‘Repossessed homes near GFC levels’, says Westpac

Westpac chief executive Peter King says the number of repossessed homes on the bank’s books is nearly back to levels recorded during the global financial crisis.

Westpac chief executive Peter King says the number of repossessed homes on the bank’s books is nearly back to levels recorded during the global financial crisis, sounding the alarm on the risk of overextended borrowers defaulting as climbing interest rates and cost-of-living pressures eat into household budgets.

Mr King said the proportion of customers falling behind on mortgage repayments remained low but pressure would only build over coming months as the 10 rate hikes since May flowed through in full to interest payments and borrowers rolled off fixed-rate loans.

“Interest rates are a blunt tool. What we’re looking at in our portfolio is who might need help,” Mr King told a business summit on Tuesday.

“The part of the portfolio we’re watching very closely (is) high debt to income — that’s people who borrowed to their maximum debt capacities,” he said.

The failure of three American lenders in recent weeks and the shock end to Swiss giant Credit Suisse have revealed the toll that surging interest rates are taking on the global financial system.

As investors fret over the potential for a new global credit crunch that would sink the global economy, Jim Chalmers spoke with US Treasury secretary Janet Yellen on Tuesday morning and European Central Bank president Christine Lagarde the night before to discuss the ongoing instability in the American and European bank sectors.

The Treasurer, who will convene an extraordinary meeting of the Council of Financial Regulators on Thursday, said “it’s clear from my conversations that international authorities are prepared to do what’s necessary to reassure markets at a time of uncertainty and volatility”.

ANZ boss Shayne Elliott said global market turmoil wasn’t over and more people were likely to be hurt by the fallout from central banks’ battle to tame inflation.

He told a business lunch in Brisbane that the world was a riskier place following the collapse of Silicon Valley Bank. “It isn’t over and it is not going to go back to the way it was quickly,” Mr Elliott said.

“The world is different when you’re living in a world with rising interest rates. To paraphrase a quote from economist JP Morgan, ‘When the Fed put the brakes on the economy, somebody always goes through the windscreen’,” he said.

“So we should remain alert, not alarmed. I don’t think we’re heading for another huge crisis but that doesn’t mean there isn’t turmoil and that won’t impact people.”

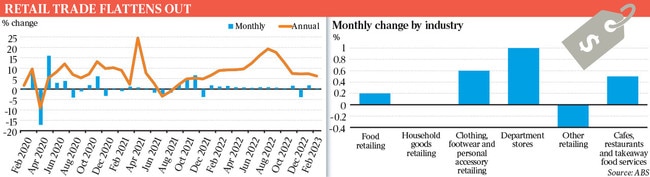

The comments came as new retail trade figures showed the most aggressive monetary policy in three decades had yet to translate into a collapse in spending, pointing to an eleventh straight rate hike to 3.85 per cent at next week’s Reserve Bank board meeting.

Retail sales lifted by a “modest” 0.2 per cent in February as Australians continued to spend more in cafes and restaurants, the Australian Bureau of Statistics figures showed.

Ahead of Wednesday’s key February inflation figures, economists said while consumption was slowing, it remained high and the RBA likely had more work to do to cool demand in the economy.

With consumer price growth running at 7.8 per cent in the year to December amid accelerating rental costs and power bills, ANZ economist Madeline Dunk said her bank’s internal card spending data pointed to a “broadbased pullback” in March.

“We think spending momentum will continue to deteriorate, as household budgets are squeezed by rising rates and inflation,” Ms Dunk said.

However, cost-of-living pressures didn’t stop Australians upping their spending in cafes and restaurants in February, helping retail sales inch higher and painting the picture of ongoing resilience among consumers.

Turnover in cafes and restaurants was more robust, increasing by 0.5 per cent in the month, the ABS said.

Department store sales also lifted by 1 per cent, and clothing and footwear retailing increased by 0.6 per cent.

There was a mixed performance elsewhere as households reined in spending on discretionary items, with “other” retailing dropping by 0.4 per cent in February. Household goods spending was steady, the seasonally adjusted figures showed.

KPMG chief economist Brendan Rynne said “this latest data suggests that retail sales growth remains constrained by the ongoing low consumer confidence and the dampening effects of high inflation”.

Dr Rynne said the latest retail trade report “seems unlikely to be enough to cause the RBA to pause its cash rate hikes next week, following high monthly employment figures in February, and the interest rate increases in the US, UK and EU in the past week”.

Households were still spending 16 per cent, or about $4.8bn, more each month than a pre-pandemic trend line would suggest, NAB economist Taylor Nugent said.

Additional reporting: Glen Norris