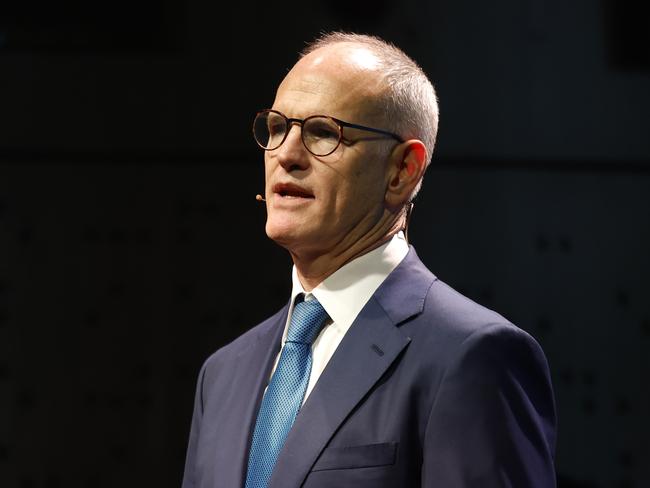

Focus on keeping energy costs low: APA Group CEO

Adam Watson is focused on doing everything he can to keep energy costs low, amid an uncertain environment.

Adam Watson is focused on doing everything he can to keep energy costs low, amid an uncertain environment.

Insurance boss Nick Hawkins says there is plenty of potential ahead in making Australia’s tax system fit for a modern economy.

Outgoing banking boss Shayne Elliott says we may have passed the worst but risks remain in the outlook.

Andrew Harding says rail infrastructure is critical to keep the economy moving when disaster hits. That’s why we need to put it back on the priority list.

Alexis George says Australia’s economy has slowed to a crawl, amid the biggest slump in per capita GDP since the early 1990s recession, outside of the pandemic.

Michael Miller says a lot of personal and business uncertainty exists across Australia due to previously unseen combinations of economic indicators.

Matt Halliday calls for economic discipline, to enable the forecast interest rate cuts that will assist in stimulating the economy.

Cynthia Scott says the payments company is built around tech, guardrails will be needed for AI.

Shemara Wikramanayake expects the RBA to ease rates toward the middle of next year, easing pressure on household budgets and supporting the housing market.

David Koczkar says many of his customers experienced cost of living pressures this year, and he expects that to continue into 2025, even if there is a rate cut.

Cecile Wake says commodity exports, tax receipts and government spending underpin the economy and stagnant productivity is a threat to that going forward.

Andrew Cartledge says the nation needs to double down on education to train more specialist tech staff.

Andrew Irvine says Australia needs more skilled migrants and to be more innovative on types of housing and construction methods, to address its crisis.

Frank Calabria says global energy transition presents enormous opportunity for Australia to be a leading economy in decarbonisation.

Paul Digney says there is virtually nothing in the current workplace relations settings to promote productivity.

Todd Barlow says we really need to see lower expenditure and lower employment growth from the government to reduce interest rates.

Graham Kerr is focused on using generative AI to drive productivity, for example through the development of large language models to enhance interactions with safety data.

Steve Johnston says building and motor repair costs are starting to moderate, but they are still well above the general inflation rate.

Jonathan Davey says small businesses are key to the economy and they continue to feel the pinch, even with interest rates steadying.

Owen Wilson says property rent prices are still rising, on the back of low stock, and contributing to higher RBA interest rates.

Investment banking boss Anthony Sweetman says despite cash rates holding high, confidence is coming back around dealmaking.

Scott Charlton’s capex spend is about to jump from $500m to $700m to meet demand coming at the airport with new infrastructure.

Ben Pfisterer who heads up payments platform says now is the time to double down and invest.

The nation’s biggest poll of business leaders comes with a pointed warning for both sides of politics heading into an election year.

Deanne Stewart sees a strong pipeline of investment opportunities is digitisation and the digital economy.

The Australian surveyed the nation’s CEOs on inflation, energy and opportunities for 2024. From Judo and Kmart to Rio Tinto. These are the responses for J-R companies.

Kmart Group boss Ian Bailey has told the 2024 CEO Survey that he believes poorly crafted IR laws being pushed by the federal government pose a threat to jobs.

AMP is facing some of its toughest trading conditions as the flow of cheap money that helped fuel returns dries up, chief executive Alexis George says.

Wind farm components are scarce, transformer supply is patchy and sourcing the special steel for them is even harder. AGL boss Damien Nicks explains the vast challenges of energy transition.

Superannuation funds will come under pressure to come up with policies to assist Australians moving into retirement, industry leaders have told The Australian’s 2024 CEO Survey.

Original URL: https://www.theaustralian.com.au/topics/ceo-survey/page/2