspective, an eye-watering $US200 billion ($A291 billion) was slashed from the crypto market in just 24 hours, as reported by CoinMarketCap, and Asian stocks linked to crypto also dropped this week, indicating the panic was spreading.

The blow has fuelled speculation we could be heading into a “crypto winter” – a term given to a long period where many cryptocurrencies lose most of their value.

In yet another sign of how deep the problems could be, even US Treasury Secretary Janet Yellen has felt compelled to comment, noting that the TerraUSD stablecoin had “declined in value” during a testimony before the Senate this week.

“I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability,” she said.

And IG Markets analyst Hebe Chen told news.com.au that the current situation was radically different to previous dips.

“The sense of uncertainty or even fear has changed the investors’ mindset substantially in 2022,” she said.

“The market correction that we are experiencing at the moment is very different to the past two years when the traders are always expecting a quick recovery from the dip, hence, the risky asset is always at the back of the mind when the market volatiles.

“However, the hard-to-predict picture for the global economic outlook has induced the traders today to take more conservative moves and rule out the most risky and volatile assets like crypto.”

Crypto’s ‘death spiral’

While the crypto boom has attracted a legion of diehard fans, there have also been a slew of sceptics who from day one warned of the market’s innate instability.

Speaking to CNN in the wake of the crash, Henry Elder, who leads decentralised finance at digital asset manager Wave Financial, said the current stablecoin crisis was “exactly the ‘death spiral’ a lot of people predicted”.

Meanwhile, Dan Ashmore, Crypto Data Analyst at Invezz.com, has also weighed into the drama, claiming one decision by Terra was the “key to their demise”.

Mr Ashmore noted that earlier this year, Terra founder Do Kwon announced that bitcoin would be used as collateral in case of a scenario where large amounts of UST was sold off – a move that may have sealed its fate.

“This is key, and it was a massive oversight by Terra. It doesn’t make much sense to collateralise an asset (UST) with a highly volatile asset (BTC). It makes even less sense when those two assets are correlated to each other,” he said.

“On a day when bitcoin was crashing, the plan was to sell this crashing bitcoin to assuage the selling of UST and prop up the peg. Terra bought 37,000 bitcoins last Thursday, bringing their collateral kitty up to $US3.5 billion ($A5 billion).

“This means less than 20 per cent of UST’s $US18 billion ($A26 billion) market cap was collateralised. Their $US3.5 billion and 20 per cent collaterisation ratio soon became $US2.6 billion ($A3.7 billion) and 14 per cent collateral.

“This, of course, causes further fear and panic, further selling, and further fear. And on we go. That’s how you get the peg collapsing, contagion and mass meltdown.”

Industry ‘will recover’

However, many experts – such as Balmoral Digital co-founder and portfolio manager Jesse Smythe – are certain crypto will “rebuild and recover”.

In a statement, Mr Smythe said confidence had been “hit hard” and that there were some “severe strains” on the system.

But he said the market would bounce back.

“We have seen really severe volatility in crypto before. One of the industry’s catchcries is ‘Hold on For Dear Life’ for that reason,” he said.

More Coverage

“Ultimately markets are made up of people, people get emotional and that can result in savage bear markets even in the safest investment grade bond markets.

“Crypto is a very young asset class. It is incredible what has been achieved already in such a short space and it will continue to evolve and get better and better.”

Have you lost money in the crypto crash? Contact news@news.com.au