Welcome whack: Banks pull discounts for new customers

The honeymoon’s over for new customers as the big banks quietly take attractive discounts off the table. CBA and Westpac are the latest to lift rates on variable loans.

The Reserve Bank paused the cash rate at 3.6 per cent this month, but there’s little relief for new customers at the big four banks as variable rates creep higher alongside decreasing fixed rate options.

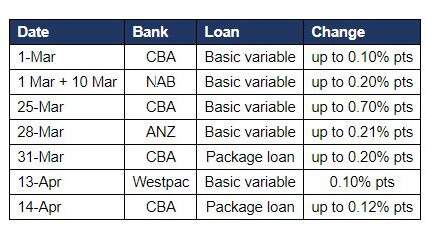

Commonwealth Bank on Friday said it is raising rates on its package variable home loan, which includes an offset account, by up to 0.12 percentage points but only for new customers.

Rates comparison site RateCity.com.au noted it was the second time Australia’s biggest bank has increased the new customer rates on this loan in the past two weeks.

“In total, since March 31, the bank has increased these rates by up to 0.22 percentage points,” RateCity research director Sally Tindall said.

Rival Westpac made a similar move on Thursday.

Westpac increased the rate on its basic mortgage by 0.1 percentage points for new customers taking out owner-occupier and investor home loans. RateCity said Westpac’s lowest variable rate is now 5.24 per cent.

However, the rate increases by 0.4 percentage points after two years. Existing customers are not affected.

NAB and ANZ increased select new customer variable rates last month.

CBA on Friday also cut its three-year fixed rate loan by 0.4 percentage points for owner-occupiers and investors paying principal and interest.

“At the start of the RBA hikes, the big four banks cut new customer rates repeatedly in a bid to bring in new business,” Ms Tindall said. “This aggressive discounting is now in reverse.

“After 10 cash rate hikes and steep increases to wholesale funding globally, the big banks are now quietly slipping their biggest discounts off the table.

“All four big banks have now walked back some of their new customer discounts as they feel the heat from the rising cost of funding.”

She said the refinancing boom has driven banks to offer competitive new customer rates. “The unprecedented volume of loans now refinancing is no doubt putting added pressure on profit margins,” Ms Tindall said.

“It’s likely to be getting too expensive for the banks to hand out discounts of this magnitude at these volumes.”

The RateCity database shows 16 lenders have taken the knife to fixed rates in the past two weeks, while just eight have hiked rates.

“With many economists predicting cash rate cuts in the next couple of years, it’s no surprise many Australians are deciding to keep their options open with a variable rate,” she said. Some economists said Thursday’s stronger-than-expected jobs report could result in the RBA lifting rates again.

The RBA paused interest rate rises in April following 10 consecutive increases.

VanEck head of investments and capital markets Russel Chesler said the RBA would raise rates again because unemployment was still historically low and inflation continued unabated.

“Something has to give,” he said. “With stubborn inflation and a tight labour market, we expect one more interest rate rise and then expect the RBA rate to remain at 3.85 per cent for the rest of the year.”

But ANZ economists don’t expect another rate rise from the central bank until August.

Morgan Stanley analysts believe after this week’s jobs data, the bar for a quick shift back to rate hikes in the near-term is quite high.

“Accelerating core inflation (with the quarterly CPI data due to be release on April 26) is likely required to bring the May meeting back into play,” they said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout