Interest rate and inflation strategy could lead to ‘economic burnout’

Inflation and interest rises are causing huge pressures for everyday Aussies – and there’s a worrying sign we’re heading for “economic burnout”.

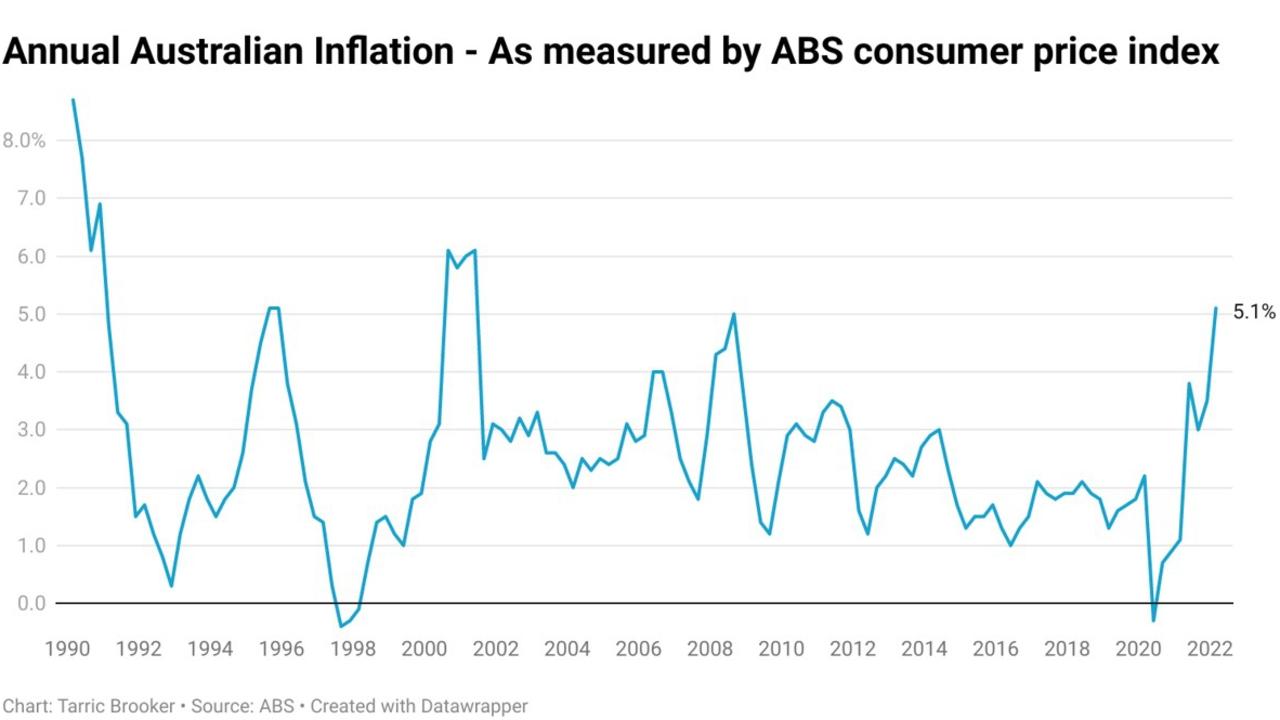

On Wednesday, the release of the latest inflation figures from the Australian Bureau of Statistics revealed that Australian inflation was well and truly outside of the Reserve Bank’s target band of 2-3 per cent. With annual inflation recently coming in at 5.1 per cent, the cost of living as measured by the ABS’s Consumer Price Index (CPI) is rising at the most rapid rate since the introduction of the GST over 20 years ago.

In this Australia is not alone, with practically every nation on Earth currently battling high inflation. In the United States and Europe, inflation is running even hotter, hitting 8.5 per cent in the US and 7.4 per cent in the European Union.

Historically high levels of inflation have been addressed by central banks raising interest rates to remove aggregate demand from the economy until such time as inflation was once again under control.

Around the globe this is exactly what central banks are generally attempting to do, aggressively raise interest rates to put downward pressure on inflation until it is tamed to a desired level.

But unlike previous economic cycles, when central banks were largely left to their own devices to address inflation, in the post pandemic world where government intervention has become a regular occurrence, policymakers around the world are also attempting their own fix.

Addressing cost of living pressures with more government money

In Australia, the Morrison Government has attempted to counter the rising cost of living by cutting the fuel excise tax by half (22 cents per litre) and providing one off payments to welfare recipients.

In Japan, the government has committed to spending 13.2 trillion yen ($142 billion) on an emergency relief package to ease the pain on households and businesses being hit by rising costs. The package includes subsidies to petrol retailers, cash payments to low income households with children and the extension of funding support for small businesses, along with several other support mechanisms.

In the United States, the Biden administration has extended the student loan repayment holiday to December, effectively providing households with student loans with an additional $8.1 billion per month.

Meanwhile, multiple US states have suspended or cut state taxes on gasoline, while others such as California are planning cash payments or vouchers to be provided to vehicle owners.

As you can see there is a bit of pattern emerging in the reaction of governments around the globe to the rising cost of living, it effectively boils down to attempting to solve the inflation problem with more money.

In fairness to the three nations singled out as examples, they are far from outliers when compared with their peers. Across the world governments are attempting to use their resources to cushion the blow of the impact of rising inflation on households and businesses.

But doesn’t that spending increase inflationary pressures? I imagine some of you may be thinking, indeed it does.

Central banks going in the other direction

As political leaders continue their attempts to address inflation by providing additional funds to households and businesses, the world’s central banks are pushing in entirely the opposite direction.

Across the Tasman, the Reserve Bank of New Zealand began raising rates in October and has cumulatively raised rates by 1.25 per cent. The New Zealand arm of ANZ believes the cash rate will peak at 3.5 per cent.

In the United States, the market is currently pricing in 1.75 per cent worth of increases to the federal funds rate (US equivalent of the RBA cash rate) across the next three Federal Reserve meetings. By year end the market is pricing a federal funds rate of 2.75 per cent to 3 per cent.

Back home in Australia, there is growing speculation that the RBA could raise rates as early as next week. With AMP and ANZ adjusting their forecasts this week for a May 3 lift off in rates.

Currently the RBA cash rate futures market is pricing in a cash rate of 2.47 per cent by years end and 3.28 per cent by the middle of next year.

Suffice to say, that central banks are looking to rapidly slam the brakes on inflation by rapidly raising interest rates to counter inflationary pressures.

The economic tug of war

As governments continue to inject cash into the economy at the same time that central banks are attempting to remove it through raising interest rates. We are effectively left with a series of policies that is akin to having one foot flat to the floor on the accelerator, while the other is hard on the brake.

This strategy is what I like to call burnout economics. Just like a car doing a burnout results in smoke, noise and not a whole lot forward momentum, so too does these two forces acting against each other.

As lockdowns continue in China and the war continues to rage in Ukraine, raising rates high enough to drive inflation down to the level consistent with central banks’ targets was always going to be challenging. By adding additional spending at a time when inflation is already running at multi-decade highs, that challenge becomes even harder.

The more cash that is injected into the economy by governments attempting to cushion the blow of inflation, the more central banks may need to raise interest rates in order to counter rising inflationary pressures.

In Australia, interest rate futures markets continue to price in an extremely swift and large rate rise cycle from the RBA. Up until relatively recently, few mainstream economists shared its viewpoint that this would come to pass.

But with inflation rocketing far higher than expectations, all of sudden one has to wonder, what if the market is even partially right about an aggressive rate rise cycle being necessary to tame inflation?

Ultimately, we live in highly uncertain times, defined by the pandemic, war in Ukraine and near all-time high commodity prices. Central banks could be successful in taming inflation in their usual manner by reducing demand within the economy.

On the other hand, rates may need to go significantly higher as various factors combine with the broadly employed strategy of burnout economics continues to support inflationary pressures.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator