ASX rewinds on China iron ore threat as BHP, Fortescue reverse

In a rollercoaster session, the market started firmly higher, fell on reports of a new trade threat and finished the day near its lows.

- No negative rates: Lowe

- China changes iron ore import rules

- Records fall as Afterpay hits US target

- Economy won’t fall off a cliff: Treasury

That’s all from the Trading Day blog for Thursday, May 21. The ASX gave up an early lift to cap a four day win streak as tensions flared with China over iron ore.

In local news, the heads of APRA, ASIC and the Reserve Bank discussed their response to the coronavirus crisis, including a push for lenders to increase their response. Aristocrat reported a 13pc profit drop as venues were closed while Afterpay surged to new records on strong US growth.

Damon Kitney 8.40pm: Rethink risk, Australia: Gonski

ANZ chairman David Gonski says Australia needs to radically rethink its risk planning for the future following the COVID-19 pandemic crisis, including being more self-sufficient in oil and being prepared to undertake domestic manufacturing of essential health supplies.

In a wide-ranging interview Mr Gonski also lashed some members of the commentariat for some of the irresponsible views that had been expressed during the crisis and said he adamantly believed the country could return to normality in 2021.

“It is quite sad that many who give the commentary fill the space and don’t actually do their homework,” Mr Gonski said, referring to one commentator who was pushing for governments to adopt herd immunity when so many people had to fall ill with coronavirus to achieve it.

David Swan 8.23pm: Afterpay surge on US users

Shares in “buy now, pay later” provider Afterpay climbed to a new high on Thursday, buoyed by strong customers numbers in the crucial US market.

The company said it had reached its US target six weeks early. The market darling now has more than 5 million active shoppers in the US, with more than 9 million US customers on its platform.

It said that more than 1 million customers had joined Afterpay in the past 10 weeks since the COVID-19 pandemic took hold, and that it had added customers 30-40 per cent faster every week than it did in January and February.

The company’s new US clients include American Eagle, Birkenstock and The Hut Group.

Jared Lynch 7.56pm: No Smile as exec exits

The revolving door in the C-suite at embattled listed dental play Smiles Inclusive has continued to swing, with the company farewelling its third executive in eight months.

Chief executive Michelle Aquilina — who was appointed in mid-April, the company’s third CEO in two years — announced the departure of CFO and company secretary Emma Corcoran last week. Her departure comes after Smiles’ former chief commercial officer left the company last September and questions have been raised over the company’s solvency.

The Australian is not suggesting not suggesting Ms Aquilina or Ms Corcoran engaged in any wrongdoing, only that the company has experience high executive turnover.

Smiles shares have been suspended from trading since late February after it missed the deadline to file its audited half-year accounts, which the company said were awaiting final sign-off from KPMG.

Perry Williams 7.37pm: Can we expect big gas price falls?

Woodside Petroleum said big gas users should not expect dramatic falls in prices amid a government-linked plan that proposes using cheap supplies to boost the nation’s dwindling manufacturing base.

A leaked report from the National Covid Co-ordination Commission estimates up to 412,000 new jobs could be created by 2030 through the gas boost spread across mineral technologies, steel, petrochemicals, food and ammonia manufacturing.

However, with the report suggesting long-term supplies at just $4 a gigajoule, less than half current levels, the Woodside boss said all players in the debate needed to be realistic. “It can’t get any lower than at the moment,” chief executive Peter Coleman said when asked about pressure to cut prices.

“I’m afraid if companies aren’t doing particularly well out of the current energy malaise, then they have other fundamental problems. We can’t get any lower.”

James Kirby, Alan Kohler 6.46pm: Listen to the Money Cafe podcast

Wealth editor James Kirby and InvestSMART’s Alan Kohler give you this week’s Money Cafe about Amazon, travel titans and recession.

Send your own questions to James Kirby and Alan Kohler via moneycafe@theaustralian.com.au

Find all episodes of The Money Cafe and subscription links here.

—

Wealth Editor James Kirby presents Your Portfolio, a free series of Facebook live Q&A sessions for The Australian each Wednesday evening at 7.30pm.

Robyn Ironside 6.15pm: Virgin $238m cash grab

Virgin Australia administrators have their eye on $238m in restricted cash to help keep the airline flying and competing with Qantas, until a sale is finalised.

The first committee of inspection meeting as part of the administration process heard Virgin Australia currently had just over $100m in cash which could potentially tide it through to the end of July.

The federal government has refused to help out, so additional funds are being sought from state governments with Houlihan Lokey chasing commercial lending options.

Max Maddison 5.44pm: HSBC house price tumble prediction

The Australian house prices could tumble 12 per cent in 2021, as a U-shaped recovery and COVID-19-related policies take their toll, said Paul Bloxham, chief economist at HSBC.

Falling housing prices across the second half of the year are predicted to write off a portion of accumulated price gains, Mr Bloxham predicted, that would remain 4 to 6 per cent higher. However, stalled migration and rising unemployment were likely to drive housing oversupply.

On the positives, Mr Bloxham said low interest rates, combined with the containment of the outbreak, would work to make the housing market more attractive to borrowers. However, rising unemployment could curtail the number of potential borrowers, while lenders were more cautious.

Eli Greenblat 5.12pm: Myer to reopen remainder of stores

The nation’s biggest department store Myer will reopen the remainder of its stores from next Wednesday after last month closing its outlets in the wake of the coronavirus pandemic.

In the last fortnight, Myer has been slowly opening its stores as government directives over social distancing, home isolation and outside gatherings are slowly relaxed or tweaked as the federal government works towards its July target of reopening the economy.

Myer said on Thursday it will open the remainder of stores from next Wednesday – 27 May 2020 – they are:

ACT: Belconnen

NSW: Penrith, Castle Hill, Chatswood, Parramatta, Sydney City, Bondi, Shellharbour, Warringah, Macquarie, Roselands

Qld: Cairns, Brisbane City, Robina, Indooroopilly, Mt Gravatt, Pacific Fair

Vic: Ballarat, Bendigo, Doncaster, Eastland, Fountain Gate, Frankston, Geelong, Highpoint, Southland, Werribee, Chadstone, Northland, Melbourne, Knox City

WA: Perth City

SA: Adelaide City

Tas: Hobart, Launceston

Bridget Carter 4.59pm: Genworth to tap bond market

DataRoom | Listed mortgage insurance firm Genworth Mortgage Insurance Australia is the latest company in the financial space set to tap the bond market.

Expectations are that the issue will be worth somewhere between $200m and $250m and Nomura is believed to be working on the raise.

It comes after Macquarie Group priced its $500m raising from fixed income funds at 290 basis points above the 90-day Bank Bill Swap Rate, lower than the initial 315 basis points first touted.

The Macquarie Bank Capital Notes 2 offer was understood to have secured strong support, with NAB, CBA, ANZ, Westpac and Macquarie all working on the transaction.

Genworth is expected to tap the market shortly.

It told the market on May 6 that it continued to monitor the market for an appropriate time to issue new Tier 2 debt.

4.43pm: Banks drag as iron ore hogs headlines

While iron ore miners were in the headlines, it was the major banks that did the most damage on Thursday.

Commonwealth Bank lost 1.7 per cent to $59.05 while Westpac fell 1 per cent to $15.17, ANZ slipped 0.8 per cent to $15.39 and NAB dialled back by 0.5 per cent to $15.52.

The move lower came as the heads of each of the three major regulators discussed their respective responses to the coronavirus crisis.

Both the RBA’s Phil Lowe and APRA’s Wayne Byres stressed the importance of banks in the recovery process, saying the capital buffers that had been built in better times were best used now.

In the major miners, BHP gave up 0.6 per cent to $34.51 as Fortescue traded down by 2.2 per cent to $13.60 and Rio Tinto slipped by 1 per cent to $93.19.

Here’s the biggest movers at the close:

4.14pm: Trade jitters cut short ASX rally

Escalating tensions with China were sharply in focus on Thursday as investors weighed up a potential threat to iron ore exports.

Continued optimism of economic reopening and renewed support from global central banks spurred an early 0.7 per cent lift on the ASX but the trade shock swiftly erased gains by the halfway mark.

Reports of changes to iron ore import rules from China stoked fears that the nation could be lining up for a fresh attack on Australia after clamping down on barley and beef exports earlier this week.

By the close, the ASX was lower by 23 points or 0.4 per cent to 5550.4.

Miners dialled back by 0.6 per cent on the trade threat, but financials were hit hardest – down 0.8pc for the session.

Max Maddison 3.50pm: Qantas profit won’t return til 2022: MS

Qantas is forecast to return to profitability in 2022, but “normal” airline traffic is unlikely to resume until the year after, says Morgan Stanley Research.

In an analyst note, Morgan Stanley analysts led by Niraj Shah revised its earnings profile for the Alan Joyce-led company, saying the return to normal airline traffic from 2023 financial year (FY) onwards would assist the company return to profitability.

Qantas is estimated to post two years of losses – $330m in FY20 and $300m in FY21 – before posting a profit in FY22.

Mr Shah based his profit forecast on traffic running under 2019 or “normal” capacity for the next three years: 74 per cent this year, 44 per cent in FY21 and 83 per cent the year after.

However, despite the positive forecast, Morgan Stanely revised Qantas’s share price down to $5.20, citing the company’s liquidity position. Mr Shah said the targeted net cash burn reduction to $40m per week “seems at the high end” compared to global peers.

In late trade, Qantas shares were trading 1.27 per cent higher at $3.58.

3.23pm: NRW leads on payout surprise

Mining services group NRW Holdings is the most improved in afternoon trade after bringing forward the payment of its interim dividend.

The group had previously deferred its dividend decision til August citing coronavirus concerns, but off the back of strong recent performance said it would pay out the 2.5c per share on June 9.

NWH shares are trading higher by 35pc to $2.23.

Read more: NRW brings forward payout

Bridget Carter 3.19pm: Myer, DJs near tenancy deal

DataRoom | Department stores Myer and David Jones are believed to be nearing a deal with at least one of their major landlords to recut lease agreements on some non-performing stores within their portfolios, say sources.

It comes as DataRoom revealed that David Jones had hired restructuring firm KordaMentha in recent months what the company says is a move to assist with its real estate.

Sources have told DataRoom that an agreement may have already been reached with Vicinity Centres, which owns high profile malls such as Chatswood Chase in Sydney and half of Melbourne’s iconic Chadstone mall.

This involves David Jones and Myer only paying for rent a per percentage of their turnover in stores that are non-performing, rather than any additional rent.

However, a Vicinity spokeswoman said the mall owner did not comment on commercial arrangements with its retailers.

Read more: DJs taps KordMentha as debt grows

Nick Evans 3.06pm: BHP, Fortescue welcome rule changes

It is understood Chinese authorities have been consulting with exporters, including Australian iron ore majors, on the proposed changes since October last year and the current rules changes have been well flagged with the industry.

A spokesman for BHP said on Thursday the iron ore major supports the changes, saying they would speed up the process for both exporters and BHP’s customers.

“We’re supportive of the changes to the iron ore inspection process and believe it will be create a more efficient supply chain for producers like us as well as our Chinese customers,” he said.

Fortescue chief executive Elizabeth Gaines also welcomed the changes, saying the company remained a core supplier of iron ore to China.

“This is part of a broader suite of efficiency reform measures under development by the Chinese Government since 2015,” she said.

Read more: Shares drop as China changes iron ore rules

2.44pm: Lowe drills down on confidence: NAB

RBA Governor Phil Lowe has emphasised the role of uncertainty in shaping the economic recovery, so points out NAB markets economist Kaixin Owyong.

In a note following the governor’s appearance at an online webinar, Ms Owyong writes confidence as a key takeaway from Dr Lowe’s comments. ‘

“He highlighted how uncertainty related to both the rollback of health restrictions and to people’s confidence about their future health and income,” she says.

“He also mentioned that total hours worked might not be quite as disastrous as the 20pc fall forecast by the Reserve Bank given the role of the JobKeeper wage subsidy.”

The sentiment backs up similar findings by Treasury Secretary Steven Kennedy, who found the critical role of policy was to ensure people were confident enough to return to work and companies confident to hire and invest.

Max Maddison 2.29pm: Higher regional bank provisions coming: MS

Regional banks’ provision coverage remains well below the major banks’ average, but Morgan Stanley analysts predicts higher COVID-19-related provisions could be on the horizon.

In an analyst note, Morgan Stanley said Bank of Queensland (BOQ) hadn’t raised its provision levels since early February, when it flagged a $10m pandemic related allocation, while Bendigo and Adelaide Bank was yet to announce a specific COVID-19 provision.

Provisions are used by banks to write off bad loans against profit.

However, Morgan Stanley said it expected the regional banks’ stance to change soon, forecasting Bendigo to raise a COVID-19 provision of $80m at its quarterly Pillar 3 capital and credit quality update next week.

In addition, Morgan Stanley said a larger top-up for Bank of Queensland would be required, citing the bank’s recent statement, that it would have needed to raise between $49m and $71m if it took conditions in early April as its benchmark.

However, even if both banks went ahead with a raise, BOQ and Bendigo provisions would likely still be significantly behind regional peer Suncorp, and even further behind the major banks, which have raised between $800m and $1.581bn respectively.

For example, for BOQ, proforma collective provisions of $189m to $211m represent approximately 14-17 basis points for housing loans and 91-99 bps for non-housing loans.

Comparatively, National Australia Bank has a collective provision for housing loans of 30 bps, while Commonwealth Bank’s provision for non-housing loans stands at 183 bps.

Geoff Chambers 2.01pm: Trade minister supports iron ore change

Trade Minister Simon Birmingham has joined Australia’s mining industry in welcoming moves by China to streamline its customs clearance of iron ore imports, describing it as a “positive example of the further opening of Chinese markets”.

Following recent clashes with the Communist nation over barley and beef imports, Senator Birmingham said Australia remained “committed” to a “mutually beneficial trade” relationship with China.

“We welcome any improvements in administrative arrangements that could streamline the customs clearance of iron ore imports,” Senator Birmingham said.

“Such easing of administrative barriers and costs would be a positive example of the further opening of Chinese markets that President Xi has previously committed to, as well as a reform that can help with global economic recovery.”

Minerals Council of Australia chief executive Tania Constable welcomed China’s move to streamline its iron ore testing, which “recognises the high quality of Australia’s iron ore”.

Read more: China cuts barriers to Aussie iron ore imports

Eli Greenblat 1.45pm: Coles inks data analytics deal

Coles has inked a new data analytics deal to help provide greater insights into customer shopping habits for its suppliers.

Coles has partnered with global market analytics provider IRI to provide suppliers with an unprecedented level of insight into customer needs, using data from more than 2,500 supermarkets, Coles Express convenience and Coles Liquor stores, the supermarket chain said on Thursday.

Coles last year named IRI as the sole provider of scan data and analysis drawn from all Coles businesses, providing subscribing suppliers with sales data for their products and the categories in which they operate, to help them plan for their business and identify growth opportunities.

As part of this partnership, Coles said it is now launching Coles Synergy, a new data analytics tool using IRI’s Liquid Data platform, which is used by major international retailers including Morrisons, Waitrose and Boots in the UK, Kroger and Albertsons in the US, Sobey’s in Canada and Conad in Italy.

Designed specifically for the retail and FMCG sector, it enables IRI clients to integrate multiple data assets including market, consumer, customer and supply chain.

1.30pm: APRA unfazed by decentralisation trend

APRA chair Wayne Byres takes a question on the economic and policy effects of decentralisation post-COVID.

He says the effects on property prices will be key, and while he’s “confident” there will be an impact, he’s “not unduly” concerned because it will play out over some time.

1.27pm: No negative rates: Lowe

RBA’s Lowe has reiterated his distaste for negative interest rates as a policy tool.

He says (unprompted) that a question that came up a number of times in the Q&A of today’s FINSIA webcast from a number of people was “were we thinking of using negative interest rates”.

“I said previously that it was extraordinarily unlikely that we would have negative interest rates and there has been no change,” Dr Lowe says.

“The Board is not contemplating negative interest rates in Australia. I think the costs of that exceed the benefits.”

Read more: RBNZ says ‘planning’ for negative rates

1.23pm: Rates won’t rise til growth robust: RBA

Answering a question at FINSIA about when monetary policy can be expected to be tightened, RBA Governor Lowe says that it won’t be until the economy is “growing robustly”.

“The time frame for that obviously depends to a great extent on the path of the pandemic and vaccine development,” he adds.

“We’ve got a lot resting on the shoulders of scientists here.”

1.12pm: Lowe’s biggest lessons from the GFC

RBA’s Dr Lowe is asked what the key lessons of the GFC have been. He answers:

- The importance of having buffers in the system

- Confidence is incredibly fragile and restoring it is key

- Contingency planning is incredibly important

1.01pm: Mining, bank hit reverses ASX gain

Shares have taken a hit in lunch trade as a new China threat emerges.

The benchmark ASX200 had jumped as much as 0.7 per cent, but reports that China was changing inspection laws for iron ore served a blow to the index.

At 1pm, the benchmark ASX200 is lower by 8 points or 0.13 per cent to 5565.5 – after slipping to 5545.2.

Miners are the key driver of the reversal – BHP and Rio Tinto are lower by 0.2pc as the major banks too slip lower.

Here’s the biggest movers at 1pm:

12.54pm: Dividend push did not happen lightly: Byres

APRA chairman Wayne Byres is next up at the webinar, and he says that bank capital ratios will understandably fall as banks draw on their buffers through the crisis.

“Capital has been built up precisely for that purpose,” he says. “Now is the time to allow that to happen.”

He says “CET1 ratios below 10pc will happen”, pointing out that the buffers haven’t always been so strong.

“Our message of the use of capital buffers to support economic activity has been strong,” Mr Byres says.

Further, he adds that APRA would “clearly prefer” capital to be used for lending and balance sheet repair rather than dividends, as the regulator made crystal clear recently to the banks.

“We didn't intervene on dividends lightly … Our mandate is to protect the safety of bank depositors and ensure insurers have funds to pay out claims.”

Byres says while decisions such as these “are invariably difficult”, he believes the regulators has taken a balanced approach.

“We hope the impact on dividends from the current COVID-19 crisis will be temporary, but obviously the outlook remains highly uncertain. For that reason, we firmly believe prudence is the appropriate strategy for the time being. Our approach is designed to underpin financial system stability over the longer term, which ultimately benefits all Australians.”

Read more: APRA tells banks to cut dividend payouts

12.51pm: Lowe stresses banks’ role in recovery

Philip Lowe twice stresses the appropriateness of banks “doing that they can to help” with the economic recovery via lending.

“If there was ever a time to let capital buffers be used, now is that time,” Dr Lowe said.

“These buffers have been built up to be used in times such as this.”

Later he adds “both desirable and understandable” that banks draw on buffers that were built up in good times.

12.44pm: Easing restrictions will lessen eco scars: Lowe

The faster the restrictions are lifted, the less the economic scarring takes place, so says RBA governor Phil Lowe in opening remarks to an online webinar.

The first speaker at FINSIA’s The Regulators webinar, Dr Lowe said last week’s horror jobs data was “a stark reminder of the very human cost of these efforts”, as he said the this once in 100 years event was the time to use capital buffers that were built up in better times.

“The faster the restrictions can be lifted safely, the sooner and stronger the economic bounce-back will be and the less economic scarring takes place,” he said.

Patrick Commins 12.26pm: Economy won’t fall off a cliff: Treasury

Treasury secretary Steven Kennedy has pushed back against the idea of the economy falling off a “cliff” when the JobKeeper and expanded JobSeeker payments end on September 30.

Appearing at a Senate committee hearing into the government’s response to the pandemic,

Dr Kennedy said the end of the signature support measures is “not quite the cliff they look like”.

“There is a sense that programs stop, but their effects don’t stop,” he said.

He said that, like monetary policy, fiscal support “works with a lag”, and the economic impact “actually builds for four to six quarters”.

Treasury’s review of Morrison government’s $130bn wage subsidy scheme will be presented as part of Josh Frydenberg’s economic update in June, and there have been growing warnings from industry groups and economists that a sudden withdrawal of tens of billions in support will derail the hoped post-COVID recovery.

Perry Williams 12.18pm: Snowy Hydro 2.0 approved

The $4.6bn Snowy Hydro 2.0 expansion project has been approved by the NSW government as part of a process to boost investment as the state emerges from the COVID-19 crisis.

Up to 2000 jobs will be created after the main works component of the development won planning clearance with environmental conditions including $100m of offset requirements to protect threatened species.

The facility involves building a new 240m-long pumped hydro power station sitting 800m underground which connects to 27km of tunnels between the Talbingo and Tantangara reservoirs.

“For a small and temporary construction footprint covering just 0.1 per cent of the park, Snowy 2.0 will deliver 2,000MW of clean energy and large-scale energy storage to support many other wind and solar projects coming online,” Snowy chief executive Paul Broad said.

NSW Premier Gladys Berejiklian included Snowy 2.0 as one of 24 projects which had their planning assessments accelerated to boost the state’s economy amid COVID-19 shutdowns.

The federal government must now approve the main works package before work can start in the next few months while exploratory works continue.

Snowy in April secured $3.5bn in debt from Australian and international banks to finance its 2.0 expansion scheme with the renewables operator on track to start bringing the project online by late 2024 to early 2025.

Critics including the National Parks Association of NSW have raised concerns the project will damage the environment and endanger threatened species.

12.05pm: Iron ore threat weighs on ASX

Fear of a new Chinese threat on iron ore has hit heavyweight miners in lunch trade, sending the ASX into the red.

All three of the listed heavyweights had been pushing higher in morning trade but those gains were swiftly erased as reports emerged of new inspection rules from China.

BHP is now down 0.6pc as Fortescue takes a 1.7pc hit and Rio Tinto slips by 0.2pc.

The reversal is sending the ASX down 0.4pc – after early gains as much as 0.6pc.

Richard Ferguson 11.55am: China changes iron ore import rules

Reports have emerged China has changed the inspection rules for iron ore, in a move which its state media mouthpiece claims is not another trade attack on Australia.

Iron ore coming into China will now be investigated on the advice of the trader rather than batch by batch.

The targeting of iron ore products will possibly inflame Sino-Australian trade tensions, after China clamped down on beef and barley exports.

The Global Times has written that the iron ore changes are not targeting Australia and will not affect imports.

“That move, coming amid tensions, may lead some to believe it targets Australia,” the Chinese paper writes. “Though there is no evidence that the new adjustment will have any negative impact on future iron ore imports from Australia.”

Follow the latest at our live blog

11.45am: May PMI weakness astonishing: CBA

Australia’s private sector experienced a further substantial decline in business activity in May, described by Commonwealth Bank as “astonishing”.

The bank’s read on May PMI shows output fell to 26.4, from 21.7 in April – where any read below 50 suggests contraction.

“Another incredibly weak result that indicates the contraction in activity observed in April intensified over May,” head of Australian economics Gareth Aird writes.

“Two consecutive reads in the 20s is simply astonishing as well as concerning. It is likely that only a manufactured slowdown due to imposed restrictions could produce such results.”

The services sector had a greater reduction in activity, though the rate of contraction improved somewhat, while the downturn in manufacturing intensified.

The data showed that while manufacturing input prices rose thanks to currency weakness and freight costs, firms lowered prices for the first time in three and a half years.

Still, there was some light in the survey, as sentiment was higher and business confidence jumped to the highest level in eight months.

Max Maddison 11.43am: NBN download speeds plunge

Average download speeds for the National Broadband Network (NBN) plunged by almost a quarter during the busiest hours of the lockdown, as the network creaked under the additional weight.

In a report measuring broadband speeds, the consumer watchdog found that between March 17 and April 1, download speeds for the NBN100 and NBN50 fell by as much as 23 per cent and 14 per cent respectively.

NBN100 plans, generally for larger households, have download speeds of up to 100 megabytes per second (mbps), compared to 50 mbps for the NBN50.

Sluggish download speeds weren’t confined to peak demand hours either. The average speed recorded each day during parts of this period fell by 12 per cent for the NBN100 and 8 per cent for the NBN50.

Max Maddison 11.20am: Fonterra grows earnings amid shutdowns

Fonterra shares are rising 3 per cent after the company announced substantial earnings growth in the face of the coronavirus downturn.

In Fonterra’s third quarter business update, chief executive Miles Hurrell said despite supply and demand challenges, the total group normalised earnings before interest and tax had increased to $815m for the nine months to April 30 – $301m year-on-year growth.

“However, the global nature of COVID-19 is like nothing we’ve experienced before. Like other businesses, we will feel the impact of COVID-19 and its flow-on effects but how and to what extent is still uncertain. We are drawing on all our experience in managing market volatility,” Mr Hurrell said.

The ASX-listed New Zealand dairy cooperative, which is owned by around 10,500 New Zealand farmers, reduced its net debt by $1.7bn to $5.7bn in the quarter.

FSF shares last traded up 2.9pc to $3.50.

10.56am: Smash repairer cheers traffic return

The nation’s biggest auto smash repair chain AMA Group says headwinds are “expected to turn to tailwinds” as traffic starts returning to the roads.

Essentially this means the likelihood of more auto collisions.

“Global trends show that as restrictions ease and during the period of transition to normality, there has been an increase in the use of vehicles compared with the use of public transportation,” AMA says.

“Australia and New Zealand are already experiencing similar trends which will have a significant positive impact on the recovery of our business”.

At the same time AMA says negotiations on price rises with major insurer customers nearing finalisation with above CPI level price increases to AMA to cover technology-related repair cost.

Shares in AMA Group surge 7.8 per cent in early trade to 70c.

10.49am: Iron ore price is peaking: Citi

Citi’s Paul McTaggart has cut Fortescue Metals to Sell from Neutral while raising his price target from $10.50 to $11.10 on his forecast that the iron ore price is “peaking”.

He says ex-Asia steel demand is expected to fall 30pc on year in 2Q20 and 25pc in 3Q20 despite a gradual restart of factories while seaborne supply is also expected to recover sequentially from severe weather-related disruptions during 1Q20.

After a 12pc rise in China’s apparent steel demand for the year to April, he says demand growth is expected to fall to 1pc over the rest of the year as the rush for starting new property projects fades.

Spot iron ore fell 1.9pc overnight after hitting an 3-month high of $US97.55 a tonne on Tuesday.

BHP is his favoured bulk commodity play with a Buy rating given his forecast of higher oil prices, while Rio Tinto stays at Neutral.

OZ Minerals is his favourite stock for leverage to copper prices after Citi upgraded base metal prices.

Citi also downgraded its coal, nickel and aluminium forecasts, and has cut Western Areas to Neutral.

FMG last traded up 0.1pc at $13.91 after hitting highs of $14.13.

10.43am: Records fall as Afterpay hits US target

Afterpay shares are setting new records in Thursday’s trade, after handing down a positive update on their US performance.

The buy now, pay later group said it had surpassed five million active customers in the US, following the addition of 600,000 customers in the quarter-to-date.

Shares jumped to a new high of $45.17, up 5.3pc, valuing the company at $12bn.

RBC notes that the five million milestone was hit ahead of its forecasts, noting that customer additions will drive sustained growth over the medium term.

“Uncertainty that existed in March around the COVID-19 impact on (Afterpay) has seemingly evaporated,” analyst Tim Piper says

“A large shift to online transactions and e-commerce due to COVID-19 effects has benefited Buy Now, Pay Later players,”

He adds that if the US follows the same trajectory as its ANZ business, “there is significant compounding in underlying sales to come over the medium term”.

“Today’s update also suggests FY20e consensus forecasts have been cut too far in recent months, however the market has arguably shrugged this off, reflected in valuation multiples sitting back at the top end of historical ranges.”

APT last up 3pc to $44.17.

10.12am: Energy boost sends ASX higher

Local shares are higher early in line with expectations to follow a strong lead from the US.

At the open, the benchmark ASX200 is up by 32 points or 0.57 per cent at 5604.6.

Energy stocks are leading the charge after a jump in oil prices overnight, while miners too are pushing higher.

Only consumer discretionary and utilities sectors are trading in the red.

Aristocrat is off by 5 per cent after reporting a profit slip and halting its interim dividend, while EML Payments is continuing yesterday’s rally to add a further 2.4pc.

US futures meanwhile are down by 0.3pc and could take the wind out of the current rally.

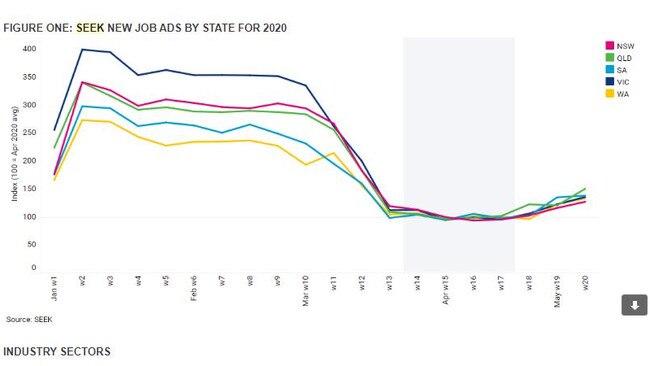

Max Maddison 9.55am: Seek job ads ‘turn a corner’

Online employment site Seek has seen new job ads posted in May soar by 26.8 per cent compared to last month, as the first signs of the economic thaw begin to show.

In an employment snapshot, Seek said the major contributors to the surge were hospitality and tourism, as ads ballooned by 101.6 per cent while ads for sales were higher by 97.1 per cent, and administration and office support by 88.5 per cent.

Seek managing director Kendra Banks said the lift was encouraging: “There are some promising signs with all states and territories showing an increase in job ad volumes compared to April, suggesting we have turned a corner as long as we do not see a return of restrictions or a further outbreak”.

Much of the advertising growth was driven by South Australia, which increased by 36.2 per cent in the fortnight ending May 17, followed by Tasmania which also increased by over a third.

Employee confidence in job security was at the highest levels for 2020, reflecting the steadying state of the economy. However, that may change in the coming months, with the Morrison Government’s Job Keeper wage subsidy program set to expire in September, placing financial pressure back on businesses.

Max Maddison 9.30am: Aristocrat profit falls 13pc

Aristocrat Leisure has seen profit fall by 12.8 per cent in the six months to March 31, as the pokies manufacturer feels the pinch of the COVID-19 lockdown, prompting the group to scrap its interim payout.

Profit after tax and before amortisation of acquired intangible fell 12.8pc from $422.3m in the same period last year to $368.1m.

While operating revenue for the Sydney-based company increased by 7 per cent across the six months, earnings before income tax, depreciation and amortisation fell by 7.7 per cent.

The company said it would suspend its dividend to enhance its liquidity position and balance sheet.

ALL shares closed on Wednesday at $27.34.

Read more: Aristocrat Leisure cuts jobs, pay, payout

9.24am: Arena REIT sets out payout guidance

Social infrastructure investor Arena REIT says all of its properties are open and trading, as it sets out its dividend estimates for the first half.

The owner of childcare and healthcare assets today told the market it anticipated paying a second half dividend between 6.75c and 6.85c per share, to take the year’s total distribution to between 13.9c to 14c.

Arena said its childcare centres had qualified for the government support packages and that it had come to rent relief arrangement with its tenant partners to June 30.

“Early learning operating conditions remain challenging as a result of increasing attendances and therefore rising costs being incurred at a time when government funding has been fixed and operators are unable to charge fees,” it added, reassuring investors it maintained liquidity in excess of its obligations and was operating well within its lending covenants.

9.07am: Shares tipped to extend winning run

Strength in US markets overnight is set to provide a lift to local shares at the open, setting the ASX up for a five-day win streak, its longest since January.

Future relative to fair value suggest an early gain of 0.6 per cent, after Wall Street hit a 10-week high as the US economy continues to reopen and oil prices rallied.

The last time markets were this optimistic was at the end of the last bull run around January 21 – just a day before market’s tanked on the initial fear of coronavirus in China.

If the market can notch this streak it will be a key validation of the recent shift in sentiment.

Elsewhere, FOMC minutes had little effect on US markets, while fresh vaccine reports from another US company Inovio helped its shares higher.

“The developments again reinforce for markets it’s a matter of when, rather than if for a vaccine,” NAB director of economics Tapas Strickland says.

“Against that background equities rose with the rally now broadening to smaller caps and suggestive that broader activity is picking up as rollback restrictions are eased. The USD remains on the backfoot with the DXY -0.5pc and back to where it was in late April.”

He adds that global growth proxies and commodity-linked currencies are outperforming, with the Aussie dollar hitting a session high of US66.16c overnight, and last at US65.97c.

9.03am: What’s on the broker radar?

- Bapcor price target raised 17pc to $6.24 – Morgans

- Charter Hall cut to Hold – Morningstar

- Fortescue raised to Hold – Morgans

- Fortescue cut to Sell – Citi

- Genworth cut to Negative – Evans and Partners

- Seek cut to Hold – Morningstar

- Sims Metal Management raised to Neutral – JP Morgan

- Sydney Airport cut to Hold – Jefferies

- TPG Telecom raised to Overweight – JP Morgan

- Wagners raised to Outperform – Credit Suisse

- Western Areas cut to Neutral – Citi

8.48am: NRW brings forward payout

Mining services provider NRW has brought forward the payment of its interim dividend, citing the strong performance of the business as it maintained its revenue guidance for the full year.

At its interim results in March, NRW had deferred its dividend pending review by the board in August, but today said it would pay out 2.5c per share given the company’s resilience through the COVID-19 downturn.

Chief Jules Pemberton said the company was on track to meet its revenue guidance of $2m as it won new projects, while increased bidding activity also boded well for the company as more public infrastructure projects were brought online.

He reported record revenue of $1.6bn for the 10 months to April, and earnings of $177m for the same period.

“NRW is very well placed to address a growing list of opportunities through both its Golding business on the east coast and the significantly enhanced construction business in the west,” Mr Pemberton said.

8.30am: Afterpay sees US boost in crisis

Buy now, pay later firm Afterpay says there are now more than five million active shoppers in the US using its service.

Afterpay also says nearly nine million US consumers have joined the platform, including more than one million new customers using the platform during the COVID-19 crisis.

“This represents a 30-40pc increase in the weekly run rate from January and February,” Afterpay told the ASX.

Afterpay launched in the US two years ago.

8.00am: Copper hits two-month high

Copper prices hit a two-month high overnight ahead of a Chinese government meeting this week expected to boost demand with pledges of higher spending on infrastructure, and on hopes for a global economic recovery.

The Chinese government typically announces new plans and economic targets at the annual National People’s Congress session which starts on May 22 and is closely watched for signs of demand increases for metals.

“The recent rally will be in anticipation of the NPC meeting over Thursday and Friday, where expectations are for big infrastructure investment figures,” said BMO Capital Markets analyst Tim Wood-Dow.

He attributed a rise in metals prices in later trade to stronger global equities, which gained on optimism over the reopening of the US economy and hopes for further stimulus in Europe.

China accounts for nearly half of annual global copper consumption estimated at 24 million tonnes.

Benchmark copper on the London Metal Exchange (LME) gained 1.6 per cent to $US5,441.50 a tonne after touching a March 13 high of $US5,455. In signs of continued recovery from the coronavirus, China’s refined copper output in April rose 9.2 per cent compared to a year earlier and was 6.2 per cent higher than the previous month.

Reuters

7.45am: Oil rises on lower US stocks

Oil prices rallied overnight after US crude inventories fell in the most recent week, but gains were capped by worries over the economic fallout from the coronavirus pandemic and weak refining margins.

Oil futures have staged a recovery from recent weakness as production has declined more swiftly than expected, reducing the supply glut that caused storage to fill.

Brent crude settled up $US1.10, or 3.2 per cent, at $US35.75 per barrel while July US crude futures ended up $US1.53, or 4.8 per cent, at $US33.49. US crude inventories fell by 5 million barrels last week, Energy Information Administration data showed, while stocks at the Cushing, Oklahoma, delivery hub dropped by 5.6 million barrels.

“What this report confirms is that your worst nightmare – that we’re going to run out of storage space – is probably not going to happen,” said Phil Flynn, senior analyst at Price Futures Group.

Reuters

7.30am: ASX set to open higher

Investors are likely to see gains in early trading on the Australian share market and will be hoping the main indexes can finish higher for a fifth consecutive day.

At 7am (AEST) the SPI 200 futures contract was higher by 36 points, or 0.65 per cent, at 5,064.0, indicating rising prices in early trade.

The three major Wall Street indexes notched finished higher overnight as investors bet on a swift economic recovery from coronavirus-driven lockdowns and the potential for more stimulus measures from the Federal Reserve.

The Dow Jones Industrial Average rose 1.52 per cent to end at 24,575.9 points, while the S&P 500 gained 1.67 per cent, to 2,971.61. The Nasdaq Composite climbed 2.08 per cent to 9,375.78.

Back on the home front, employment figures for April are due to be published. The data will give more insight into the economic toll of social distancing restrictions after employers let go and stood down thousands of workers.

The heads of APRA, ASIC and the Reserve Bank will discuss their response to the coronavirus in an online forum held by the Financial Services Institute of Australasia.

The S&P/ASX200 benchmark index finished Wednesday up 13.5 points, or 0.24 per cent, at 5,573 points. The All Ordinaries index gained 21.3 points, or 0.38 per cent, to 5,680.1.

At 7am (AEST) the Australian dollar was buying US65.98 cents, up from US65.43 cents at the close of trade on Wednesday.

AAP

6.50am: Lufthansa rescue offer agreed: report

German ministers agreed final details of a rescue deal they will offer coronavirus-stricken airline giant Lufthansa, business daily Handelsblatt reported.

Berlin will take a 20-per cent stake in the group, topping it up with a convertible bond worth five per cent plus one share – “putting the state in a position to build a blocking minority in case of a hostile takeover”, the newspaper said.

If confirmed, the solution would close weeks of wrangling between Chancellor Angela Merkel’s CDU conservatives and their centre-left junior partners the SPD.

Pro-business politicians among Merkel’s ranks have long rejected excessive state involvement in Lufthansa, saying business decisions should be left up to managers.

AFP

6.10am: Wall St gains on recovery hopes

Led by tech giants, US stocks rose on optimism about the prospects for a global economic recovery in the wake of the coronavirus pandemic.

The S&P 500 gained 1.7 per cent, erasing Tuesday’s losses, as of the close of trading in New York. The Dow Jones Industrial Average added about 369 points, or 1.5 per cent, and the technology-heavy Nasdaq Composite rose 2.1 per cent.

The gains were broad, with all 11 sectors of the S&P 500 in the green. The beaten-down energy group led the S&P 500 sectors, rising about 4 per cent as crude oil prices rallied.

After posting a small gain yesterday, the ASX is set to open higher. At 6am (AEST) the SPI futures index was up 34 points, or 0.6 per cent.

On Wall Street, airline shares, which have been battered by the halt in global travel, popped, with United Airlines, Delta Air Lines and Southwest Airlines up 4.4 per cent or more. Airline executives have said people are starting to book flights again, a potential inflection point for the industry.

State governments hoping to revive their economies are taking steps to ease the restrictions put in place to limit the spread of coronavirus. In one sign of a positive investor outlook, the Russell 2000 index of small-capitalisation companies, which tend to be sensitive to the domestic economy, gained 2.7 per cent, outpacing the major large-cap indexes.

“If the economic reopenings are going well, or better than expected, on a consistent basis, the small caps will let us know,” said Chris Hyzy, chief investment officer at Merrill and Bank of America Private Bank.

Investors are continuing to focus on any sign of hope for a vaccine. Shares of Inovio Pharmaceuticals jumped 11 per cent after its experimental coronavirus vaccine induced immune responses in mice and guinea pigs, according to a new study published in Nature Communications. Researchers from the biotechnology company and its academic collaborators said the data were encouraging but more testing is needed in animals and humans.

The Inovio news came two days after drugmaker Moderna said the first human study of its experimental coronavirus vaccine showed promise in some of the healthy volunteers who were vaccinated. That report helped send stocks surging Monday.

Many investors expect to continue seeing big market reactions as news trickles in about the success of business openings and the race to develop treatments and vaccines.

“What’s key is how we open up this economy going into the fall and whether or not the opening of the U.S. economy induces a coronavirus surge,” said Quincy Krosby, chief market strategist at Prudential Financial. “We remain at the mercy of the virus.”

Investors carefully watching the Federal Reserve for signs of future monetary policy got their first opportunity to parse the minutes of the central bank’s April 28-29 meeting. Officials spent much of that meeting reviewing progress on lending programs to backstop everything from short-term funding markets to markets for corporate debt and municipal bonds.

Stocks have rebounded sharply from their March lows, with the S&P 500 up more than 30%. But the rebound has been more pronounced in the U.S., where tech giants have pulled indexes higher, said Sebastian Mackay, a multi-asset fund manager at Invesco.

Overseas, the Stoxx Europe 600 index rose 1pc. Japan’s Nikkei 225 rose 0.8pc, while the Shanghai Composite declined 0.5pc.

Dow Jones Newswires

6.00am: US oil futures highest in 10 weeks

Oil futures climbed, with US prices ending at their highest in about 10 weeks.

The Energy Information Administration reported a weekly decline of 5 million barrels for U.S. crude supplies, along with a 5.5 million-barrel fall in stocks at the Cushing, Okla., storage hub.

July West Texas Intermediate oil rose $US1.53, or 4.8pc, to settle at $US33.49 a barrel on the New York Mercantile Exchange. That was the highest front-month settlement since March 10, according to Dow Jones Market Data.

Dow Jones

5.55am: Virus crisis disrupts iron ore market

Brazil’s deadly coronavirus outbreak has disrupted global supplies of iron ore just as demand from China is revving up, pushing the price of the steel ingredient to a seven-month high.

Iron ore is one of the most heavily traded commodities and can influence the price of materials used in everything from buildings to cars.

Front-month futures for ore with 62 per cent iron content jumped 10 per cent to nearly Y759 ($US107) a tonne on Wednesday on China’s Dalian Commodity Exchange. That is their highest closing price since October 2019.

Prices have risen 20 per cent since early April, driven by squeezed supplies from Brazil, which dominates the iron-ore mining industry along with Australia. The rally is also an indication that China’s economy is gathering momentum, after a downturn at the start of the year when swathes of the country went into lockdown to stop the coronavirus spreading.

Dow Jones

5.50am: Fed worried about recession toll

Federal Reserve officials last month worried about the coronavirus pandemic’s toll on the U.S. economy, especially its impact on the most vulnerable, expressing fears that a large number of small businesses may not be able to survive the shock.

Minutes of the Fed’s April 28-29 meeting released Wednesday showed that Fed officials fully supported continuing to keep the central bank’s benchmark interest rate at a record low near zero. This while backing a number of emergency programs to keep parts of the financial system operating. The minutes said that Fed officials believed the economy, as measured by the gross domestic product, would decline “at an unprecedented rate” in the April- June quarter.

The officials expected that “the burdens of the present crisis would fall most disproportionately on the most vulnerable and financially constrained households in the economy.”

AP

5.48am: Apple, Google release virus app tech

Apple and Google released long-awaited smartphone technology to automatically notify people if they might have been exposed to the coronavirus.

The companies said 22 countries and several U.S. states are already planning to build voluntary phone apps using their software. It relies on Bluetooth wireless technology to detect when someone who downloaded the app has spent time near another app user who later tests positive for the virus.

Many governments have already tried, mostly unsuccessfully, to roll out their own phone apps to fight the spread of the COVID-19 pandemic. Many of those apps have encountered technical problems on Apple and Android phones and haven’t been widely adopted. They often use GPS to track people’s location, which Apple and Google are banning from their new tool because of privacy and accuracy concerns.

AP

5.44am: European stocks rally on rebound hopes

Stock markets picked up on hopes for a US economic rebound even though retailers reported mixed results and US-China tensions continued to mount.

Equities have enjoyed a broad advance for several weeks as virus infection and death rates slow overall, allowing some governments to lift strict stay-at-home measures that have hammered businesses.

But, while there was a general feeling the worst is past, increased China-US tensions continue to cast a shadow over trading floors.

Meanwhile, the dollar declined against its main rivals, while oil prices rose. Global markets have been weighing hopes for an economic rebound as more countries relax confinement measures after a flood of expected but dreadful data on unemployment, business outlooks and consumer confidence.

The World Bank warned the crisis could leave about 60 million people in extreme poverty, and estimated that the global economy might contract by five per cent this year.

Markets in Europe were mixed earlier in the day, but perked up when New York weighed in, and the Dow Jones index continued to gain 1.7 per cent in midday trading.

“US equities are showing signs of resilience after the testimonies from both Fed Chair (Jerome) Powell and Treasury Secretary (Steven) Mnuchin remind (that) more stimulus is likely just around the corner,” remarked Edward Moya at online broker OANDA.

London, Paris and Frankfurt all ended the day in positive territory. London ended up 1.1 per cent, Frankfurt rose 1.3 per cent and Paris gained 0.9 per cent.

Tokyo closed with a gain of 0.8 per cent and Hong Kong edged 0.1 per cent higher, while Shanghai dipped 0.5 per cent and Singapore shed 0.9 per cent.

AFP

5.38am: Air France-KLM to ditch A380s

Air France-KLM announced the “definitive end” of operations of the world’s biggest commercial airliner, the A380, owing to the devastating coronavirus impact on air travel.

As the pandemic has slashed all travel and eliminated demand for huge planes, the airline said it would switch to a newer generation of aircraft that included smaller Airbus A350 and Boeing 787 jets.

“In the context of the current COVID-19 crisis and its impact on anticipated activity levels, the Air France-KLM Group announces today the definitive end of Air France Airbus A380 operations,” a statement said.

“Initially scheduled by the end of 2022,” the move should make the group’s fleet of planes “more competitive, by continuing its transformation with more modern, high-performance aircraft with a significantly reduced environmental footprint,” it added.

AFP

5.35am: Two arrested over Ghosn escape

A former U.S. Green Beret and his son accused of helping aid former Nissan Motor Co. Chairman Carlos Ghosn flee Japan while awaiting trial on financial misconduct charges were arrested Wednesday, the Justice Department said.

Justice Department spokeswoman Nicole Navas said Michael Taylor, 59, and Peter Taylor, 27, were arrested by the U.S. Marshals Service on Wednesday morning in Harvard, Massachusetts.

The Taylors are wanted by Japan officials on charges that they helped Ghosn escape the country in December after the former Nissan boss was released on bail.

Ghosn reappeared in Lebanon, saying he had fled to avoid “political persecution.” Ghosn, who was charged with under-reporting his future compensation and breach of trust, has repeatedly asserted his innocence, saying authorities trumped up charges to prevent a possible fuller merger between Nissan Motor Co. and alliance partner Renault SA.

AP

5.32am: ‘Frugal four’ to make own virus plan

Four European countries will propose a tougher alternative to a huge Franco-German fund to help the economy through the coronavirus crisis, Dutch Prime Minister Mark Rutte said.

The Netherlands, Austria, Denmark and Sweden – dubbed the “Frugal Four” – will insist on greater guarantees that countries getting aid will enact reforms, and that any help should be in the form of loans not grants.

French President Emmanuel Macron and Chancellor Angela Merkel on Monday proposed a 500-billion-euro ($US546 billion) fund to mend an economy devastated by the pandemic.

AFP

5.28am: Securities case ended against VW chiefs

Volkswagen said charges of securities-law violations against its CEO and board chairman are to be dropped in return for a 9 million- euro ($US10 million) payment, removing a potential distraction for the company’s management team as it copes with the virus crisis and oversees the rollout of a new generation of electric cars.

CEO Herbert Diess and Chairman Hans Dieter Poetsch were charged in September with failing to tell investors in time about the company’s looming diesel scandal in 2015. The end of the case through the payment, allowed by German law, means the two do not admit wrongdoing and will not have to appear for multiple court sessions as part of a trial.

Prosecutors said the two violated securities laws that require companies to notify investors about matters that could affect the price of their shares. The company said it had met its disclosure requirements ahead of the announcement of a notice of violation from the U.S. Environmental Protection Agency on Sept. 18, 2015.

The end of the case against Diess and Poetsch does not stop other investor complaints against the company currently before a court in Braunschweig, Germany.

AP

5.22am: VW apologises for ad

A video advertisement shared by Volkswagen on social media was met with accusations of racism, prompting the German auto giant to issue an apology on Wednesday.

The clip shows a black man being pushed around on the street by an oversized white hand. When the words “Der neue Golf” (the new Golf) gradually appear on the screen at the end, a combination of letters resembling the word “Neger” emerges.

“Without doubt: The video was wrong and tasteless,” the company said, adding that it understood the anger and disgust that the ad had provoked. “We distance ourselves from this and apologise,” the statement said, promising an investigation and consequences to follow.

An initial VW statement responding to the uproar was posted on Instagram: “As you can imagine, we are surprised and shocked that our Instagram story could be misinterpreted in this way.” This was met with further criticism, with one user writing, “Everything imagined and a misunderstanding? Sorry, but we do not imagine racism.” The carmaker followed up with an apology, while also noting that it runs several initiatives within its worldwide workforce to promote diversity and inclusion.

DPA

5.20am: Germany bans abattoir subcontracting

The German government banned the use of subcontractors in the meat industry after a string of coronavirus infections among mainly foreign slaughterhouse workers sparked alarm.

“It’s time to clean up the sector,” Labour Minister Hubertus Heil told reporters after Chancellor Angela Merkel’s cabinet agreed on stricter regulations.

From January 1, 2021 abattoirs and meat processing plants will have to directly employ their workers, putting an end to the controversial practice of relying on subcontractors to supply labourers from abroad, often from Bulgaria and Romania.

Critics have long argued that the imported workers are paid less and are more vulnerable to abuses, and Heil himself has described the system as “dodgy”.

Concern mounted after several German slaughterhouses were hit with coronavirus outbreaks, prompting fresh scrutiny over working conditions.

At one slaughterhouse in the northwestern district of Coesfeld, more than 260 workers tested positive for the virus. Many were from eastern Europe and lived in shared housing, a common practice among subcontracted workers.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout