Westpac declares house price correction ‘largely over”

Westpac has become the latest forecaster to declare the housing downturn is ‘largely over’ as auction clearance rates lift and prices track higher in April but there are risks on the horizon.

Influential Westpac chief economist Bill Evans has become the latest forecaster to declare the housing market price slump won’t be as bad as initially feared.

But he has warned the housing market will remain on edge in the near term with prices expected to hold flat this year with a sustained recovery only coming in 2024.

Westpac had previously flagged a further 7 per cent fall in prices this year.

“Australia’s housing correction is largely over, several factors combining to produce a stabilisation,” Mr Evans and senior economist Matthew Hassan said in a market update on Monday.

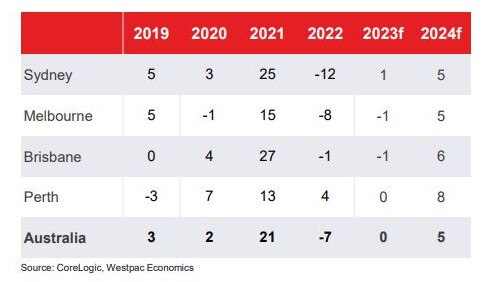

“Prices now expected to lift 5 per cent in 2024, revised up from +2 per cent.”

They noted that increased migration, rising construction costs and a lower level of supply were contributing to the market’s stabilisation.

Prices nationally held flat in February, posted a 0.8 per cent gain in March and are tracking a similar gain for April based on daily figures for the month to date, Westpac said.

Westpac has revised its forecasts and now see a peak to trough decline nationally of 10 per cent in housing prices, rather than 16 per cent as previously forecast.

“Further rate cuts and an improving economic backdrop will see momentum carry into 2025 although affordability is likely to constrain upside prospects,” Mr Evans said.

The price gains are lopsided – centred on Sydney where ‘upper tier’ markets are leading the way – but Westpac said all major capital city markets have now seen prices stabilise or post small rises over the last three months.

Auction markets also show clearance rates have lifted to be back around long-term averages in April with pre-auction withdrawals also back near long run averages.

Turnover also appears to have stabilised, and housing finance approvals figures to February show a clear moderation in the pace of decline.

“Another major slide seems unlikely although gains will be hard to sustain given interest rates and wider economic headwinds,” Mr Evans said. “A May rate hike is likely to ‘check’ the improvement in housing-related sentiment near term. Some lift in ‘on-market’ supply is also likely to test the depth of demand.”

Mr Evans said the main risks continue to centre around inflation, particularly if disappointing progress on bringing inflation under control leads the RBA to resume hiking rates later in the year but also if ongoing high inflation constrains the central bank from easing policy

in 2024.

“Both developments would clearly undermine housing market improvements and could potentially lead to a reversal,” he warned.

Financial markets are pricing in a 17 per cent chance of the RBA hiking the official cash rate by 25 basis points to 3.85 per cent in May.

Global banking heavyweight HSBC last week lifted its expectations from a year-on-year fall of 6-8 per cent for the Australian housing market in 2023, to a fall of just 1-3 per cent.

HSBC chief economist, Australia and NZ, Paul Bloxham, said the reopened international border had driven a stronger-than-expected pick up in inward migration, which was boosting housing demand and supporting a levelling out in housing prices earlier than expected.

If this was the end of the downswing, it was a smaller and earlier peak-to-trough fall than expected, said Mr Bloxham who had previously predicted a fall of about 15 per cent.

“Population growth has been even stronger than we had factored in and the leading indicators of new construction have been weaker than expected,” Mr Bloxham said.

“However, we do not expect a big bounce in prices, given the fixed-rate mortgage resets and expected economic slowdown,” Mr Bloxham said.

It followed the RBA last week noting that housing prices steadied in March following an 8 per cent decline from their peak a year ago and that prices could stabilise earlier than expected and at a level above the previously forecast trough.

CBA head of Australian economics Gareth Aird said the bank would be revisiting its house price forecasts over coming weeks.

Mr Evans said the stabilisation in the housing prices has not been an interest-rate driven shift.

He noted that survey measures suggest most consumers are still bracing for further rate rises near term.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout