Warren Buffett’s backflip after calling crypto ‘rat poison’

Billionaire US investor Warren Buffett slammed cryptocurrency as pointless. Now he’s had to eat his words.

US billionaire Warren Buffett has had to backflip on his staunch stance against cryptocurrency in an embarrassing concession.

The businessman is a well-known proponent against blockchains and compared Bitcoin – the most popular cryptocurrency – to “rat poison” in 2018.

“Bitcoin is probably rat poison squared,” he said at the time, adding later on that the digital asset “has no unique value at all”.

But in a filing with the US Securities and Exchange Commission (SEC) released earlier this week, Mr Buffett’s company Berkshire Hathaway revealed that it had spent a whopping US$1 billion (A$1.4 billion) on cryptocurrency.

In the last three months of 2021, a bumper year for cryptocurrency, Berkshire Hathaway poured money into Nubank, a digital bank based in Brazil that is popular with Bitcoin investors.

Unlike most banks, Nubank encourages cryptocurrency by offering Bitcoin exchange-traded funds to its customers.

Mr Buffett, 91, has a net worth of US $114 billion, according to Forbes.

He acquired most of that wealth through his financial company Berkshire Hathaway, which owns other prominent companies in the insurance, energy, distribution and retail sector, among others.

He first bought stock at age 11 and filed his first ever tax return two years later, at 13 years old.

The billionaire has been hailed as one of the most successful investors of all time.

Mr Buffett acquired his staggering fortune from traditional investments, not speculative and experimental areas like cryptocurrency.

Cryptocurrency had an unprecedented year in 2021, with most coins breaking all-time highs and surging by as much as 41,000 per cent of their value.

Against the backdrop of the Covid-19 pandemic, cryptocurrency had an amazing 12 months in 2021, with highlights including Tesla billionaire Elon Musk spruiking the coins, El Salvador adopting bitcoin as legal tender, Facebook creating an entire metaverse with crypto as the only currency and digital assets entering global stock markets in the form of exchange traded funds (ETFs).

A coin called gala rose by more than 41,000 per cent, ceek is up by 27,000 per cent, axiom with a 16,000 percentage increase and solana is at around 15,000 per cent more than it started out in 2021.

Bitcoin rose 157 per cent over the course of the year.

However, since Mr Buffett’s company purchased the cryptocurrency entity, cryptocurrency has had a dramatic fall from grace.

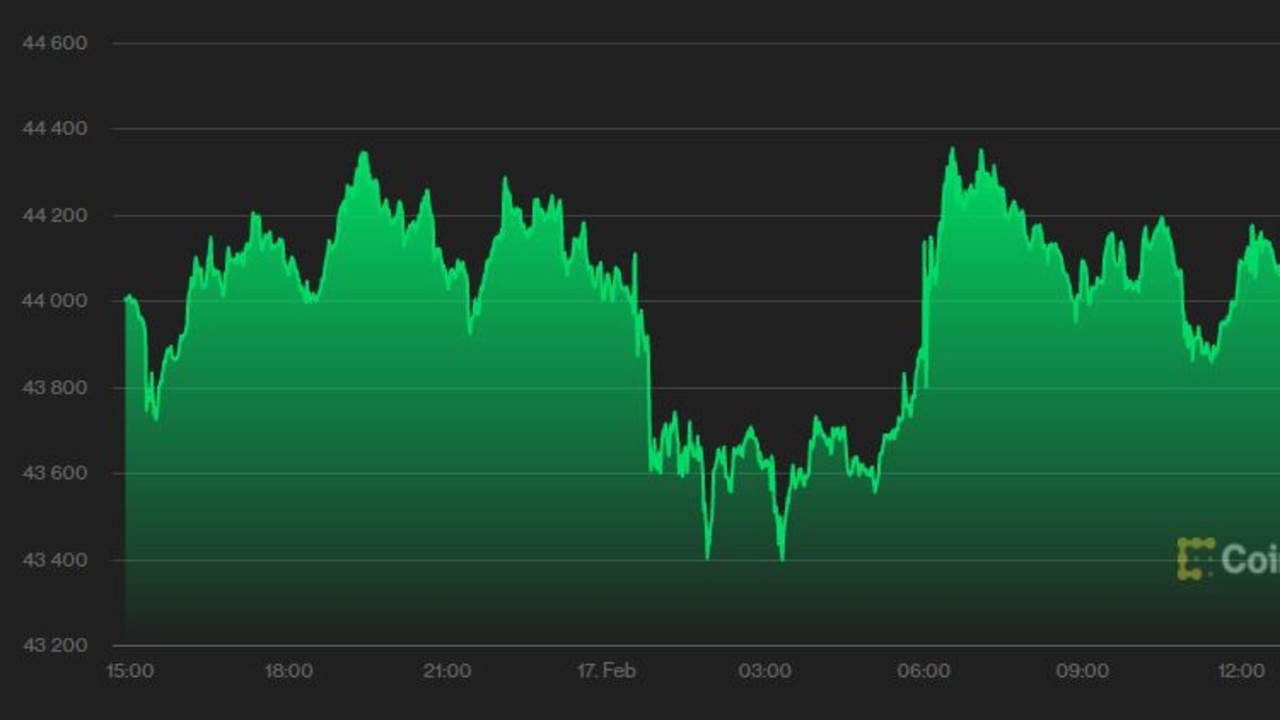

Bitcoin has shed nearly 50 per cent of its value since it hit an all-time high in November of nearly US$69,000.

At time of writing, the number one cryptocurrency was trading at US$43,000, a drop of $26,000.