Ruinous oil and gas prices could lead Australia into recession

The rising cost of energy is so “ruinous” that it could see Australia plunge into recession before Christmas. There is an easy solution though.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

Mining and extractive industries like oil and gas often say that they are “saving Australia”. So their argument goes, when commodity prices are high, Australia can prosper no matter what is happening elsewhere.

This was always only half of the argument, though, because commodity prices often fall and when they do extractive industries lead Australia down.

But what happens when commodity prices are so high that it is actually doing harm to Australia? And what is the appropriate response when those high prices are being driven by human suffering such as war?

These are the critical question facing the Albanese Government in the first days of office. Australia’s gas and coal miners are imposing economically ruinous international prices upon the local economy owing to the Ukraine war and, if nothing is done soon, then every Australian east of Western Australia is going to get a lot poorer in a hurry.

WA is OK because it has a domestic gas reservation policy so its local price is under $6 gigajoule (Gj).

The energy shock

Australian gas prices are traditionally in the $3Gj range. Yesterday they hit $382Gj for a brief period as the wholesale market failed. We are now seeing the gas regulator fix prices in other states at $40Gj.

These prices are far above the price we charge our export customers for the same gas because the gas export cartel of Shell, Origin, Santos, Woodside and Exxon have sent so much gas overseas that Australia is being starved and gouged.

Gas plays a large role in setting the price of electricity in parts of Australia, particularly in Victoria and South Australia. So these prices are going absolutely bananas as well.

Coal plays a larger role in NSW and Queensland but coal and gas are interchangeable in the stationary power fuels market so track one another’s prices. Coal is traditionally $100 per tonne. It is now $500 per tonne.

In short, Australia’s east coast energy markets are in the process of failing and they could crash the economy.

Demand destruction for business

As things stand, gas bills could rise anywhere from 500 to 1000 per cent. This would wipe out what remains of Australian manufacturing. Anything above about $7Gj will shrink Australia’s industrial base.

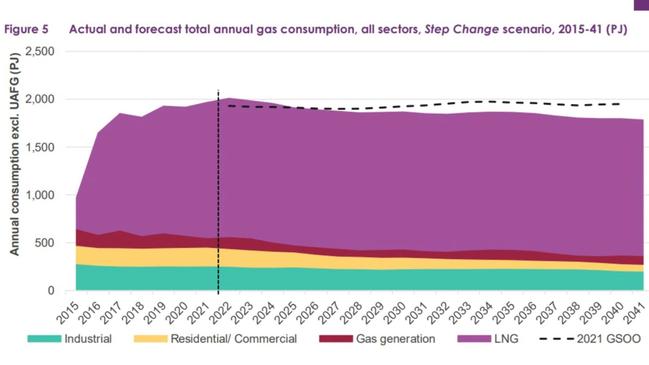

The Albanese Government has a mandate to repair manufacturing owing to the fragility exposed by China and the pandemic in the past few years. We will see the opposite as the post-2014 trend shutdown of industrial gas users dramatically accelerates:

Add the coal price rises and that effect on electricity prices, and what we get is a scenario in which every business on the east coast is going to see energy bill increases from 100 to 200 per cent in the next two years. If that happens, swathes are going to shut, sack workers, and wind back investment.

Demand destruction for households

Utility bills make up only 3 per cent of the CPI but if they double or triple then that is a corresponding income shock to every household east of WA. In effect, this is a 4-6 per cent real wage cut over the next two years.

This will come straight out of discretionary spending budgets and hammer the entire consumption sector which is 55 per cent of GDP. Roughly speaking it is a hit of $20 billion to $33 billion a year in spending and double that in year two.

It will smash growth.

CPI crisis, rate hikes and house price crashes

It’s true, 3 per cent of the CPI does not sound like a lot. But if that price doubles or triples then it is gigantic. The RBA will have … wait for it … an additional 4-6 per cent of inflation over the next two years to deal with.

But that’s not even the worst of it. Every business east of WA will have to pass on the new cost. So, the 60 per cent of the economy that is non-tradeable will add another 1.5-1.8 per cent to the CPI each year. Tradeable may add it too. A total of 7.5-9.8 per cent extra inflation over two years.

This will deliver the runaway interest rates that futures markets have been forecasting as the RBA is forced to tighten enough to “make room” for an economically empty war-profiteering price shock.

A house price crash would follow which will, in turn, crater the banking system. That would drive the Aussie dollar to the moon in the middle of a recession triggering even more hollowing out.

Budget demolition and inequitable distribution

The federal budget would be hammered on multiple fronts.

First, a recession would gut income and radically lift outgoings.

Second, interest rate payments on the huge national debt would balloon.

Third, the poorer you are, the higher the proportion that utility bills make up of your outgoings. So much greater compensation would be paid to low-income households.

Fourth, there would be some benefit from coal profits but the gas cartel pays no tax. So, unbelievably, there is no upside from its increased export earnings.

What should the Albanese Government do?

The Ukraine war doesn’t look like it’s ending anytime soon and the Russian sanctions regime inhibiting the flow of gas and coal to Europe is all but permanent. The European ban on Russian coal does not even start until August.

Gas and coal prices will come down eventually as the supply of global supply adjusts and renewable investment skyrockets, but not swiftly enough to prevent the above economic disaster for Australia. For the time being, the European war is the marginal price setter for both gas and coal prices globally.

The answer is simple for Australian gas prices. Holding back greater volumes of gas from export markets for Australia’s east coast economy does not even require policy innovation nor is it a political risk. It is already bipartisan.

The Coalition created the Australian Domestic Gas Security Mechanism (ADGSM) in 2017. At the time it was written, gas prices collapsed from $20Gj to $10Gj. And that was achieved only by then PM Malcolm Turnbull threatening to trigger the Heads of Agreement.

All that Anthony Albanese needs to do is trigger the ADGSM and call in the gas cartel executives for a polite chat in which he makes clear that the local gas price will either fall below $10Gj in the near future or he will trigger the ADGSM, as well as toughen it with explicit price targets as necessary.

WA already has this policy and has a gas price of $5.50Gj.

For coal, the answer is similar if a bit more complex because the market is more fragmented.

A Domestic Coal Security Mechanism could apply a 100 per cent levy on all domestic sales above $100 per tonne. To drive compliance, $20 per tonne of this levy is returned to those mines that meet the sales price criteria.

The point is, that there are plenty of ways to bring energy prices to heel. It is only a matter of political will to tackle the war-profiteering.

If that gumption is lacking in the Albanese Government then the entire Australian eastern economy could crash into recession before year’s end.

David Llewellyn-Smith is chief strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.

Originally published as Ruinous oil and gas prices could lead Australia into recession