Reason China is getting Aussie gas cheaper than Australians

China is currently getting Aussie gas at a cheaper rate than hard working everyday Australians. And the reason is ridiculous.

ANALYSIS

Labor has secured a majority to rule Australia for three years. A large part of its victory was built upon promises to help drive down the cost of living for households.

There are two components to this. First, wages must rise faster than they have for a decade. The Albanese government appears ready to support stronger wage claims amid a fantastically tight labour market so that is to the good.

The second component is rising costs for goods and services. Can Prime Minister Anthony Albanese succeed on that front?

There is one point of good news. The global supply chain shock that drove up so many offshore goods prices has all but disappeared. Ships, ports and trucks are all flowing as normal now and the prospect is for large price falls.

There is also good news in the global production of consumer goods catching up to demand that is falling away as interest rates are tightened around the world.

The US in particular has huge inventories of goods so any slowdown in its consumer is going to drive global goods deflation for the next year.

But, that was always coming anyway and the Albanese government is really only enjoying a windfall.

Energy is the issue

The biggest problem confronting the Albanese government is one of its own makings. It is the extraordinary energy price shock hammering the east coast economy.

Ever since the Ukraine war, global oil and gas prices have skyrocketed. We’re all feeling that at the petrol pump. What is perhaps less known by Aussies is that the Australian gas price has followed suit.

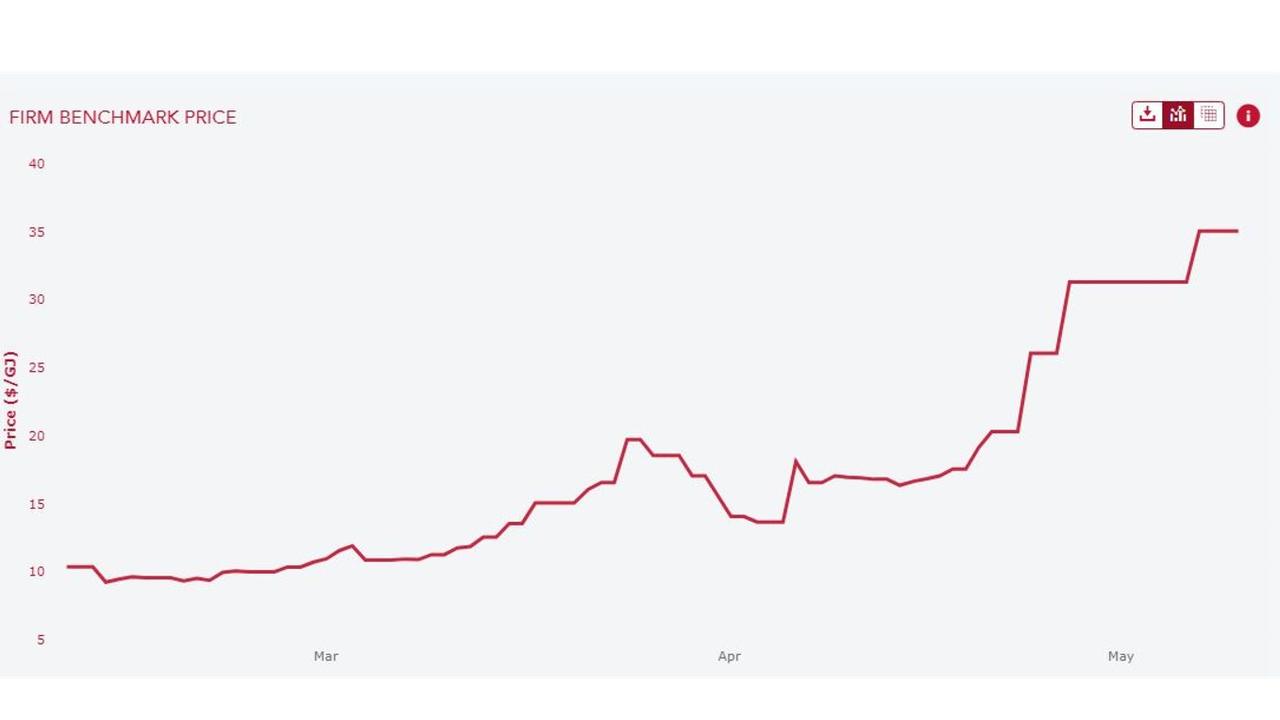

Traditional Aussie gas prices are $3 gigajoule (Gj). Currently, the price is $35Gj. This is exactly the same price that Europe is paying Russia for its gas, a price gouge being used as a weapon of war.

But Europe has no gas of its own so has no choice. Australia does have gas. Loads and loads of it. Far more than we could ever possibly need. It comes out of the ground at $1Gj all across QLD and SA.

But then what happens to it is beyond all hope and reason. Three-quarters of it is shipped to China as LNG at $31Gj, $4Gj cheaper than it is sold locally.

This is the crazy world of the east coast gas export cartel that deliberately starves the local market of gas to force prices up at home, while also forcing down prices for China.

To add insult to injury, the gas cartel pays no tax for doing so, and in the final kicker for every person east of WA, drives up the electricity prices because gas-fired power stations set the marginal cost in that market as well.

To put it bluntly, every Australian east of the WA border is currently being forced to pay a massive and spiking energy tax that will drive up the cost of absolutely everything. WA is OK because it has a domestic gas reservation policy so its local price is under $6Gj!

And we are doing this as a subsidy for the Chinese economy even as that country is doing all sorts of economic and geopolitical harm to Australia in return.

Gigantic carbon tax

There is a very simple solution to this curious form of cost-of-living self-abuse. It is called the Australian Domestic Gas Reservation Mechanism (ADGSM).

Installed by Malcolm Turnbull when the local gas price was a measly $20Gj in 2017, it is a contract with the cartel that forces it to leave more gas here so that the local price crashes to acceptable prices around $7Gj.

Yet, with this Heads of Agreement already in place, with the trigger ready to pull, with the cost of living crisis in full swing and being severely exacerbated by the energy inflation shock, Labor’s new Treasurer Jim Chalmers has already declared that “electricity prices are the pointy end of the cost-of-living crisis” but says he will rely instead upon measures to boost renewables to bring down prices.

This will work eventually. But it will take years while everybody’s utility bills go berserk, every producer of goods and services east of WA tries to recoup the cost with higher retail prices, and the RBA is forced to make it all worse with rate hikes.

In effect, Labor is allowing an energy cartel to impose a gigantic private carbon tax amid a cost of living crisis when the renewable rollout will happen anyway.

Just why the Albanese government is allowing this travesty of economic mismanagement you might like to ask your local member.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review. MB Fund is underweight Australian iron ore miners.