Warana man learns lessons after BussQ insurance drama

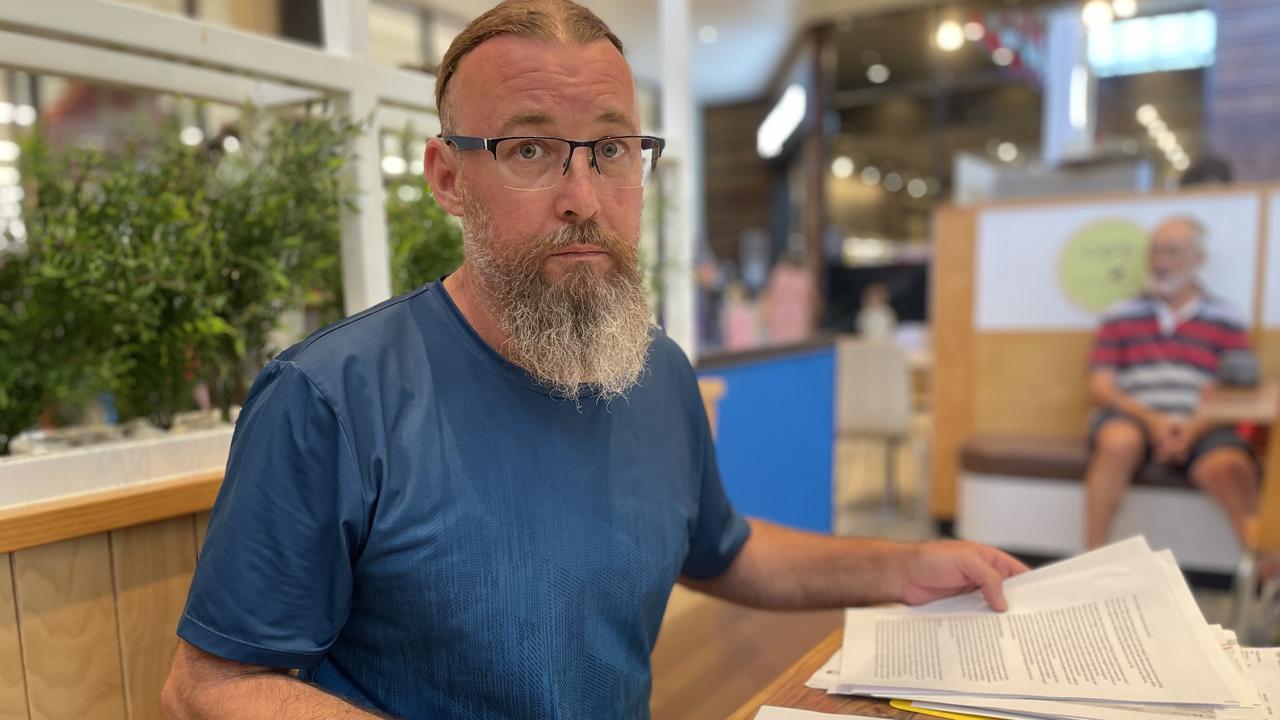

A terminally ill man is devastated he has nothing to leave his children following six years of drama surrounding his insurance and is now warning others of his lessons learnt.

Sunshine Coast

Don't miss out on the headlines from Sunshine Coast. Followed categories will be added to My News.

A terminally ill man has been left without any compensation following a protracted battle with his insurer for a payout of more than $500,000.

He is now speaking out to warn others to get legal advice and ensure they have access to their full medical history before signing income protection or disability insurance.

In July 2014, Warana resident Jason Tapp applied to increase his income protection, plus his total permanent disability from $60,000 to $500,000 and insured death benefit from $200,000 to $2m with BussQ.

McDermott Aviation CEO voices fear for future pilot training at Teewah

Mr Tapp claimed that following a physical exam and a blood test, BussQ approved the changes.

Then the steel fixer of more than 20 years, who estimated he lifted more than six million kilograms over the course of his career, twisted his ankle and went to the doctor in December 2016.

“The doctor got me to do an x-ray on my back,” Mr Tapp said.

“When he got the results, he shook his head and said ‘mate, your career is over’.

“‘If you continue ... you’ll end up in a wheelchair.’”

Mr Tapp first made an income protection claim and then the total disability claim six months later.

BussQ denied them in 2017.

“That’s when I called Slater and Gordon,” Mr Tapp said.

As the law firm lodged appeals over the claims, Mr Tapp lived on about $500 a fortnight.

He sold his car and most of his possessions to pay rent but, eventually, he lost his home.

He said his doctors believed it was likely he picked up his terminal lung condition during one period of sleeping rough for six months.

Mr Tapp claimed in a recent court appearance that he was prescribed CBD oil and it had shrunk the growths on his lungs but it became too expensive.

In a release, BussQ stated that if his full medical history was advised in 2014, Mr Tapp would have been declined for the increases.

The insurer also stated that it made “good faith” payments between January and June 2016 because Mr Tapp was in financial difficulty.

“The decline was objected to by the member’s solicitor, Slater and Gordon in June 2017, and the claim went through a re-review,” BussQ said.

“The claim decline was maintained in August 2017.”

The insurer then “re-reviewed and declined again” in December 2019.

“... It was found that the member had worked in various periods of employment,” the insurer stated.

Mr Tapp said he was forced to work because he had two children to care for.

They said Mr Tapp’s cover was removed from his account “effective the acceptance date of January 2015” and all premiums refunded.

“The account was put back to the position it should have been in, which was the default cover of $200,000 death and $60,000 (total permanent disability),” the insurer stated.

Mr Tapp said he had placed his “full faith” in BussQ in 2014.

“They had an opportunity to do their due diligence ... they could have easily said no,” he said.

He said he did “not purposely” leave out information about his medical history.

A Slater and Gordon spokeswoman said she could not comment on “the substance” of Mr Tapp’s personal injury claim.

“In order for Mr Tapp to progress his claim there were a number of actions he was required to undertake,” she said.

“We provided advice to Mr Tapp ... but he did not take the required actions.”

She said the law firm was aware of Mr Tapp’s personal circumstances and provided him with support.

Mr Tapp said his periods of homelessness and lack of transport made it impossible to get to specialist appointments in Brisbane, as lawyers requested.

Mr Tapp claimed his lawyer had sporadic contact with him.

Following his experience, he said he would have ensured he had access to his full medical history and a lawyer before applying for an increase in insurance.

“I don’t want any other families to go through this,” he said.

Mr Tapp has engaged Maurice Blackburn lawyers to try and continue his appeal.

“Once I give up and walk away, then it gets real,” he said.

“I worked hard to provide for my children’s future and now they’ll be left with nothing.”

More Coverage

Originally published as Warana man learns lessons after BussQ insurance drama