More banks hike up interest rates

Three of the four big banks have now changed their interest rates for mortgage holders and some saving accounts.

Three of the four big banks have now changed their interest rates for mortgage holders and some saving accounts.

Millions of customers will be able to track their carbon footprint based on their spending habits as the bank vies for a stake in the nascent green lending market.

The sharemarket has closed flat after recovering, as US futures gains. Most sectors closed in the black, offsetting falls across the financial sector, led by NAB. Westpac joins ANZ and NAB to hike rates after RBA’s 11th move.

Westpac’s Bill Evans has slashed his forecast on interest rate hikes, tipping the Reserve Bank will decide not to move any higher.

Megaport rockets on guidance upgrade. Bubs Australia launches China review. Bank of Japan to review monetary policy. Mirvac cuts outlook. Woodside defends climate policy.

Westpac has become the latest forecaster to declare the housing downturn is ‘largely over’ as auction clearance rates lift and prices track higher in April but there are risks on the horizon.

The near-term unemployment rate will be difficult to balance as the bank pursues its specific inflation target, Westpac’s Bill Evans says.

Westpac says case for a May hike is stronger than April. Iron ore rallies on Chinese GDP growth. Telix, Core Lithium rise on updates. OZ Minerals exits ASX on BHP deal.

With the shift away from cash-based transactions, the big banks have been reducing their ATM networks. A new deal will give Westpac’s customers free access at Armaguard’s ATMs.

The honeymoon’s over for new customers as the big banks quietly take attractive discounts off the table. CBA and Westpac are the latest to lift rates on variable loans.

There’s more pain for new homeowners as one of Australia’s biggest banks announces new rate hikes on its home loan repayments.

Australians are feeling the most optimistic about the nation’s economy in nearly a year after the Reserve Bank ended the most aggressive rate rising cycle in history.

The big lenders have shown the rest of the world they are backing themselves and getting on with business.

ANZ says some branches will be cashless in a move critics argue will hurt vulnerable Australians – but will other big banks follow?

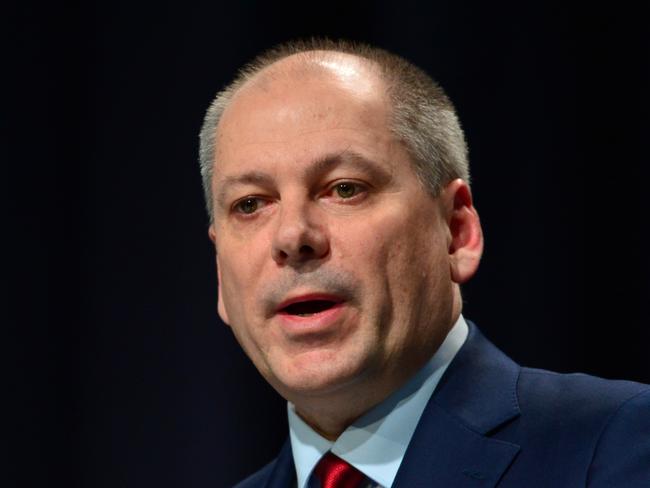

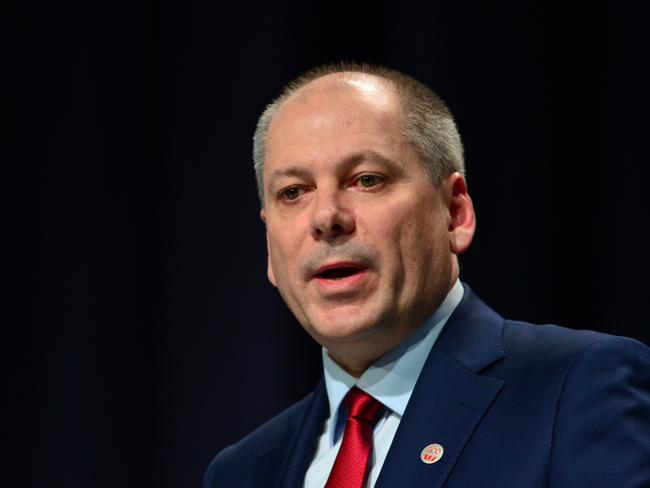

Westpac chief executive Peter King says the number of repossessed homes on the bank’s books is nearly back to levels recorded during the global financial crisis.

Westpac boss Peter King says the bank is closely watching its highly-indebted borrowers as the banking system responds to uncertainty.

The ASX 200 closed 1 per cent higher at a nine-day, led by energy and materials. Liontown soars 67 per cent after latest takeover bid. Global market turmoil isn’t over, warns ANZ boss Shayne Elliott.

Forecasters are pulling back from earlier predictions of ever-higher rates amid fears about global financial institutions and budget pain for many borrowers.

Shares end higher on energy, but fall for a sixth week – the longest since 2008. Westpac tips April pause. Kelsian dives after US buy raising. Link sells BCM for $48m.

Confidence among renters has fallen, helping hold household sentiment at recessionary levels amid soaring mortgage repayments, rents and living costs.

Shares close at 10-week low. Gold miners rally in volatile trading. Real estate stocks lift on rate bets. IPH reports cyber incident. Wall Street tipped to rebound.

NAB, Westpac, and ANZ have all moved to raise borrowing rates after the RBA lifted the cash rate on Tuesday, but some banks are rewarding savers better than others as the need for cash grows across the industry.

NAB, Westpac, ANZ reveal rate hikes. Myer shares rocket after dividend boost. Xero jumps on move to cut up to 800 jobs. Piedmont halts, will respond to short-seller claims.

Westpac chief economist Bill Evans has warned that the country must tame inflation, amid calls from union and housing industry bosses for the RBA to freeze rate hikes.

Influential Westpac chief economist Bill Evans reckons the Reserve Bank of Australia is facing its ‘now or never’ moment to get inflation back under control.

Westpac has launched a new feature to block suspicious transactions amid concern about a boom in scams.

One of the big four banks has introduced new protection against scams as customer losses reach a new “record high”.

Westpac’s chief economist Bill Evans says the Reserve Bank may have underestimated the level of variable-rate borrowers with no spare cash or capacity if the official rate hits 3.6 per cent.

One of the big four banks has explained their new prediction on when interest rates will drop – and delivered a warning to RBA boss Phil Lowe.

Gold miners lead broad gains. Harvey Norman tumbles on sales hit. Adbri confirms Irwin as CEO. Retail sales rise more than expected. Rex fails to post profit.

Original URL: https://www.theaustralian.com.au/topics/westpac/page/11