Russia Ukraine war could lead to 77 per cent increase in oil prices

A combination of factors have aligned to leave Australia in a very vulnerable position – and there’s one reason it could be about to get a lot worse

Since the pandemic first began in the Chinese city of Wuhan in January of 2020, the highly interconnected nature of the global economy and the world around us was revealed like never before.

While these connections have always been there quietly operating behind the scenes of our everyday lives, the pandemic and the supply chain crisis that followed, rammed home how vulnerable these systems were to shocks and how those shocks could butterfly out to impact things half a world away.

Despite Australia’s relative geographic isolation, off in our own little corner of the South Pacific, we are not immune to the challenges impacting the rest of the world, such as supply chain issues and the rising cost of fuel.

When Russia invaded Ukraine on the February 24, another chain of events was put in motion that would weigh heavily on the global economic recovery, impact social stability around the globe and drive costs higher for Australian households.

A major blow for Moscow

In early April there was growing speculation that Russia could end its campaign in Ukraine on May 9, and come to the negotiating table to hammer out some sort of peace agreement.

For Moscow, the date holds a very special significance, as the anniversary of the surrender of Nazi Germany and the conclusion of World War Two in Europe.

With the sinking of the Russian Black Sea Fleet Flagship, the cruiser Moskva (Moscow) on the April 14, the outlook for the potential end of the conflict has changed significantly.

Since then the rhetoric from Russian state media and the Russian military has escalated, with calls for an extended conflict and a formal declaration of war becoming more commonplace.

For Russia, the loss of Moskva was a major blow to morale and its national pride.

Prior to Moskva’s loss, it was one of just six Russian Navy warships to displace more than 10,000 tons, with all six constructed prior to the collapse of the Soviet Union.

Moskva and the other large warships of the Russian Navy’s surface fleet embody the phrase “they don’t make them like they used to”, because they quite literally don’t. Since the collapse of the Soviet Union, not a single warship even in the same size class as Moskva has begun construction, making it an irreplaceable asset for the Russian Navy.

Historically, the loss of a major warship has been a damaging hit to a nation’s morale and prompted a furious response. But for the Russian’s, there is no enemy warship to hunt down to seek revenge. Moskva was sunk by a Ukrainian anti-ship missile battery operated by a couple of dozen men in a field somewhere in Western Ukraine, not in a major naval engagement.

Escalating attacks and rhetoric

In recent days, Russia sent strategic bombers (large bomber aircraft) into Ukrainian air space for the first time since the war began, conducting attacks on the besieged Ukrainian city of Mariupol with dozens of unguided bombs.

Up until recently, the usage of Russia’s strategic bomber fleet had been relatively limited and exclusively conducted in Russian or Belarusian airspace using air launched cruise missiles.

In Russian state media the rhetoric regarding the ongoing conflict has also intensified. A senior Russian commander, Major General Rustam Minnekayev, recently told Russian state media that Moscow’s goal was to take territory up to the border of Moldova, effectively cutting Ukraine off from the sea.

If Moscow was to achieve these goals, it would link up the Russian speaking breakaway Moldovan region of Transnistria to Russia and put Kyiv in an even more challenging position economically.

With alleged attacks on targets in Transnistria in recent days, which is garrisoned by Russian forces, there are growing concerns that the war could spill over into Moldova.

Global consequences

Since the Russian invasion of Ukraine began in late February, the impact of the conflict has echoed around the world. From the cost of wheat to the price of gas, the war has amplified existing inflationary pressures present within global commodity markets.

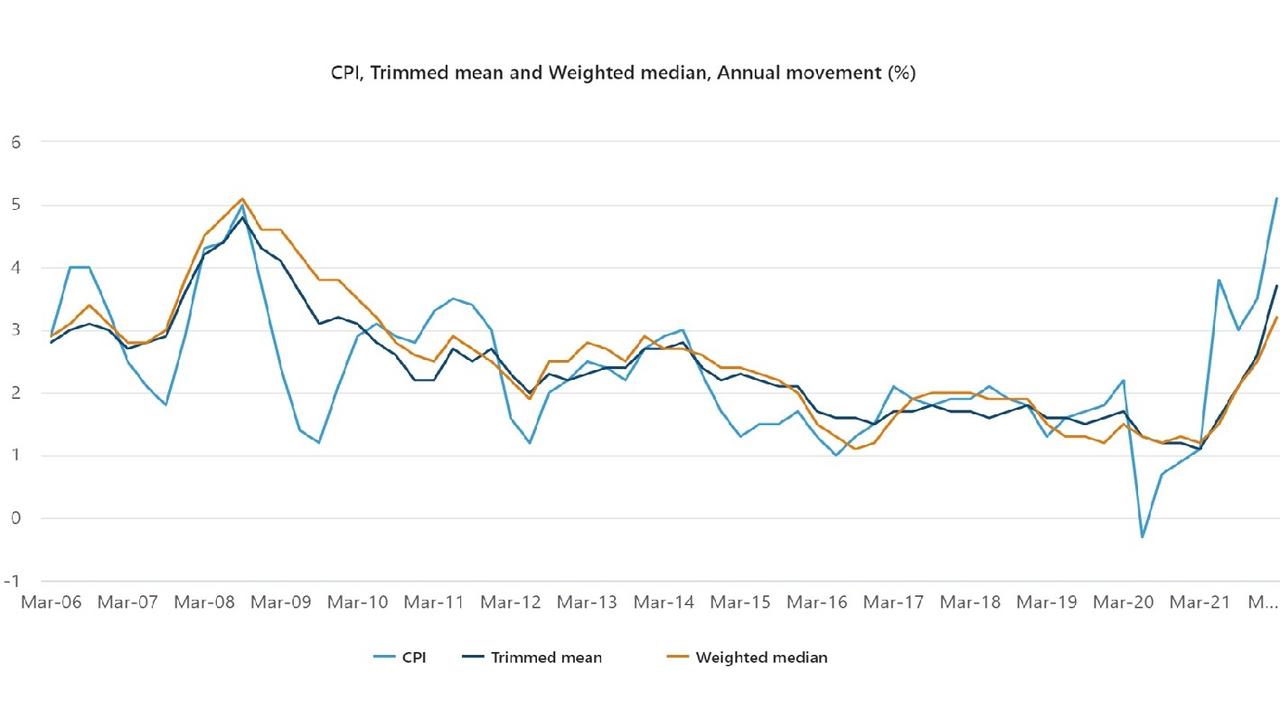

In Australia, the rising cost of fuel and food both played a role in the nation recording the highest level of inflation since the introduction of the GST more than 20 years ago, with the annual figure coming in at 5.1 per cent.

While many of the inflationary trends driving this outcome were already present prior to the war, the ongoing conflict has effectively made a challenging problem worse.

For Australian farmers, the Russian ban on fertiliser exports has had a heavy impact on their costs. According to the Australian Bureau of Statistics, the cost of fertiliser imports into Australia rose by 19 per cent in the first quarter of the year. As costs at the farm gate continue to rise, so too does the cost paid by households at supermarket and green grocer’s check-outs.

With the conflict in Ukraine now increasingly predicted to continue for months to come, we haven’t seen the last of the impact on the global economy or Australian households.

There are projections that if the proposed EU embargo on Russian oil was to go ahead, the price of oil and by extension petrol and diesel could once again go skyward.

In a recent note, US investment bank JP Morgan warned the price of oil could rise to US$185 a barrel if a EU embargo on Russian oil and natural gas was to be swiftly implemented.

This would represent a rise of roughly 77 per cent above current oil prices and put Australia and the world in a challenging economic position.

Going forward the outlook remains highly uncertain. As the cost of living continues to rise around the globe and governments increasingly look to secure the interests of their own people, there are risks this could butterfly out into an even more challenging environment.

As nations take to export bans of all manner of commodities from palm oil to fertiliser in order to keep domestic prices low, this puts upward pressure on global prices for importers if demand outstrips supply.

While Australia’s status as a wealthy nation may afford it a degree of protection from rising costs, it is not immune and some Australians may feel the bite of the rising global cost of basic staples far more than others.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator