Lucrative iron ore royalty spin-off a ‘liberation’

Mineral sands miner Iluka is pushing ahead with plans to demerge a lucrative iron ore royalty asset that has been a steady source of cash flow.

Mineral sands miner Iluka is pushing ahead with plans to demerge a lucrative iron ore royalty asset that has been a steady source of cash flow.

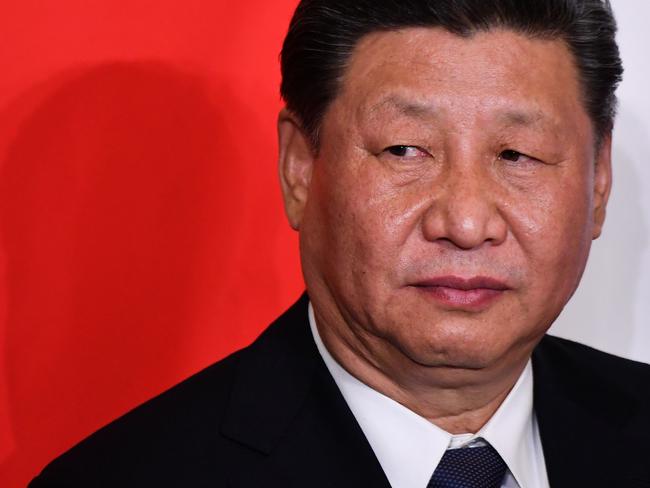

China believes Australia has exploited the pandemic to force it to pay exorbitant prices for iron ore. And Xi Jinping is determined to teach us a lesson.

Having convinced BHP and Rio Tinto to favour local workers, the WA Government is now trying to lure young West Australians to toil in the regions for agricultural work.

The extension of Victoria’s lockdown weighed on Transurban, but did little to hamper recovery in the major banks, while the newest BNPL stock jumped 45pc.

Share losses accelerated at the close, to mark the benchmark’s worst day since May 1, with more weakness to come in the US overnight.

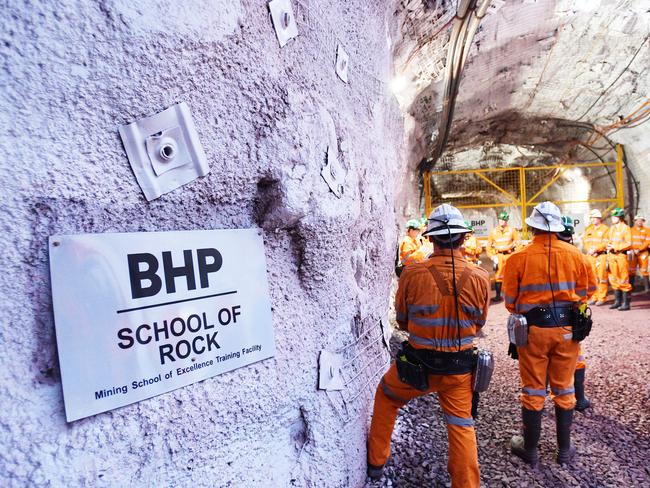

BHP says using new LNG-powered vessels to ship iron to China from 2022 will cuts its greenhouse gas emissions.

In the midst of an Australian corporate bond frenzy, BHP is playing it differently.

Shares touched 5-day highs but faded at the close, led by outperformance in Dexus on takeover talk, while BHP traded ex-dividend.

India-based commodity trading company, Adani Group, ran the rule over the Mount Arthur thermal coalmining operations in NSW last year.

One of Australia’s major mining companies says it will reduce emissions by 50 per cent from its electricity usage in Queensland.

Son of former BHP chairman pleads guilty to a charge of obstructing ACCC probe into alleged cartel conduct by steelmaker BlueScope.

BHP has signalled a greater focus on building joint exploration ventures with junior miners.

Strength in Woolworths and BHP helped the market to hold on to gains at the close, as Fortescue shares rose to new heights.

Resources giant BHP is understood to have hired UBS to work on the sale or demerger of its coal mines.

The executive leadership team changes at BHP foreshadow more significant shifts.

BHP plans to join ExxonMobil in selling its Bass Strait oil and gas assets in a potential $3.5bn deal.

The miner still warned it could take two years for global economies to return to their earlier growth track.

At a strategic level, the BHP we see emerging in 2020 is unlike any previous iteration of the Big Australian.

Volatile commodity prices dented BHP’s full-year profits, but the mining giant’s huge iron ore assets operations bolstered its bottom line.

BHP is understood to have called on Goldman Sachs to work on a potential $2bn-plus demerger of its coal mining assets.

Mining giant promises ‘real time’ disclosure of disputes with industry groups over policy positions.

Rio shares closed down 3pc after the first round of its cave blast inquiry, while the RBA board says the recovery is slower than first thought.

Shares rose 0.7pc amid a surge in resources, while retailers cheered strong results from Nick Scali and Freedom Foods appointed a new boss.

Iron ore wars back in full swing as BHP flags a rise in Pilbara exports and Brazil’s Vale promises a dramatic increase in output.

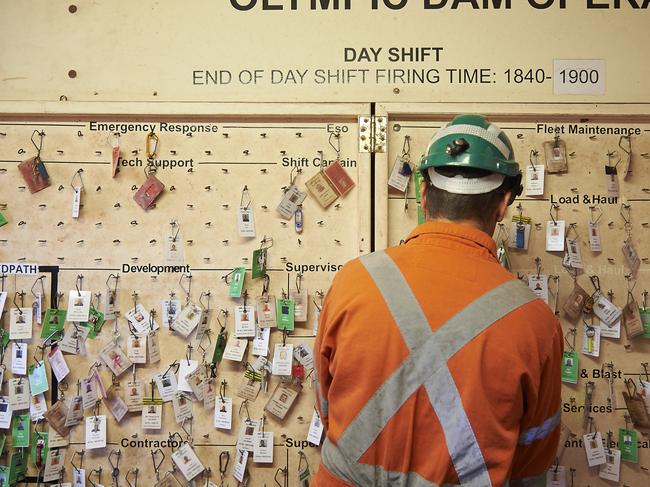

BHP has sought to calm job fears as it moves to introduce autonomous trucks at a second Queensland coal mine next year.

The last time BHP looked outside its own ranks for a finance boss was in 1999, when Paul Anderson tapped Chip Goodyear.

The federal government should spend on social housing and dams.

In a rollercoaster session, the market started firmly higher, fell on reports of a new trade threat and finished the day near its lows.

The changes from China come as the iron ore price surges, with Brazil’s Vale facing further production disruptions.

The ASX slipped by 0.4pc but was supported slightly by strength in Fortescue and BHP, while Rio told shareholders China was back to ‘business as usual’.

Original URL: https://www.theaustralian.com.au/topics/bhp-group-limited/page/35