Insurance pain of victims wrecked by a wall of water

More than 100 questions from victims of the Northern NSW-South East Queensland floods were put to the insurance industry. We went to the meeting so you didn’t have to. What we found out.

Lismore

Don't miss out on the headlines from Lismore. Followed categories will be added to My News.

The real cost of the floods which brought heartbreak to residents of Byron Bay, Woodburn and Lismore and other towns across the Northern Rivers will be much greater than previously estimated.

The bill for the catastrophe which swallowed Northern NSW and South-East Queensland earlier this year had already been put at a staggering $3.3 billion - making it the nation’s costliest flood of all time.

But it was revealed at an online forum for flood victims on Wednesday night that figure did not take into account the damage to community assets and properties not covered by insurance.

This sobering headline hung in the air at the forum - hosted by the Insurance Council of Australia (ICA) - which attracted some 300 RSVPs, and more than 100 pre-lodged questions from the community.

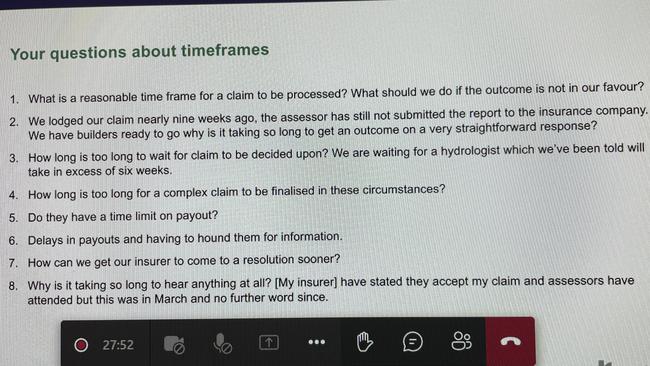

The pleas for answers by flood victims was so great that their questions were lumped into common themes at the digital ‘town hall’ meeting.

Chief among those was the time it has taken for claims to be processed, and repairs/rebuilds to be made.

The meeting heard insurance companies should make decisions on claims within four months - but the sheer breadth of the disaster was likely to see some firms ‘breach’ governance regulations.

As of late April, insurers had received 196,761 claims across Northern NSW and South East Queensland. Of these, 22,409 have been finalised and $580 million has been paid to policyholders.

The average claim cost is $17,000.

Flood victims heard of a perfect storm which was frustrating the make good process - a shortage of hydrologists to assess what had actually happened, a shortage of tradesmen to effect repairs, and continuing rain across the district.

Mere hours after the forum concluded, evacuation sirens were sounding across South East Queensland as a fresh rain system pounded in the Lockyer Valley and Ipswich.

ICA chief executive officer Andrew Hall said unlike cyclones, the industry now had a good handle on where floods would occur, and said government planning assistance was crucial to mitigate future disasters.

“We’ve got more than 100 years of data now - we understand where the floods occur,” Mr Hall said.

“And that’s why when insurers price a premium at an address level they will probably have a pretty good idea whether that property is going to flood.

“Rather than spending millions and millions and millions of dollars on subsidising insurers’ premiums we think that money should be spent on actually making that house floodproof in the first place.”

And there was a sting for Lismore residents in particular when the topic was raised of relocating homes - a subject which has already deeply divided the community.

“Moving people out of harm’s way or making those homes more resilient to floods would be a starting point,” Mr Hall said.

“Where it’s done insurers have come back into the market. Roma for example, Launceston in Tasmania, Wagga (Wagga).

“There’s been many towns in this country where because the infrastructure has been built insurance premiums have come down and people are able to take out insurance again.”

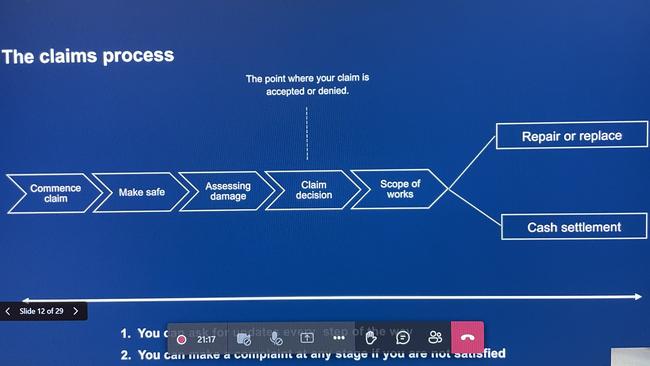

Flood victims were given a detailed explanation of the claims process, and if they were unsatisfied were advised they could contact Legal Aid, and/or the Australian Financial Complaints Authority (AFCA).

John Price, Ombudsman Insurance, AFCA, said the body was an independent arbiter which could make binding decisions on insurance companies, and its investigations were not limited to expert hydrologist reports of how a property was impacted.

“We look at everything,” Mr Price said.

“The best information that we can obtain is on the ground, listening to people, listening to local communities, listening to personal observations.

“We want to know when the water first inundated the property, we want to know whether water previously inundated through the roof, we want to know was there water escaping from the gutters or from the drains.”

Residents were advised that insurance companies traditionally didn’t offer cash settlements when it came to building insurance - preferring to use their own panel of builders to effect repairs.

Flood victims were cautioned about taking a cash settlement, as that meant they would have to project manage the work themselves.

They were also told to be wary of “disaster chasers” who, Mr Hall said, offer to pursue a claim on behalf of a property owner - but often “take a cut” from an insurance payout.

The insurance town hall was scheduled to run for an hour-an-a-half but was extended by 10 minutes to accommodate additional ‘live’ questions from the audience. The ICA said it would post a recording of the meeting to its website.