Insurance Council of Australia: Lismore part of Australia’s costliest ever flood

It’s official, the flood which ransacked Lismore was the costliest in Australia’s history. The insurance industry is now reaching out to residents, explaining the enormity of the job ahead.

Lismore

Don't miss out on the headlines from Lismore. Followed categories will be added to My News.

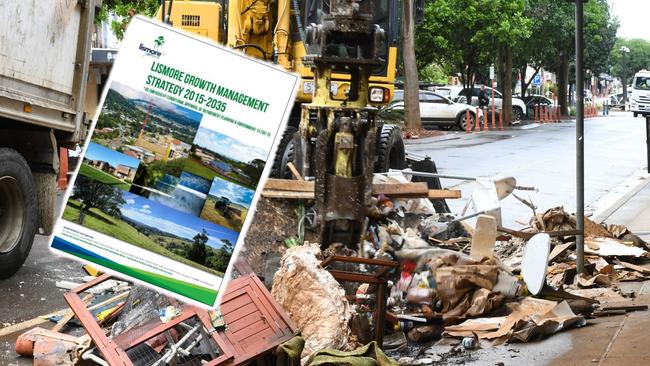

While debate rages whether some Lismore residents should relocate to higher ground, the cold facts of the back-to-back floods which devastated the city are only now coming to light.

Lismore was officially ground zero and the pained human face of Australia’s costliest ever flood.

The numbers have been tallied by the Insurance Council of Australia - and in dollar terms, the bill for the Northern NSW-South East Queensland catastrophe has been put at a whopping $3.346 billion.

As the country digests that reality, tensions in Lismore are back on a knife-edge with more rain forecast.

Take a walk around town, and the state of flux, exasperation and resilience can be found in every mud-crusted cranny.

The inevitable inquiries are in full swing, the blame game rages on social media, and Lismore is caught in the headlights with all sorts of post-flood notions including establishing an alternate CBD at the city’s only golf course.

The Insurance Council has released a raft of figures which paint the enormity of the current situation.

Firstly there’s the total cost of the event - which takes in the Northern Rivers and South East Queensland - at more than $3.3 billion.

To give that some context, the costliest storm event of all time was the 1995 East Sydney hailstorm with a normalised loss value of $5.6b.

For those with longer memories, the 1974 Brisbane floods had a normalised loss value of $3.16b.

Since the Black Summer of 2019/20 there have been 764,996 claims recorded from 12 declared catastrophes.

This has resulted in insurers recording $12.13b in claims costs over the past two years.

The sheer size of the devastation at Lismore - and across the Northern Rivers and into the densely populated South East Queensland catchment - means the majority of householders and business owners are still waiting for things to be made good by their insurers.

That would come as no surprise to Lismore householders and business owners who have spent recent weeks working with their insurers toward redress.

As of late April, insurers had received 196,761 claims across Northern NSW and South East Queensland. Of these, 22,409 have been finalised and $580 million has been paid to policyholders.

The average claim cost is $17,000.

Just over 60 per cent of personal claims have been made for building, 12 per cent for motor and 27 per cent for contents.

And that’s not the end of it for Lismore, or for nearby towns like Ballina, Woodburn, Coraki and Byron Bay - as claims continued to be assessed by insurance companies.

The inevitable lag in getting through the massive number of claims has led to frustration on the ground, as homeowners wait for the green light to start arranging for repairs and/or replacement.

To address community concern, Lismore residents are invited to dial in to an online forum with insurance industry representatives on Thursday - and put their questions.

The digital ‘town hall’ meeting will be hosted by the Insurance Council of Australia, which represents all the major general insurers.

This will be a chance for policy holders to get up-to-date information on the claims process, complaints avenues and other useful information.

There will be presentations from the Australian Financial Complaints Association and Legal Aid, followed by a virtual Q&A where community members can ask questions.

The Insurance Council will next week announce dates and locations for in-person community forums to be held throughout Northern NSW.

Bookings are essential for the virtual town hall - go to insurancecouncil.com.au/onlinetownhall

“These online events are important for communities and individual policy holders to understanding the ins and outs of the claims process,” Insurance Council chief executive officer Andrew Hall said.

“We understand that there are sometimes delays and the industry is working through the current challenges.

“We hope this online event will provide policy holders with a clear picture as to the processes in place to support those affected as soon as possible.”