Bitcoin price slumps after US billionaire says crypto is worthless

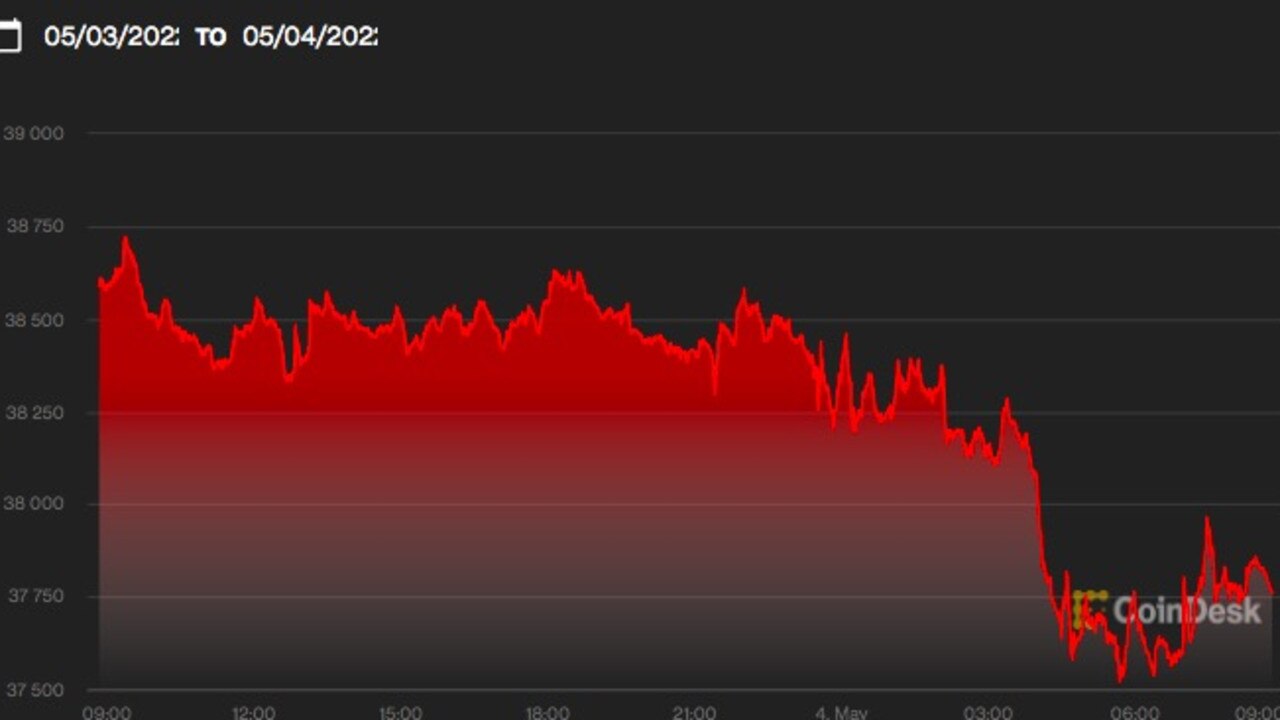

Bitcoin’s price has plummeted in the past 24 hours after one of the richest men in the world called it less than worthless.

Bitcoin’s price has slumped in the past 24 hours after one of the richest men in the world called it less than worthless.

US billionaire Warren Buffett absolutely savaged the top-ranked cryptocurrency on Tuesday at an annual shareholder meeting for his company Berkshire Hathaway.

“If you told me you own all of the bitcoin in the world and you offered it to me for $25 [$A35], I wouldn’t take it because what would I do with it?” the 91-year-old said.

The remark sent bitcoin’s value plummeting.

BTC is now in the red, trading 2 per cent lower since the day before according to CoinDesk – for $US37,700 ($A53,060) at time of writing.

Mr Buffett also said at the meeting: “Whether it [bitcoin] goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything.”

The famed investor explained why he believes bitcoin is intrinsically worthless.

“If you said … for a 1 per cent interest in all the farmland in the United States, pay our group $25 billion [$A35 billion], I’ll write you a cheque this afternoon,” he said.

“[For] $25 billion [$A35 billion] I now own 1 per cent of the farmland. [If] you offer me 1 per cent of all the apartment houses in the country and you want another $25 billion [$A35 billion], I’ll write you a cheque, it’s very simple.

“Now if you told me you own all of the bitcoin in the world and you offered it to me for $25 [$A35] I wouldn’t take it, because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food.”

Mr Buffett’s right-hand man, Berkshire Hathaway’s vice chairman Charlie Munger, previously said at the shareholder meeting: “In my life, I try to avoid things that are stupid and evil and make me look bad … and bitcoin does all three.”

Mr Buffett’s comments attracted the notice of the world’s richest man and crypto enthusiast Elon Musk, who noted the investor had a lot to say about bitcoin for someone with such a low opinion of digital currencies.

The Tesla CEO commented on a clip of Mr Buffett’s speech, tweeting: “Haha he says ‘bitcoin’ so many times.”

Another bitcoin enthusiast and large investor, Anthony Pompliano, also slammed the views expressed by Buffett.

“Everyone fears something they don’t understand,” he tweeted.

Mr Buffett is a well-known sceptic when it comes to blockchains.

Back in 2018 he said: “Bitcoin is probably rat poison squared,” he said at the time, adding later on that the digital asset “has no unique value at all”.

Haha he says “Bitcoin†so many times

— Elon Musk (@elonmusk) May 1, 2022

Everyone fears something they don't understand

— Pomp 🌪 (@APompliano) April 30, 2022

Self-made billionaire made fortune from traditional investments

Mr Buffett, 91, has a net worth of $US115.9 billion ($A163 billion), according to Forbes.

He acquired most of that wealth through his financial company Berkshire Hathaway, which owns other prominent companies in the insurance, energy, distribution and retail sectors, among others.

He first bought stock when he was 11 and filed his first ever tax return two years later, at the age of 13.

The billionaire has been hailed as one of the most successful investors of all time.

Mr Buffett acquired his staggering fortune from traditional investments, not speculative and experimental areas like cryptocurrency.

Against the backdrop of the Covid-19 pandemic, bitcoin had an amazing 12 months in 2021, with highlights including Tesla billionaire Elon Musk spruiking the coin, El Salvador adopting bitcoin as legal tender, Facebook creating an entire metaverse with crypto as the only currency, digital assets entering global stock markets in the form of exchange traded funds (ETFs) and bitcoin breaking its all-time high.

However, so far in 2022, bitcoin has struggled to maintain the same momentum.

Cryptocurrency currently has a market capitalisation of US$1.71 trillion. Of that, bitcoin makes up the bulk, with a market cap of US$718 billion, more than any other cryptocurrency.